Other writeups:

Hyfusing Group Holdings United.

Analysis date: February 26, 2025.

Key Points

Global Leadership in high quality surgical instruments

.29.47% CAGR 2019-2024 of Net sales.

Quality business with a strong worldwide expansion strategy.

Additional growth through strategic acquisitions of products & sales channels.

Strong financials. Net cash position.

Competitive advantages and dominant position in the industry.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

Introduction

Stille AB (STIL) is a Sweden-based company that manufactures and sells premium- quality surgical instruments that have made new types of surgery possible and facilitated the work of surgeons.

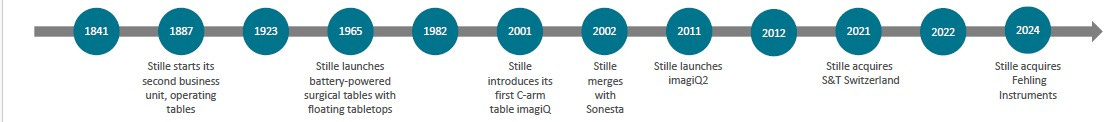

Stille AB is one of the oldest medical technology companies in the world, founded in 1841.

The Company was foundaded in 1841 by Albert Stille.

In 1887, Stille also began manufacturing and marketing surgical tables.

Currently and the company is the leader in the segment of surgical tables that are used together with C-arms during minimally invasive vascular procedures.

Business Model

Stille offers market leading products with a focus on the cardiovascular, plastic and microsurgical disciplines. Clinical segments where product quality allows for premium pricing.

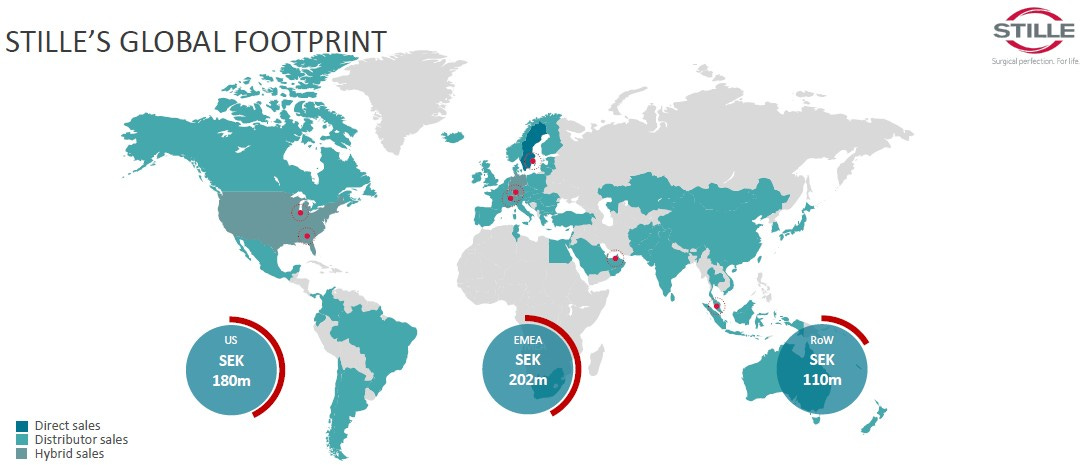

Stille operates globally through direct sales and distributors. In some cases a hybrid model between the two above. In 2023 Stille had more than 95 distributors worldwide.

Main partners: General Electric Healthcare, Philips, Ziehmimaging and Siemens.

Stilles´s Premium Brands

Stille. Premium, highly-durable, hand-crafted instruments. Product catalogue of > 1,000 unique surgical instruments, including > 200 varieties of scissors

S&T. Microsurgery CH. Premium microsurgical instruments

Product catalogue of 400 different micro surgical instruments

FEHLING Instruments. Products focused on neuro, spine and cardiac surgery.

Surgical Instruments

Stille offers a broad range of premium instruments, focusing on attractive and select clinical niches and segments where Stille is able to deliver unique value to customers and maintain premium pricing power.

Scissors.

Clamps.

Retractors & Skin Hooks.

Forceps.

Services such as Instrument Care Education, Instrument Repair & Maintenance and Instrument Inspection.

Instruments segment represent 76% of net sales.

Tables

Vascular.

Pain Management.

Neuro / Spine.

ERCP / Abdominal fluoroscopy.

