Q1´23 RESULTS

Notice

For personal reasons I cannot publish the May write up. However, I will publish two pieces of research in June.

Thank you for understanding.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

Date: May 30, 2023.

Stock Price SEK 509.80

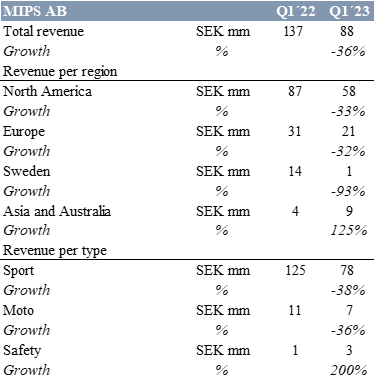

Net sales, was down around 35%.

Sports decline of 38% mainly due to bike sales.

Moto down 33% in the quarter.

Safety segment is following following the company plan. Strong growth but on a soft base.

Management team says:

“We see fantastic development in the Asian markets, no real inventory position there. And it seems actually like bike is doing really, really well. And you also see that in the report with more than 100% growth in the Asian market”.

“Q1 was better than Q4. But it's still quite low numbers when it comes to bike”.

“In snow, we grew about 60% in the quarter. If you take the other type of helmet, which is equestrian, we had a growth of 82% in the quarter, so indeed those 2 types of helmets, is doing really well”.

Financial Performance

Gross margin around 70%, 72.5% last year due to decrease in in net sales and cost of sales.

In OpEx R&D and marketing is the main priority to the management.

EBIT was down to SEK 15 million and an EBIT margin around 17% versus 45% last year.

Strong cash position with cash and cash equivalents of SEK 487 million (Including investments).

Mips does not hold any loans.

Inventory was down around 62%

Negative operating cash flow in the quarter of SEK 42 million relating to decrease in earnings and paid tax related to 2021 profit.

Shimano Guidance

Shimano is forecasting around a 20% drop in sales for FY 2023, citing global economic conditions and supply chain disruptions. I consider Shimano as a leading driver in bike sector.

“Shimano lowered its revenue and net-profit projections for 2023, citing high levels of market inventory. It now expects revenue to fall 27% to Y460.00 billion and net profit to drop 46% to Y69.50 billion”. [Kosaku Narioka].

Management team says about it:

“Shimano, given that they are a component producer to the bicycle industry normally with a lead time of 18 months plus, I think weather will probably not be a big issue for them, especially not when it comes to a couple of weeks”.

“But I think in really order to understand Shimano, we still think even though they are Japanese that they might be a little bit on the bullish side, because if you look at their market assumption is that if you look versus 2022 versus 2019, they have grown a little bit more than 60% of the market, which means that they had 4% growth in 2019, very similar to 4% in 2020”.

“We don't expect to see the same impact as Shimano, because, of course, we didn't -- we were hit a lot earlier than them. But we also expect to be out of the starting gate a lot earlier than them”.

Supply Chain

Management Team says:

“I would say 6 to 9 months, a lot of the retailers have already rationalized their portfolio to make sure that they have much newer SKUs than they had before”.

“People are more worried about the inventory. But that has already been reflected in the industry. And that actually started already in June last year and not something that we are seeing at the moment”.

Outlook

Soft Q2 bike market.

Gradual recovery of the bike market already during the second quarter. Good outlook in both Safety and Moto in 2023.

Around SEK 20 million to SEK 30 million in net sales in the safety category for the FY 2023.

Back to 40% EBIT Margin by the end of the year

Conclusions

Stock price has increased by 34.48% since the analysis date. Upside is narrower now. Valuation is a dynamic process, and the intrinsic value could increase or decrease if company fundamentals change.

Checking Bike category during the second half of 2023 and 2024 is a cornerstone for MIPS thesis.

Safety may be a strong driver of growth in the future.

At date I own shares of Mips AB.

Date: May 30, 2023.

Stock Price USD 11.60

Total revenue was down around 46%.

All categories decline strongly.

Management team says:

“First quarter revenues decreased by 46% year-over-year in the context of a global inflationary environment and a particularly difficult comparative. The first quarter of 2022 was the strongest quarter in our company's history”.

“Sales of our flagship neck brace for the first quarter of '23 were $780,000 or 6% of our total revenues for the quarter, a 49% decrease year-over-year. The decrease was primarily attributable to a 51% decrease in the volume of neck braces sold”.

