Other Recent writeups:

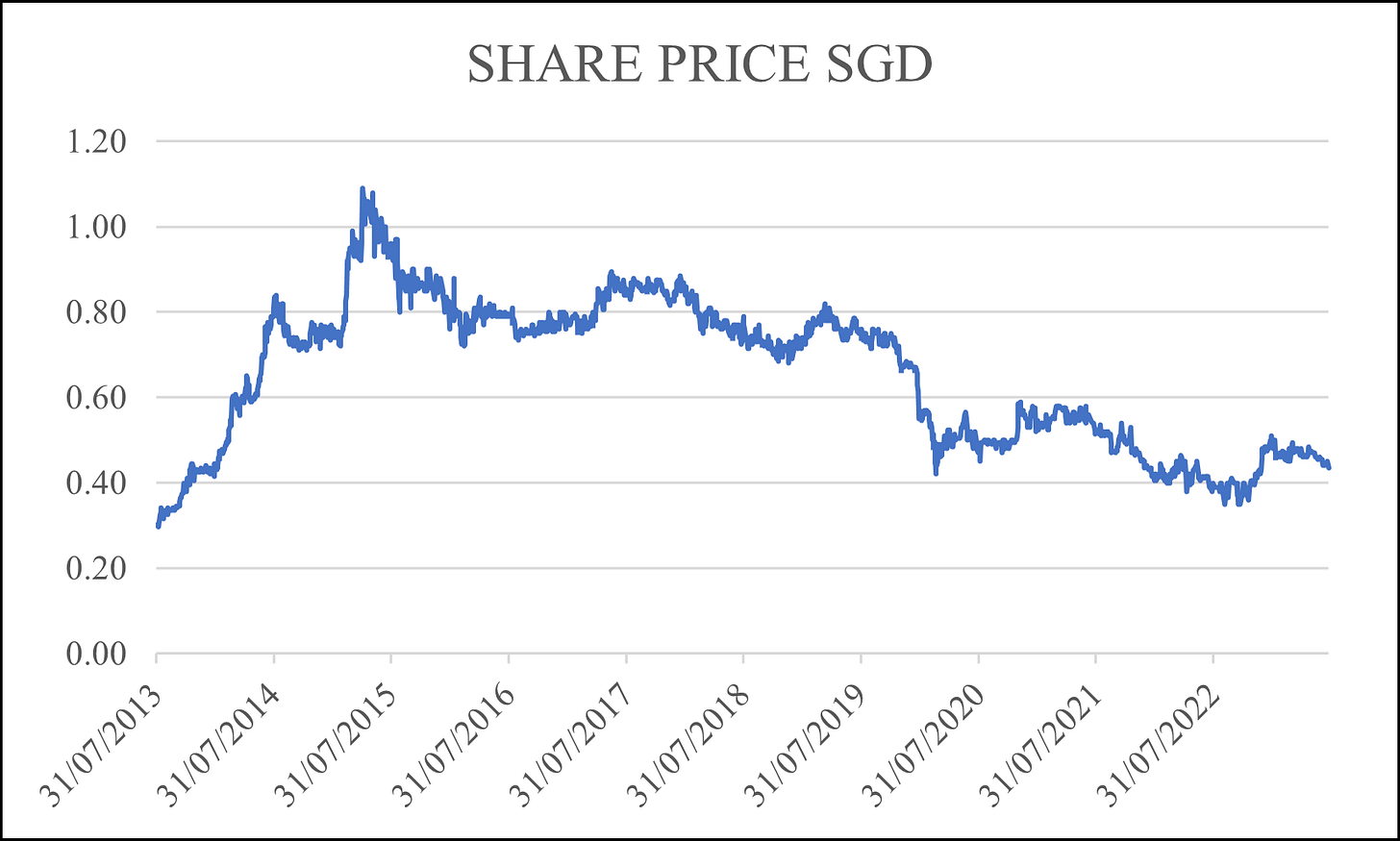

Analysis date: July 31, 2023.

