Other Recent writeups:

Analysis date: April 27, 2023.

Key Points

20% Market return 2018-2022

Good execution and alignment of interest from CEO and key person.

Excellent capital allocation strategy.

Positive trend for IT Industry.

Strong financial position.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

I own shares of Altia since 2016.

Introduction

Altia Consultores S.A. is a Spain-based company primarily engaged in the provision of information technology (IT) services. The Company's activities are divided into seven business areas:

The Company cooperates with a number of entities, such as IBM, McAfee, Hewlett-Packard (HP), Hitachi Data Systems, Oracle and Microsoft. It is a subsidiary of Boxleo Tic SL.

1994-Altia is founded in La Coruña, Spain by Amadeo Fernández Sánchez, Álvaro Sánchez Silvela and Constantino Fernández Pico.

2010-Altia trades in MaB (Now BME Growth).

2013- International expansion under an agreement with Chile government

2020- Noesis acquisition for around EUR 14 mm.

2022-Bilbomatica and Wairbut acquisitions.

Currently, is part of IBEX Growth Market® All Share.

Business Model

Altia Group offers high value IT services and digital transformation consulting under a B2A and B2B model business.

The Company's activities are divided into seven business areas:

Advisory services

Reports.

Strategic plans.

Security consulting.

Training.

2% of total sales for FY 2022.

Development of IT systems

Design, development and implementation of computer systems.

17% of total sales for FY 2022.

Implement of Solutions from third parties

Third parties solutions from international companies.

5% of total sales for FY 2022.

Outsourcing

Outsourcing of advanced ICT services and maintenance, operation and management of applications and infrastructures.

59% of total sales for FY 2022.

Ad-hoc Solutions

Products developed by Altia:

Altia Mercurio. Public tender plattform.

Altia Flexia. Process management software for administrative structures.

Online booking system mainly for tourism industry.

0.40% of total sales for FY 2022.

Hardware and Software

Technology solutions and software licenses.

7% of total sales for FY 2022.

Managed services

Hosting, apps managing, outsourcing and advanced operating services and maintenance.

11% of total sales for FY 2022.

Customers

Altia Group is focused on big customers, which have high expenses on IT or potential of implement projects.

Portfolio is diversified with around 700 clients and high recurrence degree.

Business model of Altia is not based in an excess of exposition in specific markets or clients.

Altia customers operates in the following industries:

E-government

Financial services

Infrastructure transports and tourism.

Energy and public services

Industry and consumer goods

Health

TELCO and Media

Remarkable projects

European Maritime Safety Agency (EMSA)

Maintenance of the web application Graphic User Interface (SEG) and its mobile application IMS.

EUR 1.6 mm.

McDonald's Portugal (Noesis)

Sales analysis and data.

Business Intelligence solution through Qlik technology.

Banco de España.

Maintenance and development of network infrastructure.

EUR 3.8 mm.

Vopak (Noesis)

Outsystems technology. Design and resources optimization.

Partners and suppliers

Spain and Portugal represent around 80% of total contracts.

Employees

The number of employees at December 31, 2022 was 3184

Altia is an IT business. Dissemination of information related to projects, products or services could have a negative impact on future operations.

Altia provides advanced services and maintenance support that require high training and specific professional skills.

Due to all those reasons the employees add a high value in Altia operations.

Project managers, engineers, systems programmers or data analysts are some of jobs required by the company.

Salaries and wages represent around 59% of sales for FY 2022.

Industry

Altia operates in IT services industry.

The global IT professional services market size was valued at USD 821.58 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.1% from 2023 to 2030. [https://www.grandviewresearch.com]

In Spain , the industry has been remarkable performance respect to others.

Peers

*FY2021

Competitive advantages

Switching costs

Altia provides to customers essential services in operating processes.

B2B companies can derive more benefits from switching costs due to greater incentives of their customer base to stick with their current providers/suppliers.

Financial Switching Costs.

Procedural Switching Costs.

Relational Switching Costs.

Altia is able to keep recurrent clients. So retention rate is high due to customer is sensible to switching costs.

Growth

CEO says:

“We are focused in Bilbomatica and other acquisitions integration. We could extend operations to other european countries” .

