Other writeups:

Hyfusing Group Holdings United.

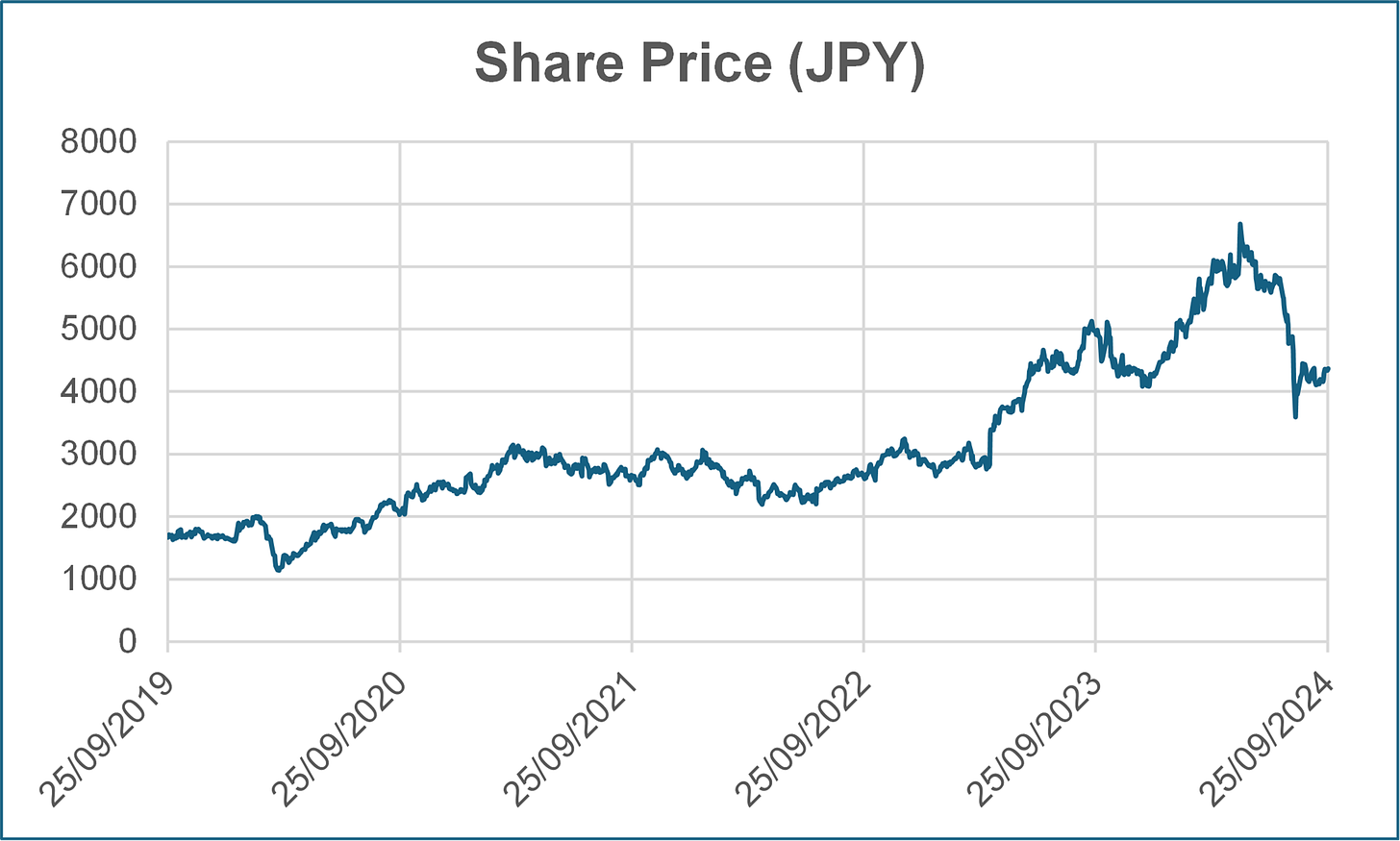

Analysis date: September 25, 2024.

Key Points

Referent player in the mini excavators and track loaders market.

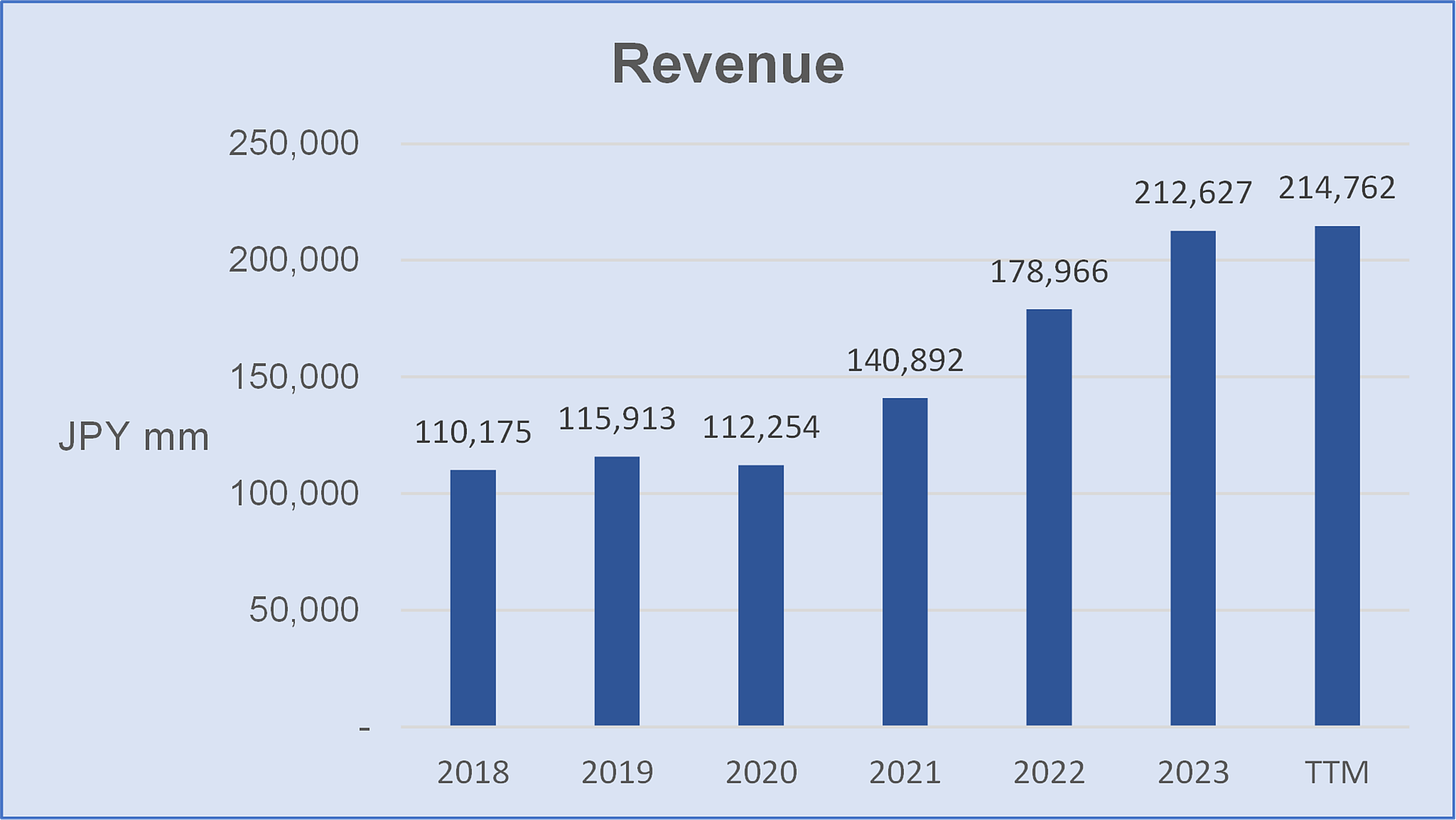

14% CAGR 2018-2023 of revenues.

Quality business with a strong worldwide after-sales network.

Excellent execution and management team. The founder's family owns around 19% of shares.

Excellent capital allocation through dividend policy and investment in capex.

Strong financial health with a level of debt near to zero.

The stock is undervalued.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

Introduction

TAKEUCHI MFG. CO., LTD (6432.T) is a Japan-based company principally engaged in the manufacturing and sale of construction machinery, such as compact hydraulic excavators and track loaders.

Established by Mr. Akio Takeuchi in 1963, Takeuchi developed the world’s first compact excavator in 1971 and developed the first compact rubber track loader in 1986. In this regard, Takeuchi transformed the global construction equipment markets.

