Disclaimer:

Eloy Fernández Deep Research publishes equity reports, and analysis posts periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports and posts is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This post is not a BUY or SELL recommendation.

At the current date:

I own TOYA shares, representing around 2.50% of my portfolio.

I own YONEX shares, representing around 2.60% of my portfolio.

I own Topgolf shares, representing around 2.30% of my portfolio.

Analysis date: March 30, 2023.

Price return since analysis date: +29.35% (+0.27% after results).

Company Overview

TOYA, S.A. (TOA.WA) is a Polish-Based company whose core business activities include production of hand tools, power tools, professional gastronomy equipment and equipment useful in every home.

To know more: TOYA S.A.

Q3´24 Results.

Revenue +13.7%

Significant increases in sales revenue were recorded in the e-commerce sales channel.

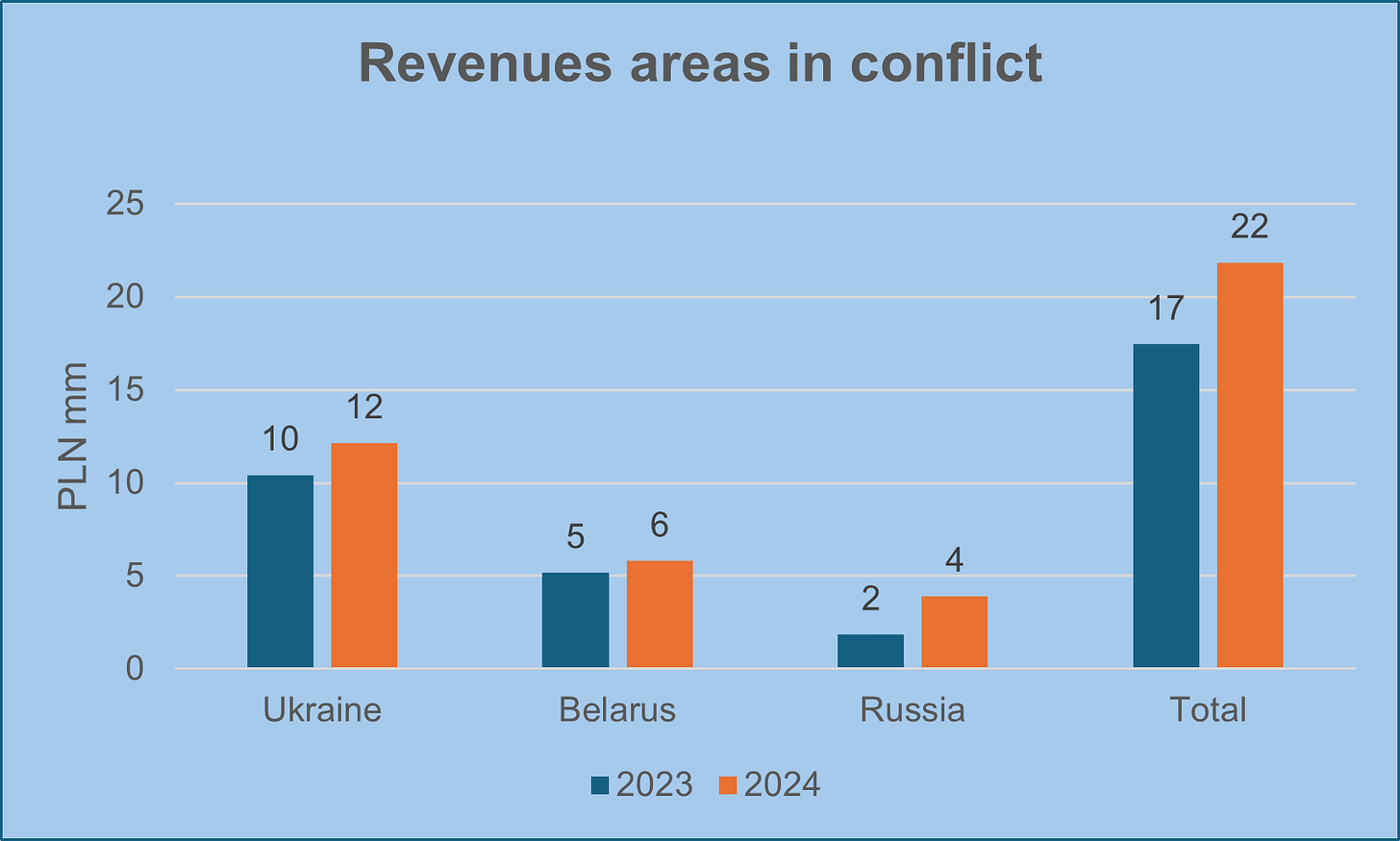

In the valuation assumptions, I suppose that revenues from conflict areas would be 0. However, revenues in Ukraine, Belarus, and Russia continue growing (25.2% YoY for Q3´24).

Gross margin flat 34.1%

EBITDA margin 13.76% (16%).

Inventory Turnover ratio is practically flat around 1.40 x

On June 6, 2024, TOYA approved a buyback share program by an amount not above to PLN 12,500,000. The amount of the minimum payment for one share shall be PLN 6.00. In order to finance the acquisition of the Shares, the Ordinary General Meeting of the Company, resolved to set up a reserve capital in the amount of PLN 100,000,000.

TOYA is an average business, but It is trading around at 6x EV/EBITDA (4x FWD), and at 0.8x EV/Sales. All of that while revenues are growing in conflict markets. In my opinion and being conservative, the stock is clearly undervalued, and I hold the intrinsic value at the analysis date.

Analysis date: July 14, 2023.

Price return since analysis date: +45.53% (+6.33% after results).

Company Overview

Yonex Co. (7906.T) is a Japan-based company that manufactures, purchases, and sales sports equipment such as sportswear, and also operates related sports facilities.

