Leatt Corp.

Analysis date: December 29, 2022.

Key Points

38% CAGR 2017-2021 of revenues. 88% YoY.

Asset light model business.

Diversified portfolio of products.

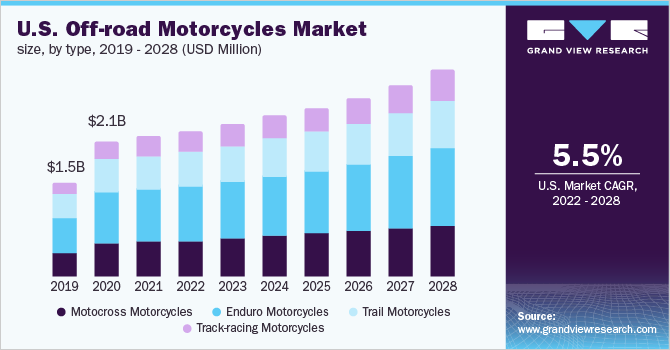

Favorable trends on Off-Road Motorcycle and MTB markets.

Strong financial position and alignment of interest in management team.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

Introduction

Leatt is a South African based company that designs, develops, markets and distributes protective equipment and apparel for motor sports and leisure activities, including riders of motorcycles and cycles mainly.

The company was founded by Christopher Leatt, a South African neurosurgeon, who was witnesses the death of Mr. Alan Selby, fellow rider, and friends of him. Then he starts working on a solution to reduce neck injuries.

Dr. Leatt, who is a passioned motorcycle rider, began to research and develop neck protection and finally he patented his first model in 2003.

Business model

The company operates through following structure:

Leatt South Africa. Based in Cape Town and formed in 2007 to conduct the company´s business and operations in South Africa.

Two Eleven Distribution. Based in Nevada to serve as the company´s executives offices in United States. Two Eleven is the exclusive distributor of Leatt products in the United States.

How makes money?

Essentially, Leatt Corp. designs, develops, markets, and distributes personal protective equipment. However, most of manufacturing process is outsourced to third-party based in China.

Leatt utilizes consultants and employees to make the quality controls before products are sent to distributors and retailers.

Revenue Model

Sales of products.

Direct distribution in the United States and South Africa.

Through a network of approximately 58 third-party distributors around the world.

Online store or other e-commerce sites.

Product royalty income.

Product royalty income is earned on sales to distributors that have royalty agreements in place and sales of licensed products by third parties with licensing rights. It represents around 0.25% of revenues.

Product and services

“Head-to-Toe Protection” is the company watchword. In other words, cover the riders needs for off-road motorcycle, downhill and cycling, and other recreational markets.

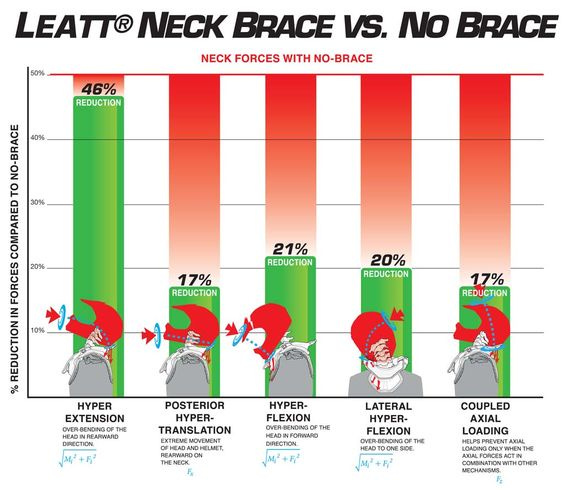

Neck Braces

Flagship is Leatt-Brace® that consists of a neck bracing system made with different combinations of carbon fiber, polycarbonate and Glass Filled Nylon. It was designed to help prevent cervical spine injuries. Leatt-Brace® is designed mainly for motorcycles, and other motor users but it can help prevent injuries for soldiers, law enforcement officers and other professionals too.

Neck Brace 6.5. Full Carbon.

Neck Brace 5.5. Fully Adjustable.

Neck Brace 5.5. Junior for junior riders.

Neck Brace 3.5. Competitively price.

Neck Brace 3.5. Junior riders.

SNX Model (Snow riders and extreme temperatures).

SNX 5.5.

SNX Trophy.

Fusion. Combines neck, chest, back, flank and shoulder protection in one piece.

Neck brace kart. Go-Kart riders.

This category represents around 12% of total revenues.

Helmets

Moto Helmet Range. Off-Road Motorcycle Riders.

Moto 9.5. Carbon Helmet.

Moto 8.5. Composite shell.

Moto 7.5. Injected polymer compound shell.

Moto 3.5. Polymer.

Moto 3.5. Junior. For junior riders.

