“There are only a handful of people, but they are my people”.

Dear subscribers.

In celebration of the fact that, as of today, Eloy Fernández Deep Research is a year old and more than 350 people have subscribed, I have to tell you: Thank you, thank you and thank you!. Thank you very much for a year of supporting my work.

To all readers who have not yet subscribed, I encourage you to do so.

If we compare those figures with other content creators in the finance area, we could conclude that they are quite poor. Personally, I prefer the quality. The open rate is very good, as is the level of activity from subscribers. Quality versus quantity, as in the companies that we seek.

After a full year, I did not have the opportunity to tell you who I am.

As you know, my name is Eloy Fernández Bretones, and I was born in Córdoba, Spain, forty-three years ago. I grew up in a working-class family without financial hardships but in a blue collar environment. In fact, I studied in public schools, and I graduated in civil engineering from a public university.

I learned to invest in an autodidact manner first and through Francisco Lodeiro Amado later. I’ve been investing as a retail investor since 2014.

In November 2021 I passed Level I of the CFA Program, and currently I am a Level II CFA candidate.

The CFA designation is globally recognized and attests to a charterholder’s success in a rigorous and comprehensive study program in the field of investment management and research analysis.

I currently manage the family farm.

I like reading books (mainly Greek-Roman classics and Hispanic literature), art, music (especially opera, classics, jazz, and flamenco), movies (My favorite directors are Capra, Ford, Antonioni, Fellini, Lubitsch, Hitchcock or Welles, among many more). I love sports, in particular golf, which represents one of my passions.

Everybody tells me that I am an excellent cook, but my favorite activity is spending a lot of time with my family near the Cádiz Coast or walking through the narrow and beautiful streets of my beloved cities. We have a dog named Cleo (referring to Cleopatra, the Egyptian Queen).

Those are my principles, and if you don’t like them…well, I DO NOT have others.”

The use of informative material about finance in the form of publications is very common among creators. However, being very respectful, much of this content can, because it is basic and redundant, become non-material. I do not rule out writing about very specific accounting or valuation topics in the future. But my space is not divulgation in nature, and much less on very general and basic topics, about which much has already been written and which can be easily accessible.

I never had the intention to gain engagement through aggressive marketing and content. My proposal is simple: write about businesses and companies that I think are interesting, without annoying the subscriber excessively with useless and redundant content. As stated in each publication, the write-ups are not investment recommendations, nor are they necessarily companies in which I am invested. I never report data about the composition of my portfolio or my track record as an investor. For some, that may be a yellow flag, but I honestly think that those are aspects that contribute little or nothing to the substance of the issue, which is the financial analysis. In addition, my investment philosophy does not see profitability in absolute terms but in relative terms. There is no target return or an ideal portfolio, but there are as many as there are investors.

That is my proposal, with 300, 20000 or no subscribers.

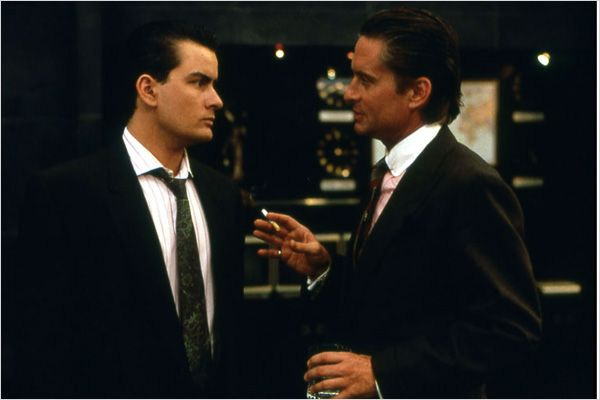

“It's all about bucks, kid. The rest is conversation”. Gordon Gekko. Wall Street (1987).

My investing philosophy is simple: “We invest for an only one purpose: to make money”.

I am not a value investor. And why not?

Philosophy is for philosophers, and thinking so much about something is a focus thief.

I was educated in the Catholic faith. I do not need another religion.

As Aswath Damodaran said, “Avoid the three R´s: Rigid, Righteous and Ritualistic.

In addition, if we see the financial industry as global, Value Investing represents a small portion of it.

However, although I am not a value investor, I don’t refuse useful and valid principles from value investors.

My goal is to make money through quality investments, but I am open to deep value companies, the use of leverage and derivatives and other types of financial assets and alternative investments.

I am an eclectic investor who supports a skeptical position about sectors, industries, sizes, etc.

I do not have any favorite CEO, fund manager, investor, or businessman, although I try to learn from each of them.

I will be back….stronger.

As you may have seen, my last write-up dates back to September (Build-A-Bear Workshop, Inc.).

I am currently facing a special situation on a personal and work level that has prevented me from publishing. I promise to return in December with even more strength. From then on, we will intensify the work and introduce new features that I think you will like. I reiterate my gratitude for your support, and I encourage you to be active through the chat and comments.

Sincerely Yours: Eloy Fernández.

Good luck 🫡

Hello mendo.

Although non-material, it is non-public information, so I comply with the mosaic theory (Lol). I needed a break. I will soon write analysis and interesting news.

Thank you for feedback.