The Company manufactures badminton rackets, tennis rackets, golf clubs, clothing and shoes, snowboards, shuttlecocks, strings, stringing machines, etc.

Yonex is one of the most famous and well-respected brands in the racquet sports universe.

To know more: Yonex

FY3/25 H1 Results.

Net Sales +16%.

North America 1.6%, Europe 27%, Asia 24%, Japan +8%.

Badminton demand continued to trend solidly on the back of increased activity in China. Net sales reached a record high for the cumulative H1 period, helped in part by the positive effect of yen depreciation on overseas sales.

Gross margin 45% (43%)

EBIT margin 11.50% (9.70%).

Operating profit grew due to an increase in gross profit driven by higher sales and improvements in gross profit margin.

EPS ¥62.68 (¥50.43).

CFO 45%.

Net cash position ¥21,647 mm +23%

Forecast

“We revised our earnings forecasts upward from those announced in May 2024 to reflect the solidly trending sports market and the increase in our marketing investments aimed at expanding the Yonex fanbase”.

Rationale: During H1, sales and profit exceeded the forecasts announced in May 2024, driven by robust demand for sports activities in Japan and overseas, the stimulative effect of international tournaments on the market, and the favorable impact of yen depreciation on overseas sales.

Assumptions:

Sports market is expected to continue trending solidly.

Marketing investments, leveraging the achievements of athletes in international tournaments to broaden the fan base.

Metrics:

Net sales ¥134,000 mm vs. ¥126,000 mm

Operating profit ¥13,100 mm vs. ¥11,611 mm

Interim dividend per share ¥21 vs. ¥10

Update valuation

Equity value per share ¥2900

Upside 43%

Analysis date: June 29, 2023.

Price return since analysis date: -57% (-9.22% after results).

Company Overview

Topgolf Callaway Brands (MODG) is a leading golf company that provides golf entertainment experiences, designs and manufactures golf equipment, and sells golf and active lifestyle apparel and other accessories through its family of brand names.

