Other writeups:

Analysis date: August 23, 2024.

Key Points

32% CAGR 2018-2023 of revenues.

Average business but shares extremely undervalued.

High gross margin.

Excellent capital allocation through buy-back shares and investment in capex.

Strong financial health.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

Introduction

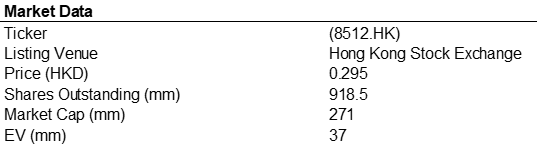

Hyfusin Group Holdings Ltd. (8512.HK) is a Hong Kong-based investment holding incorporated in the Cayman Islands, principally engaged in the manufacturing and sale of candle products.

The Group is principally engaged in the manufacturing and sale of candle products with headquarters in Hong Kong and operations in Vietnam.

Founded in 1993 by Wong brothers, Hyfusin Group Holdings Limited (8512.HK) successfully listed on the GEM Board of The Stock Exchange of Hong Kong Limited on 19 July 2018 and China Yinsheng International Securities Limited acted as the joint lead manager.

Business Model

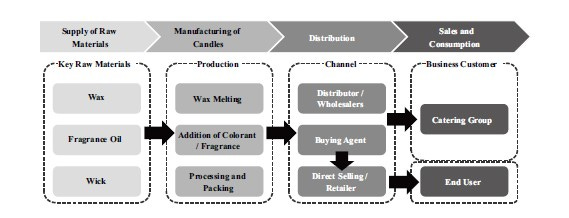

The Group manufactures and sells daily-use candles, scented candles, decorative candles and other products such as diffusers.

Applications of Hyfusin products may be: home scent, bath and body, therapeutics, adult pleasures and other.

The products are manufactured in factories owned by the company in Vietnam. Around 97% of non-current assets are located in Vietnam.

Value proposition

Hyfusin manufactures customized products adaptated to clients needs. (Candle, crystal, packaging…).

To satisfying to needs of consumers, manufacturers have been an efford on the design of decorative candle products to differentiate themselves from competitors. Candles for high-level events and ceremonies require high quality and exclusive design, which sell at a higher price than general candles. Distinct designs generally result in high profit margin for the manufacturers. Scented candles are also usually sold at a higher price compared with general candles.

Hyfusin Group enjoys good reputation in the candles market, in terms of quality and offered prices adding value to the clients throught production, delivery and quality to best standards.

“The Group offers a wide variety of services to its customers ranging from product design, raw material selection and procurement, provision of sample candle before mass production, laboratory testing to recommendation to improve the product quality”. [Annual Report].

Customers

Hyfusin is B2B business . The Group targets in mid-to-high end candle products mainly in U.S. and U.K. markets. Hyfusyn manufactures candle products based on the requirements and specifications from its customers.

The major customers of the Group are mostly U.S. and U.K. department store operators and buying agents.

Revenue from the main customer of the Group contributes around 63% of the total revenue.

Revenue from the three main customers of the Group contributes around 80% of the total revenue.

Most relevant clients:

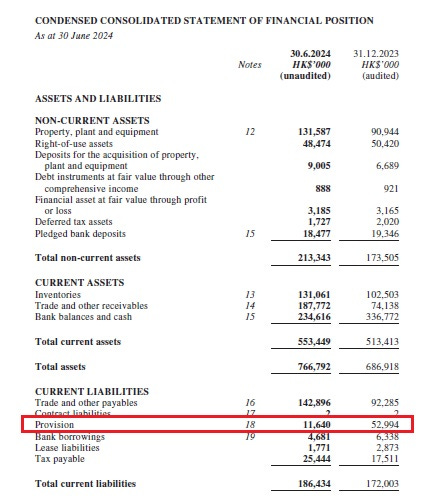

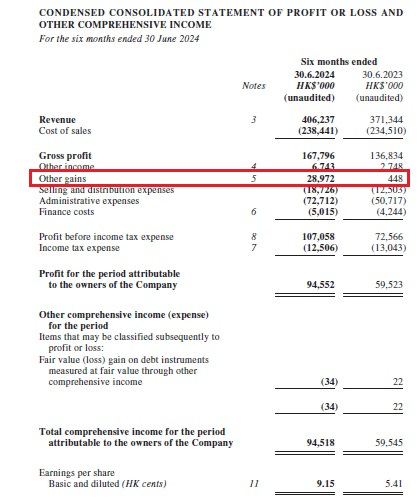

RECALL OF CANDLE PRODUCTS

During the FY2023, theHyfusin Group was advised by a customer in the U.S about two alerts initiated by the United States Consumer Product Safety Commission, requiring the customer to recall a certain number of units of glass jar candles supplied by the Group.

