MIPS AB

Analysis date: November 22, 2022.

Key Points

Ingredient brand in a high growth potential market.

Asset light business model.

Leading player with 10% of market share.

48% CAGR 2017-2021 in revenues.

Substantial competitive advantages.

Favorable international trends on bike and moto users.

Strong position in bike market.

Safety market opportunity.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

Introduction

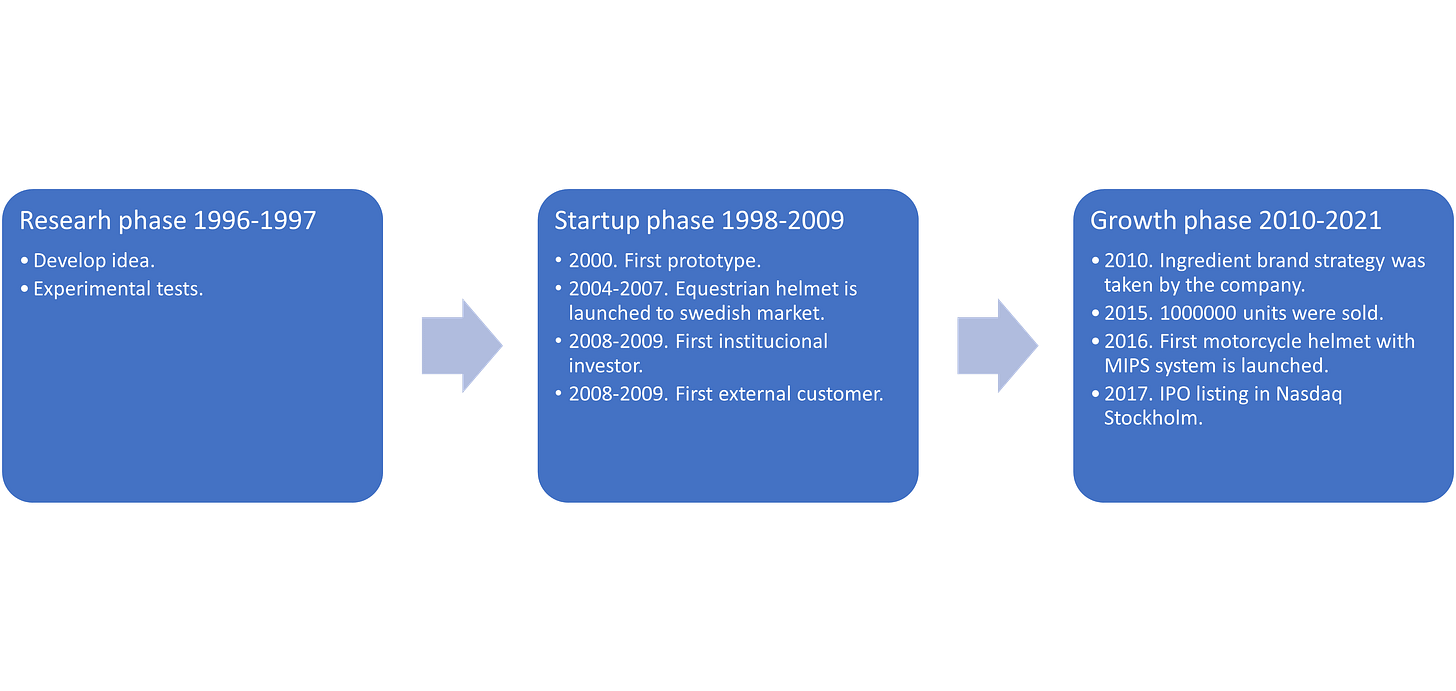

MIPS AB is a Sweden-based company that sells solutions against rotational forces, integrating them into helmets brands models. MIPS AB is a world-leader in this area. The company was founded in 1995 by Hans Von Holt, a Swedish brain surgeon.

Von Holt was working at the Karolinska Institute in Stockholm. He began studying how helmets were designed. Conclusions were that although standards helmets provide certain level of protection against cranial injuries, they did not against brain injuries.

After that time Von Holt contacted Royal Institute of Technology in Stockholm to launch research about head and neck injuries. As results, in 1996, Von Holm and Peter Halldin, a student at the institute, presented their idea for MIPS solution.

Afterward Svein Kleiven, a PhD student, was incorporated to Von Holt teamer order to develop finite element models of human brain. That model is the core tool for researching process for MIPS AB, being able to visualize the effects of MIPS system.

The first prototype with a Mips solution was tested in 2000, and the first agreement with a customer was signed in 2008.

In 2017 MIPS announces its intention to list its shares on Nasdaq Stockholm. The price for its initial public offering was SEK 46 per share and comprised 12,399,372 shares.

Historical events

Business model

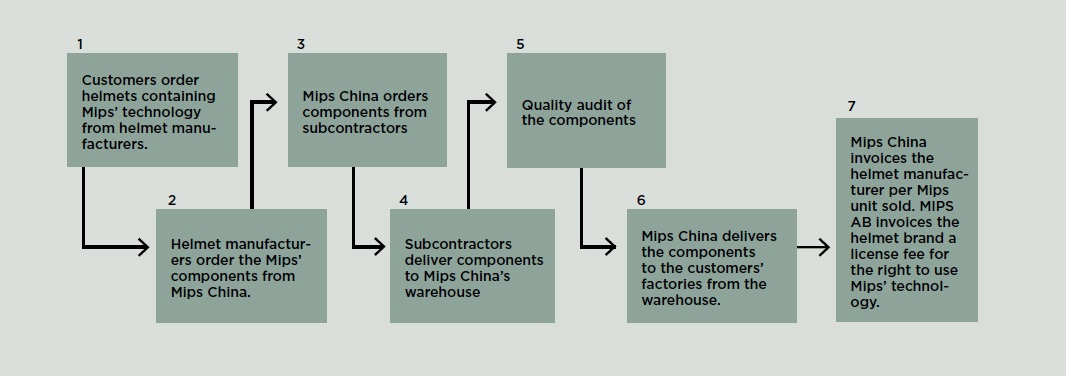

To understand how MIPS makes money, we must consider several players on the supply chain.

Essentially, MIPS business comprises MIPS AB (The parent), and MIPS China (The subsidiary). Helmets brands, that are usually based in China, requires to MIPS to integrate the safety system on their products.

MIPS does not directly produce any of their products. Nevertheless, the company operates through the subsidiary who is charged to order the different components from external suppliers.

