Robertet SA

175 years of fragrances, flavors, and resilience.

Other writeups:

Hyfusing Group Holdings United.

Analysis date: January 29, 2025.

Key Points

Global Leadership in Natural Raw Materials for fragances, cosmetics, and food industries.

6.55% CAGR 2018-2023 of sales.

Quality business with a strong worldwide expansion strategy.

Vertical integration, through its “Seed to Scent” program.

Excellent execution and management team. The founder's family owns around 38% of shares.

Competitive advantages and dominant position in the industry.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

Introduction

Robertet SA (RBT), is a France-based company renowned for its expertise in flavors, fragrances, and natural raw materials, has a rich history dating back to its founding in 1850.

Robertet was established in 1850 in Grasse, France, as “A La Confiance”, a factory that treats “Flowers and plants of Proven ce”, and recruits his nephew, perfumer & distiller, Jean-Baptiste Maubert.

In 1875, Paul Robertet acquired the company, leading to its renaming. Robertet patents the first process for the manufacture of instant coffee.

In 1950 Maurice Maubert breaks ground with new methods of obtaining natural essences: first, the “Colorless” essences in 1935, then the authentic and reliable scents of the “Butaflors” in 1950. Innovation and tenacity triumph with admiration from Parisian perfumers: Guerlain, Chanel, Patou.

In 1984, Robertet was listed on the Paris Stock Exchange, marking a significant step in its international expansion. The company has since grown to have a presence in over 50 countries, with key investments in the United States, Asia, and Europe.

The fourth generation of the Maubert family owns The Company.

