Other Recent writeups:

Analysis date: September 14, 2023.

Key Points

High gross margin and pricing power.

Shopping experience and a multi-generational customer base, under a recognized brand in the market.

Multichannel business model beyond a brick-and-mortar footprint.

The company is repurchasing stocks.

Excellent execution and management team. The key person owns around 4% of shares.

The stock is undervalued.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

Introduction

Build-A-Bear Workshop, Inc. (NYSE:BBW), a Delaware corporation, was founded by Maxine Clark in 1997. BBW sells teddy bears and other stuffed animals and characters.

Customers can assemble and tailor the product through the choice of sounds and oufits varying scents, sounds, and outfits.

Clark took Build-A-Bear Workshop public in 2004 and currently The Company operates its products “as a multi-channel retailer of plush animals”, in the United States, Canada, the United Kingdom, Ireland, and internationally.

Business Model

Originally, Build-A-Bear was formed as a mall-based, experiential specialty retailer where customers (children and their families), could create their own stuffed animals. Certainly, mall-based retail can be seen as an industry in decline. However, The Company has shifted to a multichannel business model.

Beyond the malls

Build-A-Bear strategy includes involve a brick-and-mortar retail footprint beyond traditional malls with a diverse range of formats and locations.

Build-A-Bear opened new locations in 2022 including Six Flags Magic Mountain and the Pro Football Hall of Fame.

Build-A-Bear Workshop offers interactive entertainment experiences via both: physical and digital engagement. Over 135% growth in digital demand in FY 2022 vs. pre-pandemic FY2019.

The Build-A-Bear strategy goes beyond to digitalizing the customer experience.

“Rather than “digitizing” the BBW “physical” experience, BBW extended the reach and size of our market with diverse consumer segments including teens, adults, gift-givers, brand enthusiasts and collectors with new licensed relationships, experiences, and advanced digital marketing activities”. [BBW Presentation 2023].

CEO says:

“We executed a multi-dimensional business-model shift, moving from a retailer that happened to have built a powerful brand, to a branded intellectual property company that just happens to have vertical retail as one of its revenue streams.”

Retail stores also act as “mini distribution centers” that provide efficient omnichannel support for digital demand.

Revenue Model

BBW revenue is derived from retail sales, being recognized when control of the merchandise is transferred to the customer.

The company sells product to customer under gift cards. Revenue from gift card is deferred until redemption including any related gift card discounts.

Direct-to-Consumer

The Company’s direct-to-consumer segment includes:

Corporately-managed stores sales.

Other retail-delivered sales and

Online sales.

Direct-to-consumer represents around 95% of total sales.

Commercial

Commercial segment includes transactions with other businesses:

Sales of merchandise, suppliesand fixtures,

Licensing the Company’s intellectual properties for third party use.

Entertainment activities.

Carnival Cruise Line's partnership.

NFL Hall of Fame

Seaworld

This segment is capital for Build-A-Bear. Partnerships provide real estate locations and cover labor costs, and inventory purchases are made on a wholesale basis.

Commercial represents around 4% of total sales.

International Franchinsing

It includes the activities with franchises who operate stores in certain countries.

International franchises represents around 1% of total sales.

Licenses portfolio generates royalty revenue from licensed products, a content creation Build-A-Bear Entertainment, which has a deal with Sony and a Netflix film The Honey Girls and NFTs.

Product and services.

Selling experiences

Apparently, selling plush bears could be seen as a replicable and commodity product. However, BBW offers a make-your-own stuffed animal experience where visitors enter a teddy bear environment and engage in the making of their very own furry friend.

BBW is focused on a beyond product strategy that provides:

Customer engagement: workshop experience creates an engagement relationships between customers and Build-a-Bear universe.

Multi-generational customer base: Buil-a-Bear products are the furry friends to kids, but they are recurrent gift for Valentine´s Day, Birthdays, marriage proposals, wedding aniversaries, etc.

Brand power.

“Trusted and iconic brand appeals to today’s desire for personalized, shared & share-ableexperiences, unique gifting, enthusiast/collectibles & nostalgia fueled by 25-years of one: oneexperiences with multigenerational demographics spanning ages, genders and socio-economic strata, who desire loyal brand relationships providing relevant engagements that can drive lifetime value.” [Build-a-bear Presentation].