M&A

Management Team says:

“We are constantly analyzing the market in order to identify opportunities that allow us to complement our current portfolio of services”.

Noesis

Altia acquired 100% of Noesis.

Noesis is a IT business that pays services in Portugal, Holland, Ireland, Brazil and U.S.

Date: 2020.

Price: around EUR 14 mm.

Multiple: 6x EBITDA.

Employees: 900.

Rationale:

Expansion to new markets.

Lowcode solutions, quality assurance, AI, devops, and data analytics.

Recruitment of talent with a qualified technological profile in the locations incorporated by Noesis.

Bilbomatica

Altia acquired 100% of Bilbomatica.

Date: 2022.

Price: EUR 24 mm.

Multiple: 9x

Rationale: experience in administration projects, with a large portfolio in Basque Country, Navarra and UE.

Wairbut

Altia acquired 100% of Wairbut.

Date: 2022.

Price: EUR 5.44 mm

Multiple: 6.8x

Rationale: portfolio in defense, telecom and health industries.

Integration

Management Team says:

“After the end of the year, the Group has managed to achieve the objectives expected for 2022, partly thanks to the integration of Wairbut, S.A. and Bilbomática, S.A. with its impact on billing and profitability. In contrast, at the balance sheet level, the deviation is greater, largely due to the increase in liabilities in terms of unforeseen financial debt. The strategy involves continuing to generate cash in such a way that this debt is reduced in the coming years. In this regard, in March 2023 the €5 Mn financing requested for the purchase of Wairbut was cancelled”.

Retribution to shareholders

Pay-out Ratio is 26.9%. (EUR 1.65 mm).

Split 10 to 1

March 6, 2023. General Meeting of Shareholders, agreed to split Altia’s share unit value to increase the total number of shares without changing the company’s share capital. (68.78185 mm of ordinary shares).

Management team

The management has had a brilliant performance and execution in terms of operations and strategic decisions. Accomplishment level respect to the company guidance has been very high in the past.

Constantino Fernández Pico “Tino Fernández” CEO.

“We were always fans of profitability. We like making money”. Tino Fernández. CEO.

“Crisis is a forbidden word in Altia”.

Fernández is much more than a CEO. He is the key person and is a brilliant manager with a large background in Altia.

He owns around 81% of shares. Thus, interest alignment is very high, excessive in my opinion.

Carlos Bercedo, representing to Mr. Bhavani investment group.

Who is Ram Bhavani?

Ram Bhavnani is an investor born in India-Pakistan in 1944. He is one of the most popular and well-known investors in Spain and has one of the largest fortunes in the country. He owns around 12% of shares.

Ignacio Cabanas López, CFO.

Risks

Risk country.

Dependency of B2A contracts.

High competitive industry.

High concentration of shares in two shareholders.

Catalysts

Split 10 to 1 provide liquidity to stock.

Call market vs Continuous market.

Management Team says:

“The eventual increase in the number of shareholders and the daily trading volume -in short, the liquidity of the security- may allow as a second objective, going from the BME Growth Single Price Fixing trading modality (“fixing”), which only occurs at two moments of the session, to the modality of General Contracting (“continuous contracting” throughout the session)".

Financial Metrics

Financial Statements as reported

Salaries and wages increase due to rising on salaries and workforce growth for Wairbut, S.A. y Bilbomática, S.A. integration.

Operating expenses increasing is due to energy costs and Due Diligence expenses relative to acquisitions.

Earnings

FCF for FY 2022 is negative (around 9 mm) due to investment in acquisitions.