MTB Helmets

Premium MTB Gravity 8.0

MTB Gravity 4.0

MTB Gravity 1.0

MTB Gravity 1.0 Junior

Half Shell Helmets

Helmets for (Off-Road cyclists) with 360-Degree Turbine Technology

MTB All-Mountain 4.0

MTB All-Mountain 3.0

MTB Trail 3.0

MTB Trail 2.0

All Mountain 1.0

All Mountain 1.0 Junior

Helmet MTB Urban 360-Degree Turbine Technology

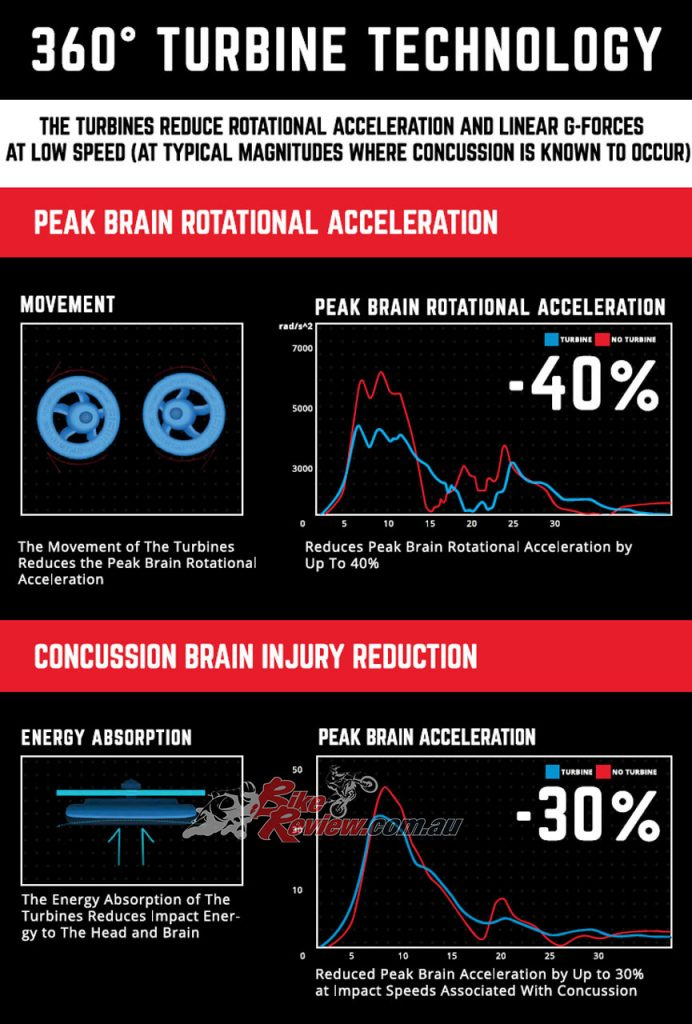

What 360-Degree Turbine Technology is?

It is a Leatt technology for concussion and brain rotation safety. It is similar to MIPS AB ($MIPS) has developed. Both help reduce the risk of sustaining serious head and brain injuries in a crash. However, there are differences between them about how they work.

“Disc-shaped turbines made of Armourgel, a non-Newtonian polymer that can absorb energy, are strategically placed all along the inside of the helmet’s EPS liner. So, when you put the helmet on, they are positioned directly against the skull”.

“In a crash, these turbines deform and bend, reducing rotational impact forces and absorbing energy from the impact. This technology can absorb both low-velocity linear and rotational impact forces in a crash”. [1]

To know more read this paper: https://www.olympiccycles.co.za/blog/leatt-360-turbine-technology/

Helmets category represent around 12% of revenues.

Body Armor

Leatt launched its Chest Protector in 2010. In 2011 the company introduced junior protectors, body vests and fully protectors.

Currently the range or body armor product consist of:

Chest Protector

Full Body Protector

Shoulder, Wrist and Knee Brace

“In the 2015 first quarter our Knee Brace was accepted for registration by both the United States Food and Drug Administration (FDA) and the UK's Medicine and Healthcare Regulatory Products Agency (MHRA), and our Shoulder Brace was accepted by the FDA, as Class 1 Medical Devices. FDA and MHRA registration allows us to take these products directly to market as medical devices for patients (not just athletes) recuperating from injuries, surgery, muscle tears or strains, dislocations, breaks or fractures”. [2]

Boots

FlexLock Boot and FlexLock Enduro.

Shoes

MTB shoes (clip and flat).

Body armor represents around 57% of revenues.

Other

Goggles, Leatt Apparel Range and Casual Clothing and Accessories, representing around 19% of revenues.

Spare Parts (Replacement or damage parts).

Sales channels

B2B Through third-party distributors and retailers.

B2C Two Eleven also sells products directly to consumers through online store available at www.leatt.com. or other e-commerce sites that sells Leatt.

South Africa

Leatt SA directly distribute Leatt products to dealers in South Africa

USA

Two Eleven directly distribute Leatt products to dealers in the United States

Rest of the World

Leatt earns revenues through the sale of its products through approximately 58 distributors worldwide.

Sold units are produced by third parts. However, costs materials, labor costs, shipping and freight may have an influence over amounts per unit that Leatt suppliers invoice to the company.

Likewise different operating expenses may be affected by rising costs of materials, salaries and energy, which have an influence over the operating activities of the company.

Main cost factors that have an influence may be:

Materials such as thermoset carbon fiber, glass fiber reinforced nylon and high impact polycarbonate resin. Prices of all of them are determined upon market conditions, supply and demand, and global conditions.

Energy.

Shipping and freight.

Labor.

Mistakes or scraps.

Cost of control quality.

Compliance.

Tooling.

Intellectual property.

Most common injuries riders have suffered from in the past:

Ankle or wrist sprains

Anterior cruciate ligament (ACL) tears

Broken collarbone

Broken ankle or wrist

Head injuries – concussions

Rotator cuff tears and other shoulder injuries [3]

“There is a growing concern about injuries in off-road motorcycle and leisure activities that involve certain level of risk. Specially in kids “In a retrospective population study carried out by UNSW and its medical research affiliates NeuRA and The George Institute, the study authors examined all records of children aged 0-16 years admitted to NSW hospitals in the years 2001-2018 for injuries sustained in off-road motorcycle or quad-bike crashes”.