After the component is made, subcontractors deliver to Mips China to make the quality audit. Then Mips China delivers components to de customers´ factories.

For each unit integrated and sold MIPS earns money on the following scheme:

MIPs China (The subsidiary), invoice the helmet manufacturer per Mips unit sold.

MIPS AB (The parent) invoices the helmet brand a license fee for the right use Mips ´technology and a fixed fee for development and implementation services.

Revenue Model:

Sales of component kits for helmet manufacturers (Including license fee).

Sales of services (implementation) are attributable to the development of customized MIPS’ safety systems for a specific customer and model.

MIPS strategy is based on “Ingredient brand”. It is a marketing strategy where a component or an ingredient of a product is branded as a separate product. It works because clients benefit from being able to promise a higher level of quality.

The main goal of ingredient brand strategy is to take advantage of the potential synergies of two or more brands.

Examples or ingredient brand may be Intel, Gore-Tex, Dupont´s Teflon or 3M.

Product and services

MIPS product offering consists of:

Mips safety system, what is implemented in the brand helmets.

Services for implementation of Mips safety system.

Licensing to customers.

Mips ´safety system

Mips (Multi-Directional Impact Protection System), adds protection against rotational motion into helmets. Rotational motion is a combination of rotational energy and rotational forces. Both increase the risk of brain injuries. Therefore, while traditional safety system pays attention to straight radial (head-on) impacts, Mips safety system focus on oblique impact.

Mips® safety system consists of a low-friction layer inside the helmet to reduce the negative effects of rotational motion on the head.

“It is found inside the helmet, generally between the padding and the EPS foam protective layer. There are different Mips® systems, but all consist of a low-friction layer between the helmet and the head”. [2]

“Every Mips® safety system is centered around a low-friction layer that allows omnidirectional movement of 10-15mm on certain angled impacts, intended to help reduce rotational force to the head”. [3]

Product range

Mips ´solutions describes different products based on its intended. All of them are designed to help to reduce the rotational force to the head upon impact from certain angles.

MIPS® ENVOLVE

World-leading safety system for helmets. It is the most used Mips ´helmet safety system.

MIPS® INTEGRA

Light, thin and deeply integrated system. Result of collaboration whit one of the helmet brands.

“Mips Integra is a rotational management system that is integrated and designed into the helmet as tightly as it gets. Since the solution is a design collaboration between the helmet manufacturer and the Mips design team with the aim to integrate the Mips system into the helmet the Integra comes in different shapes depending on the properties of the particular helmet”. [4]

MIPS® ESSENTIAL

It is a simple safety system what is perfect as an introduction.

MIPS® AIR

The lighter system of all.

MIPS® ELEVATE

Advanced system that can be used in a classic hard-hat safety helmet and in other harness-based helmets.

“Mips Elevate is a rotational management system RMS. The system consists of an injection-molded Low Friction Layer that rests on the head straps and then extends up to the headband and is held in place by the front padding. On the inside, facing the user’s scalp the LFL comes with foam pads that improve both the comfort and the ventilation so that the helmet can be worn all day. The padding has flexible connectors that make sure the Mips Elevate is kept in place during daily use while still allowing the padding to be easy to remove and wash or replace when needed. Mips Elevate offers a revolution in head protection designed and built with the tough conditions on a work site in mind”. [5]

Substitutes and alternatives

WAVECELL is a patented technology by Bontrager based in a triangular cell to absorb rotational force upon impacts. That technology is integrated in TREK helmets. [6]

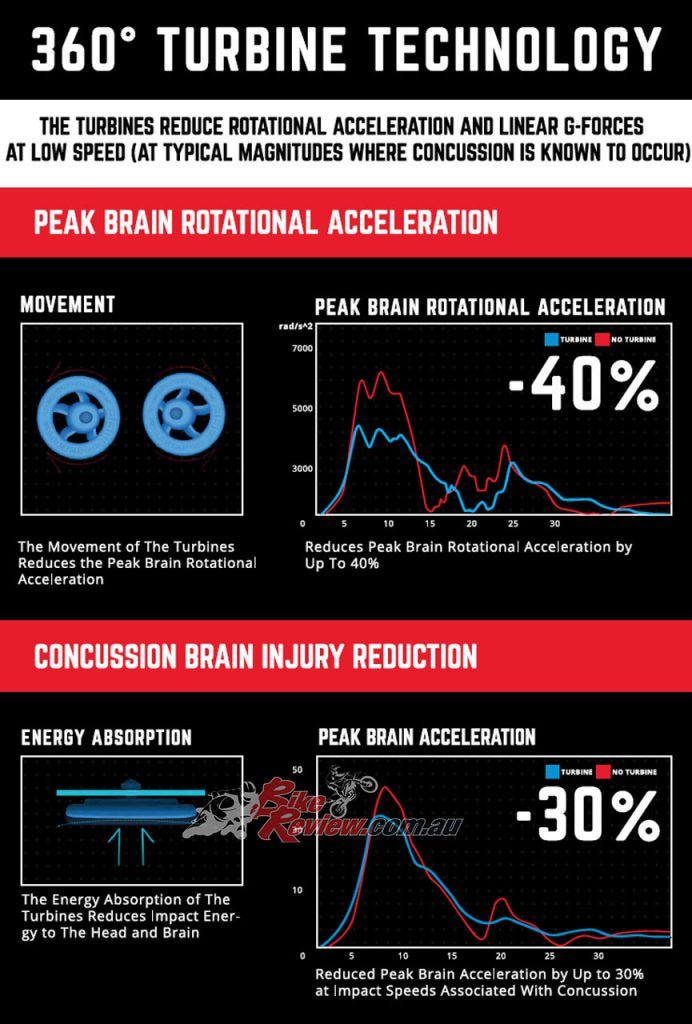

360° TURBINE TECHNOLOGY is a system from LEATT Corporation that reduces rotational acceleration and G-Forces.

SPIN is a technology from POC that ensures that rotational forces are not transferred to the head.

All of them are from by helmets brand that have developed their own technologies. Moreover, Bontrager and POC sell helmets equipped with Mips safety systems.

Helmet brands such as POC have decided to abandon their own solutions, indicating that MIPS are superior to existing competitors. [7]

In 2019, MIPS purchased Fluid Inside, a technology similar to SPIN, before announcing later that year that they were partnering with POC again to develop new rotational impact protection solutions. [8]

Cost factors

Sold units are produced by third part. However, costs materials, labor costs, shipping and freight may have an influence over amounts per unit that MIPS suppliers invoice to the company.