Business Model

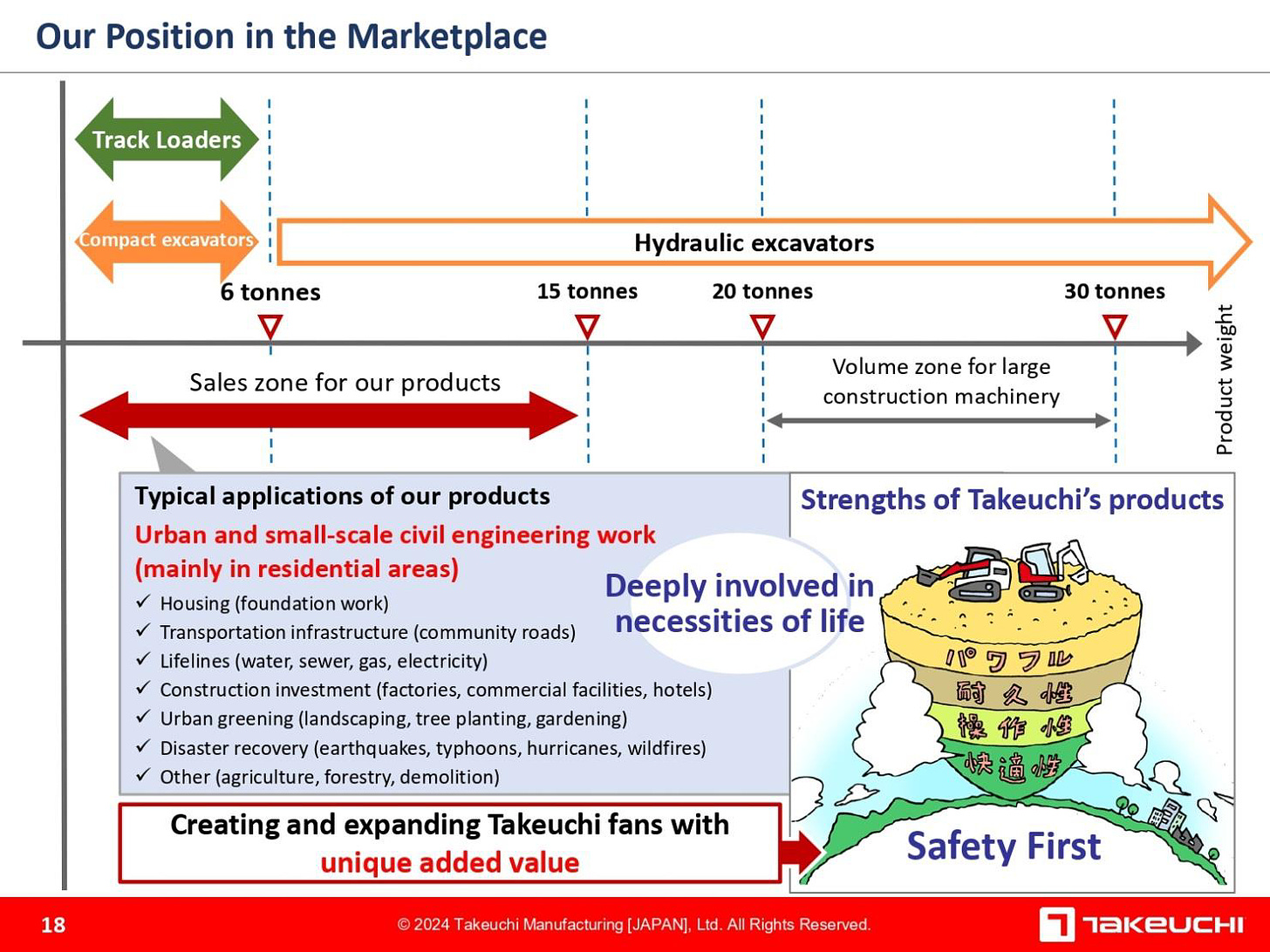

Takeuchi is a well-known brand in the construction equipment industry, specializing in compact machinery, that manufactures compact and hydraulic excavators, track loaders and other construction machinery.

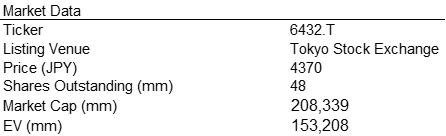

The Takeuchi Group

“The Group” is made up of five companies, including “The Parent” and four consolidated subsidiaries.

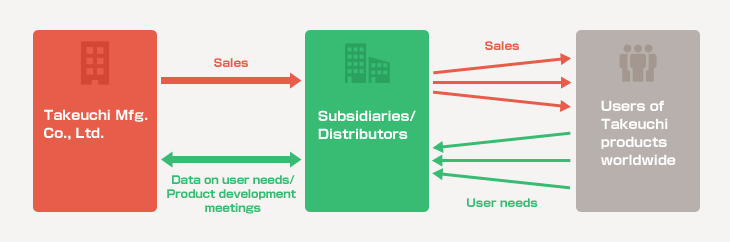

Takeuchi MFG. CO., LTD. (Japan Segment) develops and manufactures construction machinery. Sales of construction machinery in Japan and sales to Asia/Oceania distributors.

Takeuchi Mfg. (U.S.), Ltd. (U.S. Segment). Sales of construction machinery in the U.S. and Canada. Manufacture of construction machinery in the U.S.

Takeuchi Mfg. (U.K.) Ltd. (U.K. Segment). Sales of construction machinery in the U.K.

Takeuchi France S.A.S. (France Segment). Sales of construction machinery in France.

Takeuchi Qingdao Mfg. Co., Ltd. (China Segment). Sales of construction machinery in China. Manufacture of construction machinery for China and other parts of Asia. Manufacture, procurement, and sales of construction machinery componets for the Japan Segment.

Products line

Compact Track Loaders.

Compact Excavators. (Operating weight of less than 6 tons).

Hydraulic excavators. (Operating weight of more than 6 tons).

Crawler dumpers.

Parts & Services.

Takeuchi manufactures hydraulic excavators with a maximum operating weight of 15 tonnes.

Electric line

Takeuchi has been moving toward engineering construction equipment that relies on electric vehicle (EV) technology. TB20e mode has been the first EV battery-operated mini-excavator.

Where are they made? Facilities and future expansion.

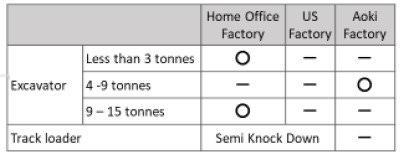

Currently majority of production is done in Japan factories (Sakaki and Aoki) with a factory in China. Takeuchi started U.S. production of Compact Track Loaders in Q3´ 22.

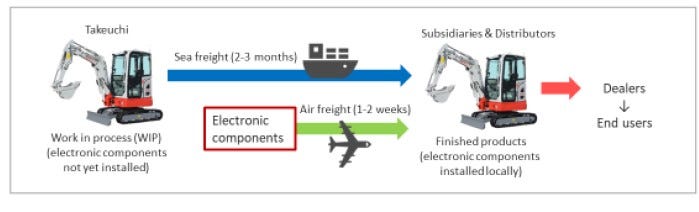

Takeuchi exports partially assembled products to the United States. It allows them to benefit from lower customs fees than would be applied to finished products. It demands optimal design for transporting parts and components purposes, and good management of logistic operations.

North Carolina facility construction eliminated the need to ship CTLs (Compact Track Loaders), from an overseas facility to North American dealers and customers, and switch to SKD (Semi Knocked Down) production.

About 65 percent of receiving parts by North Carolina plant are sent from Japan for assembling work.

Takeuchi U.S. President said in 2023:

"Our goal in the next 24 months is that we will make all Takeuchi compact loaders for the worldwide market from this plant and then start exporting them to other countries”

Full operation of U.S. factory is expected for FY2024.

Aoki factory started to operates in september 2023, transfering production of medium-weight excavators (4 to 9 tonnes) from the home office to Aoki.

Full operation: FY2024.

After sales

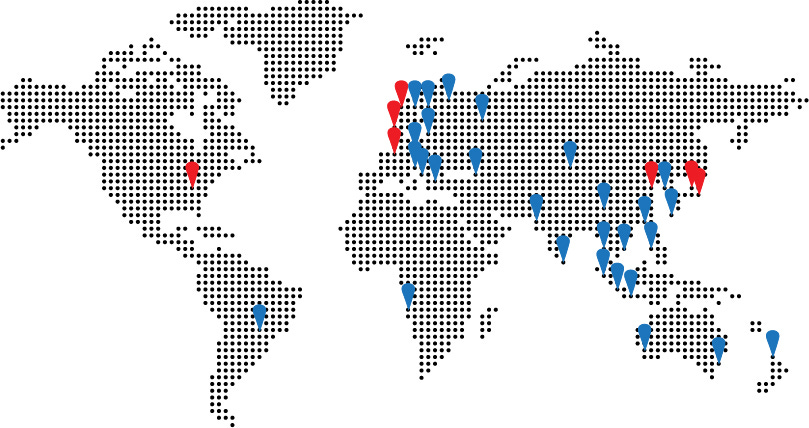

The European Part Centre based in Nijmegen (Netherlands), provides approximately 8,800 sqm of spare parts for all Takeuchi machines available in European markets.

Revenue Model

The Group's main business is the development, manufacture, and sale of construction machinery, and it has a performance obligation to deliver products based on sales contracts with customers.

Revenue is recognized at the amount expected to be received when control of those goods or services is transferred to the customer.