“Published in the journal Injury Prevention, the research noted 6624 crashes resulted in hospitalizations during this time, with 5156 (78 per cent) involving motorcycles (including motocross bikes, trail bikes and other off-road motorcycles) and 1468 (22 per cent) involving quad-bikes”. [4]

In my opinion a large range of Leatt products are essential for riders in their different categories and activities. We should think about riders and motor-MTB fans’ perspective to understand the risk-benefit to wear a high level of protection, focusing in avoid or help to reduce head, cervical and thorax injuries.

Action Sports EMS runs the ambulance service at the North American motocross events and has evaluated more than 8,500 crashes and pointed out the consequences linked, or not, to the use of the neck brace.

This research study has been continuous from 2009 to now and reveals some data about the effectiveness of wearing the neck brace:

A Critical Cervical Spine injury is 89% more likely without a neck brace.

Death is 69%+ more likely (due to Cervical Spine Injury) without a neck brace.

A Non-Critical Cervical Spine injury is 75% more likely without a neck brace.

Cervical Spine injuries sustained without a neck brace are more severe, require greater care.

A Cervical Spine injury of any kind is 82% more likely without a neck brace. [5]

Why does Josep García use neck brace?

García is a Spanish rider who competes for Red Bull Team in enduro category. He won FIM Enduro2 World Championship in 2021.

Clients

Most of Leatt transactions are B2B, where the client is not the user. The customers are the different distributors and regional retailers that around the world sell a Leatt range of products.

Leatt works in five categories focusing on users of off-road motorcycle, downhill and cycling market and other activities where a full-face helmet is necessary.

The motorcycle market is the largest market. Downhill and cycling is the second one.

A significant portion of revenues come from a limited number of customers, however none of customers suppose more than 10% of revenues.

Suppliers

The company uses external suppliers in China, Thailand, and Bangladesh in accordance with Leatt manufacturing specifications.

Protocols are implemented by the company to check the quality of raw materials. Suppliers are required to perform testing on critical parts. Certain materials and critical parts are tested by Leatt R&D employees and independent laboratories.

The company makes payments in advance that consists of upfront deposit payments for the purchase of moulds, tooling and raw materials. Occasionally Leatt buy raw materials on behalf of suppliers in order to maintain production capacity.

Employees

The number of employees in 2021 was 98. 57 of them full-time and 41 independent contractors.

Majority of employees work in Dunbarville, South Africa and Reno, Nevada offices.

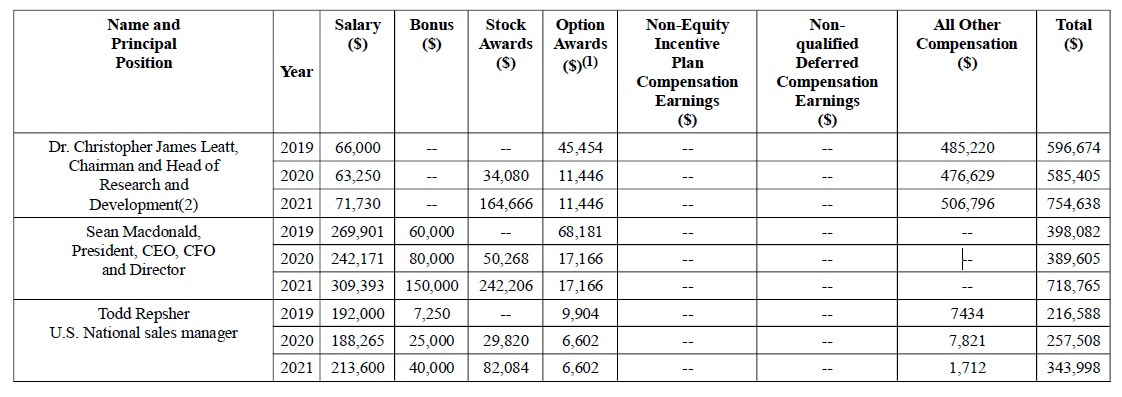

Salaries and wages for FY 2021 were $5,003,640. Around 44% of increase respect to FY 2020.

“This 44% increase in salaries and wages during the 2021 period was primarily due to the Company's decision to issue equity to key staff members in line with the Company's exceptional financial performance during the 2021 period as well as the employment of marketing and sales personnel in North and South America”. [6]

Leatt depends on key personnel, and turnover of key employees and senior management Specifically.

Dr. Christopher Leatt, Chairman and Research and Development Consultant and the licensor of some of our intellectual property.

3 full-time employees who are dedicated exclusively to research, development, and testing.

Unit economics

Total revenue includes Royalty Income representing around 0.25%.

On the cost side we can consider:

COGS around 56% of total revenue.

Cost of goods sold include costs related to third parties and manufacturers and royalty fees associated with sales of Leatt-Brace products. Royalty fees of 4% of Neck Braces sales revenue are paid to Xceed Holdings, a company owned and controlled by Dr. Christopher Leatt, chairman and founder of Leatt. 1% of Neck Braces are paid to Mr. J. P. De Villiers, the former director.

“Royalties are based on 5% of the cash received from net sales of neck braces worldwide “. [7]

Salaries and wages represent around 7% of revenues. For 2021 this item has increased for 44%.