“Helmet sales were $3.13 million or 24% of our revenues for the first quarter of 2023, a 45% decrease compared to the strong first quarter of '22 for MTB helmet sales. MTB helmet sales in the first quarter of '22 were up 357% over the first quarter of 2021. Sales of other products, parts and accessories for the first quarter were $2.8 million or 21% of our total revenues, a 38% decrease year-over-year”.

“Sales of other products, parts and accessories for the first quarter were $2.8 million or 21% of our total revenues, a 38% decrease year-over-year. The decrease is primarily attributable to a 41% decrease in revenues from our MOTO and MTB technical apparel designed for off-road and mountain biking use compared to the exceptional first quarter of 2022. Apparel revenues for the first quarter of 2022 were up 171% over the prior year period”.

Financial Performance

Despite sales was down around 9 million, gross margin improve to 44%.

EBIT margin was worsened to get to 11%

Net income for the first quarter was $1 million versus $4.22 million in Q1 2022.

NWC 33 million (37 million).

Current ratio 5.63x (4.36x).

Cash 11 million (7 million).

Leatt does not hold financial debt.

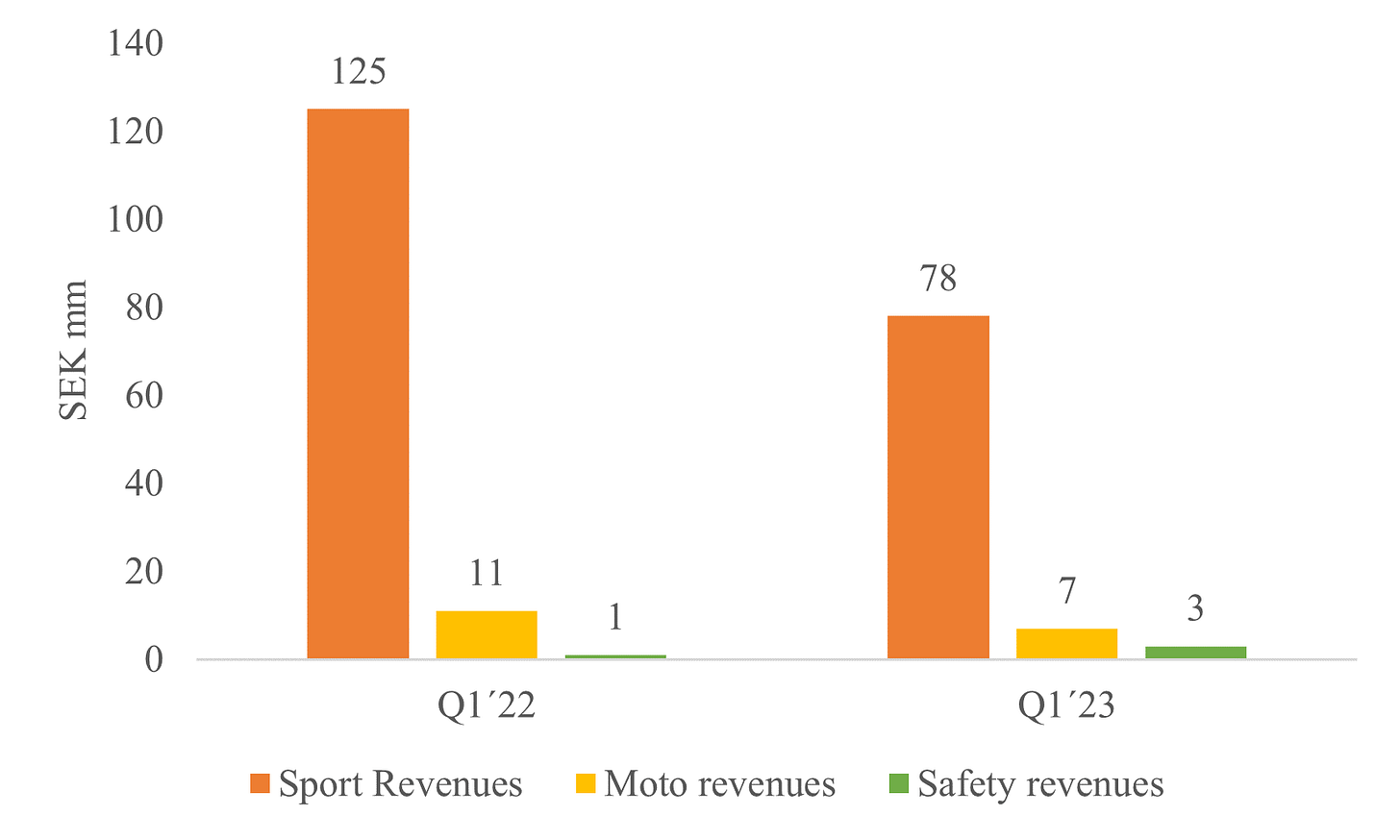

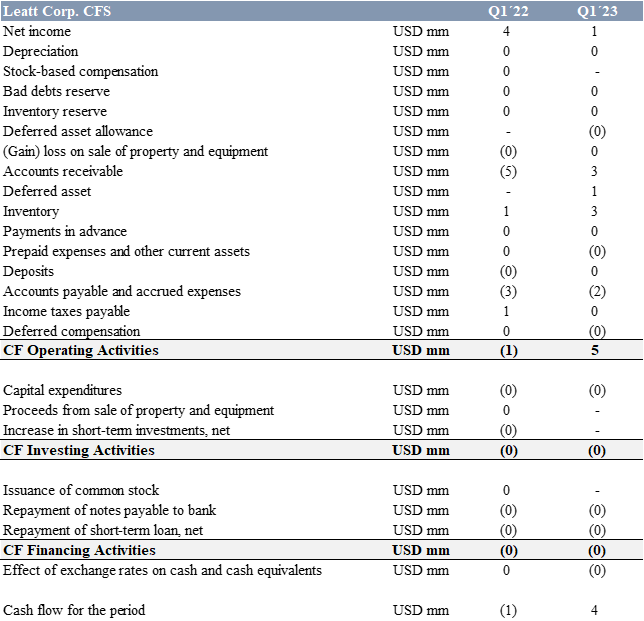

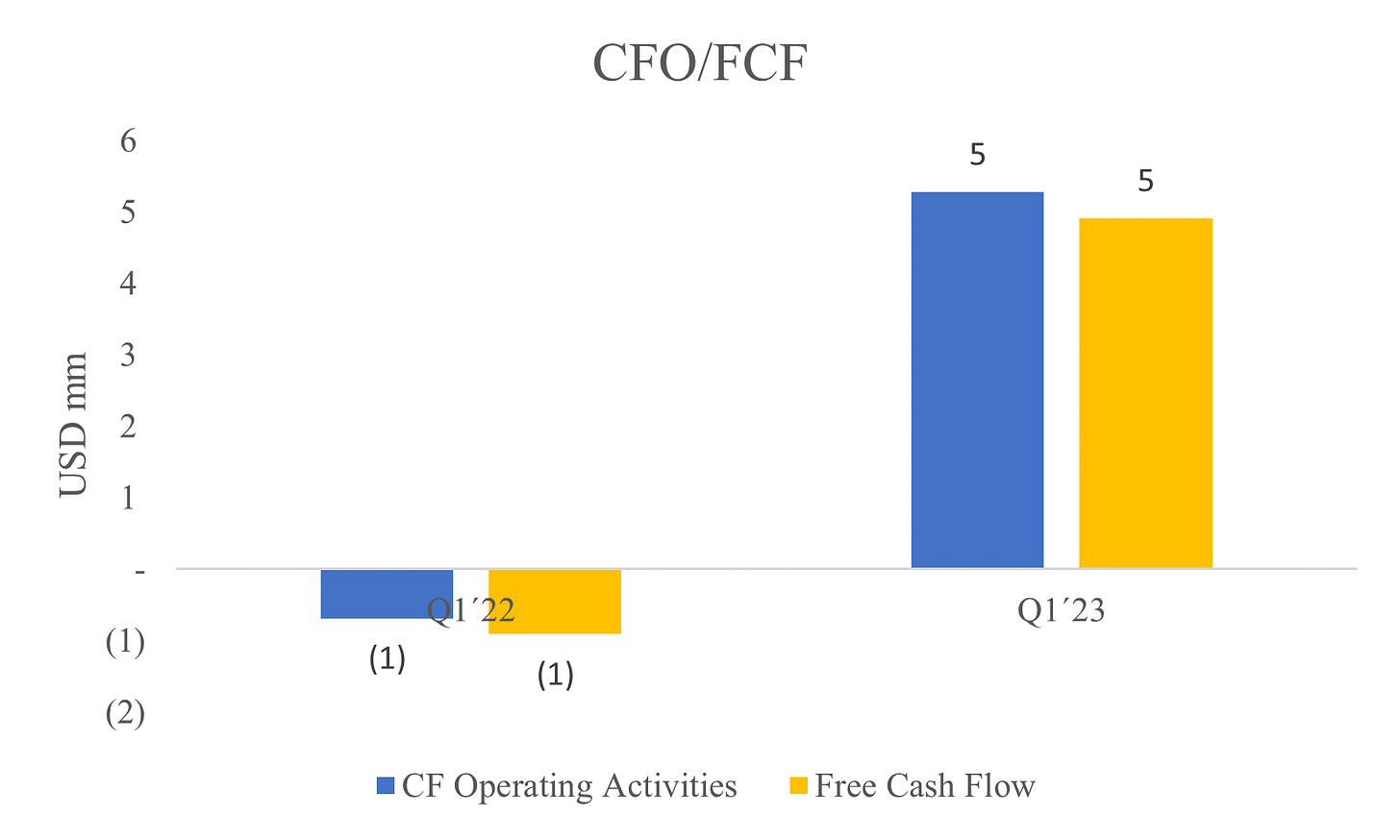

Cash flow from operations 5 million vs -1 million.

Positive FCF.

Cash flow for the period 4 million.

Management Team says:

About strategy:

“We continue to invest in our strategy of developing innovative cutting-edge products. Our design and engineering team in collaboration with our team riders continues to deliver an exceptional product pipeline and product offerings that are recognized throughout the industry. We believe that this continued focus on excellence in product innovation will allow us to gain additional market share. We are especially excited about our first partnership with the professional endurance mountain biking team, the Orbea Leatt Speed Company Racing team”.

“Now we're working really hard at turning on Leatt as an MTB brand and with strong MTB distribution in the U.S. It's one of our key strategic areas that we are focusing on. It's taken us a bit longer than what we expected. Unfortunately, as we were kind of starting to get some momentum, we had the stocking dynamics that particularly affected the MTB industry. But I feel quite confident that as we move ahead now, the domestic situation will start picking up and we'll start seeing that domestic sales also returning to a higher percentage of our revenues moving forward”.

About brand building:

“Strong brand building, a global multichannel sales organization, a pipeline of exceptional products, a plan to reach a much wider rider audience and continued financial resilience. We are encouraged by the increased activity in sales on leatt.com and through our e-commerce partners internationally. Consumer direct sales now represent 5% of global revenues, a testament to the brand momentum that we have experienced over the past several years. Our online global dealers continue to report that consumer demand and resultant sell-through of our product categories remain healthy and well positioned for future growth”.