CEO says:

“Innately understanding that our Build-A-Bear Workshop experience locations provide powerful memory-making personal engagements that creates the basis of our meaningful, leverageable equity and potential continued expansion of our consumer lifetime value. Due to the emotional connections we literally build with our guests one unique heart ceremony at a time”.

“With that understanding, our concerted business model evolution combined with our multi-generational audience, Build-A-Bear has worked to successfully capture an addressable market beyond kids, expand its brand access beyond malls to reflect the changing consumer shopping behavior and drive mechanisms for further engagement beyond retail stores”.

Build-a-bear stores are more like traditional brick and mortar. In fact, 80% of visits to experience locations are planned, and the top occasion is a birthday [Proprietary research, LEK Consulting, 2022 survey with consumers]

What makes Build-a-Bear product different?

It is a “make your own” product concept.

The process of procuring a toy in the company follows the following steps:

Hear Me.

Choose Me.

Stuff Me.

Stitch Me.

Fluff Me.

Dress Me.

Name Me.

Take Me Home.

How to Make a Stuffed Animal at a Build-a-Bear Workshop

It is a multi-generational product.

The experience makes the sale.

“Our engaging digital purchasing experiences include our online “Bear-Builder”, the animated “Bear Builder 3DWorkshop”, an age-gated adult-focused “Bear Cave” and the “HeartBox” gift site”. [Annual Report FY2023].

Pricing Power

Strong brands and improvent of the value offered to the clients are sources of pricing power.

High and sustainable gross margin are pricing power drivers. BBW gross margin is around 53% versus Mattel (45%) and Hasbro (49%). Median sector gross margin is around 35%.

Build-a-Bear visitors are mainly characterized by:

Strong purchase power.

Loyal to the brand.

70% of them have children.

Mostly female. 40% millenials, 40% GEN X and 10% other.

Over 40% of furry friends are for teens and adults. (Multi-Generational business).

[BBW proprietary loyalty program database].

Over 50MM annual visitors to experience locations each year.