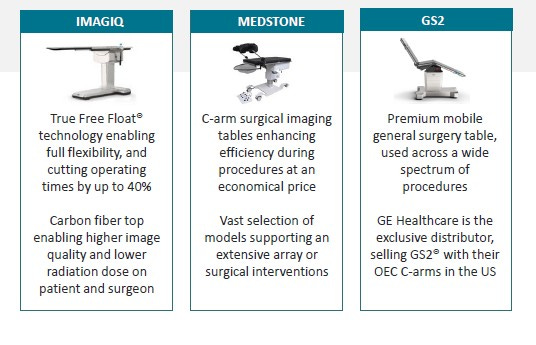

In 2024 the company decided to retire the GS2 platform.

CEO says:

“GS2 platform within the surgical table business. The decision aligns with our focus on high-quality premium products within niche surgical segments where we see the greatest opportunities for profitable growth. The GS2 project was started in 2015, the product was launched in 2021, and since then it has not met commercial expectations”.

Tables represent 24% of net sales.

Value proposition

Stille focuses on high-quality products and high-growth niche segments, which enables premium pricing. Stille shows a gross margin of around 52% (FY24) which gives you the idea of a very high-quality product line that creates switching cost dynamics for the end user.

Why Stille products are superior?

Stille´s craftsmanship and unique manufacturing process yields instruments of unparalleled quality.

Anyone might think that surgical scissors are a product that is difficult to differentiate from other competitors. But let's take the case of dental implants, where there are usually substantial price variations between prestigious brands such as MIS, Nobel Biocare or Straummann versus other cheaper ones. In the end, they are cylindrical pieces made with materials compatible with the body, such as titanium or zirconium, no more. But this is not exactly the case. Just like for a dental implant, a quality surgical material is distinguished by its guarantee of reliability and precision , and that includes the manufacturing process and R&D. Stille AB gives a 30-year guarantee on surgical instruments, which is the result of excellent work that results in a product of the highest quality.

Dr. Brent Moelleken, M.D., FACS One of the most distinguished Plastic surgeons in the world, says:

“Stillescissors are very precise and very reliable. They perform better than any other scissor. It’s really the perfect scissor. An extremely precise instrument is no longer a luxury, it is a necessity.”

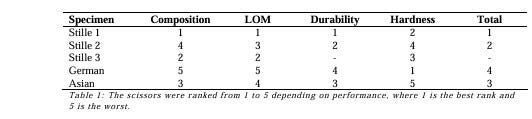

According to The Royal Institute of Technology, Stockholm, Sweden:

“Hand forged surgical scissors from Stille AB were compared to conventionally manufactured German and Asian instruments. The material properties of the scissors were examined and tested for hardness, durability, microstructure and though a compositional analysis. The scissors were then ranked based on performance”.

For example: Stille scissors not only cut precisely, but also provide tactical feedback indicating how much pressure and what angle is appropriate to achieve the desired result.

Stille is highly specialized in instruments for microsurgery, a field where precision and reliability are a keystone.

Stille scissors have been developed and refined over generations, always in close cooperation with distinguished surgeons. The materials and manufacturing methods are thoroughly evaluated to provide a perfect result, every time.

The products are developed in close collaboration with leading surgeons, based on the most innovative technologies. Stille surgical instruments are sold through a worldwide network of professional distributors. Here the distribution channel is of great help for the continuous improvement of the product that comes from the experience of the practitioner. Stille sells needs for very high-level medical professionals, which again plays into the idea of a strong switching cost advantage.

C-arm tables

Stille's market-leading C-arm tables are specifically designed for minimally invasive procedures where precision and high-quality imaging are critical.

Stille not only provides advantages for the end user, but distributors also benefit from the high versatility and integration capacity of the C-arm tables with the C-arm in the operating room.

What is a C-Arm?

A C-Arm machine is an advanced medical imaging device based on X-ray technology. They are primarily used for fluoroscopy capabilities, although they have radiography capability too. C-Arm is called so, due to its C-shaped arm, which is used to connect the x-ray source on one end and the detector on the other.

Stille's surgical tables are complementary to the C-arms. C-arms suppliers sell a combined solution, limiting Stille's need to maintain an expensive sales and marketing organization. Increasing sales volumes will thus quickly lead to increased profits.

This provides a double advantage: a wider network of distributors and a high dependency on the distributor due to the high compatibility of sStille tables.

The imagiQ2 operating table reduces surgical time by up to 40 minutes, allowing for greater efficiency.

Ergonomics and reduced radiation exposure during fluoroscopy make Stille tables an added value for physicians, surgeons and surgical staff.

Dr. Peter Goverde, MD Specialized in arterial & endovascular procedures, says:

“The True Free Float technology offered by Stillegives total freedom of movement and control, which both reduce procedure time as well as enhance procedure efficiency”.

Costs Structure

Cost of good sold Purchases represents around 48% of net sales being variable in nature.