In the case of export sales, The Company recognizes revenue when the risk is transferred to the customer.

For transactions in which the installation of parts is performed after the product is shipped, revenue is recognized when the parts are shipped or the inspection after the parts are installed is completed.

For domestic sales, revenue is recognized at the time of shipment.

Value proposition

Takeuchi culture is based on “When you put your customers’ needs first, sales and profits will follow”.

Most people don't know that Mr. Takeuchi was the inventor of the compact track loader.

“Our products are used in housing-related construction projects, road construction, and as part of infrastructure works for daily life such as water and gas pipes, as well as for restoration work after natural disasters. Our products are deeply involved in the daily lives we take for granted and are deeply related to food, clothing, and shelter. In addition to durability, our commitment to operability, comfort, and power has created and expanded the Takeuchi fan base in its own unique way”. [Takeuchi].

Mini excavators’ strengths:

High mobility and maneuverability.

Versatility. They can operate in urban civil engineering, small construction projects in residential areas where large construction machinery cannot enter, as well as in large civil engineering projects.

Mini excavators are easier to transport.

Mini excavators requires less fuel than larger excavators.

Small adquisition/rental cost.

Mini excavators are easier to electrify.

Takeuchi is focused on small-sized machinery, which makes it a specialist, creating a product known in the market for its quality, versatility and comfort. The network of dealers and after-sales service, specialized in the needs of a specific type of customer, makes Takeuchi's value proposition a strength compared to some of its peers.

CEO says:

“This spirit of product and market development has been passed down within the Group as our corporate philosophy of "From World First to World Leader Takeuchi." We have focused not on imitating others but instead on bringing our own products to the world”.

“Our second strength is the quality of our products. Our customers have high expectations that we will provide tough, durable, long-lasting construction machinery. Whether we can offer some extra added value will be the decisive point in our favor in the future. So far, in addition to durability, we have developed products focused on user-friendliness, comfort, and performance. Going forward, while continuing to develop these strengths, I believe we must refine the performance and environmental aspects in the future with added features, such as automation and electrification”.

Customers

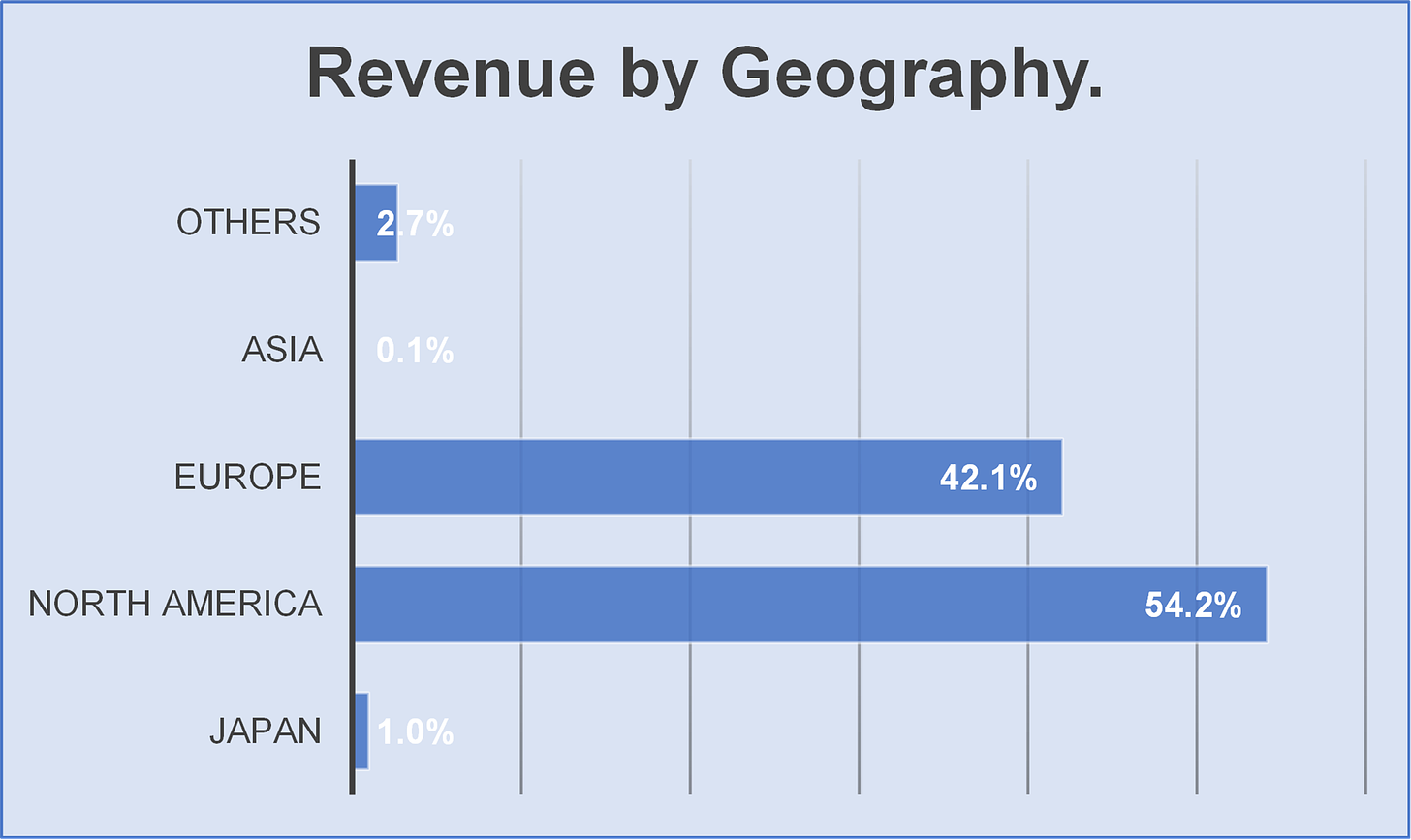

The major customers of the Group are mostly U.S. and Europe.

The U.S. is the world’s largest market, mainly for crawler loaders. More than 90% of them are sold in U.S.

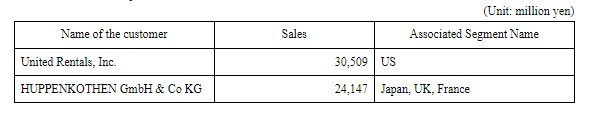

Most relevant clients

Revenue from the two main customers of the Group contributes around 25% of the total revenue.

United Rentals, Inc., is an equipment rental company based in Stamford, Connecticut, that trades in the Nasdaq Index.

United represents around 14% Takeuchi´s total revenue.

Huppenkothen is an Austrian company and a market leader in mini and compact construction machinery. The link between manufacturers of construction machinery and end users is through selling and renting services.

Huppenkothen represents around 11% Takeuchi´s total revenue.