“This 44% increase in salaries and wages during the 2021 period was primarily due to the Company's decision to issue equity to key staff members in line with the Company's exceptional financial performance during the 2021 period as well as the employment of marketing and sales personnel in North and South America, as the Company continues to build a global regional team of brand management professionals”. [8]

Commissions and consulting represent around 1% of total revenues. The company maintains an agreement with Innovate Services Limited, a Jersey company which is owned by Christopher Leatt. Innovate provides R&D and marketing consulting services in exchange for a monthly payment of $42,233. During FY2021 consulting fees were an aggregate of $422,330.

Other expenses related to payments and commissions to dealers are included on this item.

Professional fees comprise audit, tax, regulatory filings, and quarterly reporting requirements, as well as patent maintenance, protection and litigation. It represents around 1% of total revenues.

Advertising and marketing are around 3% of total revenues. It includes payments in exchange for advertising in motosport and bicycle magazines, online media and teams and sportsmen to increase visibility and relevance.

Office rent and expenses are related to warehousing and distribution centers in Reno and South Africa.

Research and development costs constitute around 3% of total revenues and are mainly related to personnel expenses and direct costs associated with developing products.

General and administrative expenses represent 3% of revenues. This item comprises insurance, travel, merchant fees, communication costs, office, and computer equipment.

Other as write-off, bad debt expense recognition and impairments.

Depreciation and amortization is related to Property and equipment.

Land.

Moulds and tools.

Computer equipment and software.

Office and other equipment.

Vehicles.

Leasehold improvements.

Salaries and SG&A expenses have a scalable nature. We can make an incremental revenue analysis keeping in mind a strong operating leverage and conclude that 25% of EBIT margin is possible in the future.

Value proposition

In terms of strategy, Leatt is clear about their mission. Head-to-toe strategy means focusing on all apparel and protection equipment for off-road and bicycles. Dealers have the opportunity to leverage a full line. Leatt dealers and distributors are able to serve a large range of products of a universe of activities and end users have the opportunity to equipment themselves with all range of safety and apparel products for moto and bicycle.

“In 2015, we launched two additions to our body armor product range, namely helmets and gloves. We also added two full apparel lines to our product range, one line designed for the off-road motorcycle market and the other designed for the bicycling market. In 2019, we added motorcycle Boots and Goggles to our range which has made the company a head-to-toe brand for motorcycle protection”. [9]

The main area of focus is the prevention of neck injuries, however Neck Braces represents only 12% of total revenues. The company offers a pipeline of categories and operates in a multi-channel global sales and distribution network.

CEO says: “I think Leatt, as a business, is a full head-to-toe business in terms of product offering on the MOTO and MTB” “If you are going to ride, you need to have a helmet, you need to have some level of armor, you need to have mountain biking shoes. If you are riding a mountain bike, you need to have boots, you need to have goggles , you need to have apparel”.

In 2012 Neck Braces, Body Armor, Helmets, and Other Products sales of Leatt represented around 74%, 20%, 0% and 5% respectively. Currently Neck Braces and Helmets categories represent only 24% of revenues. Other Products represents 19% of revenues and Body Armor is the main category with 57% of sales. It is clear that the company has implemented a diversification strategy for reaching to Head-to-toe business model.

Industry analysis

The company operates in the consumer discretionary sector and Protective Gears Market including off-road, on-road and bike. Leatt is focused in off-road (dirt bikes or scramblers, specially designed for off-road use) and bike (MTB).

Trends for off-road Motorcycles and MTB use around the world are very positive. Precisely where the severity of injuries may be higher. I think that it represents a strong cornerstone for growth in neck protection, helmets and body armor.

Moto and MTB have low seasonality.

Competitors

Atlas Brace Technologies is based in Surrey, British Columbia Canada. Founded in 2011, Atlas is the home of the first racer designed, racer tested next generation neck brace, the Atlas Brace™. The Atlas Brace™ was uniquely designed and engineered to be only of the highest level of safety, comfort, mobility, and forward thinking ideas. [10]

Alpinestars generates $176 million in revenues. The company is one of main competitors of Leatt in Neck Braces market. They offer a diversified portfolio focusing on protection and apparel for moto riders. Alpinestars is owner of intellectual property and they sell products with ingredient brand as Gore-Tex too.

EVS Sports is one of main competitors of Leatt in Neck Brace segment.

Founded in 1985, EVS Sports launched the AMX-5, the industry's first ever motocross specific knee brace.

Model business is similar to Leatt (Head-to-toe). EVS works with third parties and dealers.

EVS portfolio products includes Off-Road Motorcycle, MTB, Safety and Aviation.

FOX

Fox Racing is the global leader in motocross, mountain biking gear and apparel. We outfit the world’s best competitive athletes and enthusiasts with products that combine innovation, style, and rooted in the brand's original competitive motocross spirit. [11]

Products:

Helmets

Boots

Guards and protection

Jerseys

Shorts

Competitive advantages

Intangible assets

"Patent Lawyers Drive Nice Cars". [12]

“The Company's flagship products are based on the Leatt-Brace® system, a patented injection molded neck protection system owned by Xceed Holdings”.

“We believe that the continued success of our business is dependent on our intellectual property portfolio consisting of globally registered trademarks, design patents and utility patents related to the Leatt-Brace®”.

“Most of these initial intellectual property rights are held by Xceed Holdings, a corporation controlled by our Chairman, Dr. Christopher Leatt and the rest of these rights are held by the Company”. [21]

The narrative is “The flagship products are based on the Leatt-Brace®”, however de main patent is not owned by Leatt but by a company controlled by Christopher Leatt.