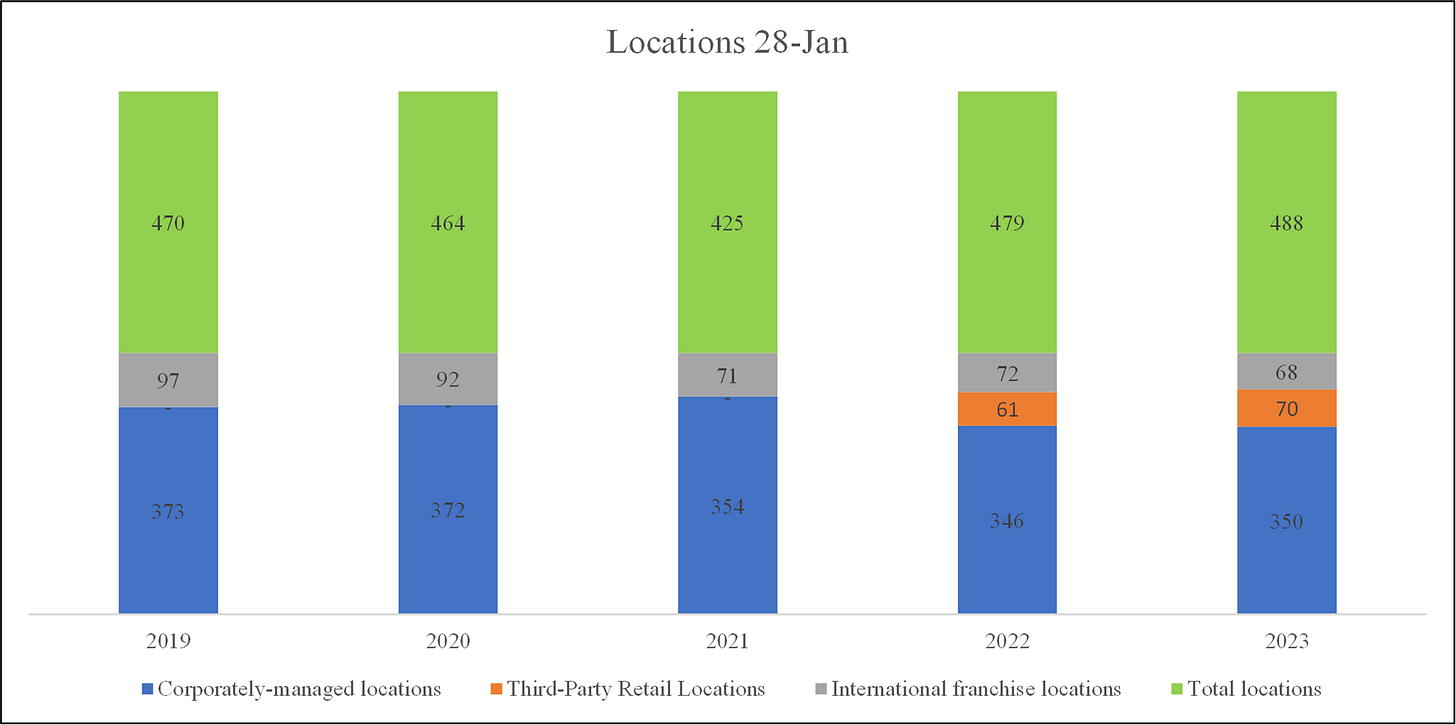

*Reported at 28-jan.

Costs Structure

Cost of Goods Sold includes:

Cost of the merchandise.

Royalties paid to licensors of third-party branded merchandise.

Storeoccupancy cost, (including depreciation).

Cost of warehousing and distribution.

Packaging.

Stuffing.

Damages and shortages.

Shipping and handlingcosts incurred in shipment to consumers.

Selling, General, and Administrative Expenses includes:

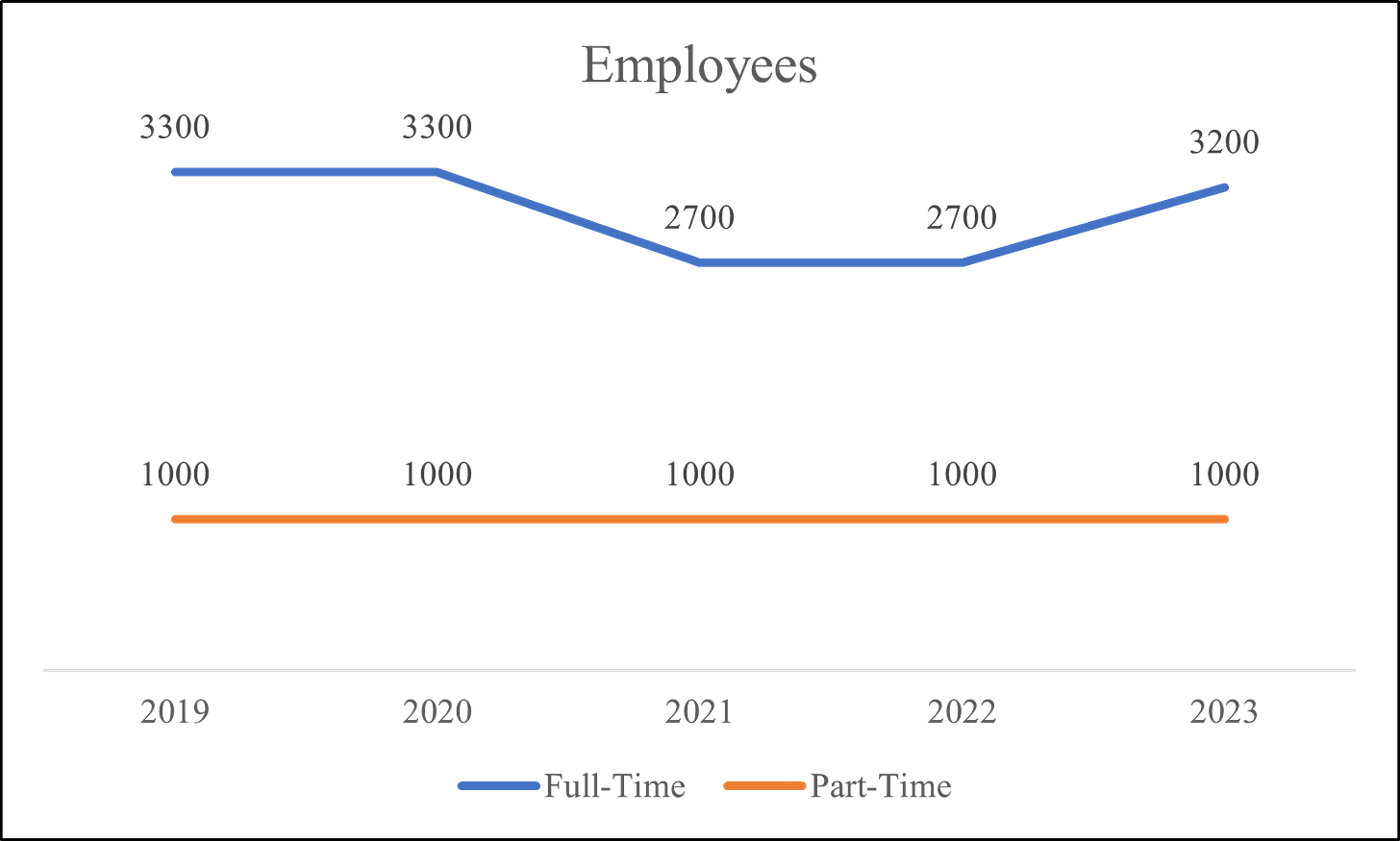

Store payroll and related benefits.

Advertising. 4.2% of total sales.

Credit card fees.

Store supplies and store closingcosts.

Central office management payroll and related benefits.

Travel.

Information systems,

Accounting.

Insurance.

Legal, and public relations costs.

Depreciation and amortization of central office leasehold improvements, furniture, fixtures, and equipment.

Bad debt expense sand accounts receivable related charges.

Store preopening expenses.

*Reported at 28-jan.

SG&A decrease respect to Total Sales is a Operating Leverage sign. SG&A for FY2021 increase respect to Total Sales due to a closing store during COVID-19.

Industry

(BBW: NYSE) competes in the consumer discretionary sector and other specialty retail.

The main players in the toy market are Mattel and Hasbro, with around USD 5.5 B and USD 5.9 B in revenues for FY 2022.

Build-a-Bear operates directly in the teddy bear market. Aurora World, Bandai, Mattel or Steiff are prominent players in the market.

Teddy Bears global market was valued at USD 6.4 Bn in 2022 [.https://www.transparencymarketresearch.com/teddy-bear-market.html]. BBW market size represents around 7% in total.

Teddy bears suggest emotional connections with a low age range. However, in the U.S., demand is driven by adult events too, such as birthdays, anniversaries, new year, etc.

The U.S. regional market leads global market demand, which is a critical driver of growth.

Aurora World

Aurora World, founded in Korea in 1981. The company offers a range of branded and licensed products sold through a wide variety of suppliers. With sales networks located in Hong Kong, USA, UK and Germany, Aurora World supplies over 25,000 retail outlets worldwide.

The business model is different from BBW, which is capable of creating value through experiences in physical stores. Aurora sells toys, but Build-a-Bear sells experiences that generate emotional engagement.

Aurora trades in the Korean Stock Exchanged and generated around USD 232 bn in FY2022.

Steiff

Steiff is a German stuffed animal, wooden, and other toys retailer. Its stores are focused on “museum style” much more than interactive and “make your own experience”.

“We are the inventors of the Teddy bear”.

“In 1902 Richard Steiff, designed a toy bear called Bear 55PB. Inspired by American President Theodore Roosevelt, the initially nameless bear received its name Teddy. Roosevelt refused to shoot a tethered bear during a hunting trip . The incident was captured by cartoonist Clifford K. Berryman and published in the Washington Post.

This was the best publicity for our Teddy bear - the teddy boom began and the Steiff brand achieved worldwide recognition”. [Steiff].

Competitive advantages

Intangible assets

Build-a-Bear brand is recognized as a prestigious brand worldwide.

The capacity to sell similar products at a higher price is a characteristic of prestigious brands. In fact, high gross margins suggest a very strong power of branding.

Licenses

“License relationships with over 75 world-class collaborators from film, TV, art, games, sports and more support enthusiast, collectible, affinity and gifting businesses with appeal to expanded consumer demographics…yet BBW is a brand unto itself providing balanced sales”. [Build-a-Bear Presentation].

Licensing represents around 45% of total business.

Patents do not expire until the years 2032 and 2033.

Growth

The company is focused in growth through a strategy with following pillars:

Leverage ongoing digital transformation.