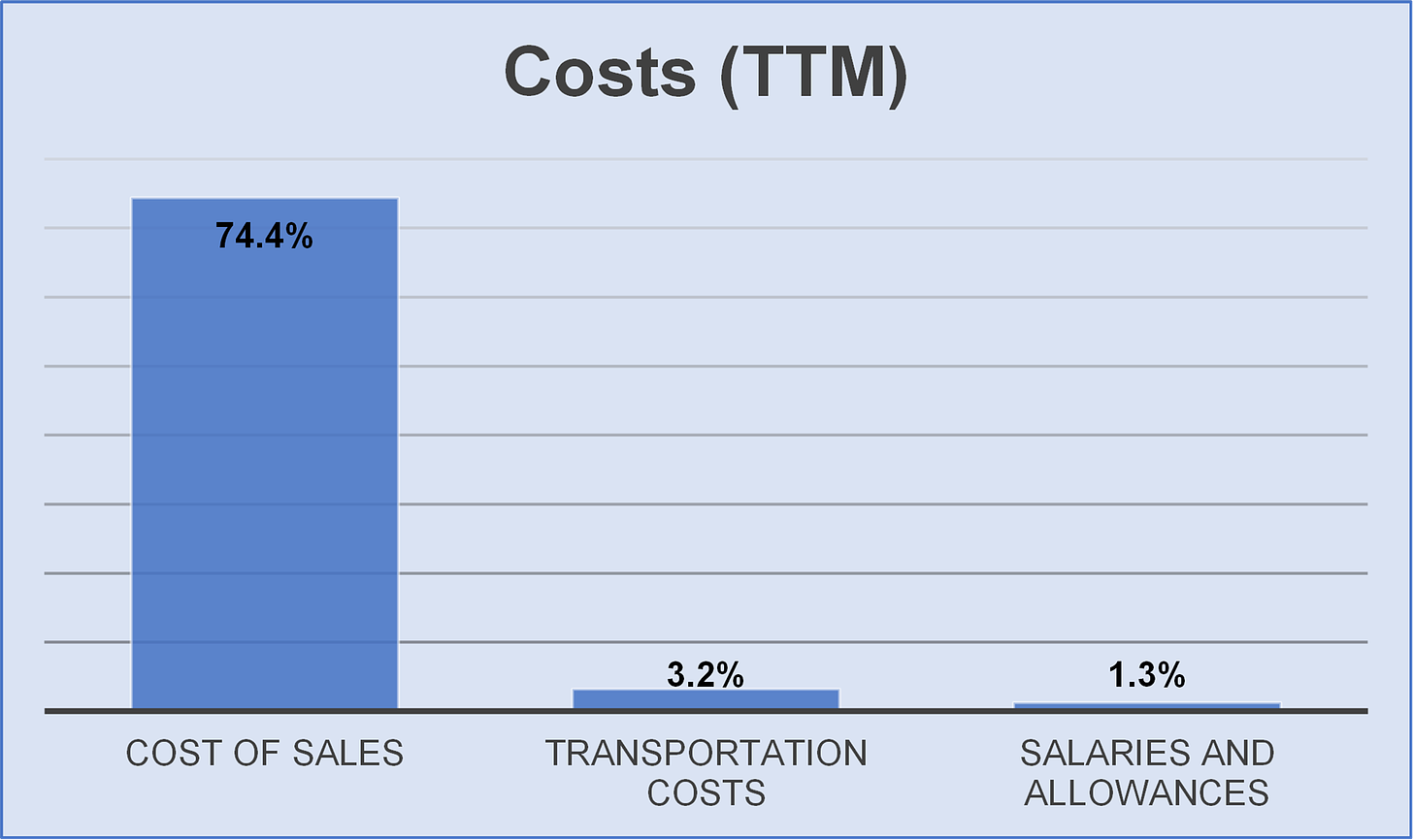

Costs Structure

Cost of sales includes:

Raw materials such as metals, paints, rubber and plastic.

Engines.

Components.

Labor and overhead costs.

Other costs necessary to bring the inventory to its present location and condition.

Takeuchi does not manufacture the engines for its equipment. Kubota and Yanmar are the main engine suppliers.

Transportation costs involve costs relative to SKD (Semi Knocked Down) production.

Takeuchi exports partially assembled products to the United States. It allows them to benefit from lower customs fees than would be applied to finished products. It demands optimal design for transporting parts and components purposes, and good management of logistic operations.

Salaries and allowances item is related to personal expenses, (excluding retirement benefit expenses, remuneration of directors and bonuses).

Employees

Construction machinery industry is highly sensitive in terms of labor costs.

The number of employees in Takeuchi is 1,198 (1,718 including temporary workers), 674 of them in Japan, 272 in the U.S., and 252 in other locations. The average annual salary for Japanese workers is around JPY6.6 mm. ($46,000).

Total expense in salaries and allowance for FY2023 is JPY3,212 mm.

According to The Company:

“The first is to expand the business, and the second is to increase the number of employees in order to have extra human resources. Only with this extra human resource capacity will it be possible to enhance human resource development through education and training, and to improve work-life balance, such as through the use of paid leave and childcare leave”.

Industry

Takeuchi competes mainly in the compact equipment industry. In fact, Takeuchi has been a pioneer in the compact excavators and compact track loaders.

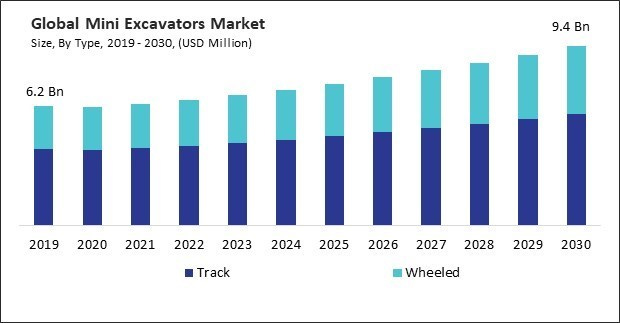

The Global Mini Excavators Market size is expected to reach $9.4 billion by 2030, rising at a market growth of 4.7% CAGR during the forecast period. [https://www.globenewswire.com/]

High barriers to entry

It is tough for new players to enter the global mini excavator market, which demands high levels of expertise, R&D and capital investment.

Takeuchi maintains its competitive position through its strong brand reputation, extensive dealer network, investment in research and development, and focus on customer satisfaction.

Specialization is an advantage for Takeuchi over other competitors, which have a broader product portfolio. On other hand, Takeuchi also has greater exposure to a smaller number of products, which can be a weakness.

For example, Deere, The forerunner in the market, manufactures several types of equipement such as agriculture, construction, golf courses, garden or military machinery.

Companies such as Volvo Group, Caterpillar, Inc., Hitachi, Ltd. are some of the key innovators in the market.

Drivers:

Urbanization and infrastructure development.

Advancements in mini excavator technology.

The U.S. regional market leads global market demand, which is a critical driver of growth.

Competitive advantages

Takeuchi is a prestigious brand and enjoys a strong reputation in the market.

In my opinion, branding is a weak advantage and perhaps the most difficult to defend.

Distribution and after-sales network represents a strong advantage for Takeuchi. We know that nobody wants to buy a car without an adequate network of official workshops nearby, or without an after-sales service that covers their needs. And the more users, the greater the number of professionals specializing in the brand, which attracts more users, which attracts the interest of more dealers. That is the network effect.

Applied to Takeuchi, the effect is even greater, since the end user is a professional who does not want to compromise his performance, so he needs a reliable and close after-sales service network. Takeuchi covers these needs in the markets in which It is present.

The European Part Centre based in Nijmegen is an example of investing on Network Effect.

Takeuchi provide more than 30 distributors worlwide (Excepting The Company subsidiaries).

Growth

The CAGR 2018-2023 in revenues has been of 14%.

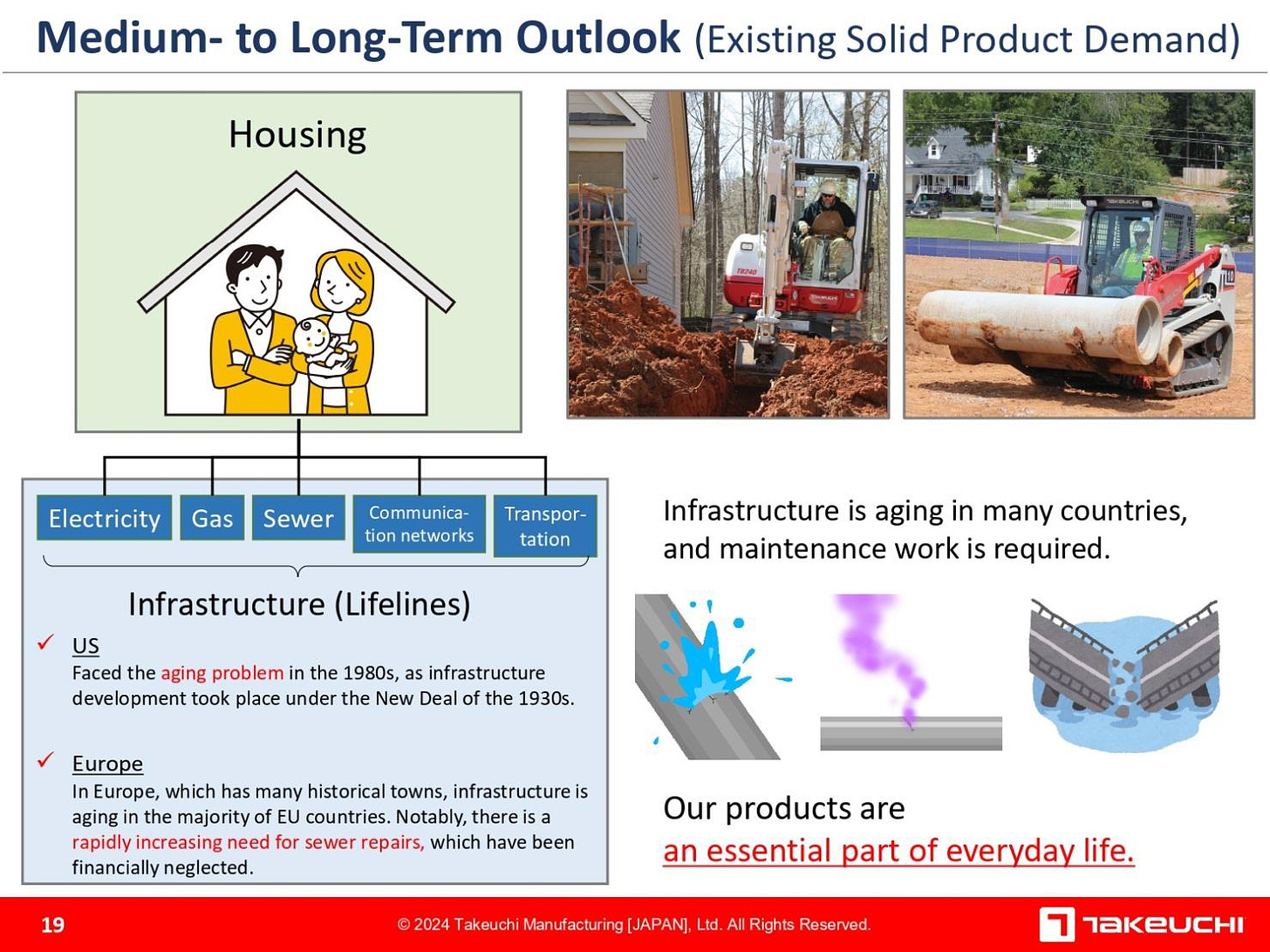

Takeuchi products have a strong cyclical component, however, due to the focus is on compact excavators segment, demands are more secular. We can say that, although cyclical, takeuchi is defensive, at least in part.