In December 2023, the Hyfusin eceived a claim of USD 6.8 mm (equivalents to approximately HKD 53 mm) from the customer to compensate for its commercial losses . Hyfusin Group made a provision of the claim by around HKD 92 mm.

On 28 March 2024, the Company finalised an agreement with the Customer for a settlement with a compensation amount of US$3.0 million (equivalent to approximately HKD 23.3 mm), payable by the Group to the Customer in four instalments, and that the Company shall be discharged from any further liability to the Customer in respect of the Claim.

Excess of provision was written off from liabilities and accounted as “Other Gains” in H1 FY24 P&L.

Suppliers

The Company select to suppliers mainly based on the following criteria: price, product and service quality depending on an audit compliance, payment terms offered, scale of production, logistics arrangement; background and credibility of suppliers, the length of business relationship; internal control of suppliers and overall stability and reliability in supply of products and services.

Hyfusin mainly purchases raw materials from China and Vietnam. China is the largest exporter of paraffin wax to Vietnam.

According to Hyfusin Group, The Company has at least two sources of supply to avoid dependency and does not enter into long-term contract with suppliers. In my opinion, two sources of supply may not be enough.

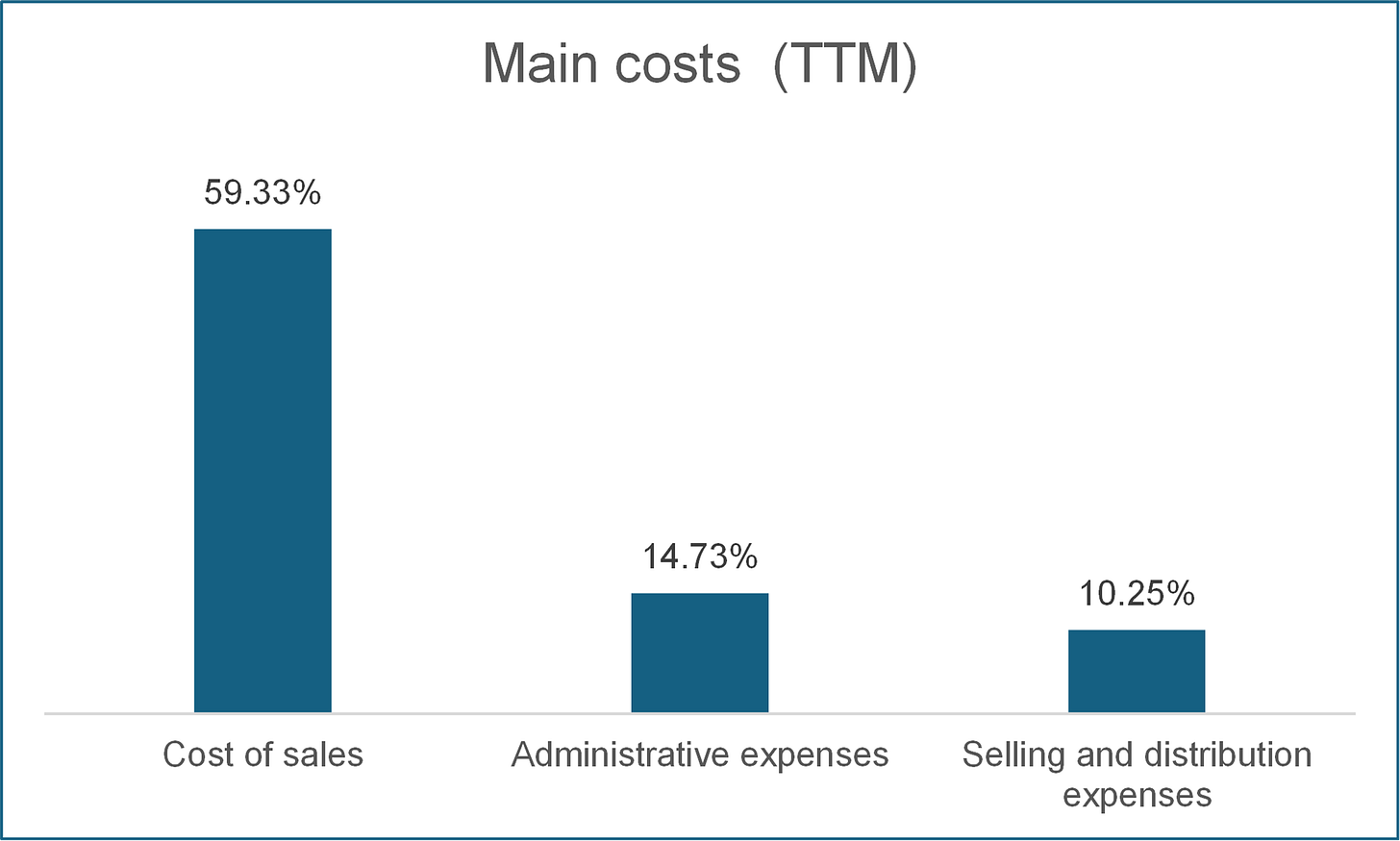

Costs Structure

Cost of sales includes:

Raw materials such as parafin wax, Vegetable and insect wax, packaging materials, fragance and other.

Labor and overhead costs.

Other costs necessary to bring the inventory to its present location and condition.

Paraffin wax is the largest raw materials component in candle products which nearly accounts for over 60% of raw materials component.

Beeswax or palm wax is usually added to the wax blend in order to enhance the texture of candle products.