The company has patent over other product as 360 Turbine, shoes and chest protector.

“We have extensive licensed and registered trademarks. Leatt® is trademarked in Argentina, Australia, Brazil, Canada, Chile, China, European Union, Indonesia, Japan, Mexico, New Zealand, South Africa and U.K. in multiple classes depending on the jurisdiction. These multiple trademarks have renewal dates between 2022 and 2031”. [14]

Intellectual property portfolio includes almost 94 patents granted or in process . Leatt is a R&D and intellectual property business and expiring patents could affect the business.

Leatt brand proportionate to customers a superior quality signal for riders. I think that Leatt is a strong brand in motor and bike universe. Nevertheless brand is the weakest intangible assets. The value of Leatt brand could be diminished due to strong competition in the market, changes in preference of consumers or negative publicity.

Growth

“The COVID-19 pandemic has positively affected the off-road motorcycles market. According to Motorcycle Industry Council (MIC), off-road bike sales gained a significant boost during the pandemic times and in the month of May, the sales increased well above last year’s numbers. Also, it is expected that the market will grow at a steady pace over the forecast period”. [15]

According to company reports, market size is currently on going and is estimated around 250 M of riders.

Leatt products demand has a strength relationship with off-road motorcycles market. We can not forget that riders need all universe of products of Leatt.

Helmet sales in 2021 increased by 134% . They increased due to exceptional global demand for our redesigned motor helmet line for off-road motorcycle use.

Neck braces (the flagship of company) has decreased from 26% of revenues in 2017 to 12% in 2021.

Body armor is the strongest item representing around 57% of revenues.

COVID Tailwinds would help demand to grow faster.

CEO says: “While we are seeing some moderation in global demand due to these headwinds, our overall strategy remains on track”.

“That said, we are seeing these headwinds cause some moderation in the extraordinary consumer demand levels that the global MOTO and MTB industry has enjoyed over the last several quarters. This doesn't change the overall strategy and solid fundamentals that have contributed to our success. Consumers continue to ride and participate heavily in outdoor activities, and dealers continue to digest inventory and reorder. These are trends that we expect to continue”.

“We were particularly pleased with our results in the U.S. for the quarter, an area where we continue to invest in our sales and distribution capacity. U.S. revenues increased by $1.1 million or 26% year-over-year, as some dealers began to restock inventory around the country. Our Reno, Nevada warehouse is now fully up and running and well stocked to ship products to customers and consumers efficiently. The U.S. sales team continues to grow substantially, as we reach and service a wider group of MOTO and MTB dealers around the country”.

In the Fourth Quarter and Year-end 2021 Results conference Call CEO said:

“We do not provide a direct guidance , but we do say is that we target double-digit revenue growth”.

Strategy of growth consits of:

Expand and improve categories.

Core segment expansion.

Brand investment.

Supply chain efficiency.

Multi-Channel development.

Management team

The full board is Jeffery Joseph Guzy, Dr. Christopher James Leatt and Sean Macdonald.

SEAN MACDONALD: Mr. Macdonald, CA (SA), aged 44, has served as the Company's Chief Executive Officer and President since November 2010, as its Chief Financial Officer since August 2009, and as a Director since May 2010. Prior to joining the Company, Mr. Macdonald served from August 2004 to December 2009, as the Chief Financial Officer of Cyclelab, the largest bicycle retailer in South Africa, where he was responsible for operational, financial and strategic leadership of the business including the implementation of a franchise model in order to grow the business. Mr. Macdonald holds a Bachelor of Commerce Degree in Finance and Information Systems from the University of Cape Town, as well as a Post-Graduate Diploma in Accounting, which included 3 years of articles at KPMG Cape Town. Mr. Macdonald is also a South Africa registered Chartered Accountant. [16]

JEFFREY GUZY: Mr. Guzy, aged 70, has served as a director since April 2007 and serves as a business development consultant and entrepreneur in Arlington.

DR. CHRIS LEATT: Dr. Leatt, aged 53, has served as the Company's Chairman since 2005 and as the Company's Research and Development consultant since July 2015. He plays a key role in Leatt, working in a critical area in the Company.

Dr. Leatt owns around 32% of shares outstanding.

Currently Dr. Leatt maintain control over Xceed Holdings, a corporation incorporated under the laws of South Africa, and wholly- owned by The Leatt Family Trust, of which he is the Company's chairman, Trustee and Beneficiary.

Use rights to the Leatt-Brace®, are owned by Xceed Holdings. Leatt Corp.has the exclusive global manufacturing, distribution, sale and use rights to the Leatt-Brace®.

Leatt is obligated to pay to Xceed 4% of sales from Leatt-Brace®.

During 2021 the Company paid an aggregate of $327,729 (Around 0.5% of total revenues) in licensing fees to Xceed Holdings.

Given that Mr. Leatt is the chairman, founder, most shareholder and he has the control on related parties what play essential roles in Leatt operational activities, it represents a personal incentive and a conflict of interest. In my opinion the key person is strongly dependent of firm performance and it may cause aggressive accounting.

In addition Leatt makes monthly payments to Innovation Services Limited, Jersey limited company beneficially owned by Dr. Leatt, for research, development and marketing services.

The original agreement dated dated July 8, 2015. in exchange . On November 8, 2021, the Company entered into a new consulting agreement with Innovation Services Limited for a monthly fee of $42,233. For 2021 the Company recognized an aggregate of $506,796 in consulting fees to innovation .