Business Model

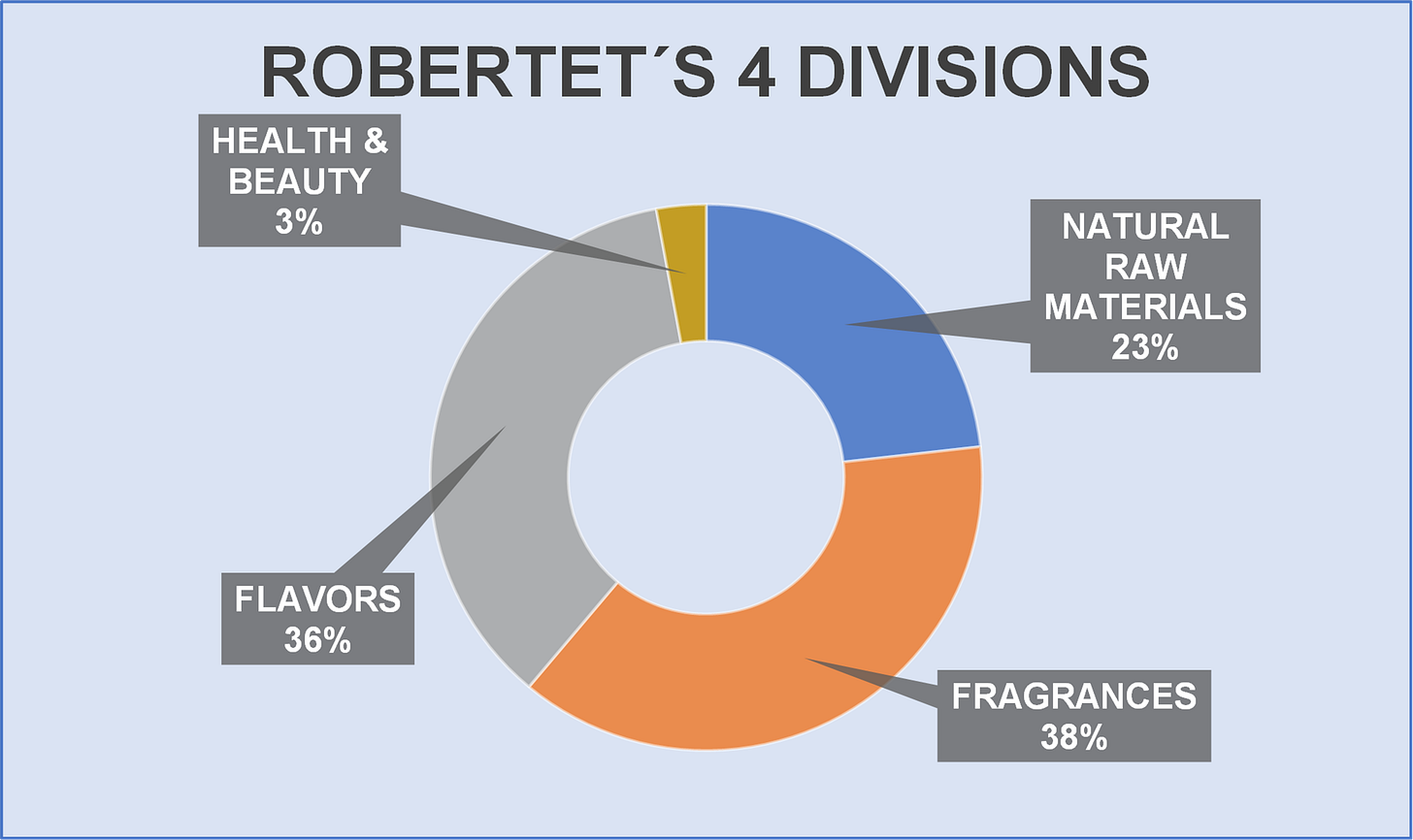

Robertet is a well-known group world leader of natural raw materials.

Its main activities are the sourcing and transformation of plant raw materials into natural aromatic and non-aromatic extracts. These extracts are then used to create flavors, fragrances and active ingredients.

Natural raw materials.

Natural ingredients, including volatile and non-volatile extracts used in flavorings and perfumes. Their active ingredients are also integral to health and beauty products.

Fragances.

Robertet designs olfactory signatures for brands across various sectors, from personal care to household products.

Flavors.

Flavors are used in all kinds of food or pharmaceutical products, from beverages to dairy products, confectionery and ready-made meals.

Health & Beauty.

Active ingredients that serve as key components in health and beauty products.

Seed to Scent

Robertet is a supplier of natural materials devivated from raw materials. Robertet revenue model is based on vertical integration.

The Group is a B2C business that sells its products to agrifood, cosmetic, beverage, fine fragances and others. In addition Robertet is a raw materials supplier for competitors.

Raw materials control process is denominated as “Seed to Scent”, by The Company. It comprises suply chain control what suposses a customer value proposition through traceability and product quality.

“Seed to Scent” involves 5 sourcing approaches, differentiated according to level of risks and the strategic importance associated with the natural raw materials:

Standard purchasing of raw materials.

Partnerships, when some conditions go beyond a standard purchase (for example, when Robertet pre-finances harvests).

Joint-ventures, when Robertet holds less than 50% of the supplier’s capital.

Local subsidiary, when Robertet holds more than 50% of the company’s capital.

Acquisition and cultivation of land by Robertet

Robertet obtains raw materials from different farms:

Local farms.

Finca Carrasquilla. Located in Spain Finca Carrasquilla is owned by Robertet (50%), and provides verbene, chamomile, rose, rosemary, oregano or immortelle.

Different locations around the world such as Turkey, New Caledonia, Tunisia, Madagascar, Somalia, Argentina, Egypt or Brazil.

Robertet works with a 1,727 natural raw materials catalogue sourced from 60 countries.

Robertet set CSR evaluation system for its suppliers of natural raw materials, since sustainable development issues are intimately linked to the strategic challenges of securing supply chains and improving the quality of raw materials.

Risk management criteria, including three types of evaluations :

Risk assessment of the country.

Raw material evaluation.

Supplier evaluation.

CEO says:

“Our integrated, traceable "Seed to Scent" business model, the depth of our natural product offering and our ability to offer exceptional products to customers of all sizes, around the world, set us apart. More than ever, we remain true to our passion for the Fragrances and Flavors business, focusing on sparking emotions. Taste and smell remain essential purchase and differentiation factors for our customers’ products”.

