Date: March 13, 2023.

Stock Price USD 54.00

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

Revenues

Revenue for 2022 grew around 2% to USD 105 M in line with my forecast (108 M).

OTC Link was impacted by a decline in trading activity.

CEO said in 2021:

“Over the long-term, we expect OTC Link to contribute revenues closer to the 20% range. We note that OTC Link’s total addressable market growth is somewhat limited”.

Corporate Services benefited from a higher number of companies subscribing to OTCQX and OTCQB markets.

Market Data Licensing business experienced growth in professional users and enterprise subscribers and benefited from the acquisitions of Blue Sky Data Corp. and EDGAR Online. Excluding Blue Sky Data Corp. and EDGAR Online revenue experienced growth around 2%.

CEO says:

“The Market Data Licensing business performed well, growing revenue by 8% while integrating Blue Sky Data Corp into our platform and closing the EDGAR Online purchase. Our integration efforts continue and the full impact of both acquisitions will be reflected in our Market Data Licensing results this year”.

“As a result of business lines trending in different directions, Corporate Services now represents approximately 45% of our overall revenue, Market Data Licensing accounts for 35% and OTC Link accounts for 20%”.

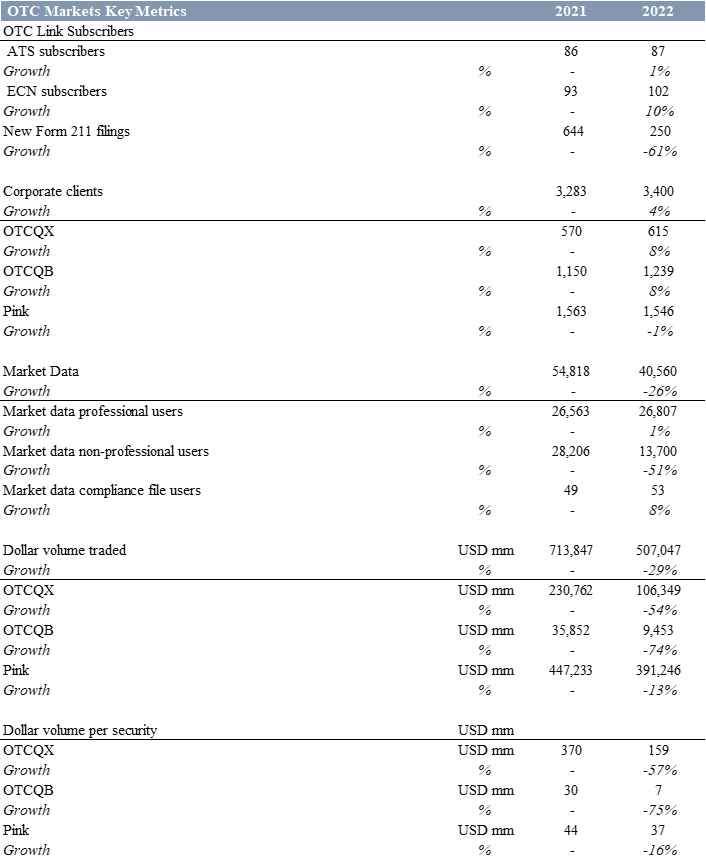

Key Metrics

During 2022, OTC Markets added 133 new companies to OTCQX compared to 212 in 2021 and 320 junior companies to OTCQB compared to 451 in 2021. For OTCQX subscription period beginning January 1, 2023, the Company achieved a 95% retention rate compared to 96% in the prior year.

Financial Performance

FY 2022 operating expenses increased by 11%. The primary drivers were an increase in compensation and benefits and an increase in professional and consulting fees. The increase in compensation and benefits reflects higher headcount, including 14 new employees from EDGAR Online, annual base salary increases and an increase in stock-based incentive compensation, partially offset by lower commissions and lower cash-based incentive compensation.

Compensation and benefits comprised around 64% of total OPEX compared to 67% in 2021.

EBIT margin for 2022 declined to 35% compared to 37% in 2021.

CFO/NI declined to 1.10 compared to 1.5 in 2021.