Key Points

Portfolio of unique assets protected against competition.

Cash-Cow Business model.

Net cash position and high returns on capital invested.

Business driven by China's middle-income population.

High upside potential.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

Introduction

Straco Corporation Limited is a Singapore-based company of tourist attractions in Singapore and China. The Company operates through two segments: Aquariums and Observation Wheel.

Its current portfolio includes Shanghai Ocean Aquarium, Underwater World Xiamen, Lintong Lixing Cable Car and Singapore Flyer.

Straco owns the development right to CYG, an integral part of the restoration project for the grand "Hua Qing Palace". The project showcases architectural features from the Tang Dynasty period through reconstructed replicas of its major buildings.

The Company started operations in 1990s and listed on the Singapore Exchange on 20 February 2004.

Business Model

Portfolio

Singapore Flyer

Openeded in 2008.

Located in the Marina Bay Precinct, Singapore.

One of the world’s largest observation wheels standing at 165m tall.

Visitors can enjoy a panoramic view of the Marina Bay and city skyline with glimpses of neighbouring Malaysia and Indonesia.

The owner is the subsidiary Straco Leisure Pte Ltd.

Shanghai Ocean Aquarium

Openeded in 2002.

Located adjacent to the Oriental Pearl Tower, district of Lujiazui in the Pudong New Area.

Group’s flagship attraction.

It is one of the world’s largest indoor, closed system aquariums with a total capacity to hold more than 6.3 million litres of water.

It has a design capacity of approximately 21,000 visitors a day and occupies an area of 20,500 square meters.

9 different thematic zones and a collection of more than 15,000 fish and marine livestock from 450 different species.

It also has one of the world’s longest underwater viewing tunnels measuring at 155 meters with 270-degree views.

More than 2 million visitors every year from within China and all over the world.

Underwater World Xiamen

Situated on the scenic Gulangyu Island off the city centre is a key tourist attraction for visitors to Xiamen.

5.8 million litres of water capacity,

It offers a wide variety of aquatic species to match its larger sister aquarium while displaying one of the world’s largest sperm whale specimens.

Lintong Lixing Cable-Car

Opened in 1993

Located about 35 kilometers east of Xi’an, Lishan Mountain.

Length of 1.5 kilometers and takes five to ten minutes to reach the mountain.

Amazing views of the Hua Qing Palace and its landscape.

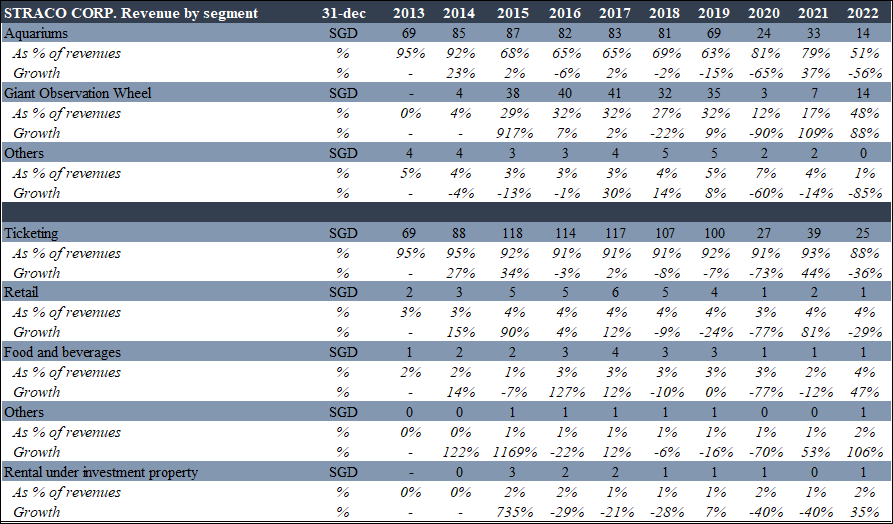

Revenue Model

Straco makes money from tickets, retail sales, food and beverage and rental income mainly.

Cost Structure

Industry

Straco operates in the attractions and entertainment sector, and tourism industry.