Subsidiaries that transform plant raw materials into natural extracts:

Robertet Grasse.

Robertet BIO,

Bionov.

Robertet Turkey.

Robertet Bulgaria.

Robertet South Africa.

Fragrant Garden in Madagascar,.

SNN in New Caledonia.

Finca Carrasquillas in Spain.

Value proposition

Seed to feel

“Seed to Feel” is a methodology that aims measure a person´s emotional responses to a specific scent by measuring their reactions.

Uses:

Evaluation of fragances.

Calibration of phyisiological data throught virtual reality.

AI tool to obtain a unique emotional signatureof each fragance product.

Robertet adds value throught a customized service for brands.

A brand that wants to create a new perfume or fragrance, could be an ideal client for Robertet.

Robertet provides a full service, helping the client from the choice of the raw material, to finding the process, creating a completely customized product. Robertet's easy access to raw materials gives it the advantage of controlling the entire process and presenting a more complete service to the market for those firms that prefer to delegate control.

Customers

Robertet serves over 5,886 clients globally.

Robertet's client base includes some of the most prestigious names in the food, beverage, and cosmetics industries.

Most relevant clients

Food and Beverage Companies

Nestlé

Coca-Cola.

Danone.

Procter & Gamble (P&G).

Cosmetics and Perfume Brands

Chanel.

Dior.

Guerlain.

Burberry.

Robertet sells raw materials to Givadaun and Firmenich, which are competitors but at the same time are shareholders of the company, which are classified as “Intercorporate transactions”.

Costs Structure

Purchases consumed comprises cost of sales and representing around 45% of sales being variable in nature.

External changes represents around 14% of sales.

Personnel costs represents around 22% of sales being fixed to some extent.

Employees

Robertet employs 2,200 individuals, of which:

Research and Development (R&D).

Production and Operations.

Sales and Marketing

Customer Support.

Administrative departament.

R&D and production are key parts The Company and involve a higher level of skills, learning and salaries.

For FY2023 personnel costs represented around 22% of sales.

Industry

Grandview Research predicts a 5.5% compound annual growth rate (CAGR) from 2023 to 2030 in the global perfume.

Robertet is the 7th worldwide in the flavors and fragrances sector and 1st Global position for natural raw materials with a 25% market share.

Givaudan, Firmenich, and IFF, dominate larger portions of the flavor and fragance market.

We have to keep in mind that Robertet is differentiated from competitors by its focus on natural ingredients. The Company has accumulated a large experience seeking high-quality farms around the world (“Seed to Scent”), building a worldwide network that is very tough to replicate. All of that implies a very large advantage of scale.

So, Robertet is different by raw materials, much more than due to the fragrances or flavors.

High barriers to entry

High Startup Costs and capital requirements. Setting up production facilities requires substantial investment. The cost of raw materials like pure rose oil can cost as much as $7,000 per kilogram [Faster Capital]. R&D is a critical area in the industry and requires allocating a large amount of cash. WC investment requirements may be prohibited by new competitors.

Brand Loyalty and Reputation based on historical legacy, quality expertise and emotional connections.

Access to Distribution Channels: players have control over or long-term relationships with key distribution channels, making it challenging for new companies.

Patents and Intellectual Property: Robertet, like other companies in this sector, might hold patents on specific processes or ingredients, which legally restrict new entrants.

Competitive advantages

Economies of Scale: Robertet benefits from economies of scale, producing in larger volumes to reduce per-unit costs. New entrants would struggle to match these cost efficiencies without similar production volumes.

Switching costs. Robertet creates significant barriers for customers considering a change to competing products. These costs arise from several factors that make it risky and costly for clients to switch suppliers. The Company invests strongly in customization creating a long-term relationship with the customer. The client assume a product formulation risk when switch. We have to think that Robertet product and service is a cornerstone for the clients. As a result, Robertet enjoys a stable revenue stream and strong customer loyalty.