CFI reached around 16M due to EDGAR and Blue Sky acquisitions.

The company paid a total of 26.355 M in dividends.

ROE declined to 111% compared to 137% in 2021.

OTC Markets have no outstanding debt.

Strategy

Sustainable revenue growth increasing long-term per share earnings power.

Blue Sky Data Corp and EDGAR Online acquisitions strengthen the ability to add value to subscribers trading, disclosure and compliance processes.

CEO says:

“We are focused on turning the EDGAR Online assets into a cash flow positive contributor to our overall operations. In the short term, our priority is moving the EDGAR Online application stack into the cloud and retaining subscribers”.

Commercialize regulatory status under Rule 211 to create new opportunities for public companies and broker-dealers.

CEO says:

“The EDGAR Online services are a vital component of our 211 compliance process, allowing us to leverage structured SEC filing data to perform our current information checks”.

Advocate for additional regulatory recognition of OTC markets to increase the value of being public.

Grow and diversify product suite and client base.

M&A

Blue Sky

In May, 2022 OTCM acquired Blue Sky Data Corp. for around USD 12 M in cash.

CEO says:

“Blue Sky was a fantastic acquisition. I wish we could do five of them a year that are five times as big”.

“We paid a premium price to a founder who built a very strong business with high quality products that clients could rely on. And we were able to take the subscriber base into our platform to produce the data and take key people with domain knowledge, both in the data quality and in the client support, and add them to our organization to strengthen what we do. It was a fantastic acquisition”.

EDGAR

In November 2022, OTC Markets Group completed the acquisition of EDGAR® Online, a premium supplier of real-time SEC regulatory data and financial analytics, from Donnelley Financial, LLC, for $3.5 million in cash.

“Following our November 2022 acquisition of EDGAR Online, we continue to focus on fully integrating the EDGAR Online business into our cloud infrastructure and into our extensive Market Data Licensing offering. In connection with these efforts, we expect to incur various integration and operational costs during 2023. Furthermore, we plan to invest in the development of the EDGAR Online platform and product suite and to devote marketing and sales efforts with a longer-term view towards growing the customer base and related revenues. We anticipate that these operational costs and investments in the EDGAR Online business could be material to our financial results”. [AR FY2022]

CEO says:

“EDGAR Online is different. We did not pay a premium price. We paid less than one times revenues. And that even includes taking away what we were paying as thel argest client. It looks a lot more like the original National Quotation Bureau web ought. It is a business that has a long track record, however, was part of a larger organization that had different core strengths that were very different than the data licensing business that we do and the compliance business”.

We see an opportunity for EDGAR Online to be the premier supplier of financial information on SEC reporting companies, to broker-dealers, both in the trading and compliance areas, as well as to other data providers. That's a core spot and really focusing on a niche. They have 72 terabytes of data, bringing it into our platform, because we don't have processes that are doing the same thing. We're taking in the IR technology. It is going to be a lot of work. The data they produce from our perspective as a client is very high quality.

Conclusions

Stock price has dropped by 9% since the analysis date.

OTC link revenue in FY2022, has decline due to a decline in trading activity what is highly volatile and unpredictable..

Corporate services is a great contributor to OTC revenue on long-term.

Blue Sky and EDGAR are inside a integration process what drive an increase in OPEX items.

Investment thesis is unbroken.

Note:

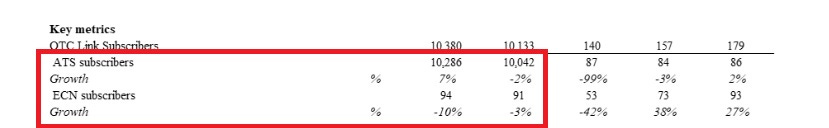

In the previous write-up ATS subscribers correct metrics for 2017 and 2018 are 94 and 91 respectively. ECN subscribers correct metrics for 2017 and 2018 are 0 and 41 respectively.

Eloy Fernández Deep Research publishes a monthly equity report, specifically the last business day of each month.

Eloy Fernandez also covers financial results and updates of the companies that have been analyzed previously.

Great work!