Tourism industry is highly cyclical and seasonable. Earnings depende on the stage of the business cycle, and revenues are volatile in extreme events.

China

Located in one of larger and visited cities on China, SOA is the flagship atrattion for Straco whose growth can be driven by:

China's middle-income population.

Domestic tourism.

International tourism.

Disney Shanghai

Far from competition, the opening of Disneyland Shanghai in 2016, may benefit Straco's flagship SOA as tourists tend to visit multiple attractions on their Shanghai trips.

Singapore

Each of the tourists who arrived in 2021 spent an average of 11,127 dollars. Singapore GDP per capita is around USD 82,808.

[https://www.worlddata.info/asia/singapore/tourism.php]

According to Trip.com Group data the most popular destinations for Chinese travelers so far are Singapore, South Korea, Hong Kong, Japan and Thailand.

Competitive advantages

Straco's moat is similar to that of other theme park operators. Companies have more pricing power and better prospects for earnings when significant barriers to entry exist. In addition, threat of new entrants make possible to mantain high returns on capital.

Straco portfolio is protected by goverment agreement until 2034 (World Xiamen), 2035 (Singapore Flyer) and 2037 (SOA).

In my opinion government agreements represent win-win for both parties. Straco assets have become in a “cash-cow” for governments and The Company enjoys unique assets protected against competition.

Growth

“THE PERFECT STORM”

In January 2020, Straco faced an unprecedented moment due to precautionary regulatory Covid-19 measures implemented by the local authorities.

It began in early 2020 as an outbreak in Hubei province, China, which prompted a strict lockdown. The increased transmissibility of the SARS-CoV-2 Omicron variant that emerged in late 2021 has posed challenges.

Medical protocols and health advisories were, and remain the order of the day, and the crisis was contained and managed with varying degrees of success across jurisdictions. There has been a heightened vigilance in the approach. For a disease that is airborne and often asymptomatic, the reliance on protective gear, safe distancing and observing good personal hygiene were deemed as key measures to observe. Despite the consensus among medical experts that the COVID-19 pandemic will come to pass, the recovery is expected to occur over an extended period of global restrictions on movement and travel, which to date have decimated tourist traffic and revenues in the global tourism industry.

CEO says:

“In summary, 2022 was to be the final but most challenging year of the pandemic for Straco, as China’s zero-Covid policy precipitated a sharp fall in revenue for our attractions from the preceding year. In Singapore, the gradual easing of Covid measures kick-started our tourism recovery and visitor numbers in Singapore - although the government’s transition to a post-Covid phase also meant the withdrawal of financial support in the form of job support schemes and tourism vouchers. Other factors would be due to the one-off arbitration award to the Group in 2021, as well as exchange losses as the Chinese yuan weakened against the Singapore dollar in the year”.

Covid In Singapore, the gradual easing of community and border restrictions in 2022 saw encouraging growth in visitor arrivals in the second half of the year. Singapore Flyer’s visitor numbers in 2022 reached 30% of 2019 pre-Covid levels, with strong inbound recovery observed from the increase in international visitors and locals.

Rides on Singapore Flyer were suspended for about three months in first half of FY2022 in compliance with the authority’s directive.

The Group’s flagship attraction, SOA, reported significant drop in earnings in 2022 compared to 2021 as visitor numbers decreased more than 60% from 2021, as the aquarium was closed for more than three months from mid-March to end of June due to the city-wide lockdowns in Shanghai to curb the spread of Covid-19 infections.

CEO says:

“After 3 challenging years, the tourism sector can finally look forth to better times. With Singapore adjusting the Disease Outbreak Response System Condition (DORSCON) from yellow to green, and China relaxing its stringent Covid control measures, it became clear that the COVID-19 pandemic had finally abated. We have now seen the gradual removal of most, if not all, of the precautionary measures that were put in place at the height of the pandemic. This is significant for the revival of the tourism industry”.