Intangibles. Robertet is a prestigious brand and enjoys a strong reputation in the market. Branding is a weak advantage, volatile in nature and perhaps the most difficult to defend. However The Company defends its market share with continous investent in intellectual property such as Actiscents (fragances), Naturia (AI) or Neutral (Fragances technology).

Growth

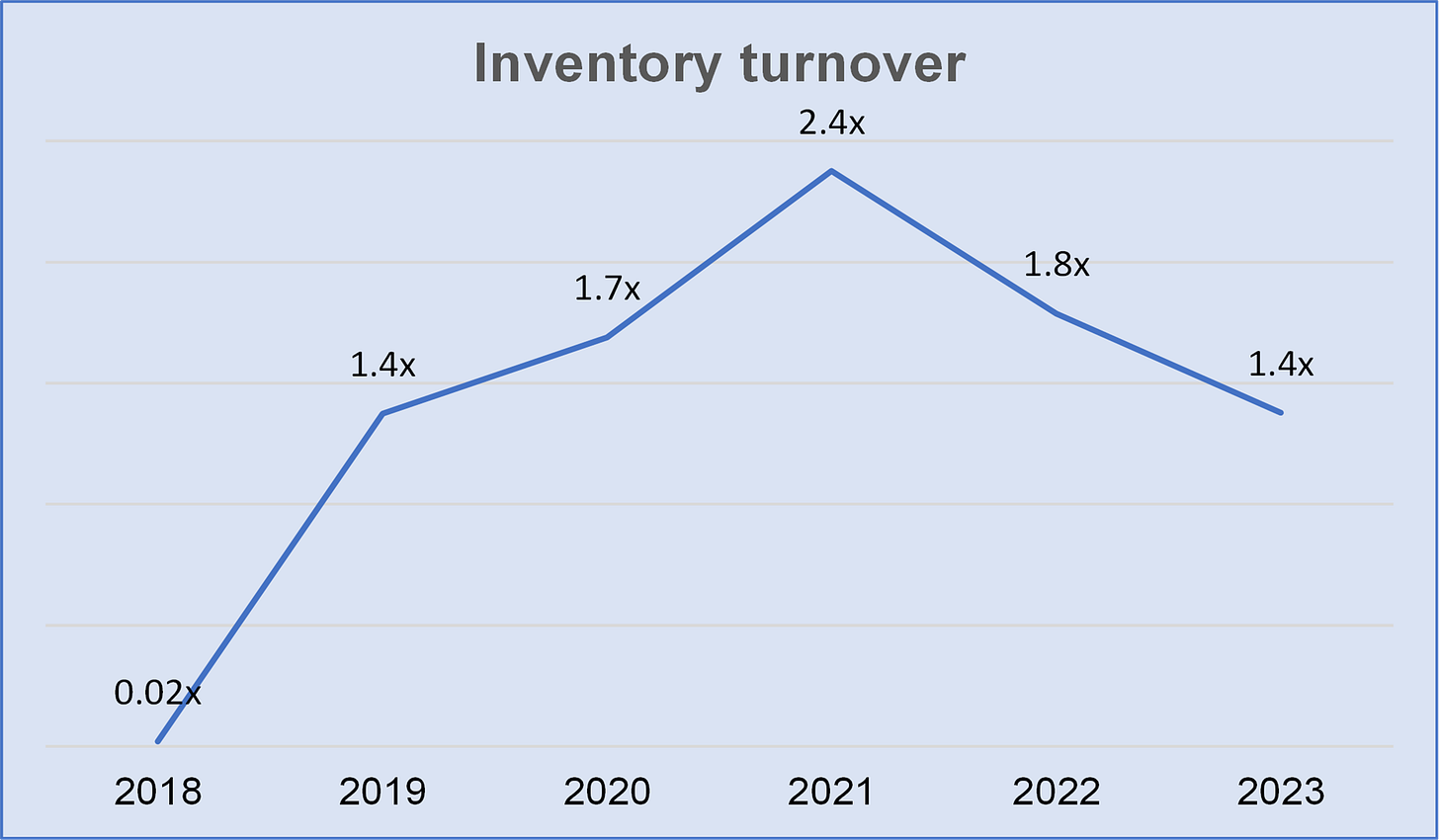

The CAGR 2018-2023 in sales has been of 6.55%.