Selling expenses represents around 23% of net sales.

Administrative expenses represents around 9% of sales being fixed to some extent.

Industry

Stille AB predicts a 5% compound annual growth rate (CAGR) from 2023 to 2026 in the handheld global market and 7% in the Microsurgical instruments global market.

Drivers:

Higher demands on instrument quality and precision in premium, high-end clinical niches including plastics, vascular, cardiothoracic, selected neuro / spine and microsurgery segments

More focus on sustainability to reduce hospitals’ environmental impact (e.g., single use scissors vs. high quality scissors)

Increased prevalence of MIS and robotic surgeries.

Increased number of surgical procedures done overall.

Key competitors vary by segment and specialty and include B.Braun, Symmetry, Integra, Steris and Scanlan

Stille AB predicts a 4% compound annual growth rate (CAGR) from 2023 to 2026 in the Surgical tables global market and 7% in the Mobile operating tables global market.

Drivers:

Global market for fluoroscopy and C-arms reached approx. USD 2.6bn in 2022, and is estimated to grow 5-6% annually by 2028.

Shift of clinical procedures from the hospital environment into outpatient surgery centersand office-based facilities.

Move towards flexible, mobile and hybrid operating rooms, utilized for many different clinical purposes, versatile mobile surgical imaging tables that are compatible with multiple accessories.

Stille leads the tables market through in-house development and partnerships with leading C-arm manufacturers.

Peers

Jungheinrich AG

A German company specializing in warehouse equipment, forklifts, and logistics systems, known for its focus on automation and energy-efficient solutions.Toyota Material Handling

Part of the Toyota Industries Corporation, this is one of the global leaders in forklifts and material handling equipment, offering a wide range of products and innovative technologies.Crown Equipment Corporation

A U.S.-based company renowned for its forklifts and warehouse solutions, emphasizing durability, operator comfort, and advanced tech like fleet management systems.Hyster-Yale Materials Handling

This company produces Hyster and Yale brand forklifts and is a major player in the market, competing directly with STILL in terms of product range and global presence.Linde Material Handling

Also under the KION Group umbrella (like STILL), Linde is a strong competitor in its own right, offering forklifts, warehouse equipment, and automation solutions, often overlapping with STILL’s offerings.

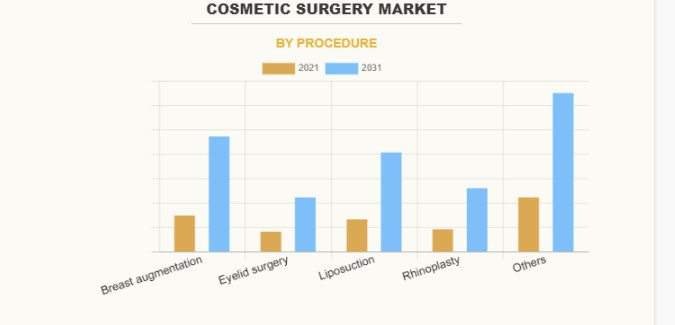

The surgical instruments industry is a cornerstone of modern healthcare and is a dynamic market driven by an ageing population and the prevalence of chronic diseases such as heart disease and cancer. The push towards minimally invasive techniques such as laparoscopy continues to drive innovation, with tools becoming smaller, smarter and more precise. Another factor to consider is the growth in the West of the body cult and cosmetic surgery. Interventions such as breast augmentation among young women are clearly on the rise in Western countries.

Growth is steady and the market is expanding thanks to technological advances. North America leads due to its strong infrastructure, but Asia-Pacific is catching up quickly, driven by medical tourism and investment in places such as India and China.

High barriers to entry

High Startup Costs and capital requirements.

Brand Loyalty and Reputation

Access to Distribution Channels

Patents and Intellectual Property

Competitive advantages

Economies of Scale:

Switching costs. Stille creates significant barriers for customers considering a change to competing products. The Company invests strongly in a long-term relationship with the customer. Products are developed in close cooperation with leading surgeons and health professionals. Services such as Instrument Care Education, Instrument Repair & Maintenance and Instrument Inspection, help create a long-term relationship. In my opinion Stille products and services are a cornerstone for surgeons and distributors. As a result, Stille creates captive customers, and therefore a high-priced product with strong pricing power. In addittion we have to think about the critic component of Stille product in a operating room. It is not the kind of product for which the customer would save costs by going to the competitors.

Intangibles. Stille operates since 19th century in the market. It is a prestigious brand and enjoys a strong reputation in the health industry. Branding is a weak advantage, volatile in nature and perhaps the most difficult to defend. However The company strives to maintain a high level of brand prestige. A high-end product image is essential in maintaining a very high gross margin. This is what sets prestige brands apart: the ability to sell at a higher price.