“The aging of living infrastructure is becoming a serious social issue in many countries around the world. Inspection and maintenance work on living infrastructure is not something that can be completed on a perennial level but is said to be a never-ending project on a multi-decade level. We believe that this solid demand for our products today will continue to support our business in the future”. [Takeuchi Securities Report]

CEO says:

“You live in a comfortable home and have clean water when you turn on the faucet. Turn on the switch and the electricity comes on. Our products are deeply involved in the daily lives that we take for granted and are deeply related to food, clothing, and housing”.

Growth drivers mini excavators and crawler loaders market:

Housing demand.

Public works/civil engineering projects.

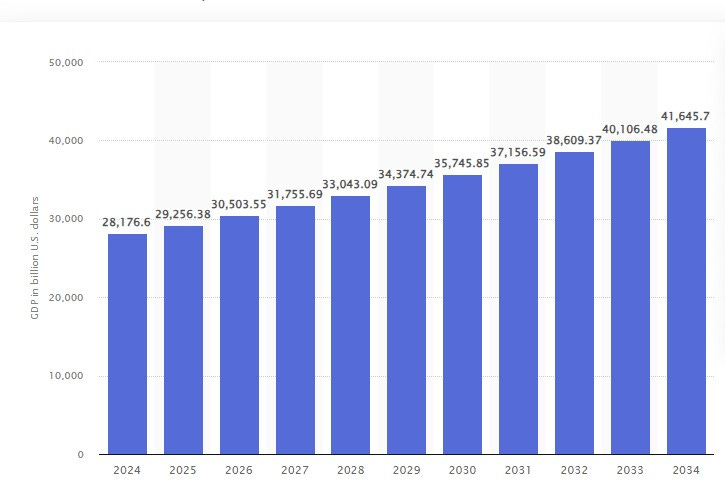

Both factors have a direct and strong dependency on interest rates, personal income, GDP in the domestic economies, global population increase and unemployment rate.

Forecast of the gross domestic product of the United States from fiscal year 2024 to fiscal year 2034:

The forecasts for 2025 from Fannie Mae, the Mortgage Bankers Association (MBA), the National Association of Realtors (NAR), and Wells Fargo show an expected gradual decline in mortgage rates over the course of the next year.

Cities population is growing worldwide and infraestructure aging making maintenance essential.

The UN's 2024 report projects world population to be 8.1 billion in 2024, about 9.6 billion in 2050

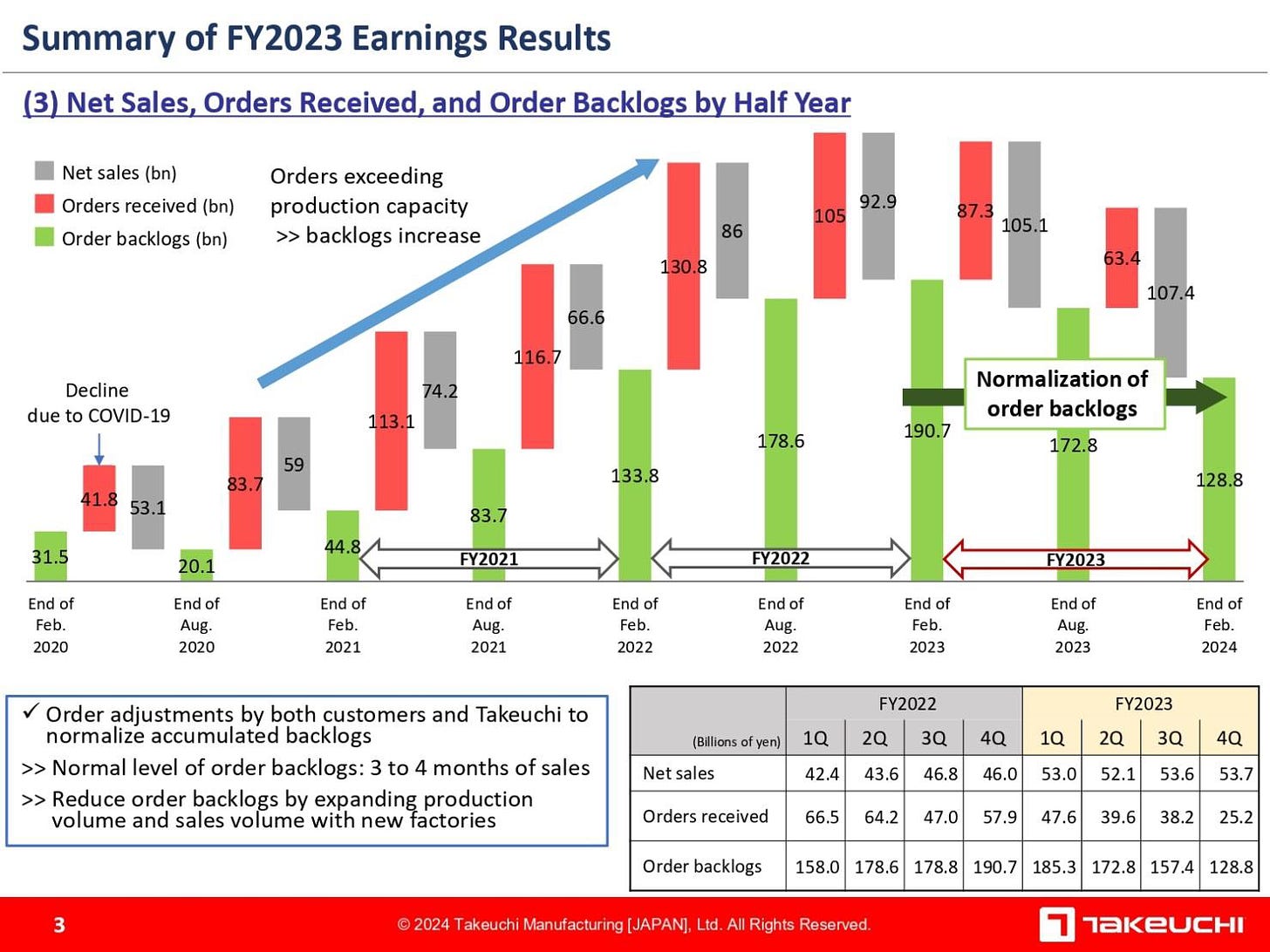

Order backlogs

In the last years, orders received exceeded production capacity, causing the order backlog to reach a level exceeding annual sales. In order to fix this situation, the Company and its customers discussed and adjusted order placement and receipt, and the order backlog has been gradually cleared, finally returning to a level where delivery can be made on the customer's desired delivery date.

In order to normalize normal order backlogs (3 to 4 months of sales), The Company has expanded its production and sales volume.

Net Sales, Order backlogs and Order Received, are KPI’s to be monitored in the future.

Outlook FY2024

17.2% increase of sales in North America.

10.2% decrease of sales in Europe.

5.3% increase in total net sales to JPY224 billion.

9.1% increase in operating profit to JPY38.5 billion.

Management team says:

“In North America, product sales will continue to be strong on the back of strong housing demand and solid demand in living infrastructure construction, and we expect unit sales of each main product to exceed the previous year's level by taking advantage of the increased production capacity created by the new plant”.

“In Europe, on the other hand, repair work on aging infrastructure is essential, and we expect sales of hydraulic excavators, which are mainly used there, to remain strong. However, we expect sales of mini excavators, which are mainly used in housing construction, to decline due to a drop in housing demand caused by soaring prices and rising interest rates”.

“As for the profit forecast, we expect that positive factors such as higher selling prices, the effect of increased sales, and the impact of foreign exchange rates will outweigh negative factors such as the continuing rise in raw material prices, investment in human capital, expenses at the Aoki plant, and a renewed rise in ocean freight costs, and we expect an increase in profit”.