Likewise different operating expenses may be affected by rising costs of materials, salaries and energy which have an influence over the operating activities of the company.

Main cost factors that have an influence may be:

Materials.

Energy.

Shipping and freight.

Labor.

Mistakes or scraps.

Cost of control quality.

Compliance.

Tooling.

Intellectual property.

The life span of Mips’ products should be at least as long or longer as for the helmet in which the product is installed.

“The replacement cycle for helmet users in Sports Helmets was estimated to be an average of five to eight years. Although no new data is available regarding how often helmets actually are replaced, Mips estimates that replacement cycles have been shortened over time”. [9]

Then, replacement of Mips safety system will tend to be similar to the lifecycle of helmets.

Trends for bike use around the world are very positive and a large amount of that tendency comes from city users. [10], precisely where the probability of accident is higher.

Helmets brands who use MIPS safety system have the capacity to pay an extra price. According to the trend of bike users are wider, demand on safety will be higher.

MIPS system could become an essential part for bike users.

“Some doctors have expressed concern that cycle helmets might make some injuries worse by converting direct (linear) forces to rotational ones. These injuries will normally form a very small proportion of the injuries suffered by cyclists, but they are likely to form a large proportion of the injuries with serious long-term consequences. In this way helmets may be harmful in a crash, but this harm may not be detected by small-scale research studies”. [11]

I see a certain level of pricing power. Mainly we can explain it from two points of view:

A few rivals in the market

A unique product that allows the client to sell a product at an extra price.

Mips believes that consumers are prepared to pay more for safety equipment today than ten years ago.

Clients

Considering that MIPS product is a B2B, the client is not the user. The customers are the different brands that integrate MIPS safety system on their helmets. The user is the final client that buys a helmet equipped with MIPS technology.

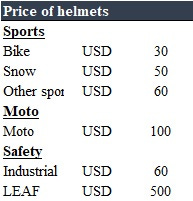

MIPS offers a product that can be implemented in helmets with prices from USD 30. So that the target market is medium and high range user.

Mips works with many of the leading helmet manufacturers in three categories:

Sports (Including bike, equestrian, team sports and snow subcategories).

Moto. (Road motorcycles and motocross subcategories).

Safety. It covers two subcategories: safety helmets for industrial use and helmets in Law Enforcement and the Armed Forces (LEAF), which include helmets for the police force, the military, and rescue services.

Bike helmet is the largest subcategory. 70%- 80% of share of total sales Q3 and Q4 2021 came from Bicycle subcategory.

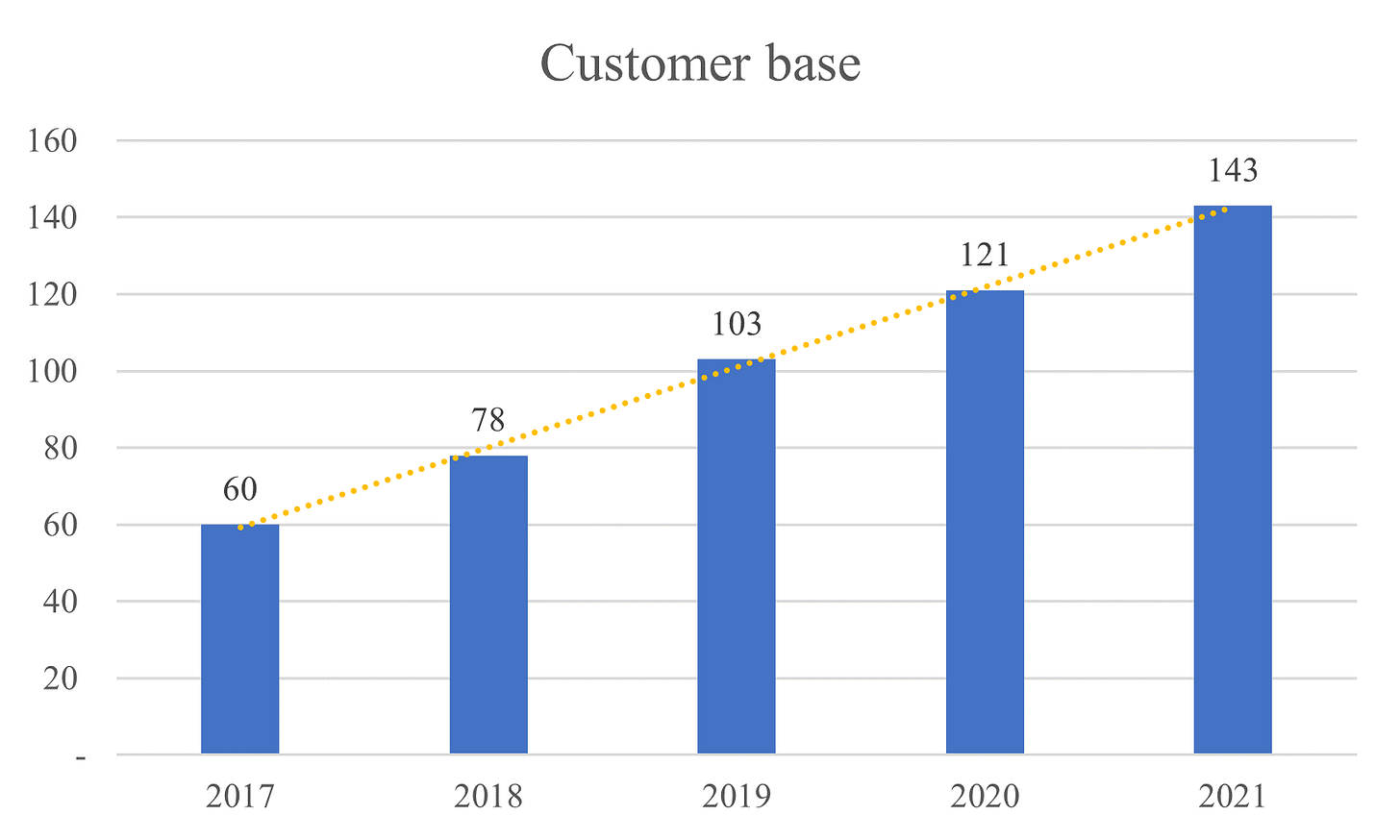

In total, MIPS customers portfolio for FY2021 are approximately 143 brands.