Growth

The CAGR 2019-2024 in sales has been of 29.47% (Organic+Inorganic).

Organic growth for FY2021 and FY2024 were +9.33% and +11.64% respectively. Net sales for both financial years, have an impact around due to SEK 31 mm and SEK 241 mm.

S&T AG and Fehling acquisitions

Stille operates in a growth market, focusing on surgical disciplines with long-term, sustainable growth. The company's focus is on solutions for cardiovascular surgery, a field in which growth is driven, among other things, by the fact that more people are living longer and by an increased need for preventive procedures.

Europe, Middle East, and Africa, represents around 41% of net sales. U.S. represents 45% and Rest of the world 14% .

CEO says:

“We continue to invest in our growth strategy in the U.S., a strategically important market for Stille”.

Growth drivers:

Acquisition opportunities. The instrument market is fragmented with numerous players across various regions, often focusing on niche high-growth surgical segments. Stille is well positioned to capitalize on the consolidation opportunity.

Transition from distributor to direct sales. Opportunity to capture distributor margins.

Stille leads the market through in-house development and partnerships with leading C-arm.

Innovations in technology and software.

New high-growth clinical segments.

Scaling sales growth without proportional cost increases. Stille’ssurgical tables are complementary to C-arms. C-arm providers sell limiting the need for Stille to maintain an expensive sales and marketing.

Outlook

Organic sales growth objective >10%.

EBITDA >25%

Net Debt/EBITDA <3x

Capital allocation

Acquisitions

S&T AG in December 2021.

S&T is a Swiss,family-owned company that develops, manufactures and sells microsurgical instruments in the absolute premium segment.

Transaction details:

Size: CHF 11.5 mm.

CHF 6 mm in cash,

CHF 2.5 mm shares issued in kind.

Earnout payment of a maximum of CHF 3 mm after 18 months of the acquisition based on the achievement of certain company goals.

At the time of the acquisition, S&T’s turnover was CHF 6.1 mm with an adjusted EBITDA of CHF 1.6 mm.

Rationale:

Complementary to Stille’s portfolio of premium,differentiated, and high-quality surgical instruments.

Attractive profitability and growth.

Presence in high-value markets.

“During its history, Stillehas undertaken several M&A activities to grow its reach and capabilities. The S&T acquisition highlights Stille’spotential for inorganic growth and competence in deal execution”.

Fehling in January 2024.

Fehling is a German company, founded in 1996, that develops and sells premium-quality medical instruments. Fehling has a strong market position with direct operations in Germany, Switzerland, the US, Singapore, the United Arab Emirates and Malaysia.

Transaction details:

36 million euros in cash upon the completion of the acquisition on a debt-free and cash-free basis.

The acquisition is financed through the previously announced targeted issuance of SEK 425 million.

For the full year, the acquired business contributed revenue

of SEK 240.6 mm and net profit of SEK 33.6 mm.

Rationale: increasing its presence in new markets.

Stille does not pay dividends to shareholders, which seems to me to be a very wise policy since one of the main drivers of growth is through acquisitions.

Management team

Stille’s Board consists of the chairman and six board members, of which one member is an employee representative.

Torbjörn Sköld (48). CEO.

Before joining Stille, Sköld held various leadership roles in the medical technology sector. Notably, he was the Managing Director of LivaNova Sweden AB and had previously served as Business Unit Director for Nordics at LivaNova PLC, a company focused on medical devices for cardiac surgery and neuromodulation. His experience also includes positions at Siemens Healthcare and other firms in the medtech industry, giving him extensive expertise in sales, marketing, and management within this field.

Torbjörn Sköld, plans to step down in June 2025 to focus on new career opportunities, according to a press release.

The board of directors has started the process of recruiting a new CEO. Mr. Sköld has a six-month notice period.

"The board and I fully respect and understand Torbjörn's decision to leave his position in June 2025. With plenty of time ahead of us, we are now beginning a well-planned and thorough recruitment process to ensure a smooth transition and find the right successor for Stille's continued development," says chairman Lars Kvarnhem.

Victor Steien (42). Mr. Steien is member of the board and represents to Impilo what owns 2,056,075 shares (23% of total shares).

Mr. Steien has been with Impilo's investment team since 2018 and prior to that spent ten years in investment banking at Goldman Sachs (2008-2014) and Morgan Stanley (2014-2018).

Other members:

Niklas Carlén. CFO

Markus Spingler. Business Unit Manager Surgical Instruments.

Johan Lundholm. Business Unit Manager Surgical Tables.