Stocking issue and future growth (Answering to Olivier Colombo) :

“So I think there's different time frames that are at play here. And the closer we get to the end consumer, the closer we get to the true demand trend, which is, of course, really important because that is where a stock is going to get consumed and that is where stock is going to get digested. It is difficult Olivier to give an exact date as to when we think this is all going to play through the market. It's a little bit fluid. We are certainly hoping that within the next 6 to 12 months, we can return to double-digit revenue growth”.

Stock price has decreased by 38.95% since the analysis date. In my opinion upside is wider now. Valuation is a dynamic process, and the intrinsic value could increase or decrease if company fundamentals change.

Cornerstones for Leatt thesis are:

Inventory management.

MTB market.

Return to double-digit revenue growth

At date I own shares of Leatt Corp.

Date: May 30, 2023.

Stock Price USD 69.61

Revenue grew 19.5% to $85.8 million.

U.S. revenue grew 22.8% compared to Q1 2022 to $51 million.

Europe revenue grew around 41% compared to Q1 2022 to $8 million.

China revenue declining approximately 25% versus the prior year quarter.

Latin America revenue grew by 80%.

Financial Performance

EBIT margin and NI margin improve to reach 17% and 14% respectively.

The company outlook for Q1 2023 in the 83M to 84M range, gross margin around 40% and SG&A in the 22% range. SG&A reaches to 24% (25%).