The number of customers has grown around 24% CAGR since 2017.

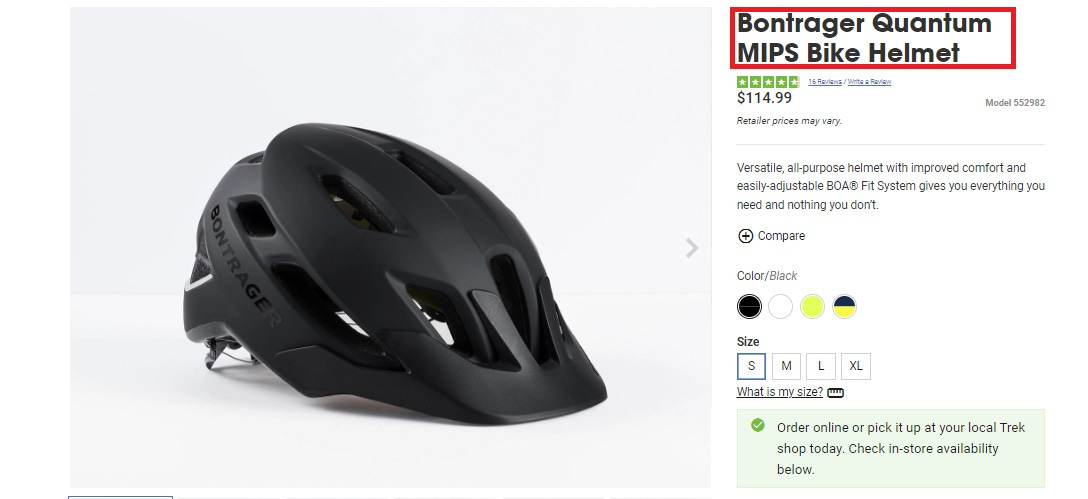

Bontrager

Bontrager is a Brand whose owner is Trek, Bikes a large and prestigious player. Bontrager developed and launched its own anti rotational technology, named WAVECELL. Despite owning its own technology, Bontrager sells helmets with MIPS technology integrated in them and helmets with WAVECELL System.

“Trek is one of the only bike brands to be the title sponsor of a UCI WorldTour team”. [12]

POC

POC is a Sweden based company that manufactures snow board and cycling helmets. They launched SPIN, their own technology against rotational forces. POC sells helmets with Mips safety system integrated and is one of the main customers of Mips AB. In fact, both companies work together on new solutions and products.

We can see a certain degree of dependency from customer1. However, the tendency is to reduce it and improve the diversification, taking new smaller customers and creating a more variate portfolio

“Loss of one of the major customers would have an impact on the company’s sales and profitability, as well as its ability to reach its long-term goals. Mips actively works with existing customer relationships, as well as broadening the customer base. As the company expands into other categories and more geographic areas, dependence on individual customers will decline”. [13]

Suppliers

Mips does not make any of its own production. The company uses external suppliers for manufacturing. of Mips’ products.

In 2021, most Mips’ products were manufactured in China where several subcontractors are. It is reasonable to think that if customers (helmets brands) are based in China, Mips ´third parties are too. The company is capable to serve products much more efficiently, coordinating operations with suppliers through Mips China who is charged on quality control and sales relationships in that country.

CEO: “We try to be where the customers are, yes. We always try to produce as close to the customer for a complexity reason. We want to avoid transport as much as possible”. [14]

However, there is a concentration risk associated with it.

CEO: “There is a challenging supply chain in the quarter, main disruption at helmet manufacturers due to power restrictions in China”. [15]

Employers

The average number of employees in 2021 was 70. 51 of them based in Sweden and 19 in China.

Costs for employee remuneration in 2021 were SEK 70 M (Including pension costs and social security contributions), which represents an average of USD 100000 per employee.

Mips is an R&D and intellectual property business. Dissemination of information related to products or services could have a negative impact on future operations. The capacity to create new products as patents expire is a key point in the company strategy.

Due to all those reasons the employees add a high value in R&D process and intellectual property areas.

I think many employers make a critical labor in MIPs due to nature of activities, based on technology, R&D and quality control.

All manufacturing processes are made by third parties.

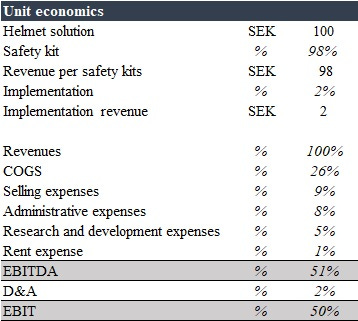

Unit economics

To make an overview over unit economics consider that of each SEK 100 invoiced to customers, safety kit (including license and product) supposes around SEK 98. SEK 2 are invoiced by implementation services. That means that if a helmet brand wants to launch a new mode with Mips technology integrated on it, Mips must develop a unique solution depending on many factors. That supposes that Mips invoiced that SEK 2 by that service, which is unique and fixed for each customer.

On the cost side we can consider:

Costs of good sales as main item representing (Ex- D&A), around 26% of revenues. COGS includes goods for resale, and subcontracted work.

Selling expenses represent 9% ex-D&A and include sales and marketing expenses. Fairs are important activities in that item. In Q3 of 2022 Mips was in three fairs:

Cologne (Equestrian).

San Diego (construction).

Frankfurt (Bike).

During Q4 Mips will be in:

EICMA (Moto).

ISPO Munich (Winter Sports).

Administrative expenses ex-D&A represent 8% of revenues including those not directly assignable to sales items.

R&D ex-D&A supposes 5% over total revenues and mainly are related to personnel.

Rent expense is around 1% and D&A 2% of revenues.

We can see an operating leverage in main SG&A items. Thus, selling expenses, administrative expenses and R&D have a scalable nature. We can make an incremental revenue analysis keeping in mind a strong operating leverage and conclude that 60% of EBIT margin is possible in the future.

At an average of around SEK 47 per unit sold, Mips needs 4 M units sold to cover fixed operating costs. For FY 2021 the company sold 12.6 M.

Value proposition

We will consider what needs are covered by Mips products from two angles:

End user. Mips solutions add a better and integrated guaranty of safety against rotational forces and reducing consequences on brain damage terms. We know about new mobility trends in cities and the recurrent incidence of impacts car against bike, skate, and scooter. Safety concern is growing, and an integrated solution like Mips technology covers a need from a user perspective.