“With the easing of community and border measures in Singapore and China, we are expecting a strong rebound in our visitor numbers in 2023, although headwinds to the global economy, including geopolitical tensions, rising inflation and labour shortages will continue to dampen growth as they have in the last three years. As we ramp up our operations with the general recovery, we will continue to adapt and innovate to ensure our long-term sustainability”.

Know more about COVID-19 restrictions.

“Straco Corporation Limited (SCL) owns the development rights to Chao Yuan Ge (CYG), which is located at the alighting point for the Lintong Lixing cable-car and has obtained exclusive permission from the State Administration of Cultural Heritage of the PRC to display relics unearthed from the CYG site on Lishan Mountain”. [Straco]

“It showcases the unique culture and architectural features of the Tang Dynasty through reconstructed replicas of its major buildings. The project when completed will be one of the next most important attraction in the vicinity following the Terracotta Warriors Museum and the Qing Shihuang Mausoleum and serves to provide visitors with a unique and engaging presentation of the Tang Dynasty’s”. history and culture. [Straco]

The project may be a catalyst for Straco stocks. I have evaluated neither the project impact on revenues nor future capital requirements for valuation purposes.

Management team

MR. WU HSIOH KWANG. Executive Chairman / Executive Director

Mr. Wu Hsioh Kwang is the founder of Straco Corporation Limited and has been instrumental in driving the Group’s growth since its inception. Mr. Wu was appointed as Executive Chairman of the Company in March 2003, to lead the Group in its strategic vision and overall management. As Chairman of the Board, Mr. Wu provides valuable business insight and guidance to the Board in developing growth strategies for the Group’s businesses. Mr. Wu’s other appointments include, Senior Honorary Council Member of Singapore Chinese Chamber of Commerce and Industry, First Vice Chairman (China & North Asia Business Group) of Singapore Business Federation, and Vice-Chairman of Singapore Chinese Orchestra. He is also Director of Confucius Institute, Board Member of Sun Yat Sen Nanyang Memorial Hall, as well as Board Member of the Haas School of Business. In 2015, Mr. Wu was awarded the White Magnolia Award in Shanghai for his contributions to the Municipal City of Shanghai. In 2016, he received the Public Service Medal at the Singapore National Day Awards, and in the same year, he was awarded the Nanyang Distinguished Alumni Award by Nanyang Technological University (Singapore). Mr. Wu holds a Bachelor of Commerce degree from the former Nanyang University (Singapore). [Straco Annual Report FY 2022]

MDM. CHUA SOH HAR. Non-Executive Director

Mdm. Chua Soh Har, spouse of Mr. Wu Hsioh Kwang, was appointed as a non-Executive Director in June 2010. Mdm. Chua played an instrumental role in the establishment of Straco Corporation Limited. Together with Mr. Wu, Mdm. Chua was a founding member of the Group’s China businesses. Mdm. Chua is a director of non-listed Straco Holding Pte Ltd, the substantial shareholder of Straco Corporation Limited. With more than 30 years of experience in business management, international trading and investment, she has provided much guidance and advice for new opportunities that are relevant to the Group’s businesses. Mdm. Chua holds a Bachelor of Commerce degree from the former Nanyang University (Singapore). [Straco Annual Report FY 2022].

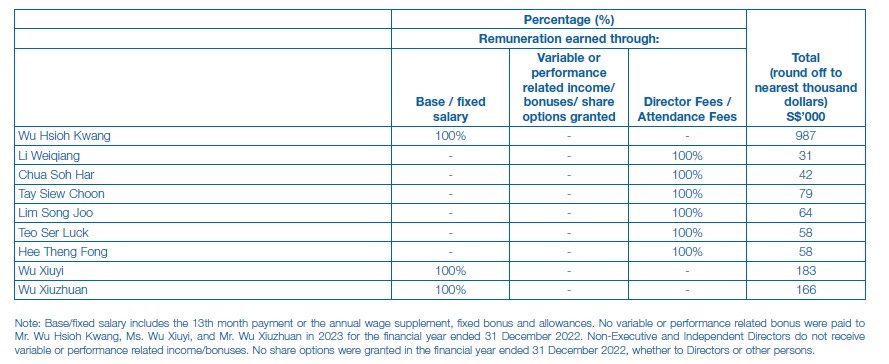

Compensation

Management execution

Dividend cut.