CEO says:

“2023 was another year of growth for Robertet, in terms of both sales and operating margin. On a personal level, I've continued to discover the wealth of expertise of this unique company. In the midst of a highly uncertain backdrop, the company is expanding and has reported another year of over 5% growth (at comparable exchange rates) compared with 2022”.

“In 2023, Robertet continued to expand, setting up operations in strategic geographic areas such as Southeast Asia and maintaining its focus on natural products, with a commitment to remain a pure player in a changing competitive environment”.

Sales growth in 2023 was strong, climbing 2.6% compared with 2022. Organic growth at constant exchange rates remained strong at 4.5%, rising to 5.5% including the scope effect of acquisitions.

Growth drivers:

Global Leadership in Natural Raw Materials: Robertet dominates the market in natural raw materials, which significantly drives its growth. Additionally, the company's 55 certified supply chains offer both a strategic competitive advantage and solidify its industry leadership.

International Expansion: Robertet has identified South America and Asia as major growth drivers for the next five years due to significant opportunities in these emerging markets.

Acquisitions: Robertet's growth model includes acquisitions that enhance its capabilities and market reach. Notable acquisitions include:Aroma Essential, a producer of high-value materials for perfumery, and Sonarome, which specializes in regional tastes

Sustainability and Innovation: Sustainability is a core competitive advantage for Robertet, influencing its growth through continuous innovation and robust ESG (Environmental, Social, and Governance) initiatives. Innovation in product development, including new extraction methods and broadening the range of offerings, keeps Robertet ahead of competition, ensuring long-term environmental and social value alongside product-driven advancements.

Outlook FY2024

Full-year organic sales growth objective of 7%.

Improve in EBITDA margin in respect to FY23.

CEO says:

“The Robertet Group had a strong start to 2024 in all regions and achieved remarkable performance in the first half. This is thanks to the unwavering commitment of its teams worldwide and its unique positioning in high value-added categories.”

Capital allocation

Acquisitions

Sonarome : In December 2023, Robertet announced the acquisition of Sonarome, a major player in the flavors industry based in India.

Sonarome, established in Bangalore , had sales exceeded 15 million euros in 2022 and was previously jointly owned by the Gulhati family and IFF.

Rationale: strengthening Robertet's flavor business in India and expanding its market presence in South-East Asia and East Africa.

CEO says:

“The acquisition of Indian company Sonarome in December gives Robertet a foothold in India and Africa in the flavors market. For decades, this family business has built up a strong local presence based on creativity and excellent production facilities”.

“With this acquisition the fragrance and flavor major will target a turnover of 80 to 100 million euros from the India business”.

Price: €46.5 million.

Phasex : In November 2024, Robertet acquired Phasex Corporation, a pioneer in supercritical CO2 extraction technology based in North Andover, Massachusetts, USA.

Rationale: reforce its presence in North America and offering a high value-added extracts for both the aroma and nutricosmetics industries.

According to the management team the goal is of doubling sales in the coming years and aiming for total sales of €1 billion by 2030.

Astier Demarest : In August 2021, Robertet acquired a majority stake in Astier Demarest, a Grasse-based company specializing in the sourcing and distribution of raw materials for perfumery, cosmetics, aromatherapy, and food flavoring.

Rationale: reinforce Robertet's sustainable sourcing of natural products.

Price: €11,011,000, financed entirely by shareholders' equity.

Aroma Esencial: Robertet adquired Aroma Esencial, a company based in Girona, Spain, specializing in the processing of natural products such as vetiver, patchouli, cedar, ylang-ylang and other strategic products for the aroma industry.