Customers (Helmet brands). Potential users of helmets have a perception of better quality, which allows a price premium, more effective promotion, better access to channels and stronger brand image.

Mips safety systems can be integrated into existing models, but new models could be designed too, incorporating a safety system in helmets that differentiates the end product and added value creation.

Helmets brands know that Mips gives a service not only with a recognizable and tangible product, but also being able to adapt their solutions for more than 800 different models.

How we have seen before POC launched its own technology (Spin), and despite that brands like POC recognize added value from Mips solutions and continue selling their own products with Mips safety systems.

Jonas Sjögren, POC CEO: “Developing world-leading protection is the very reason POC exists. Enhancing safety is the guiding light, and together with an inspirational mission, a whole new world of innovation and opportunity opens up, especially when you’re willing to do things that have never been done before. This is the foundation upon which POC’s collaboration with Mips in 2009 was established, when no one talked about oblique or rotational impacts, and it’s a pleasure to soon be introducing the new Mips® Integra system to our collection”. [16]

“The Mips label usually adds twenty to forty bucks to the price”. [17]

Mips products are different respect to the competence because Mips’ technology can be included in most types of helmets. Mips offers a product but an integral service too.

Industry analysis

Although Mips AB covers categories such as safety, we could say that the company operates in the consumer discretionary sector.

We could say that Mips AB operates in head protection business sphere.

According to the categories split, Sports suppose around 85-90% of revenues and Cycle around 70-80%.

Seasonality of both is large or very large. Snowboarding and alpine Ski are winter sports, and they have a high seasonality. 60% of bicycle helmet production in Q1 Evidently There is a strength relationship between bike use and climate conditions.

Only a small quantity of helmets is equipped with some safety system against rotational forces. A few players are developing, manufacturing, and selling solutions against rotational forces. That is explained by the early stage in the industry and low capacity to adapt safety kits for low end users.

Attending to the total market helmets information and keeping in mind that Mips is the main player in the market, the industry is still in a growth stage.

Competitors

Among competitors we can make a distinction between ingredients brands and helmets brands that have developed their own technology.

Ingredients brands competitors represent a small part of market players with a small base of clients.

Helmet brands with their own technology are limited to a single brand. I consider that competition is limited.

Trek

POC

Leatt Corp.

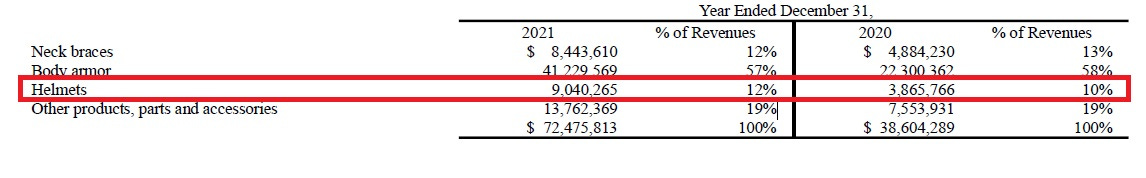

It is a South Africa based company that designs, develops, distributes, and markets different accessories and apparel for Motorcycle and bicycle markets. Leatt specializes in body armor and neck protection, which represents most of sales.

In 2015 the Company launched its helmet range and commenced shipment with a limited helmet range.

The Company expanded its off-road helmet range in 2016 to include two junior helmets and its award-winning MTB range for downhill and BMX bicycle use. The Company currently sells various models of helmet products.

Leatt covers moto trail, BMX and MTB mainly representing around 10-12% of total revenues.

The company developed its own technology against rotational forces and brain damage: 360-degree Turbine technology.

Leatt doesn’t work with Mips, and they don’t collaborate on projects in common, thus both are direct competitors in motorcycle and cycle segments.

Competitors offer solutions in only a few helmet models and helmet categories. Mips is the biggest player in protection against rotational forces with a 10% of market share and provides to the helmet market a differentiated product.

Activities in the industry require a high quantity of capital. That is a strong barrier of entry.

We know that launching a new and successful solution against rotational forces is hard. Helmets brands have tried in the past and they have continued to integrate Mips technology on their products. Mips brand is strong, and substitutes don’t offer the same price power. The limitation of profit through substitutes is low.

37% of sales depend on 3 customers. The rest of revenues depend on smaller customers.

The floor price for the product target is 30 USD (Bike). The average price per sold unit is around 4.50 USD.

There is a certain level of threat of integration. Several brands have tried to develop their own technologies but most of them continue to sell Mips.

Helmets are protection accessories. Helmets that are equipped with Mips proportionate an integral solution adding protection against rotational forces. So, helmets brands and retailers can obtain a higher end price.

Third parties manufacture and integrate Mips systems on helmets. It is a critical process that requires experience and know-how. However, the last step before delivering to the customer is quality control by Mips China.

Competitive advantages

Intangible assets

"Patent Lawyers Drive Nice Cars". [18].

According to the company estimations, patents and brands have a protection period of around 18 years.

Patent portfolio includes almost 300 of them. This protection creates barriers of entry for competitors allowing to Mips takes a wider target market and a market share around 10%.

Units sales have grown around 60% CAGR since 2017 and the customer base has become stronger year by year. Pricing power is possible due to the protection that intangible assets provide.

The challenge is to protect technology solutions that Mips markets today and apply for new patents in the future.

Mips is an R&D and intellectual property business. Intellectual property rights play a key role in Mips´ strategy since they give to Mips capacity to maintain its competitive advantage. Thus, efforts and investments in the future should focus on protecting intellectual property rights, expanding the patent portfolio through an active strategy in R&D, legal issues, and credibility.