Retribution was cut down.

Buyback program.

Conservative capital management policy.

Although, in a scenario of raising rates of interest, a large amount of cash could be seen as a positive signal. We should evaluate the cost of opportunity that an unbalanced capital structure implies.

In my opinion, the background of the management team is excellent, with a magnificent level of execution and a long-term vision focused on providing value for the shareholder.

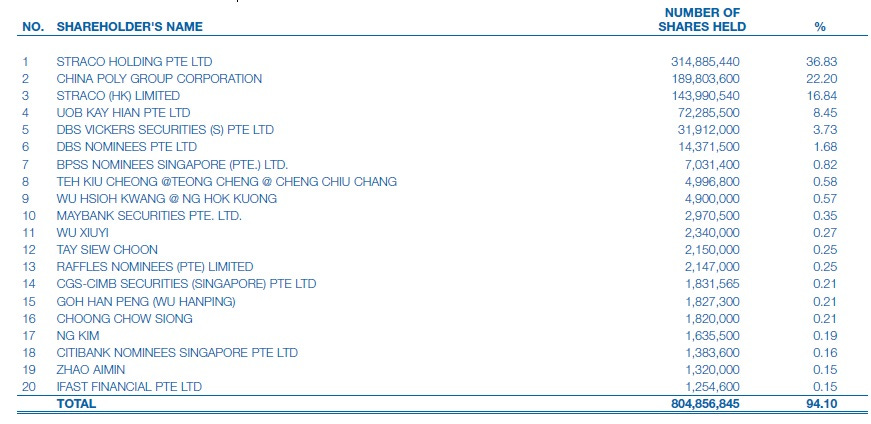

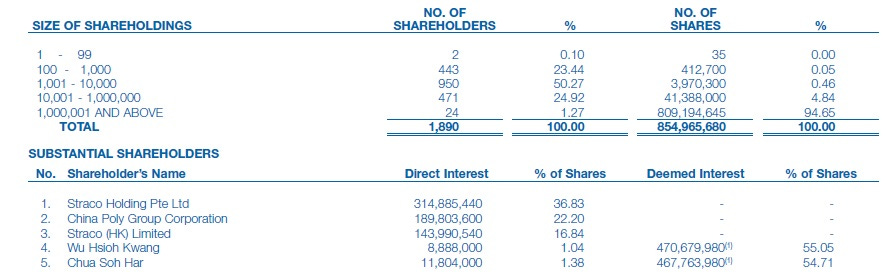

Shareholders

24 shareholders own around 95% of total .shares

Approximately 13.92% of the ordinary shares of the Company is held by the public.

A concentrated ownership may arise controlling owners take advantage to the detriment of minority shareholders.

In many cases, investors focus on companies where practically all the control is exercised by a group or family. Personally speaking, must have a balance between a lack of skin in the game and an excess of control.

Risks

The impact potential future outbreaks of infectious diseases or other health concerns, could adversely affect business operations.

Possible conflict with China over Taiwan.

China economic slowdown.

Regulatory risk.

Principal-principal conflict.

Future consumer discretionary purchasing activity.

Changes in foreign currency.

Despite Mdm. Chua Soh Har a Non-Executive director, her relationship with The Company CEO Mr. Wu Hsioh Kwang, may be a“ conflict of interest”.