Rationale: increase the Raw Materials Division's capacity to produce very high value-added ingredients for the luxury fragrances market.

Price: €10 million, financed entirely by equity.

Dividend Policy

Dividend payout ratio is around 20-30%, securing the necessary internal reserves to ensure the future business development.

Personally speaking, dividend policy is conservative and according to The Company performance.

Management team

Philippe Maubert (73), chairman of the board. Mr. Maubert has led the 4th generation of the Robertet Group for over 30 years. In its background are the raw materials strategy and the internationalization of the group. He is the key person and a authentic symbol of the company.

Mr. Maubert obtained a total remuneration in 2023 of €395,568.

Jerome Bruhat. CEO. Mr. Bruhat started his career in 1991 at L´oreal where he spent over 30 years. He became Global Director of the Maybelline-New York. Since 2015 to 2022 he held the position of President of Lóreal Group in Japan. He held the position at Robertet since 2022.

Mr. Bruhat obtained a total remuneration in 2023 of €1,664,435 including fixed compensation, bonus, shares compensation and benefits in kind.

Other members:

Christophe Maubert (65). Director Fragance Division.

Catherine Maubert (Maiden name Catherine Canovas) (74). Board.

Julien Maubert. Director Raw Materials Division.

Olivier Maubert. Director Flavor Division.

Ownership

Free float represents around 54% of share.

Maubert family owns near to 38% of shares, what supposes a balanced control and influence position.

Peugeot Invest and Givadaun SA own 7% and 4% respectively.

MAUBERT SA is represented by Mr. Elie Vanier.

Free float, skin in the game from the key person, and ownership composition indicates a low probability of principal-agent conflict.

Maubert is a family with a long history in the sector, and that has demonstrated solid performance over time.

Financial Metrics

Earnings

EBITDA has been calculated from an investor's perspective. However, from a consideration of the EBITDA to FCF conversion rate (29% for FY2023), we can get a view of the efficiency of the company on a consistent basis, ignoring interest and D&A expenses, which could be on a more irregular basis.

FCFF for FY2022 is negative due to an acquisition of Treasury shares in an amount of €204 mm.