2021 digital demand of $73MM representing a 34% CAGR since 2016

CEO says:

“We expect to continue to fuel cross-channel growth, the expanded data-driven digital marketing content and capabilities enhanced by access to well over 20 million social media follows, loyal members – loyalty members, and first-party data contacts that enable us to generate billions of impressions per year. In addition, the growing pop-culture status of Build-A-Bear fuels high interest for PR as well, delivering approximately 10 billion incremental annual media impressions for the last few years”.

Leverage omnichannel capabilities while evolving retail experiences.

New territories have a hight potential for expansion.

Total locations growth runs at a low rate. However, the company's strategy has been very efficient in terms of revenues per square foot.

CEO says:

“Through the combination of the above, the successful execution of our plans are expected to result in an overall increase in revenue and profitability in 2023 that surpasses that of 2022 to post yet another record setting year for our company. While we believe the 2022 annual results alone are noteworthy when also considering the external impacts over the last few years, including the COVID induced forced closure of our entire fleet in 2020, I believe it makes the fact that we just concluded our second record setting year in a row calls for noting how immensely proud I am of this organization, the leadership team, and the board of directors”.

Tourism activity

Commercial segment includes transactions with other businesses such as cruise lines or park attractions. Then, BBW is exposed to tourism activities, which represent a driver of growth for the company.

Licenses

45% of total business is exposed to the rights to sell products under license agreements. Movies and entertainment, sports, and video game markets are strong drivers of growth.

Revenues

FY2023 is FY2022 reported by the company at 28-Jan 2023.

FY2023* Guidance assumptions:

Total revenues to increase in the range of 5% to 7%, with growth in its three operating segments.

Pre-tax income growth of 10% to 15%.

To open 20 to 30 experience locations, through a combination of partner-operated. and corporately-managed business models.

Capital expenditures in the range of $15 million to $20 million.

Depreciation and amortization of approximately $13 million to $14 million.

Tax rate to approximate 25%, excluding discrete items.

*FY2023 is FY2022 reported by the company at Jan-28 2023.

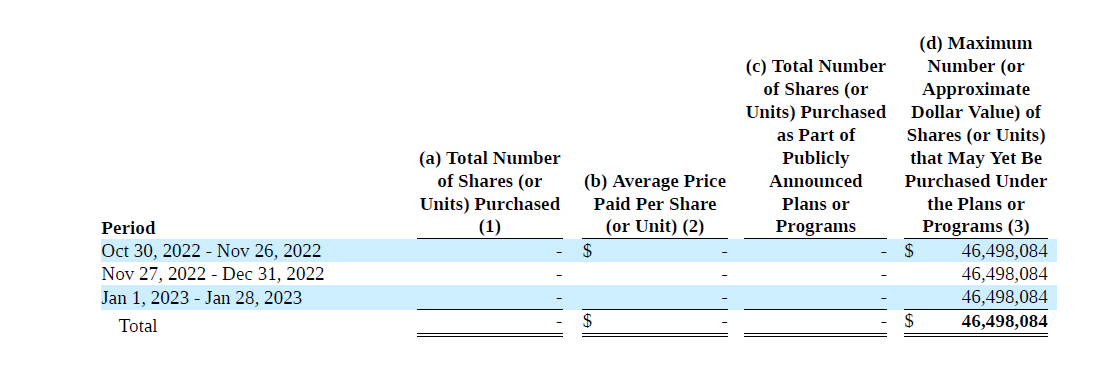

Retribution to shareholders.

“During fiscal 2022, the Company utilized $24.1 million in cash to repurchase 1,533,503 shares of its common stock. As of March 9, 2023, the Company had $46.5 million available under the current $50.0 million stock repurchase program adopted on August 31, 2022”.

“As announced March 8, 2023, the Company’s Board of Directors declared a special cash dividend of $1.50 per share that will be paid on April 6, 2023, to all stockholders of record as of March 23, 2023, following a $1.25 per share special cash dividend declared on November 30, 2021”. [BBW Annual Report].

Dividend coverage ratio is around 2x, which is a good measure to ensure to pay out its dividend to shareholders into the foreseeable future.