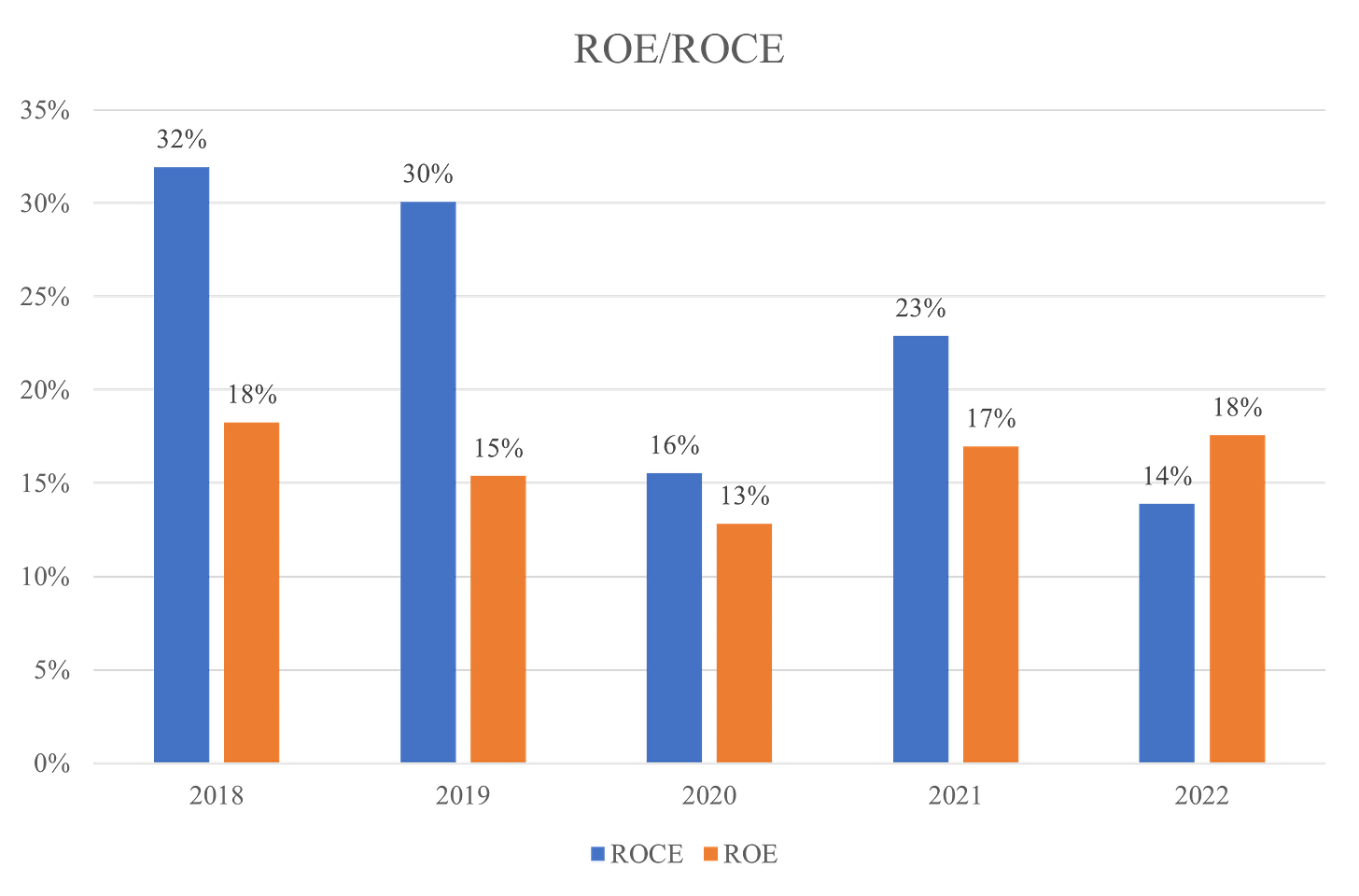

Capital Structure Analysis

Bilbomatica and Wairbut integration induce to an increase in Capital Employed by 57 mm eroding substantially ROCE.

Profitability

Solvency

Historically Altia has reported net cash position, however financial debt has increased by 35 mm due to Wairbut and Bilbomatica financing.

Despite that increasing Net Debt-to-EBITDA represents around 0.6x.

Valuation

We could assume a base scenario at 10% CAGR in revenues and EBITDA margin 10%.

Despite an increase in salaries, Bilbomatica, Noesis and Wairbut integration process will help to dilute operating expenses long-term.

Revenues 2027 EUR 269 mm.

EBITDA Margin 10%

EBITDA 2027 EUR 27mm.

Sector EV/EBITDA around 12x.

Value per share 2027 EUR 4.54

Upside 44%

Nice write-up, thanks. Not heard of this company before, looks interesting.