“In Vietnam, most waxes rely on import trade. From 2013 to 2017, the import value per tonne of paraffin wax has declined from US$1,662.0 per ton to US$1,029.0 per ton, representing a CAGR of -11.3%. Vegetable and insect wax, while lesser quantity is needed, are more expensive than paraffin wax and have decreased from US$6,052.0 per ton to US$3,247.0 per ton, with a CAGR of -14.4% during the same period”. [IPO document].

According to the Frost & Sullivan Report, the import value per tonne of paraffin wax and vegetable and insect wax are expected to be approximately US$1,066.0 per ton and US$4,672.0 per ton in 2021, representing a CAGR of 0.9% and 9.5% from 2017, respectively.

Employees

Candle manufacturing is influenced by increasing labor costs. Therefore, a common practice for candle manufacturers is to set up their manufacturing factories in developing countries. However, due to the economic development, manufacturers could encounter a rise in labor costs in the future. That circumstance is being balanced with a depreciation of VND in respect to the USD.

Hyfusin currently has around 1270 workers hired.

Industry

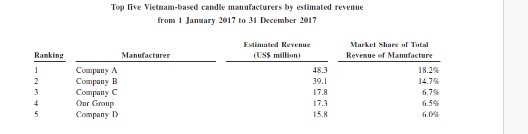

Hyfusin Group competes in the consumer discretionary sector and household products.

The candle production in labour intensive and the competition is homogeneous. A majority of low end candle products are made by OEM manufacturers with no patents and design, who usually sell products at low margins. Therefore, the market concentration of low-end candle products is comparatively low.

However, the market concentration of mid-to-high end candle products is comparatively higher since these manufacturers have strong competitiveness in branding, design, technique, customisation, marketing and business management. .

The candle market is expected to continue its upward trajectory, with growth driven by ongoing trends in home decor, wellness, and sustainability.

According to Market Growth Reports the major players covered in the Candle market report are:

Gies

Diptqyue

Qingdao Kingking Applied Chemistry Co., LTD

Dandong Everlight Candle Industry Co., Ltd.

Empire Candle Co., LLC

Yankee Candle (Newell Brands)

Vollmar

Hyfusin Group Holdings Limited

Zhongnam

Universal Candle

Fushun Pingtian Wax products Co., ltd.