Brian Anderson.General Manager Stille US.

Gerald Fehling. General Manager Fehling

Lars Kvarnhem (53). Chairman of the Board. Mr. Kvarnhem has declined re-election, and Jón Sigurdsson is proposed as the new Chairman of the Board.

Stille applies the following principles for remuneration and terms and conditions:

Remuneration to group management should be market-oriented.

Remuneration consists of the following components: basic wage, short-term variable remuneration, pension benefits and other benefits as well as severance terms and conditions.

The Board decides on pension benefits for group management.The so-called Supplementary Pension Plan for Salaried Employees [ITP plan] constitutes the basic pension benefit.

Group management may be entitled to a company car, fuel benefits and health insurance.

Renumeration for members of the Board is SEK 145,000 per year.

Renumeration for Chairman of the Board is SEK 375,000 per year.

The Annual General Meeting resolved to authorise the Board of Directors to issue new shares. Such share issues may deviate from the shareholder’s preferential rights to subscribe for new shares. The issue of new shares may only increase the total number of shares by 900,000 shares, meaning around 10 % of the total number of shares in the company.

Conclusions:

No member of the management team has a significant position in the stock, indicating a lack of alignment with the shareholder and a more professional than business-like management profile. Except for the above, Mr. Steien, who represents the interests of Impilo (23%), which means a position of significant influence but not control.

The remuneration structure and salary level of the managers are reasonable to me.

The strategy adopted by the management team is based on international expansion and organic growth. In my opinion, it is a solid strategy that is yielding very good results. The acquisition policy is fully aligned with the company's strategy. I like the decision not to pay dividends.

I declare some concern about the resignation of CEO.

Ownership

Free float represents around 50.1% of share.

Financial Metrics

Gross margin 51.9%

EBITDA margin (before non-recurring items) 25.5%

EBIT margin (before non-recurring items) 20.2%

Net profit margin 10.21%

EPS SEK 6.48

FCF margin (Excluding SEK 316 mm for Fehling acquisition) 10.37%

ROCE ex-goodwill* 10.71%

ROE 8.75%

Current Ratio ≈ 3x

Quick ratio ≈ 2x

Net Debt-EBITDA (Excluding non-recurring items) -1.10x

*The company has not separated working capital items from current liabilities for FY2024, so the ROCE has been estimated with a higher employed capital, which results in an underestimated ROCE.

Auditors

Radek KB and Mannhart & Fehr. In my opinion, Big-Four auditors provide greater credibility and trust, although their absence is not a necessary condition for a lack of diligence or professionalism in the audit work.

Risks

Market and Competitive Risks. Stille operates in a niche but competitive medtech sector. Larger players could pressure Stille’s market share, especially if they innovate faster or undercut prices. Stille’s reliance on high-quality, handcrafted surgical instruments might limit scalability compared to mass-produced alternatives, potentially capping growth in cost-sensitive markets.

The acquisition of Fehling Instruments could bring challenges overlapping product lines, or unexpected costs could erode anticipated synergies.

Regulatory Risks.Stille must comply with stringent regulations. Any delay in approvals for new products could stall revenue. Non-compliancecould lead to recalls, fines, or reputational damage.

Foreign currency risk. Stille exposes to SEK/EUR/USD volatility, and a stronger sweden krona could dent export competitiveness.

Operational Risks. Dependence on skilled labor for handcrafted instruments Stille is stronglyulnerable to workforce shortages or rising wages in Sweden.

Technological and Innovation Risks.

Supply Chain Vulnerabilities. Raw material costs (steel, titanium) or delays from geopolitical tensions. Tariffs and export regulations (U.S).

Strenghts

More than 180 years of background being pioneers and leader in the industry.

Excellent capital allocation policy.

Global Leadership in surgical instruments.

Strong global distribution channels.

Market expansion and acquisitions strategy.

Instruments of unparalleled quality. Higher price and higuer margins.

Competitive advantages and dominant position.

High barriers of entry.

Strong financials. Net cash position.

Valuation

Stille AB stocks are trading at 14x EV/EBITDA and 35x EV/FCF for FY2024.

Assumptions:

Organic sales growth objective 10%.

EBITDA margin 26%

FCF Margin 11%

EBITDA Multiple 18x

Terminal FCF multiple 30x

Upside ≈60%

If you are a professional or qualified investor, and you like my work, don't hesitate to contact me.

Next report: March 27, 2025.

Why did operating margins increase so much since 2015? The company spent the previous ~15 years at breakeven or barely profitable and not growing all that much...suddenly it shifted to growing 15-20% per year and margins jumped to mid-teens? What changed?