Financial Metrics

Financial Statements as reported

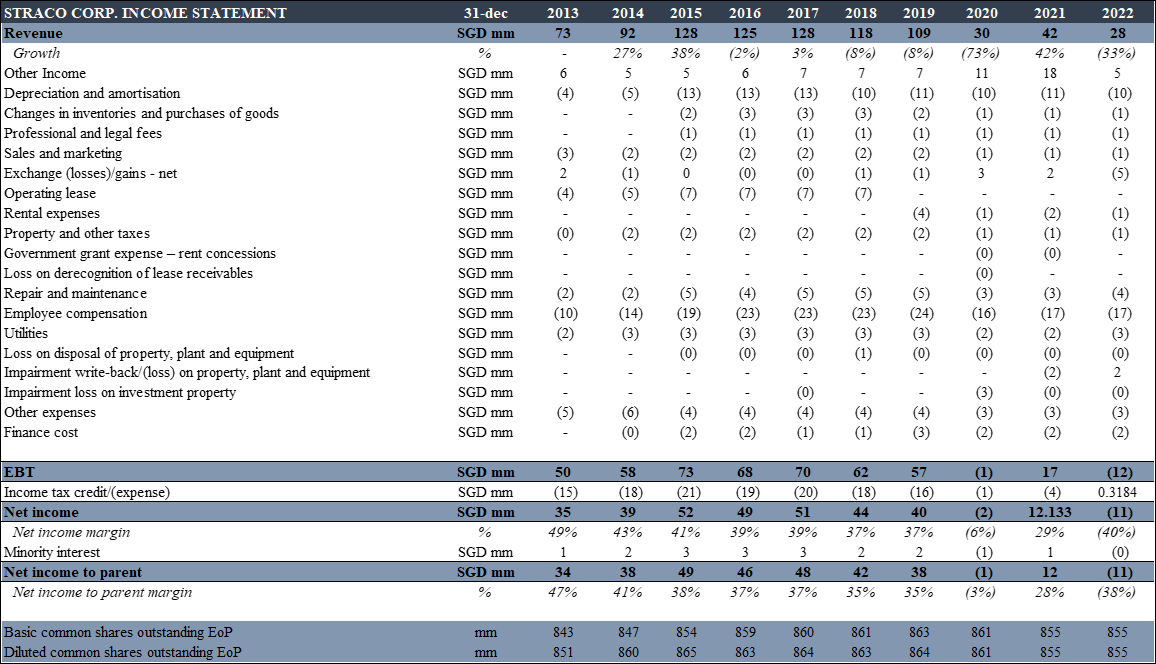

Earnings

EBITDA from the lens of Eloy Fernández Deep Research.

Profits decline for 2020-2022 financial years due to COVID-19 restrictions and lockdowns in both China and Singapore.