“Expiring patents can affect the business. Being a leader in technology related to helmet safety systems creates a high threshold for other players attempting to supply credible solutions”. [19]

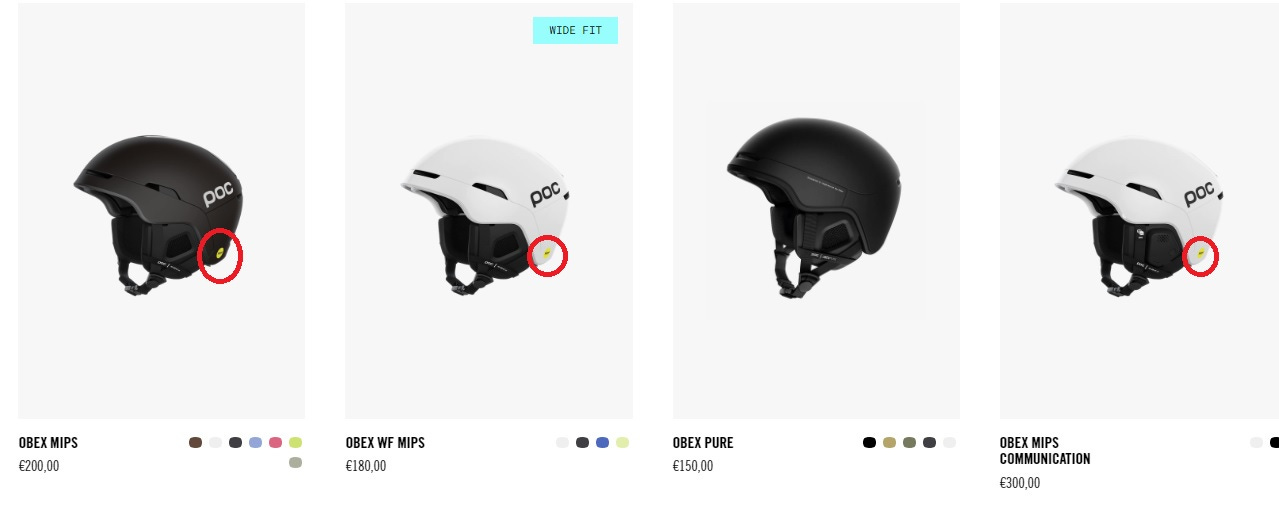

Mips Brand

The yellow circle of Mips has become a recognizable image in the safety world. Mips means prestige from a protection head point of view.

Mips brand gives to customers a superior quality signal and helmet brands show it as we can see in shops. Helmet’s view is shown from the yellow circle side. Helmets equipped with Mips technology are named model name followed to “MIPS" denomination.

Don’t forget that Mips invoices a part as license fee what provides to the brands rights to sell products under MIPS denomination.

Company management membership commented:

“Consumers go into store, and they ask for MIPS” “We have the MIPS logo and MIPS exposure. Big estores want to exposure it because if they sell MIPS, they get a couple of bucks more for that type of helmets”.

Switching costs

“Sticky customers aren’t messy, they’re golden”. [20]

Mips AB has been leading the protections against rotational forces since inception. They differentiated themselves in the early years with a large R&D investment and building a reliable customer portfolio.

We know that the market helmet tendency is offer to users a higher level of security, mainly in high price segment, but in medium price too. Customers have no incentive to switch nor add a new safety system, nor creating own technologies for replacement to Mips for several reasons:

Safety kits for rotational forces have become essential to sell a superior product. It is not a component to differentiate yourself from competitors, is a minimal requirement if you want to offer a medium-high price product successfully. Switching is risky being an important component of final product what creates add value though a higher price respect to the helmets without it.

Helmets brands are too busy creating new models for the market. The development of a new technology requires a high quantity of capital, R&D expenses, and time. Efforts don’t compensate for the goal. It doesn’t make sense to invest to develop a technology internally when you can get it cheaper and easier, focusing on your strategy.

E.g: Gore-Tex and Timberland.

Profit warning and Q3 results

On the 12th of September the company sent out a profit warning.

Later Mips presented financial numbers respect to Q3 where was reported a decline in sales for quarter.

Sales were 39% lower YoY. CEO said: “Decline that we see is fully explained by a soft bike end market”.

Company explains the soft quarter:

COVID unwind

Bike end market (-47% YoY)

Helmets and bike accessories overstocking amount. Channel blocked by low-end products, mainly in U.S. market.

Change in prioritizing of consumers giving up the low-end market. (Not an overproportion of Mips helmets).

Retail inventory unbalanced with very high inventory levels. Normally inventory days from factory to the markets 60-90 days. Currently 120-150.

“The pandemic boosted the bicycle industry. But now, stores are in trouble”.

“Bike sales surged early in the pandemic. But now, stores are struggling with excess inventory”. [21]

The company thinks that is a short-term event. CEO “Most people in the industry do see this as a temporary issue and that growth will return to bike as soon as the industry situation unwinds”.

According to the company estimates the market is selling out inventory and at the beginning of the season old goods will be sold-out. In 2024 customers won’t have any inventory and will need to replenish it.

We know the low exposure of Mips to retail sales, thus Mips lead time to the market.

CEO: “If you need goods for the next season you need to be at 3-6 months upfront”.

U.S. represents around 60-70% of sales. In U.S. market company expects that inventory levels will be normalized for Q1. Being conservative we could say that inventory corrections will normalize in 6-9 months.

Therefore, we can expect a soft 2022 Q4, 2023 Q1 and 2023 Q2 for bike subcategory. Growth in Moto and safety could be stable.

CEO: “Impact in 2023 Q1 returning back to growth again in 2023”.

Growth

According to company reports, the helmet market is currently around 550 M of helmets per year. 65 M of them belong to Sports, 85 M to Moto and 400 M to Safety (390 M industry and 10 M LEAF).

MIPS AB updated its TAM (Total Addressable Market), to 195 M units per year.

9 of the 10 biggest bike brands in the world are Mips customers. 6 of 10 in snow. Currently Mips covers 130 brands in the Sports category.

Scooter represents around 10M units over 40 M of total. Currently Mips works with 30 brands.

Safety market share in terms of brands would be around 25% of logo (10 of 40 brands on board), including helmets Type I.

In 2021 Mips market share is around 10%. However, considering the market share of the total market the company would have 98% of the total market to go.

The view of the company about market growth in volume in different subcategories is the following:

Bike +5%

Snow 0%

Equestrian +3-5%

Moto +5%

Safety +5%

Type I helmets Mips price point could get around 25-30 USD As demand increases and the company can develop new solutions at lower price points, TAM grows.

Moreover, to date the company has only penetrated a small portion of the total market.

We know that revenues have grown around 67% for 2021. However, operations are exposed to changes in foreign currency. Organic growth (growth excluding the currency effects) was 72%. Thus, the impact of currency was around -5%.

Geographical split

North America represents around 67% of revenues and Europe 20%. Europe is a low penetration market, but the company target is to get the same level of penetration in Europe than U.S. That is due to different market structure between both geographies. The number of retailers in U.S. is higher, and a lot of sales are done in home depots, which have their own helmets at a low price point. Thus, U.S. is a high price point market. Outlook is growth in the US market and replicate in Europe.