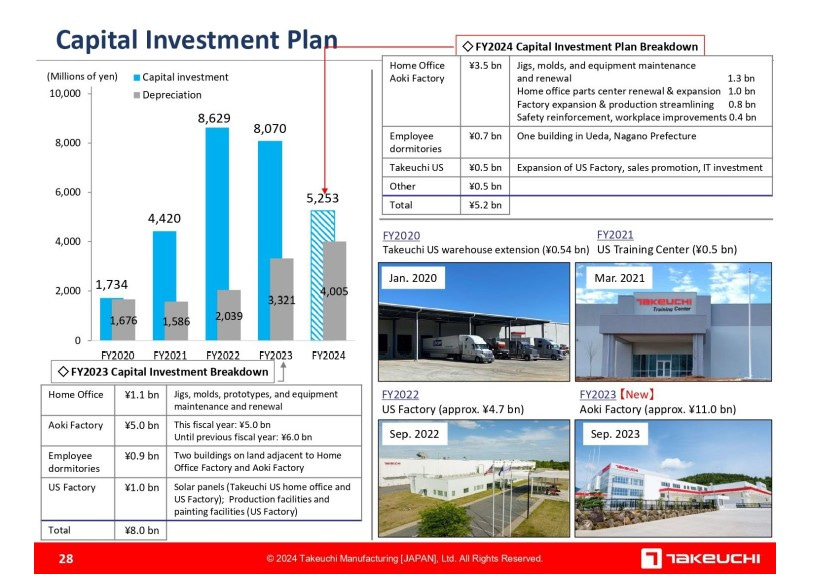

Capital allocation

New factories

Takeuchi has built two factories (North Carolina and Aoki) in order to implement SKD, increase production and improve processes. The Sakaki factory has also been expanded to increase production and dissipate existing backlog levels.

“Significantly the new Aoki factory will provide a 35% increase in productivity by the spring of 2024 expanding to 50% increase by the winter of 2024, compared with the previous productivity levels.

This increased productivity is geared to meet the growing worldwide demand for Takeuchi excavators and tracked loaders”. [Takeuchi].

As of March 1, 2023, the after-sales support department was established near to Rotterdam (Netherlands).

The port of Rotterdam is one of the busiest in the world for commercial activity, and a benchmark in logistics.

Share buybacks

The Company implement share buybacks programs as appropriate, taking in consideration stock prices, capital efficiency and others.

Dividend Policy

The Company's basic policy is to continue paying stable dividends, aiming for a consolidated dividend payout ratio of 30%, while securing the necessary internal reserves to ensure the future business development.

The company pays a year-end dividend from surplus earnings once a year.

According to The Company forecast pay out ratio for 2024 will be 34.7%.

Personally speaking, dividend policy is conservative and according to The Company performance.

Management team

Akio Takeuchi (90). Founder of the company and Chairman and Representative Director.

Mr. Takeuchi has been part of the construction equipment industry for six decades.

Toshiya Takeuchi (61). He is the founder's son and has served the company since 2005. Nowadays, Mr. Takeuchi is CEO and director.

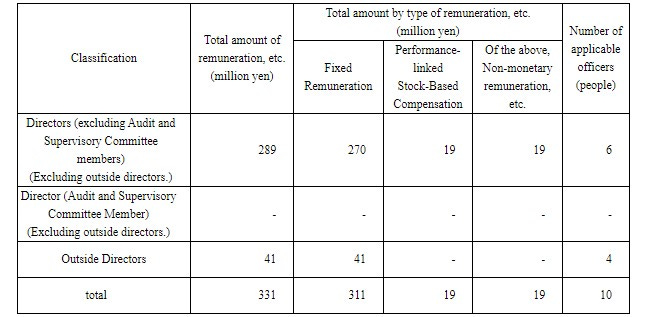

Executive Compensation

“Performance-linked stock compensation" is linked to the consolidated operating profit margin. The reason for selecting the operating profit margin as the indicator is that the consolidated operating profit margin is an indicator that shows the degree of profit achieved in relation to sales generated.

Toshiya Takeuchi remuneration is JPY106 mm ($740,000) , what represents around 0.40% of Net Income. In my opinion, the remuneration of Key person and rest of Managent Team is fair and accordly with the standards.

Fixed remuneration payments eliminates the incentives to be aggressive and take risks in order to get certain goals.

Ownership

Free float represents around 75% of share.

Takeuchi family own near to 19% of shares, what supposes a balanced control and influence position.

Free float, skin in the game from the key person, and ownership composition indicates a low probability of principal-agent conflict.

As of February 29, 2024 Takeuchi held 1,253,900 of treasury shares, not including 77,640 shares of the Company's stock held by the Executive Compensation BIP Trust.

In brief, Takeuchi is the typical familiar Management Team, with a deep background in the industry, moderate remuneration and a straight alignment of interest with investors, focusing on adding value to shareholders.