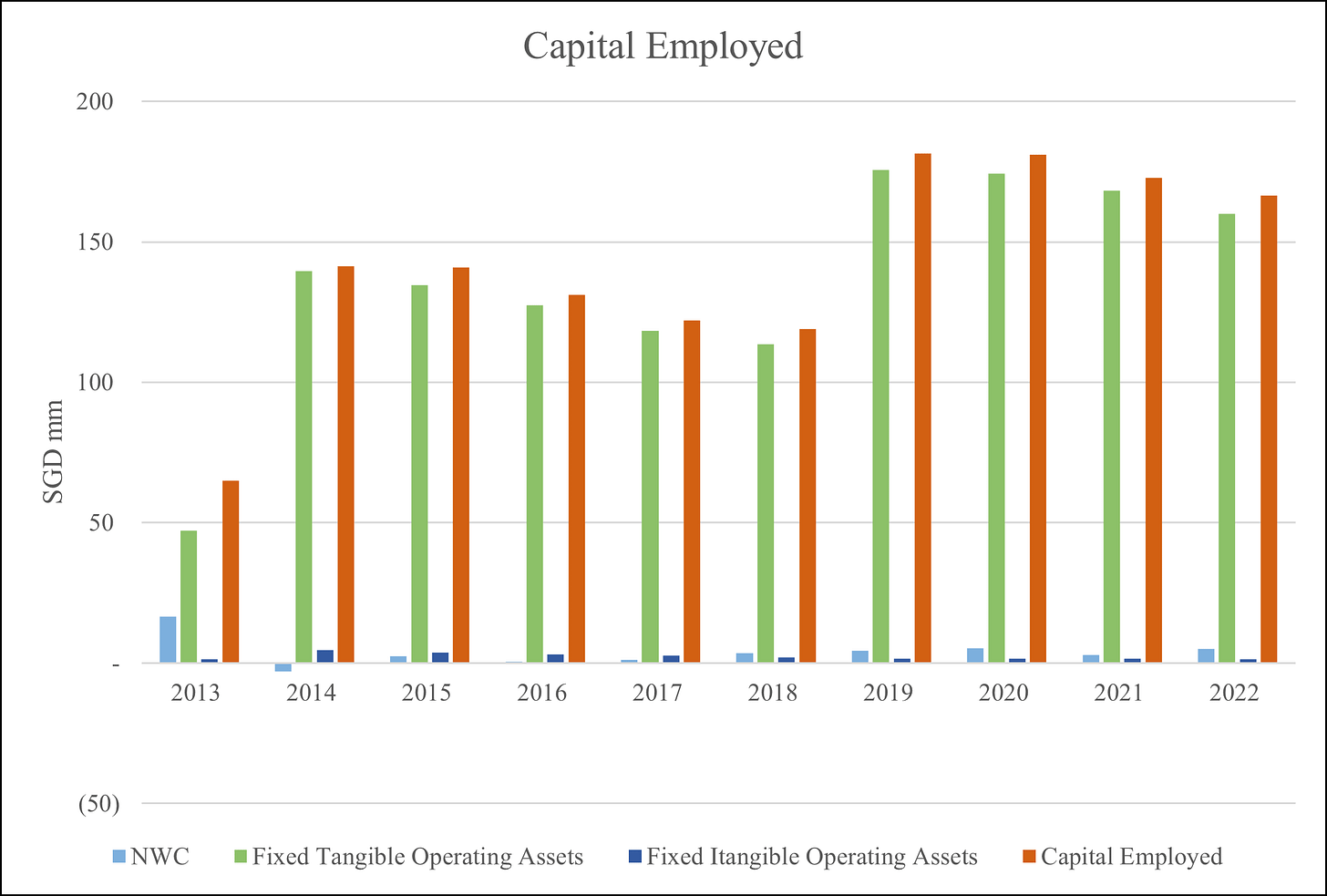

Capital structure analysis

Capital Employed ex-goodwill/Sales normalized (Pre-FY 2020) is around 120%. Straco needs a high level of capital to operate the business. That circumstance offset with recurrent and predictable revenues, and high return on invested capital.