Asia and Australia represent only 5% of revenues. Moto category is playing a key role in developing countries, concretely in Asia. Historically emerging markets have been low use and low-price points markets, but that is changing mainly due to the opportunity in China and India. Since 2020 is mandatory to wear helmet for Chinese scooter drivers. India also developed a similar mandatory. That is a great opportunity for growing in Asia. According to the company Xiaomi and NEO could be potential customers in China.

Segments split

Sports category represents most of sales (94% of revenues). Moto and safety represent 5% and 1% of revenues.

Snow, equestrian and team sports are minor subcategories and Bike suppose most sales (70-80% of total).

e-bike is a key trend in growth

In motocross most riders wear MIPS. Objective is to get relevance in On-Road market.

In 2022 the company updated the outlook for 2027. That included TAM and total market estimation and growth.

According to the company revenues could reach SEK 2 B for 2027.

The Company strategy has three pillars:

Growth through existing business (Organic)

New channels and markets

Safety

The target is to cover 2/3 of SEK 2 B with the current market and 1/3 under the implementation of new channels and markets.

Reaching down the volume price point is an opportunity for gaining new markets. Floor price for helmets in which Mips safety is offered is 30 USD.

For industrial helmets Type I, price is 25-30 USD. A lower price point makes the potential market wider. That is the second pillar on Mips strategy, which has a certain level of cannibalization. The management team commented that “Customers are not the same”.

The third pillar consists of installing a strong base on safety market. The replacement rate in industry is very high. In the U.S. market, industrial helmets are refurbished every year. That could be a long-term driver of growth.

Tailwinds like COVID would help Bike demand to grow faster.

In my opinion, and given the replacement rate of products, competitive advantages, and global trends, Mips has long-term potential.

Capital allocation

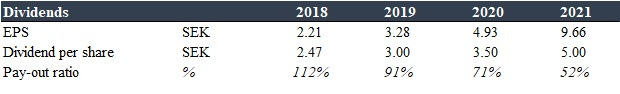

Shareholder distribution

The company targets a dividend pay-out ratio of 50% over time.

Management team

*2021

The management has had a brilliant performance and execution in terms of operations and strategic decisions.

The CEO is a brilliant manager with a large background in companies like Cloetta AB and Unilever. However, the key person in Mips AB is Peter Halldin who was co-founder close to the founder: Hans Von Holt.

Halldin completed his doctorate in biomechanics from The Royal Technical University of Stockholm and he has been a delegate of the European Commission for Standardization on head protection since 2012 charged to science, a critical area in the company.

Peter Halldin plays a key role in Mips, working in a critical area in the Company.

Interviews and presentations from Peter Halldin:

Interviews and presentations from Max Strandwitz:

The strategy has been consistent over the years, focusing on growth through ingredient brand concept, scalable model of operations and asset light model business. At the same time, Mips has followed a strategy of reduction in price level, reaching down the volume price point and increasing the focus market and units sold.

The company target for 2025 was to reach SEK 1 B net sales and 40% EBIT margin in 2025. That target was updated in 2022 and replaced for SEK 2 B and 50% EBIT margin for 2027.

The new strategy of the company is based in three pillars:

Growth in existing business.

Open new markets and channels.

Capture opportunities in the safety market.

Auditor is KPMG at least since 2017

Risks and catalysts

The company has a certain dependence on a small number of customers. In 2021 the five largest customers represented 49% of total sales.

Mips business core is supported in reliance and reputation. Future events, like legal conflicts or demands, could have an influence on the company reputation.

Mips may encounter strong competition in the rotational motion market. There is a risk that competitors will become better integrating new solutions in helmets. As the market grows, new players entry, reducing pricing power and resulting in lower profitability.

Mips has a strong technological risk and a strong dependence on its capacity to defend patents. The lack of that capacity could have a significant impact on operations. Likewise expiring patents can affect the business.

Mips products may suffer obsolete by launching of alternatives and substitutes in the market.

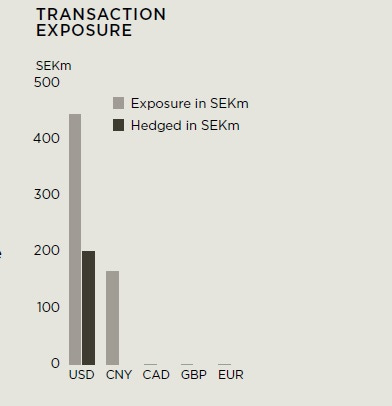

Mips has a dependency through its subsidiary on foreign currency fluctuations, primarily CNY and USD. Those fluctuations may affect to the earnings when translating the Chinese Subsidiary´s BS and IS to SEK from CNY.

Mips hedges 50% of forecast sales in USD to limit the short-term impact of currency risk using currency futures. The Company´s customer contracts in CNY are linked to the USD.

MIPS manufacturers and the subsidiary are based in China and operate under local regulatory framework. Changes in regulations, strike outs and other conflicts could affect MIPS operations.

A good performance in safety segment, new mandatory helmet use and recovering the growth path in next quarters could be catalysts in the future.