Luminex Home Décor & Fragrance HoldingCorporation

Bolsius

MVP Group International, Inc

Talent

Armadilla Wax Works

Allite

Anti-dumping duty

The anti-dumping duty had a negative impact on PRC candle manufacturers exporting to the U.S. market. As a result, many of the said PRC candle manufacturers were forced to close down or relocate to Southeast Asian countries where cost of production is lower.

“The United States was the largest importing country of candle products with an import value of US$464.7 million in 2017. The U.S. government imposed an anti-dumping duty of 54.21% on petroleum wax candles imported from the PRC in 1986 as a measure to maintain the competitiveness of the U.S. local candle manufacturers against those in the PRC. The anti-dumping duty was raised to 108.3% in 2004 and was further extended in 2011 to cover all shapes, sizes, styles and types of candles containing any amount of petroleum wax”. [Hifusin Group].

The U.S. regional market leads global market demand, which is a critical driver of growth. Chinese companies are under antidumping duty, what represents an advantage for Hyfusin.

According to Hyfusion Group estimates, the likelihood of the imposition of anti-dumping duty on candle products from Vietnam in the future is minimal.

Poland was a main player exporter to the UK before Brexit. Hyfusin gained market share due to the relationship between costs and Brexit.

The candle manufacturing industry is very intensive in terms of labor costs. Hyfusin enjoys a cost-competitive advantage with respect to several players that manufacture products in countries with higher salaries.

Due to the high demand in candle products, Hyfusin continues to focus on the development of production and operations. The level of customers’ order hit the record high of the Group.

“In order to catch up the rapid growth of candle products especially in the U.S. market, the Group entered into the contracts with sales representatives for the sales incentive to sales representatives for the orders from customers introduced by them. The management of the Group gladly cooperates with sales representatives and expects the potential orders introduced by sales representatives in future”. [Hyfusin Group].

“Based on the well established long-term relationships with the customers and with support from our experienced management team of the Group in the industry, the Group has confidence in capturing business opportunities and growth in future”. [Hyfusin Group].

Growth

Growth drivers market:

Increasing demand from developing countries, mainly U.S market.

Increasing consumption of mid-to-high end candle products.

CEO says:

“Looking forward, the business and operation environments of the Group will remain challenging. Nevertheless, we will embrace these challenges by implementing proactive marketing strategies, investing more resources for product development and reinforcing on cost control measures”.

The company shows a lack of scope in the reported growth forecasts.

“Based on our success, we remain optimistic about the Group’s future development. We intend to execute our development plan as set forth in the Prospectus carefully and prudently for the purpose of bringing desirable return to the Shareholders and facilitating the long-term growth of the business of the Group”. [Annual Report].

Capital allocation

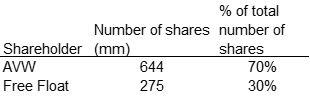

On 20 February 2024, the Company entered into the Share Buy-back Agreement with Vibes Enterprises Company Limited, a substantial shareholder of the Company prior to the completion of Share Buy-back.

The Company agreed to purchase, 181 mm of shares held by Vibes Enterprises at the Buy-back Price of HKD 0.165 per Buy-back Share.

After the completion of the Share Buy-back, the Buy-back Shares had cancelled . The total number of shares outstanding reduced from 1,100 mm shares to 918.5 mm shares.

In my opinion, the company has done a magnificent operation in terms of value for shareholder.

As at 30 June 2024, there is no treasury shares held by the Company.

In 2019, Hyfusin completed the acquisition of the new land for new production facility. In 2021, the new production facility was completed and fully utilised approximately HK$18.1 mm. from part of net proceeds allocated for the new production facility.

The management of the Group may consider that the renovation of existing production facilities will be planned and implemented after the completion of the new building construction work for the new factory, which commenced in July 2023 and is expected to be completed by the first half of 2024. The new factory would improve the operational efficiency of the Group.

No dividend was paid or proposed for ordinary shareholders of the Company for the years ended.

Management team

Mr. Wong Wai Chit (Mr. Vincent Wong) aged 56, is the chairman and executive Director. Mr. Wong Wai Chit is one of the controlling shareholders and founding members of the Company. Mr. Vincent Wong is responsible for formulating our Group’s overall strategic plans and overseeing its financial control, business development and policy setting.