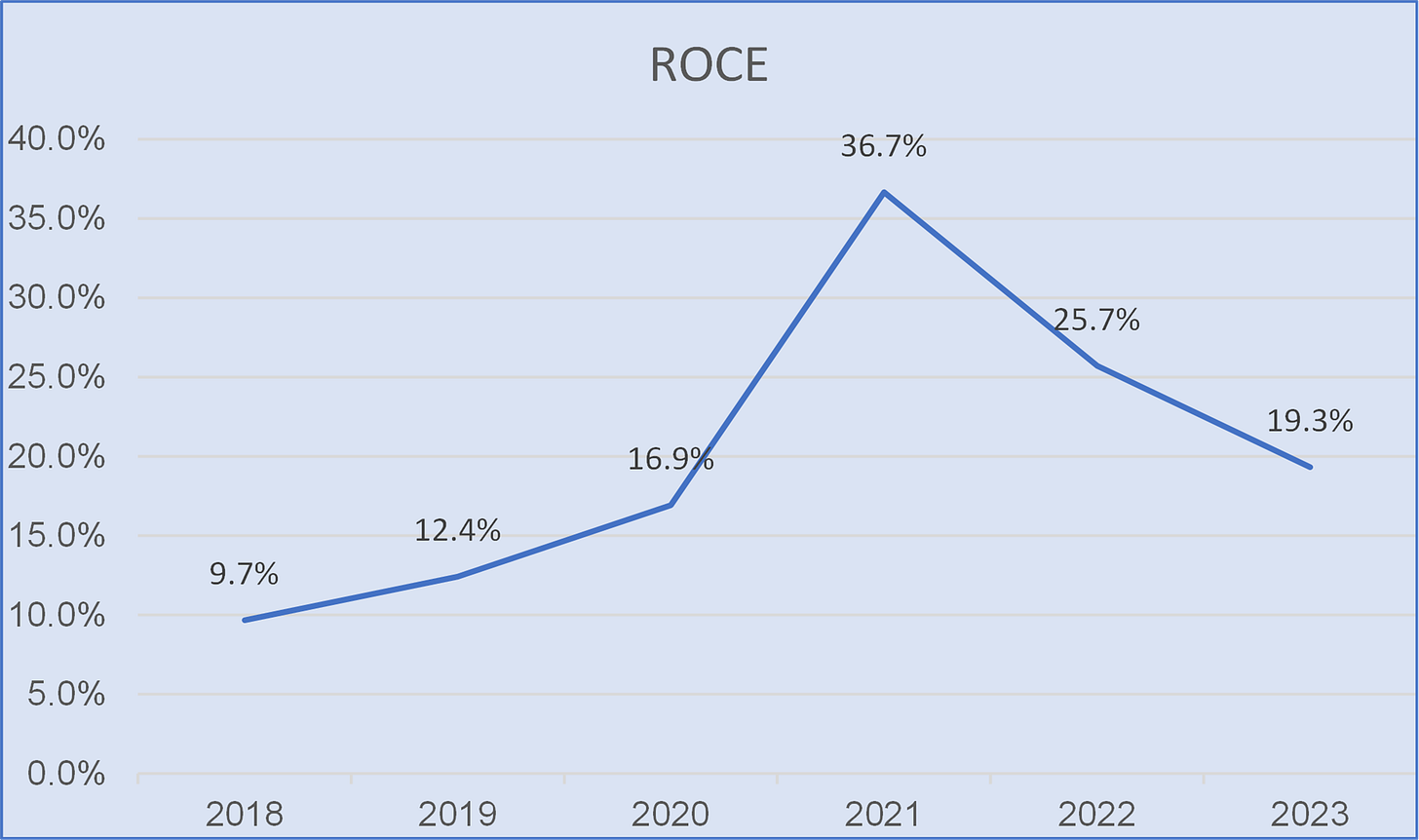

Profitability

Robertet is a heavy asset company . The company generates €0.07 by €1 invested.

Capital employed is calculated taking 20% of Cash and equivalents, which, in my judgment, is a conservative amount in order to operate the business.

Margins and turns.

Liquidity

Generally speaking, a good quick ratio is anything above 1 or 1:1. A higher ratio indicates the company could pay off current liabilities several times over.

Solvency FY2023

The company has a net debt around €153mm (1.15x Debto-to-EBITDA ).

Long-term debt represents 77% of total debt.

Cash position is €173 mm.

KPMG is the statutory auditor.

Auditor opinion:

“In our opinion, the financial statements give a true and fair view of the assets and liabilities and of the financial position of the Group as at 31 December 2023 and of the results of its operations for the year then ended in accordance with International Financial Reporting Standards as adopted by the European Union”.

Risks

Economic cycle. Many Robertet clients operate in the premium market, marketing discretionary consumer products.

Country risk. Many of the raw materials that Robertet works with are obtained from farms in countries with a high risk in terms of political and economic stability.

Supply Chain Vulnerabilities. The raw materials that Robertet uses are agricultural products whose production depends strongly on weather conditions.

Negative Social Impacts. The operations of Robertet or its suppliers may lead to adverse effects on local communities, potentially damaging the company's reputation and disrupting supplier relationships.

Foreign currency risk.

Technological challenges.

Strenghts

More than 50 years of background being pioneers and leader in natural ingredients.

Excellent capital allocation policy.

Global Leadership in Natural Raw Materials.

Familiar company. 38% of shares are on Maubert family hands.

Excellent execution and management team. Key persons, are involved directly in the business and they know perfectly the industry.

Competitive advantages and dominant position.

High barriers of entry.