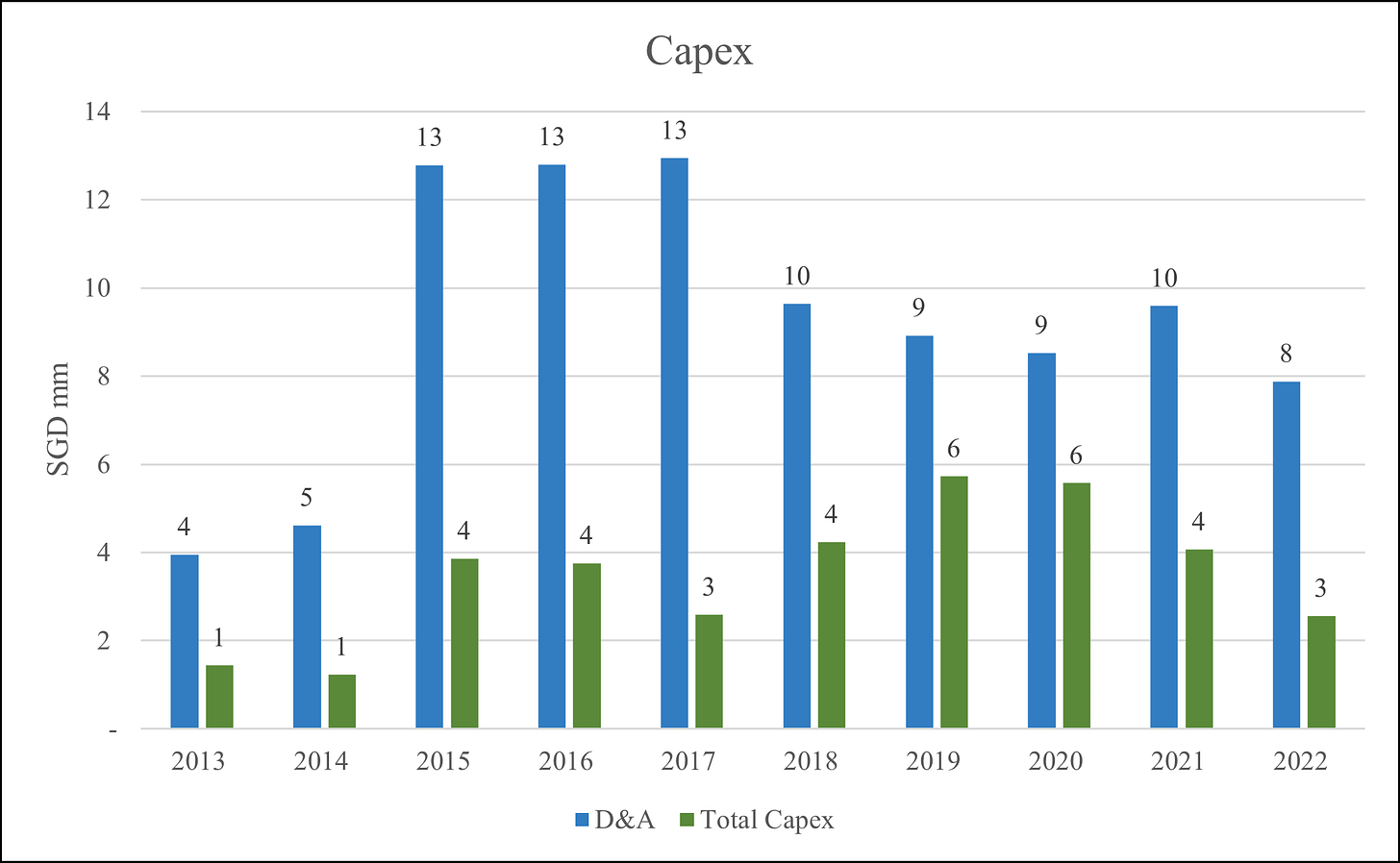

D&A is significantly higher than Capex. Straco Capex is mainly maintenance Capex such as D&A amount shows.

Profitability

Solvency

Historically Straco has reported net cash position.

Net cash, low financial leverage and high interest coverage (EBIT/Interest expenses), are typical signs of strong financial health.

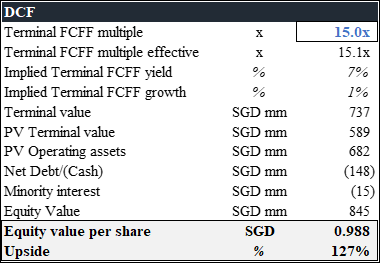

Valuation

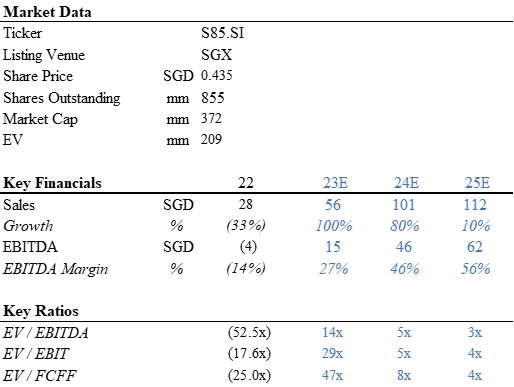

For projections I take the following assumptions:

COVID-19 effects should be considered temporary.

Forecast horizon and projections shoul be normalized to mitigate impactful event such as COVID-19 .

I estimate EBITDA and FCF margins, revenues and capital requirements similar to the pre-FY 2020 scenario.

Next report: August 31, 2023.