Financial metrics

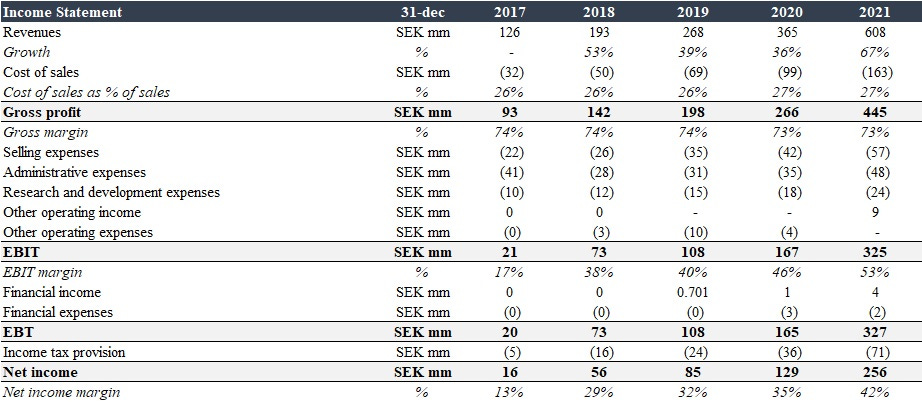

Financial Statement as reported

Earnings

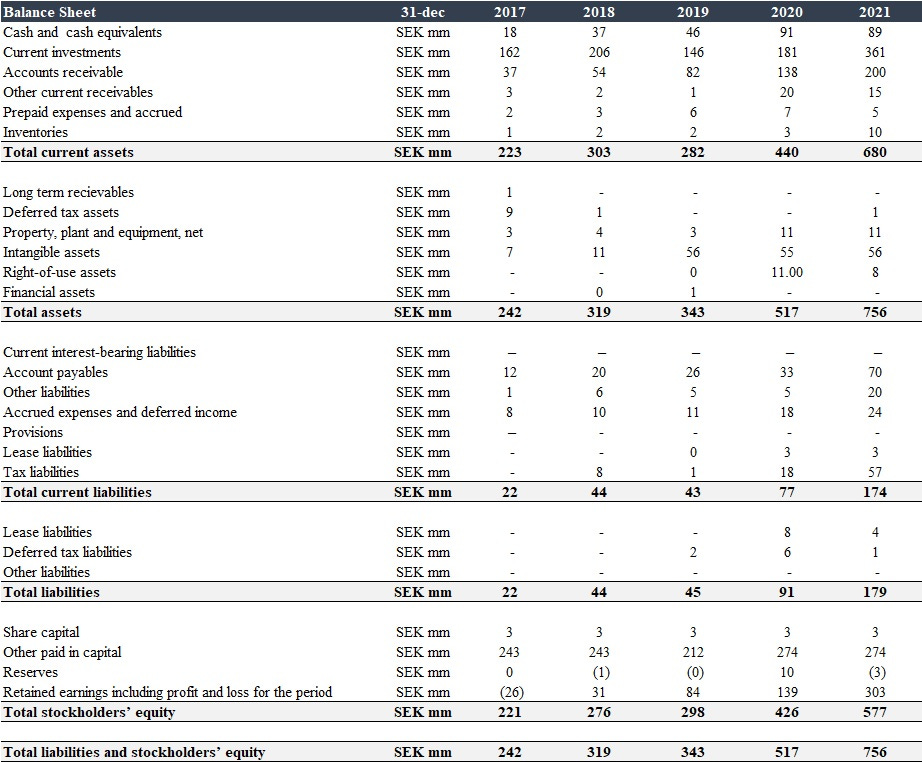

Capital structure analysis

Management´s strategic objective

There are no plans to raise debt. 50% pay-out ratio is the target in shareholders retribution terms.

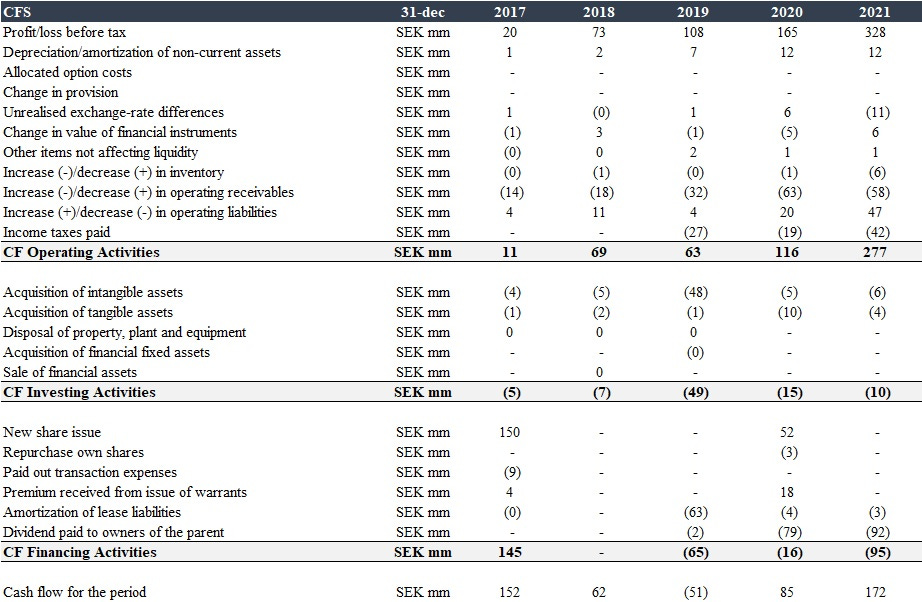

Capital intensity

CAPEX

In 2019 the company acquired the patent portfolios and other intellectual property associated with the technologies for Fluid and GlideWear for SEK 48M.

Profitability

High ROCE suggests a very asset light model and a good quality of business.

Activity

Cash conversion cycle is negative or close to 0. It implies that the company has not an excessive amount of capital investment in the sales process. Too high Days of payables outstanding or too low Days of receivables outstanding could induce to friction costs between the company, suppliers, and customers.

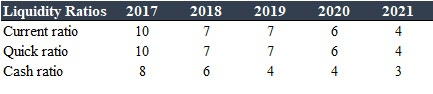

Liquidity

Solvency

Currently Mips doesn’t hold any financial debt. The company presents capital lease obligations around SEK 4 M for 2021. That item is mainly related to Rent Expense and is recognized over a period of 12 months and SEK 50000.

Valuation

We could assume a base growth scenario:

Sports ex-bike: according to the company outlook snow, equestrian or team sports are low growth subcategories. I suppose 0% growth for this subcategory.

Bike: We know that YoY growth in 2022 Q4 and half of 2023 will slow down or no growth in bike subcategory. If inventories levels normalize for the second half of 2023, we could see growth for 2024 and later.

Moto: high double-digit growth.

Safety: high growth since 2023.

It represents growth of 18% CAGR 21-26. Around 4% under MIPS guidance.

[1] https://mipscorp.com/investor/share-key-figures/

[2] [3] [4] [5] [19] MIPS Company

[6] https://www.trekbikes.com/

[7] POC is Back to MIPS - Bike World News

[9] [13] MIPS Reports

[10] https://ecf.com/system/files/ECF_Annual_Report_2021.pdf

[11] https://www.cyclehelmets.org/1039.html

[12] https://www.pelotonmagazine.com/features/five-minutes-with-trek-ceo-john-burke/

[14] [15] Earnings Call Q4 FY 2021

[17] Forbes

[18] Pat Dorsey. The Little book that builds wealth. Page. 34

[20] Pat Dorsey. The Little book that builds wealth. Page. 43

[21] https://www.deseret.com/2022/8/21/23312856/bike-stores-how-pandemic-changed-bicycling-industry