“On July 8, 2015, the Company entered into a Director Agreement with Board Chairman, Dr. Christopher Leatt, pursuant to which, as amended, in addition to his duties with the Company's Research and Development department, Dr. Leatt agreed to devote as much time as is necessary to perform the duties of a director of the Company, including duties as a member of any committees that he may be appointed to by the Board of Directors, including but not limited to assisting the Company with the development of business and new business strategies relating to the objectives of the Company, participation in the Company's investor relations activities, including road shows and shareholder communication activities, and participation in corporate strategy decisions of the Company. Effective January 1, 2022, as compensation for his services Dr. Leatt will receive a base fee of ZAR 95,000.00 per month, approved expenses for travel, medical and life insurance benefits and participation in the Company's Senior Executive Wellness Program, and the Company has agreed to indemnify him to the full extent allowed by law except where such indemnification is prohibited due to intentional misconduct, fraud or knowing violation of law. Either party may terminate the Director Agreement at any time upon six months' written notice unless he resigns from his position or is removed by shareholders of the Company prior to such termination”. [17]

Risks

Given that Leatt sells t discretionary products, global economic crisis could negatively affect to sales, results of operations, and financial condition.

International operations expose to foreign exchange risk and currency fluctuations. Because primary operations in South Africa, a portion of consolidated revenues are denominated in ZAR. Thus, the Company is sensitive to exchange rates of ZAR, EUR and USD.

Shipping, freight costs, tariffs and other could affect to result of operations.

The largest customer accounted for approximately 10% and 9% of annual U.S. revenue. Loss of any key customer could affect to result of operations.

Future events, like legal conflicts or demands, could have an influence on the company reputation.

Products may suffer obsolete by launching of alternatives and substitutes in the market.

Leatt manufacturers are based in Asia and operate under local regulatory framework. Changes in regulations, strike outs and other conflicts could affect result operations.

Leatt has a strong dependence on its capacity to defend patents. The lack of that capacity could have a significant impact on operations. Likewise expiring patents can affect the business.

Leatt trades on OTC Market. Securities on Over-the-Counter markets are less liquid than those on exchanges.

Leatt has a strong dependence on its founder and chairman Dr. Christopher Leatt who plays a key role in the Company operations and is owner of Leatt-Brace® named “The flagship” by the company.

In my opinion it exists a conflict interest on the relationship between Dr. Leatt, Xceed Holdings, Innovate Services and Leatt Corp.

Catalysts

Currently a few analysts cover the Company. Leatt is a small and unknown company. An increasing in number of analyst could raise the share price in the future.

Leatt trades on OTC market. An uplisting could increase exposure and opening it to new investors. Respect to upsliting CEO says:

“It is not a immediate need in terms of raising capital and getting more exposure. But it is something which would be on the cards at the right time”.

Financial metrics

Financial Statements as reported

Earnings

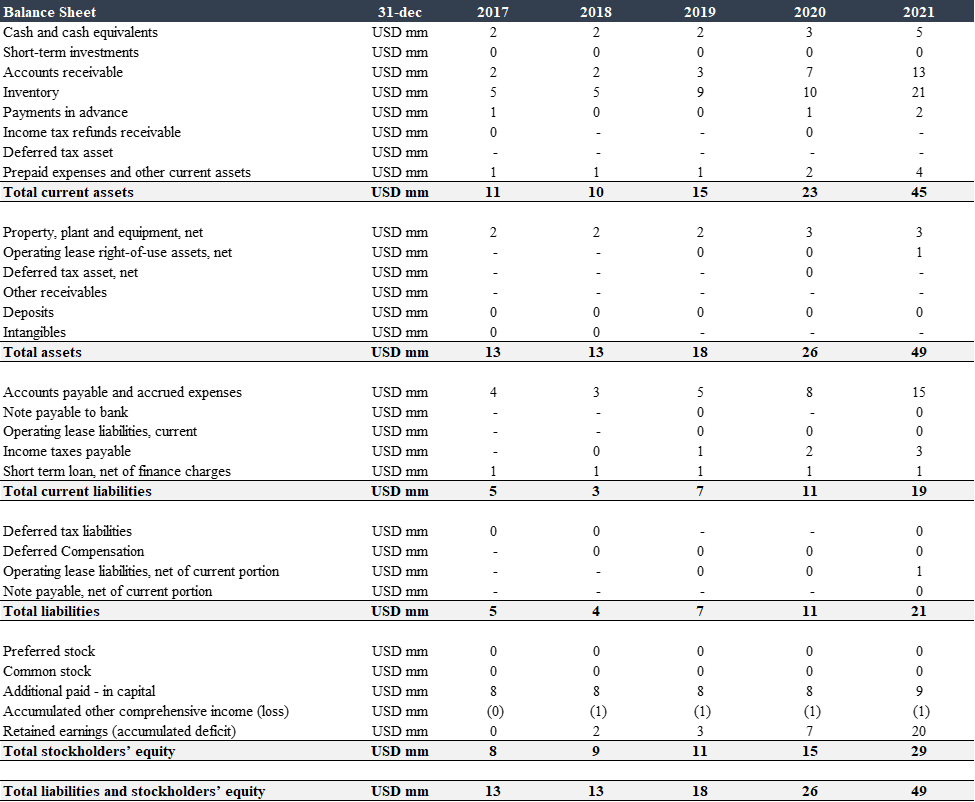

Capital structure analysis

Changes in inventories of 110% could indicate a excess of inventory and slowing down of demand. CEO, in Q1 2022 Earnings Call CEO Said:

“We have really ensured that we have enough inventory in order to sell out for period".