Audited by KPGM

Valuation

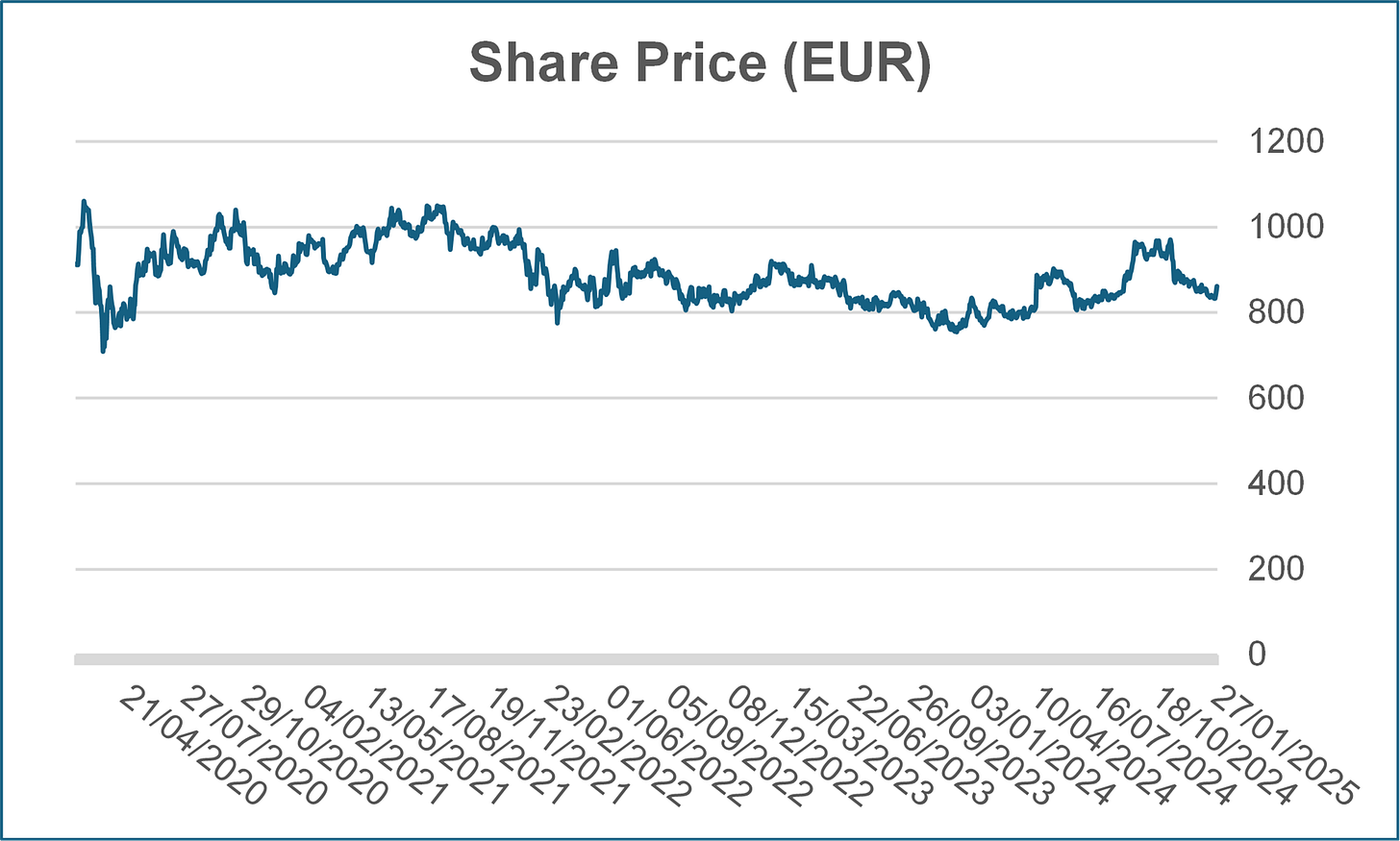

Robertet stocks are trading at 14x EV/EBITDA for FY2023.

DCF

Assumptions:

Salesgrowth 23-28 +5%

Gross margin 55%

EBIT margin ≃15%

Terminal multiple 20x

If you are a professional or qualified investor, and you like my work, don't hesitate to contact me.

Next report: February 27, 2025.