Mr. Vincent Wong has over 22 years of candle manufacturing experience. He was educated in secondary schools in Hong Kong.

Mr. Wong Man Chit (Mr. Andrew Wong), aged 58, is the CEO and executive Director. Mr. Andrew Wong is one of the controlling shareholders of the Company. Mr. Andrew Wong is responsible for overseeing our Group’s business operations, its overall sales and marketing strategies and its production and product development.

Mr. Andrew Wong is one of the founding members of our Group and has over 22 years of candle manufacturing experience. He was educated in secondary schools in Hong Kong. Mr. Andrew Wong is the elder brother of Mr. Vincent Wong.

In my opinion, Wong brothers have the typical outsider manager profile. Deep industry expertise, low-profile, unassuming career in finance along with excellent performance in management, represent the keys to potentially excellent managers.

Executive Compensation

The remuneration of the CEO and the Executive Director represents around 8% of income and 65% of Net Profit. Compensation for management team should be “reasonable and not excessive,” but also sufficient to attract and retain the best possible talent to lead the organization. In my opinion, the remuneration of executives is clearly excessive, and together with the shareholding structure (excess influence and control), they represent a key factor to take into account and be monitored.

Discretionary bonus payments are not under specific criteria, which eliminates the incentives to be aggressive and take risks in order to get certain goals.

Ownership

AVW is beneficially owned as to 50% by Mr. Wong Wai Chit and 50% by Mr. Wong Man Chit, executive directors of the Company.

Financial Metrics

Earnings

Profitability

Margins

Gross margin increased as sales increased due to pricing power and lower cost of sales. Wax and paraffine prices has declined in the last years, but this situation could change depending on market conditions.

“The Group continues to improve the gross profit margin, benefiting from the lower unit price of raw materials and lower production overhead from synergy of high automation of the new factory. The Group continuously improve the liquidity position by lower the external borrowing during the high interest rate period”. [Hyfusin Group].

Liquidity

Solvency

In my opinion the company enjoys a strong financial position, with a net cash that is close to its market cap. and a very low debt level.

Cash deposits is denominated in HKD and USD mainly. Currency exchange risk is covered).

According to https://valueinvesting.io/8512.HK/valuation/wacc Hyfusin cost of debt averages around 10%.

Risks

Increase in raw material costs.

Increase labour costs in Vietnam.

Economic cycle, mainly in U.S economy.

Customer dependence.

Share compsosition.

High management team retribution

Poor quality reporting .

USA/China trade agreements.

Competition.

Takeover from Wong brothers.

Regulatory risks.

Strenghts

28 years background

Excellent capital allocation policy.

Dominance position respect to the Chinese competirors in U.S.

Strong financial health. (High returns, recurrent income and excellenet cash balance)

High gross margin.

High quality auditors (BDO).

Valuation

Base case scenario

Assumptions:

Revenue growth 23-28 5%

Gross margin 30%

Terminal multiple 10x

Bull case scenario

Assumptions:

Revenue growth 23-28 10%

Gross margin 40%

Terminal multiple 15x

Considering an unlikely and extreme bear case where the company's stock price drops to zero, Hyfusin intrinsic value could be around HKD 1.20 per share. Upside is around 300%.

If you are a professional or qualified investor, and you like my work, don't hesitate to contact me.

Next report: September 27, 2024.

The stock looks cheap but I have major concerns with the two brothers:

- They pay themselves huge bonuses instead of paying dividends to all the shareholders. They milked the IPO investors to finance their operations and I would be surprised if they ever declare a dividend. What does the Remuneration Committee do in this company?

- Why did Vibes Enterprises accept a share buyback @ HKD 0.165 when the stock was trading @ HKD 0.27? Vibes purchased the shares pre-IPO @ HKD 0.12 but it is a poor return for them nonetheless.

- Why didn't Vibes get a seat on the board? They owned 16.5% of the company after the IPO.

- They have just appointed their sister as an executive director (she will probably get a large bonus too!)

I linked to your piece (but just noticed that I forgot to include the actual link 🤦♂️) in my EM links post for last week as I am not familiar with this stock: Emerging Market Links + The Week Ahead (September 3, 2024) https://emergingmarketskeptic.substack.com/p/emerging-markets-week-september-3-2024