“Much of that stock is inventory that is not subject to obsolescence”.

Receivables increased in 2021 around 77% against a 88% in revenues. It is a positive signal about misstated profitability.

We should be concerned about working capital expense and capacity to sold out inventory. Narrative of management team is focusing in temporary factors and maintain a positive speech but we have to pay attention to key points such as headwinds post COVID, change in demand from dealers and distributors, aging of inventory, changes in AR and AP.

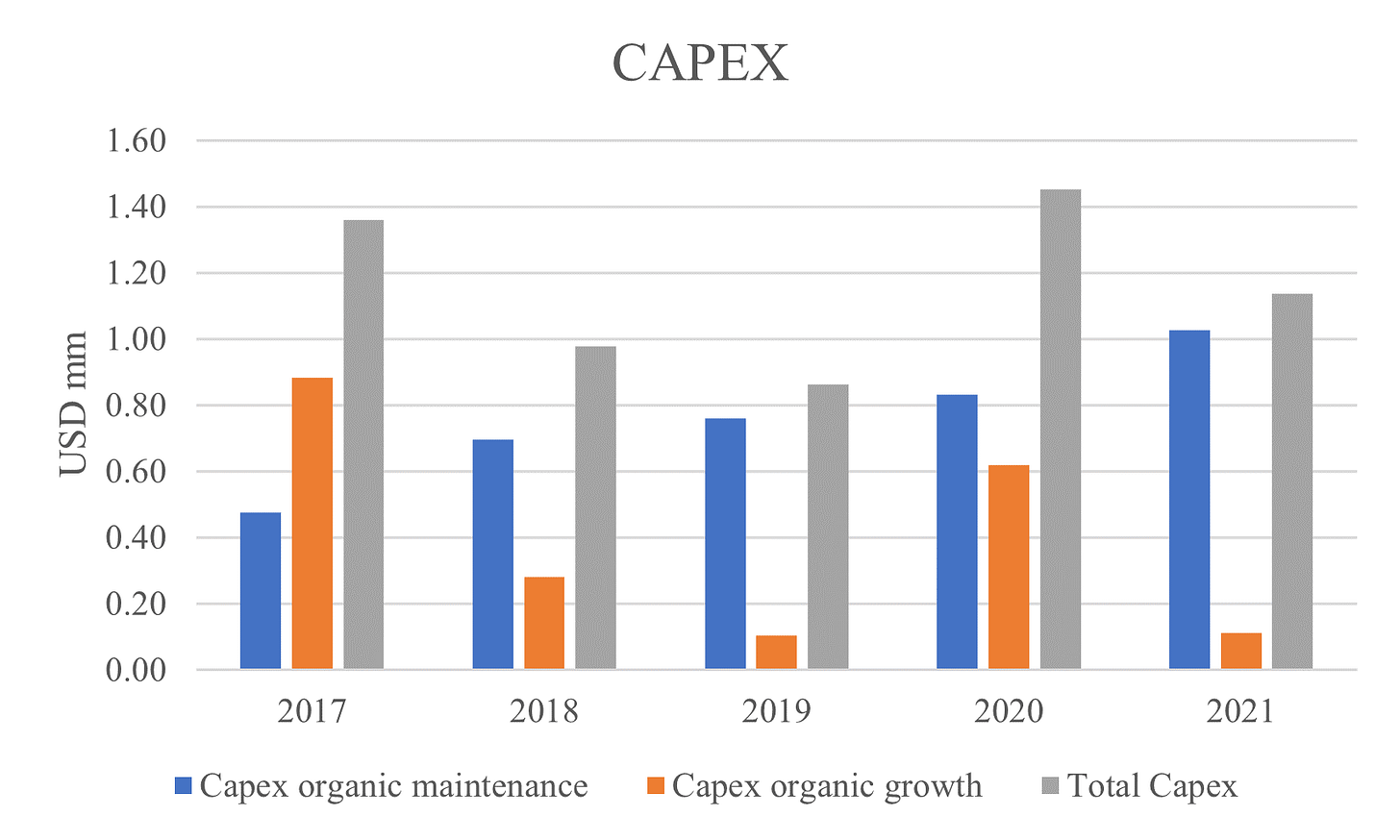

Capex represent barely 1.5% of revenues. It does make sense because most of capital employed by company is WC.

Future needs of Capex could be stable or decrease due to the operating leverage and asset light model business.