Financial Metrics

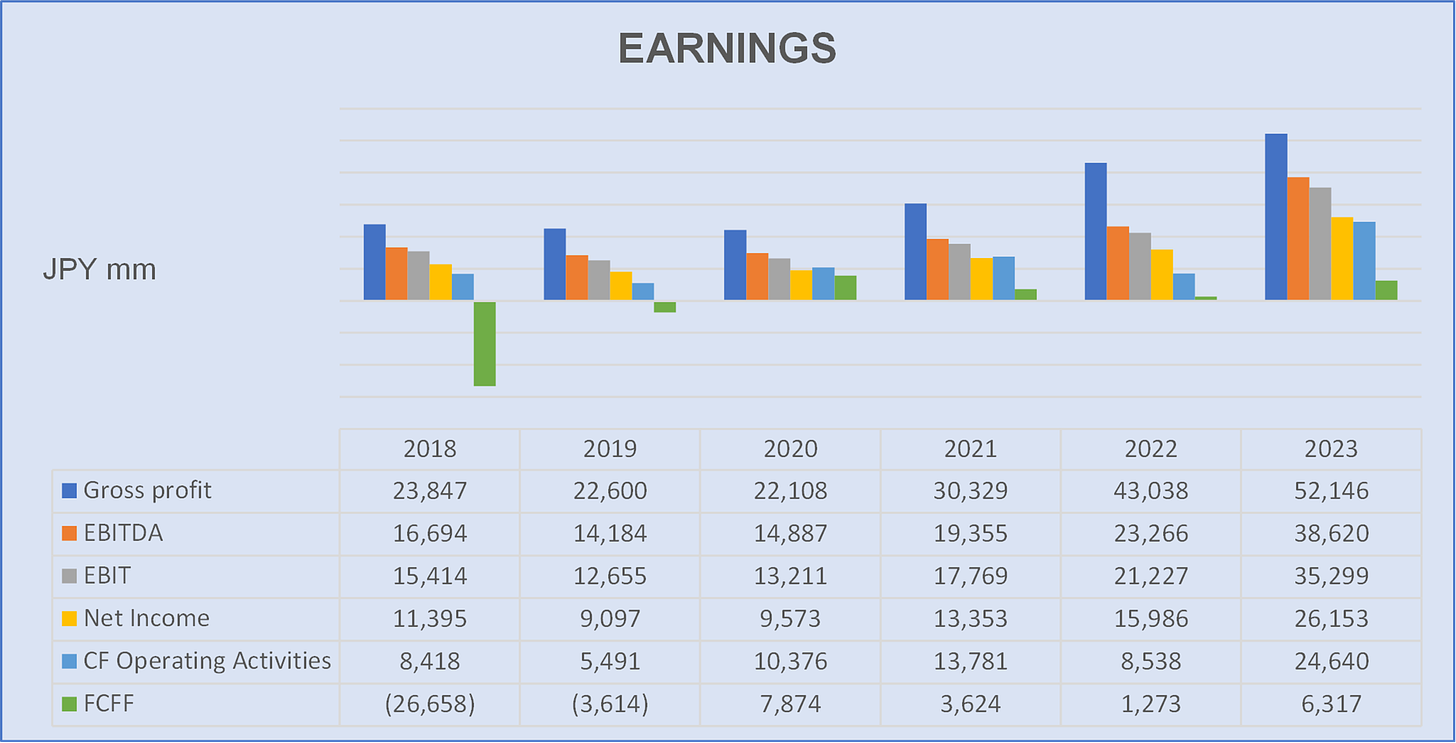

Earnings

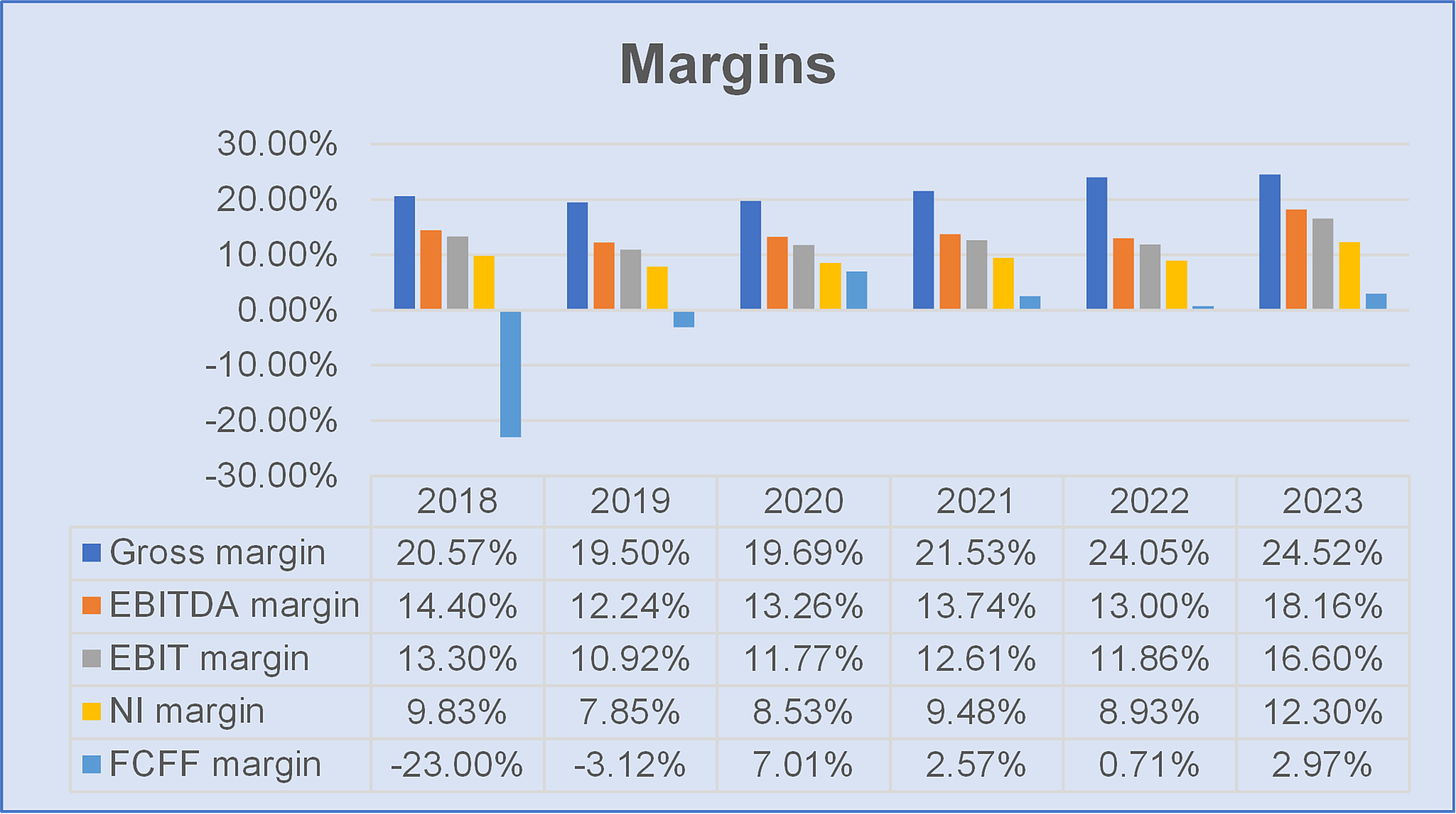

EBITDA has been calculated from an investor's perspective. The company does not report in terms of EBITDA, but rather in terms of operating profit. However, from a consideration of the EBITDA to FCF conversion rate, we can get a view of the efficiency of the company on a consistent basis, ignoring interest and D&A expenses, which could be on a more irregular basis.

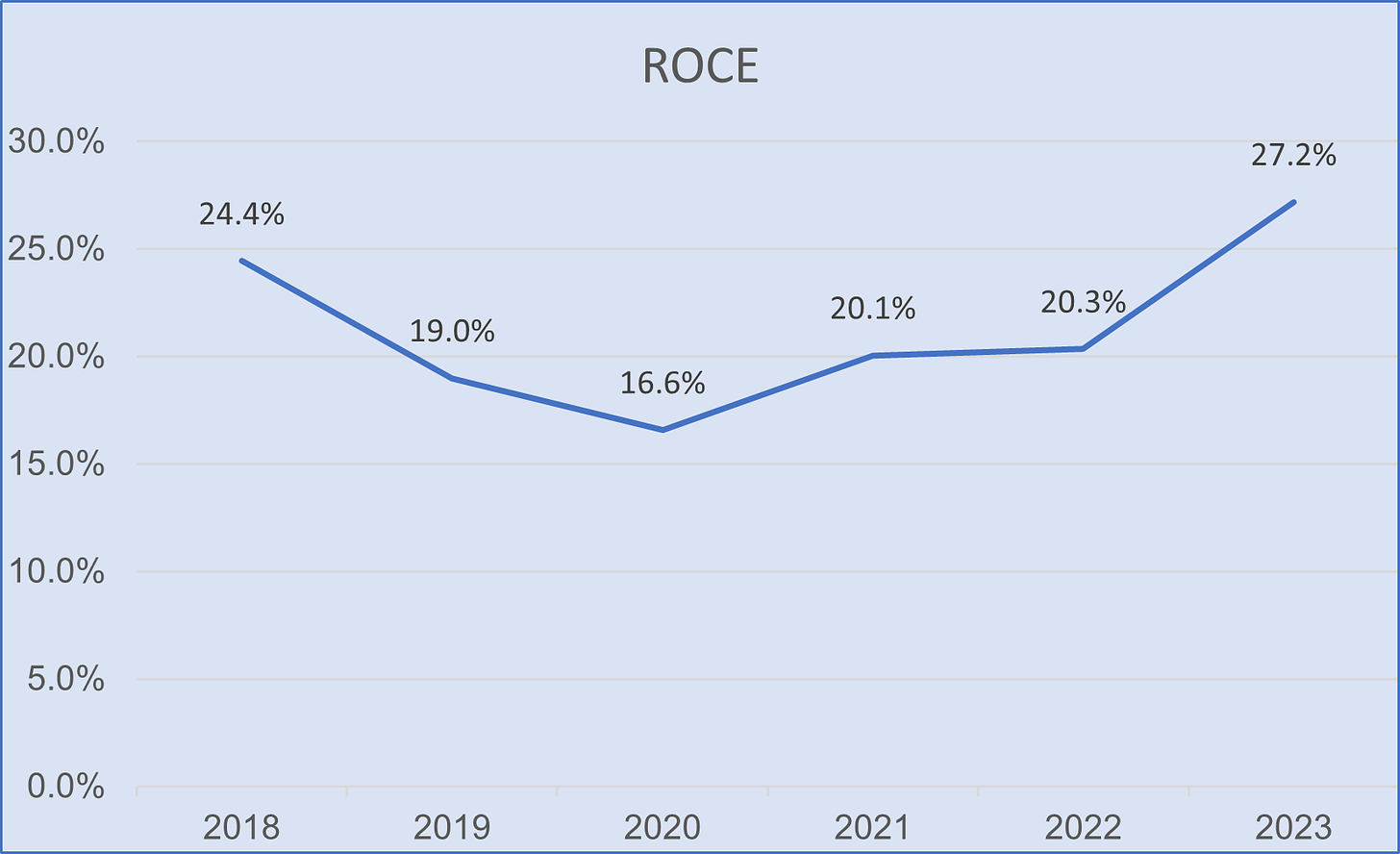

Profitability

Takeuchi Capital Intensity is around 60%. The company generates ¥1 by ¥0.60 yen invested). It is a good metric compared to the Manufacturing Industry mean.

Capital employed is calculated taking 50% of Cash and equivalents, which, in my judgment, is a conservative amount in order to operate the business.