Management team

The Company key person is Sharon Price John who has served as Chief Executive Officer of Build-A-Bear Workshop, Inc. since 2013. In her tenure as CEO, she revitalized the brand, bringing profitability back to the publicly traded company (NYSE: BBW) and creating a springboard for the brand’s relevance in the years to come.

She started her career in advertising, overseeing accounts such as Hershey’s and the Snickers/M&M Mars business. Ms. John served in companies such as Hasbro, Mattel or VTech Industries.

Sharon Price John: a turnaround history.

During that time, she revitalized the brand, navigated economic uncertainty during the global pandemic, and managed to emerge from the “retail apocalypse” with the company’s two most profitable years to date, in 2021 and 2022.

Mrs. John met a company with a gross margin of around 42%, 323 locations and $409 in net retail sales per gross square foot in North America. Currently, metrics have shifted to 53%, 488 and 479, respectively. In addition, the company has been able to shift to a multichannel model under a strong digital demand.

Under a strong reduction in COVID-19 on retail store operations, The Company was able to also exceed gross profit margin in respect to the previously guided range with an increase in merchandise margin and a small decrease in sales (-25%) compared to the retail industry.

CEO says:

“We believe our back half results demonstrate the benefit of a solid strategy, and the disciplined focus and execution from a responsive and driven management team. We are committed to monetize the power of our beloved brand to deliver future profitable growth as the challenging times stabilize and consumers return to more normal activities”.

When a CEO generates better returns than his peers and the market, especially in tough situations, we could call him excellent.

In my opinion, Mrs. John has a high knowledge of the industry and is focused on generating value to shareholders.

Currenty Mrs. John owns around 4% of total shares outstanding.

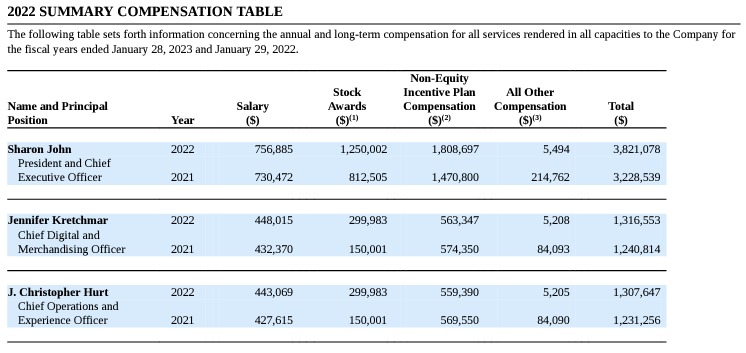

Executive Compensation

Annual compensation consist of a mix of base salary, annual cash bonuses, and long-term incentive awards consisting of performance-based restricted stock and time-based restricted stock.

Bonus Plan, including consolidated earnings before interest, taxes, depreciation and amortization (“EBITDA”) goals, consolidated total revenue (“Revenue”) goals, strategic and operational goals based on loyalty and retail objectives

EBITDA is a Non-GAAP measure subject to judgment.

Revenues can be recognized aggressively.

Compensation based on both EBITDA and revenue goals could involve a perverse incentive.

Risks

The impact of potential future outbreaks of infectious diseases or other health concerns.

The Company could not be able to maintain power of brand.

The shopping experience could deteriorate.

High exposure to retailer purchasing activity.

The teddy bear market is a cultural phenomenon. The company could be unable to expand its business to new geographies and markets.

Changes in foreign currency.

BBW could not transfer an increase in COGS to clients, or if they did, it could mean a decrease in sales.

High level of dependency on the CEO.

The teddy bear market is very competitive, seasonal and discretionary on purchases.

BBW products are considered high-priced, so the company depends on the economic cycle.

Financial Metrics

All metrics as reported at 28-jan.

Earnings

Capital structure

Capital employed includes NWC, PP&E, Right-of-use assets, and intangibles assets.

Capex represents around 3-4% of total sales.

Margins

Liquidity

Solvency

Valuation

DCF

Next report: October 15, 2023.

thanks for the well-articulated article on an intriguing name here.

I haven't dug into the details, but noticed it had Y03-05, and Y14-16, 2 periods that it achieved a relatively healthy economics/margin, but both time faded in about 2-3 years.

this is a competitive space, and hard to build a durable moat that results in long term superior economics. would like to hear if you think this time is different (from the last two), if so how?

Siyu LI

Under the Hood