To know more: Topgolf

Q3´24 Results.

Net revenues -3%.

Topgolf 1.1% driven primarily by new venues, Golf Equipment flat slightly ahead of expectations and Active Lifestyle -11.1% primarily from lower European wholesale revenue at Jack Wolfskin.

SVS (Same Venue Sales) -11%.

1-2 bay was down approximately 9% and 3+ bay was approximately down 19%.

The impact of spending per visit and traffic is balanced.

“Looking forward on same venue sales, the team continues to work on key initiatives to return the business to same venue sales growth. This includes a new game that the team is very excited about, Sonic the Hedgehog, which will launch mid this month and coincides with a new movie coming out in December. Exciting new reasons to visit and enhanced consumer experiences such as this are a key part of how we intend to drive long-term traffic growth, and thus, we are ramping up our ability to deliver these both more frequently and more effectively. Beyond this, we're full speed ahead on leveraging our new consumer data platform to provide more targeted promotions and offers to lapsed or new visitors. We're also launching new passes and bundles aimed at more frequent visitors”.

SVS is a cornerstone metric. I am concerned about the trend in respect to the same venue sales, what is decreasing in the last quarters. It will be a key metric to track in next quarters.

EBIT margin 3.33% (7.1%).

Liquidity position to $863 mm +17.5%

Net debt leverage ratio 4.1X (3.8x)

CFO 48%.

BRAND HIGHLIGHTS

Announced new Sonic the Hedgehog game to be released in mid-November.

Successfully launched our new lineup of Apex Irons.

TravisMathew expanded outerwear line.

Regarding spin off, CEO says:

“We're definitely fully engaged on the process of separation of TopGolf, and we believe that will maximize shareholder value. We're evaluating both the spin and sale. And we still would expect that if it's a spin is the outcome that it would happen as the earliest it would happen is mid next year, but that would be our target date”.

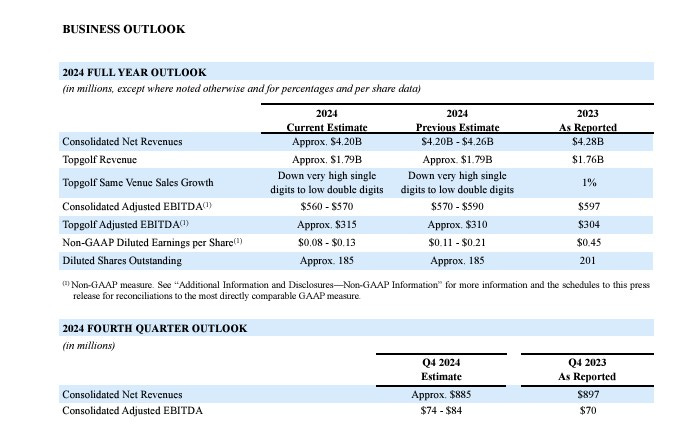

Outlook

“On the venue expansion front, we're on track to add 7 new owned venues this year, 6 of which we built and 1 acquired”.

For the full year, the company hold the previous guidance for SVS to be down very high single digits to low double digits.

What should we expect now?

Factors that have an influence on the current stock price:

Deceleration in SVS (Same Venues Sales).

Synergies between Callaway and Topgolf have not been materialized.

Slower consumer spend.

Market considers Topgolf debt level as a risky factor.

Uncertainty after intent of separation announcement.

In my opinion, uncertainty and risk level have increased after the announcement.“RISK” does not mean “Fact” or “Event”, but “Likelihood of”.

Clubs and balls is a strong business with a wide barrier of entry, but the potential growth is limited. The intention of reducing financial leverage could be a catalyst.

Topgolf is in an expansion stage that requires high quantity of capital investment and debt issue. However, potential growth is very high.

Valuation

Equity value per share $20

Upside 133%

If you are a professional or qualified investor, and you like my work, don't hesitate to contact me.