Management team says:

“Our Q1 SG&A expense grew 18.9% to $21 million and represented 24.5% of revenue. And our expense growth was a bit muted in the quarter with the out of period impact from the timing of our annual dealer conference. The impact was about $800,000 in Q1 2022. So we’ll see those conference expenses hit in Q2 this year, but even considering that we saw some really nice leverage in the quarter”.

Management team says:

“We did increase our inventory levels by about $4 million, so that had a negative impact as well. And finally, timing of PMA payments can impact operating cash flow either way from quarter-to-quarter. And this quarter that impact was negative by approximately $2.5 million.

“And there’s no doubt the increase in our inventory levels over the last few quarters has been a primary driver in our decreased efficiency in our cash conversion cycle. But we expect our day sales outstanding and our day’s payables outstanding to be somewhat consistent in the coming quarters. So given that we’ll begin to see positive impacts to future operating cash flows as our inventory levels normalize”.

Credit line

“Also in April, we closed on a new $125 million credit facility. The primary driver in doing this was just to get better term – financial terms in addition to increasing our borrowing capacity. And this new facility nicely enhances our financial position to execute on all of our strategic initiatives. And while we expect to be able to fund most of our acquisition pipeline with cash, the new facility provides maximum financial flexibility and plenty of dry powder for the foreseeable future. So again, really good start to the year and we’ve got some good momentum going into Q2”.

Outlook

“Overall, our outlook for the year really hasn't changed substantially from our view in February. The business – our business has remained strong in spite of the macro uncertainty and our current view sees that continuing. We're certainly aware of the possibility of some delayed onset pain from this tightening cycle and the impact on vehicle affordability. But right now, we haven't seen it impacting our business”.

Stock price has decreased by 7.15% since the analysis date. The company execution level is excellent and, in my opinion, upside is wider now and the essential part of thesis continues strong.

At date I own shares of Xpel.

Date: May 30, 2023.

Stock Price USD 56

Market Data Licensing business expanded by 26%.

OTC Link revenue saw modest growth.

Corporate Services revenues were down by 2%.

Management team says:

“Our Corporate Services revenues were impacted in part by a reduction in companies using our Disclosure & News Service or DNS to maintain compliance with their ongoing disclosure obligation”.

“The Market Data Licensing in business saw a 26% jump in revenue, largely related to our Blue Sky Data Corp and EDGAR Online acquisitions. Certain price increases and organic growth of our existing market data products also played a part in driving revenue this quarter”.

Key metrics

Financial Performance

EBIT margin declined to 25% impacted by expenses related to the integration of EDGAR Online:

17% increase in Compensation and benefits.

35% increase in IT infrastructure and information services costs.

34% increase in professional and consulting fees.

Management team says:

“The increase in compensation and benefits reflects higher headcount, including 14 new employees from EDGAR Online, annual base salary increases, and an increase in cash and stock-based incentive compensation, partially offset by lower commissions”.

“Compensation and benefits comprised 64% of our total operating expenses during the first quarter compared to 68% in the prior year period. IT infrastructure and information services costs increased primarily as a result of the acquisition of EDGAR Online as we added the technology, data services, and data center cost supporting the EDGAR Online platform”.

Stock price has decreased by 4.92% since the analysis date.

In my opinion, quality of business is very high. However, stocks trades close to fair value.

Date: May 30, 2023.

Stock Price PLN 5.85

Revenues was down by 7% impacted by Poland and Export.

Areas in conflict represent around 9% of revenues.

Retail sales increased by 12%.

Despite write-down of inventories increased by PLN 487 thousand, gross margin is remain around 33%.

EBIT was down to 11% (14%) due to cut down in revenues and strong operating leverage.

Current ratio reached 3.72x (2.63x)

Inventory was down by around 5%.

Financial debt was down by 35%.

CFO was PLN 29 million (-18 million).

Cash flow for the period was negative mainly due to repayment of debt.

Conclusions:

TOYA needs a substantial quantity of WC to operate. Lack of capacity o manage inventory or other items from WC may affect to results of operations.

TOYA operates in a very competitive industry. TOYA products are easily replicable. Investing in TOYA may be a value trap (Low quality to low price).

Stock price has not changed since the analysis date.

In my opinion TOYA stocks are undervalued and investment thesis continues unaltered.

At date I own shares of TOYA S.A.