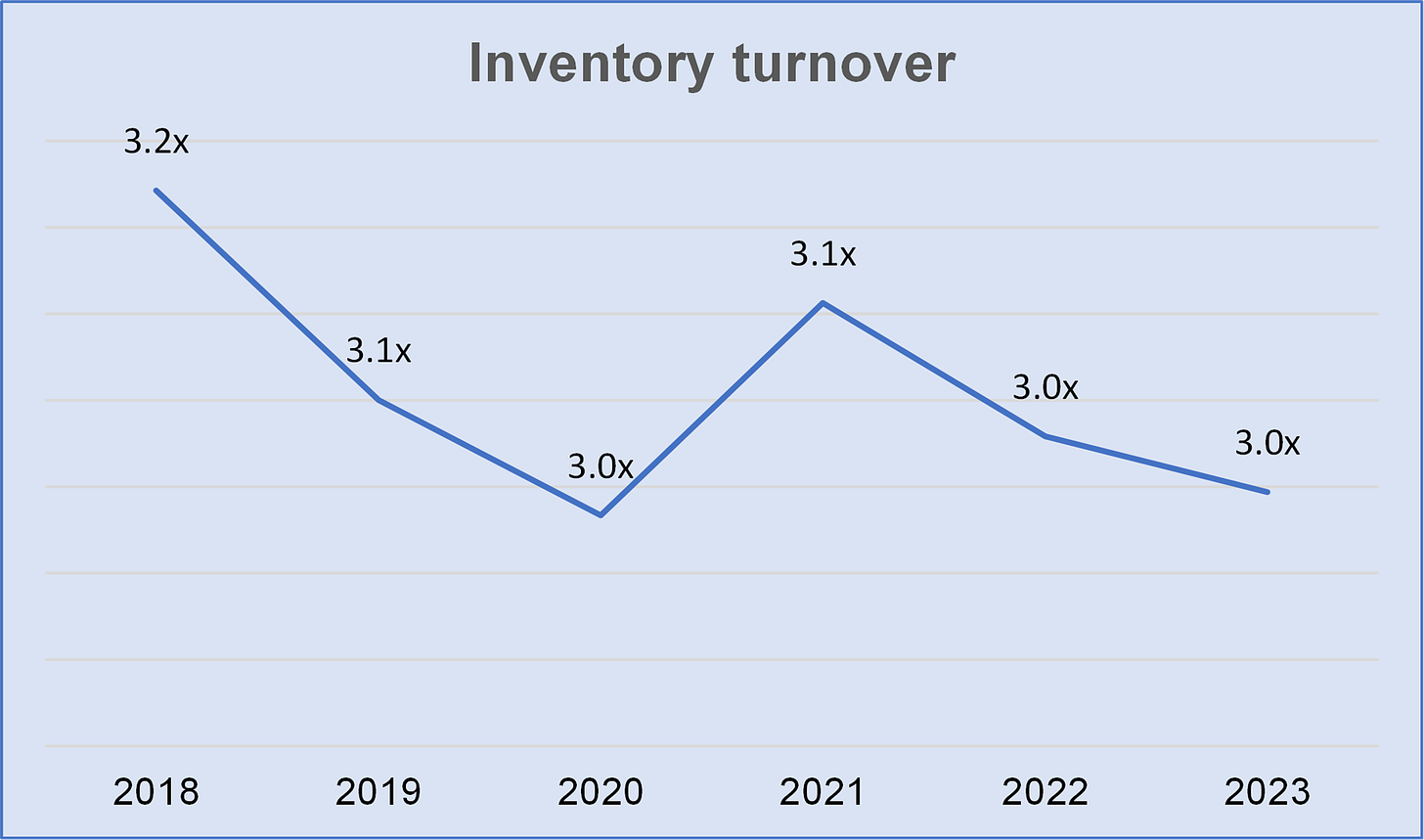

Margins and turns.

During COVID-19, Takeuchi has been able to fix the general raising of the price of raw materials and transportation costs, improving the gross margin.

An improvement in turns could come from a deterioration in margins, which in many cases would result from a price reduction strategy.

Nevertheless, the company has improved its gross margin as well as stabilized its inventory turnover. This is a good sign in terms of efficiency and profitability regarding inventory levels.

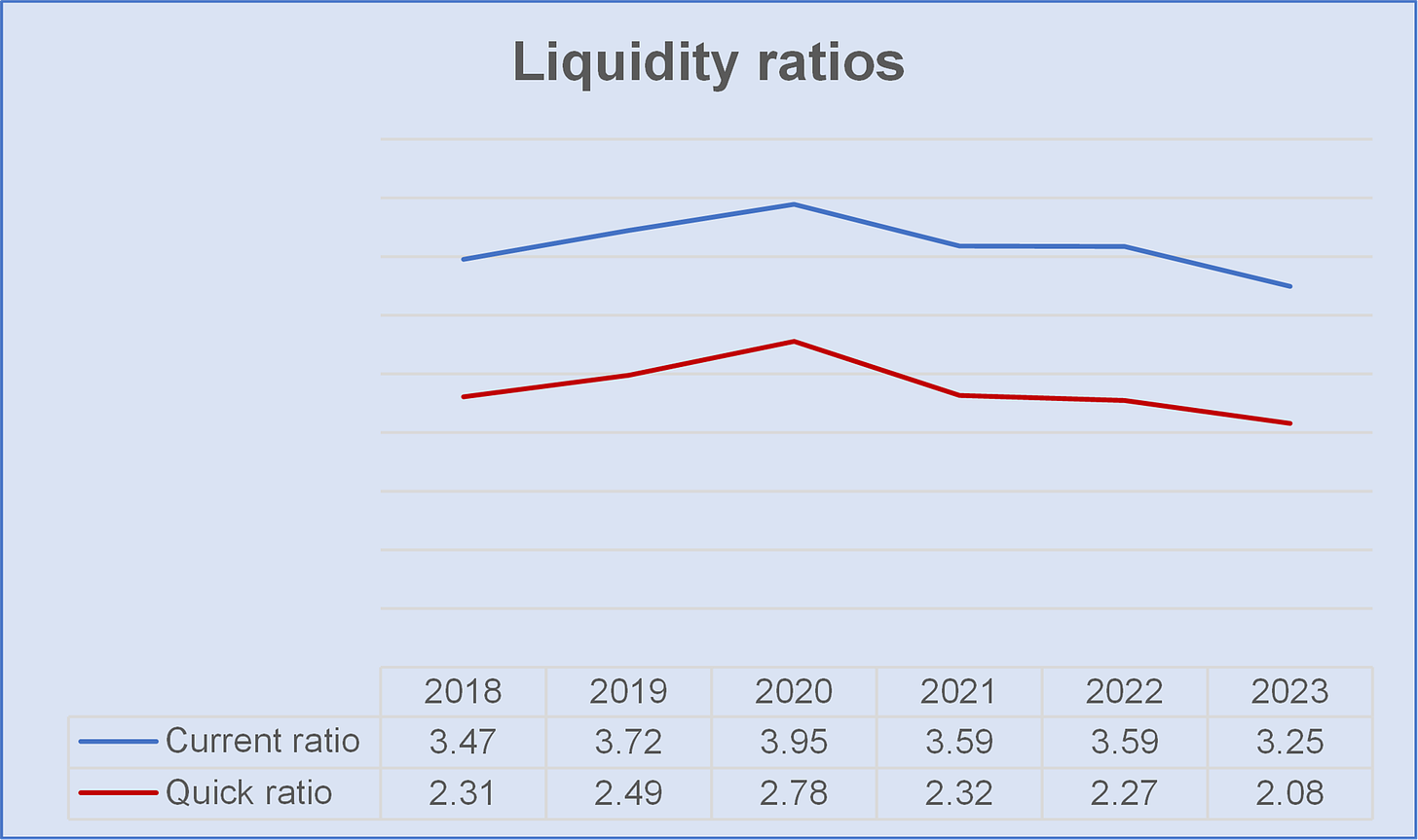

Liquidity

Generally speaking, a good quick ratio is anything above 1 or 1:1. A higher ratio indicates the company could pay off current liabilities several times over.

Solvency

The company enjoys a strong financial position, with a net cash position around JPY 55,175 mm (27% of its market cap.) and no Long-term or short-term debt on the Balance Sheet.

The Company reports JPY44 mm of lease obligation in the B.S.

Zero debt or near to zero, can grant a company financial stability and autonomy. However, zero debt may be a “Double-Edged Sword”, from a deductible interest payment perspective or in terms of the efficiency of the capital structure.

The Company has foreign currency exposure to:

USD throught its U.S. subsidiary.

EUR throught its French subsidiary.

RMB throught its Chinese subsidiary

Risks

Increase in material and transportation costs.

Economic cycle, mainly in U.S. economy.

Cooling of housing market.

USA trade policies about SKD production.

Currency exchange exposure.

Technological challenges. Especially referring to automatization and electrification.

Very competitive industry.

Strenghts

More than 50 years of background being pioneers and leader in mini excavators and track loaders.

Excellent capital allocation policy.

Dominance position in track loaders U.S. market.

Strong financial health with a level of debt very near to zero

Strong worldwide after-sales network

Familiar company. 19% of shares are on Takeuchi family hands.

Excellent execution and management team. Key persons (Founder and son), are involved directly in the business and they know perfectly the industry.

Audited by Deloitte.

Valuation

Takeuchi stock is trading at 4x EV/EBITDA for FY2023, versus 19x in the construction machinery and equipment industry.

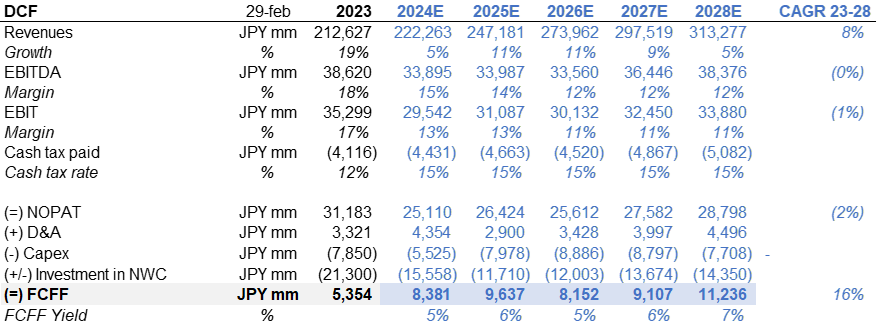

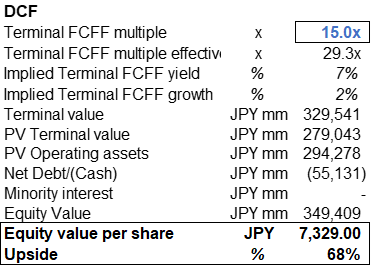

DCF

Assumptions:

Revenue growth 23-28 +8%

Gross margin 23%

EBIT margin ≃12%

Terminal multiple 15x

If you are a professional or qualified investor, and you like my work, don't hesitate to contact me.

Next report: October 24, 2024.

Really enjoyed the post, learned a lot. Thanks for the detailed work.

What is leading to the decline of EBIT margins?

Quarterly orders received have dropped; what led to this decline? Is demand dropping?

How come sales in China and Japan are so low despite having a manufacturing plant there?

Nice post. Am finding lots of potential value investments in Japan Company Handbook. Best of luck to you.