Profitability

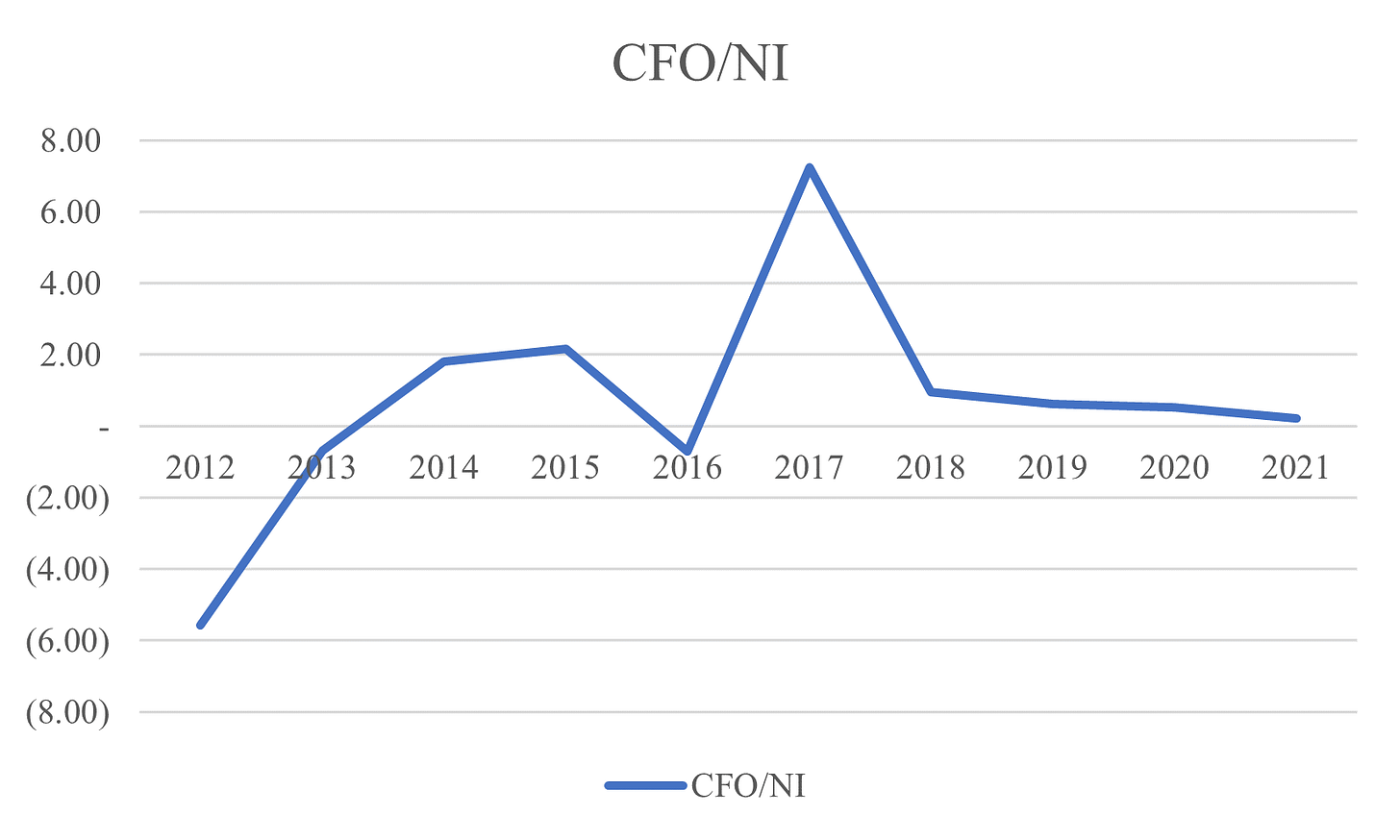

FCF margin is noticeably smaller than EBIT margin due to working capital expenses.

We can say that the company has a poor conversion rate FCF/EBITDA.

The key point is inquiring about WC investment will generate profits in the future or increases in Receivables and Inventory indicate changes on demand side.

Operating cash flow lower or same than NI is a sign of low profitability. In this case due to high expense in WC in last four financial years (mainly changes in inventory and AR).

High ROCE suggests a very asset light model and a good quality of business. Model business of Leatt is asset light. NOPAT increases 225% in 2021. Average of capital employed increases 71% (Mainly working capital). Incremental ROCE is around 61%.

Breakdown ROE is:

Net Profit Margin around 17% and 11% for 2021 and 2020.

Asset Turnover 1.9x and 1.7x for 2021 and 2020.

Leverage Ratio (A/E) around 1.70x for 2021 and 2020.

In many cases increase of ROE is due to a higher-than-average financial leverage. Leatt increase is due to a increase in margin and turns.

Activity

Liquidity

Solvency

Leatt doesn’t hold financial debt. The company presents operating leases obligations net of current portion around USD 1.1 M for 2021.

Notes payables

Two Eleven entered into a Note Payable with a bank effective December 17, 2021 in the principal amount of $272,519, secured by equipment. The Note is payable in 36 consecutive monthly instalments of $7,990, including interest at a fixed rate of 3.5370%, commencing February 5, 2022, and continuing to January 5, 2025. As of December 31, 2021, the full amount of $272,519 was outstanding. [19]

Valuation

We could assume a base growth where, given certain level of operating leverages Opex items could decrease as percentage of revenues. Conservative scenario based on growth15% 2022-2026 in revenues and EBIT margin around 26%.

[1] https://www.cassonsmedia.com/post/leatt-what-is-360-turbine-technology

[2] [6] [7] [8] [9] [13] [14] [16 ] [17] [18] [19 ] Annual Report FY2021

[3] [https://www.mx-gear.com/dirt-bike-injuries/]

[4] [https://www.news-medical.net/news/20220713/Study-Off-road-motorcycles-cause-higher-rate-of-injuries-among-kids-than-quad-bikes.aspx]

[5] https://enduro21.com/en/products-reviews/latest/product-focus-leatt-neck-braces-and-their-benefits)

[10] [ https://www.linkedin.com/company/atlas-brace/about/]

[11] [https://www.linkedin.com/company/fox-racing/]

[12] Pat Dorsey. The Little book that builds wealth. Page. 34

[15] https://www.grandviewresearch.com/industry-analysis/off-road-motorcycle-market-report