Analysis date: Sep 15, 2023.

Price return since analysis date: +48.33% (+9% after results).

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports and posts is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

At the current date, I own Build-A-Bear shares, representing around 5% of my portfolio.

Company Overview

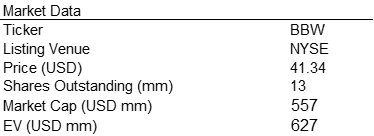

Build-A-Bear Workshop, Inc. (NYSE:BBW), a Delaware corporation, was founded by Maxine Clark in 1997. BBW sells teddy bears and other stuffed animals and characters.

Customers can assemble and tailor the product through the choice of sounds and outfits varying scents, sounds, and outfits.

To know more: Build-A-Bear

Q3´24 Results.

Total Revenues +11%

CFO says:

“The Company’s strong retail and third-party sales have contributed to the most profitable third quarter in our history, although web demand continues to perform below expectations. In conjunction with Build-A-Bear’s solid cash flow generation and our confidence in the company's strategy, we have repurchased more than 6% of our shares outstanding over the past year."

“Regarding product, we are expanding our audience with new offerings as we continue to broaden Build-A-Bear's consumer base by taking advantage of our growing multi-generational appeal through collectibles, trends, licensing and gifting as well as new plush segments. Trend products include bulk offerings such as our fan favorite Pumpkin Kitty and viral items such as our Mothman Plush or our new holiday cookie Capybara, which has already generated over 20 million online views”.

Retail sales +9.1% were driven primarily by existing stores in both the U.S. and the U.K.

Retail gross margin 54.2% (52.6%).

Store activity

The Company had net new unit growth of 17 global experience locations, comprised of 1 corporately-managed location and 16 partner-operated locations. At the end of the third quarter, Build-A-Bear had 565 global locations through a combination of its corporately-managed (362), partner-operated (123), and franchise models (80).

Stores saw increases across all 4 sales levers: traffic, conversion, average unit retail and units per transaction.

Retail sales/square foot was $140 (+9%).

e-commerce demand increased 1.3%

Diluted EPS reached $0.73 +38% due to buyback shares and an increase in net income.

Net debt is around $71 mm. what represents around 0.89X EBITDA (TTM).

Return of Capital to Shareholders.

Through the first nine months of fiscal 2024, the Company returned $31.3 million to shareholders through share repurchases and quarterly dividends.

Outlook

“We remain positioned for fiscal 2024 to deliver our fourth consecutive year of record revenue”.

Total revenue in the range of $489 million to $495 million, representing growth on a low-single-digit percentage basis at the midpoint.

Pretax income in the range of $65 million to $67 million, in line with the prior year at the midpoint.

Net new unit growth of at least 65 experience locations through a combination of corporately-managed, partner-operated, and franchised business models.

Capital expenditures in the range of $18 million to $20 million.

Build-A-Bear strategy cornerstones:

Experience location footprint.

The acceleration of comprehensive digital transformation.

Leveraging the power of the Build-A-Bear brand, all while returning capital to shareholders.

We have to keep in mind that Build-A-Bear performance in the last fiver years has been excellent, with a price return (CAGR) around 59%. All of that growing in revenues and stores, and returning capital to the shareholders efficiently.

I maintain a long position in BBW. Considering projections, level of execution, capital returned to shareholders, and financial position, the upside could be around +60%

If you are a professional or qualified investor, and you like my work, don't hesitate to contact me.