Other writeups:

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

As of the date of this report, I own shares of Topgolf Callaway Brands Corp.

Report date: September 12, 2024.

About Topgolf

Topgolf Callaway Brands is a leading golf company that provides golf entertainment experiences, designs and manufactures golf equipment, and sells golf and active lifestyle apparel and other accessories through its family of brand names.

To review the full Thesis, please visit: Topgolf Callaway Brands

On March 8, 2021, Callaway completed the merger with Topgolf, to expand the business which now includes Topgolf venues in addition to retail, e-commerce and digital communities.

Callaway acquired 100% of the outstanding equity of Topgolf. The purchase consideration, together with the fair value of the consideration transferred for outstanding stock awards and warrants totaled $3,048.9 million.

Under the terms of the merger agreement, Callaway issued approximately 90 million shares of its common stock to the shareholders of Topgolf, excluding Callaway, which previously held approximately 14% of Topgolf’s outstanding shares. Immediately following the merger, Callaway shareholders owned approximately 51.3% and former Topgolf shareholders (excluding Callaway) owned approximately 48.7% of the outstanding shares of the combined company.

On September 4, 2024 Topgolf Callaway Brands announced the intent to separate into two independent companies.

Rationale of spin-off

Capital allocation optimization.

Strategic focus.

Simplified operating structure.

Distinct investment thesis.

Maximizing shareholder value and driving the full potential of each business.

CEO says:

“As we look towards the planned separation, we are committed to positioning Topgolf to deliver against its white space opportunity as a stand-alone business, while at the same time delivering positive free cash flow and maintaining a strong financial position. To this end, Topgolf will be well capitalized at the time of separation with a cash balance of approximately $200 million and no financial debt. Looking ahead to 2025 to appropriately balance growth and free cash flow during this transition year, we intend to reduce Topgolf's new venue growth plans for 2025”.

Transaction Structure

The Company intends to spin at least 80.1% of Topgolf to obtain the desired tax-free treatment Spin-off for U.S. federal income tax purposes.

Existing shareholders would receive a pro-rata allocation of shares in the new Topgolf company.

Based on the Management Team's comments on the Special Call, another path that is more attractive to shareholders could be explored. In my opinion, this comment adds further uncertainty.

Timing

Management team expect that new shares to be listed in The NYSE. Transaction could be completed on first half of 2025.

CFO says:

“This type of transaction can generally be completed in approximately 9 to 12 months from the time of announcement”.

“Based on what we know today, we would expect to complete our transaction in the second half of 2022. For internal purposes, we are targeting July 1, 2025”.

Closing conditions

The Company intends to spin at least 80.1% of Topgolf to obtain the desired tax-free treatment of the spin-off for U.S. federal income tax purposes.

Existing shareholders would receive a pro-rata allocation of shares in the new Topgolf company.

Management.

Oliver Brewer, CEO of Topgolf Callaway, will lead Callaway. Artie Starrs, CEO of Topgolf, will be in charge of Topgolf.

Strategy and Financial Position Post-Transaction

Topgolf action plan

Currently, Topgolf business, excluding Toptracer (USD 46 mm), revenue represents around 42% of total. SVS (Same Venues Sales), have decelerated in the last financial year from 7.4% to 0.7%. However, Topgolf business has grown by 42% due to new venues.

Topgolf’s strategy is designed to re-accelerate performance in existing venues:

Same Venue Sales Growth: enhance Topgolf´s Digital Bay Inventory Management System (PIE), continue to marketing strategy and adding new partnerships.

PIE provides to Topgolf the ability to charge different reservation fees based on time of day, and provides more predictability for operators and how to staff. In 2023 only 36 venues are equipped with PIE.

Margin Expansion: scale efficiencies, drive further efficiencies through mobile order and pay, COGS improvement.

Development Pipeline.

CEO says:

“At the same time, we are taking clear action to further strengthen the ability of the business to drive positive same-venue sales as conditions normalize. We believe the longer-term trends for golf and experiential entertainment, such as Topgolf, remain positive. Furthermore, Historical data shows that even prior to the improved capabilities we are now putting in place, for instance, from 2015 through 2019 the business was able to deliver positive same-venue sales performance”.

“With these expected improvements in venue returns, coupled with the ongoing capture of our significant white space opportunity, we believe Topgolf is well positioned to drive durable top and bottom line growth. And I should note that while these are the pillars of our immediate action plan today, I look forward to the Topgolf team providing greater detail on the company's ambitions as we get closer to the separation”.

Toptracer

Toptracer is patented technology developed by Topgolf that allows you to track your golf ball and accurately score each shot based on the target it enters. Topgolf venues are also adding Toptracer technology, allowing you to see a real-time trace of the ball's flight path as well as insights into speed, distance, angle, and accuracy. Toptracer is used by PGA and LPGA tour, DP Tour, Ryder Cup, Solheim Cup and most relevant golf competitions.

Currently, Toptracer represents around 1% of total revenues.

After the separation Toptracer will be part of Callaway.

Rationale: overlapping between Callaway customer base and Toptracer customer base.

Synergies

Callaway will support development and sourcing of Topgolf golf equipment.

Digital integration and shared use of consumer data.

Golf equipment will be displayed at venues and co-promoted.

Financial position

75% of construction costs (PP&E) are financed by Deemed Landlord Financing Liability and 25% cash outlay.

After the transaction, Topgolf will retain its venue financing obligations, without financial debt. The management team estimates that Topgolf cash balance would be around $200 mm. We have to remember that DLF (Deemed Landlord Financing) is around $980 mm.

On the other hand, Callaway will retain the financial debt of the company. Management team will intend to reduce the net debt to EBITDA to be at 3x within 12 months of separation. We keep in mind that Callaway reports around $258 mm in Convertible notes with a maturity date on May 1, 2026. Management team excludes convertible notes from debt assumptions due to the accounting diluted shares outstanding (201 mm vs. 185 mm basic shares).

Outlook

Topgolf Revenues FY2024 $1.8 B. Adjusted EBITDA $310 mm.

Non-Topgolf Revenues FY 2024 $2.4B. Adjusted EBITDA $260 mm.

Capital allocation for 2024 does not change, but venue openings will be reduced to mid-singles-digit in order to ensure the positive FCF in the transaction closing.

Adjusting of the venue growth depending on market circumstances.

In my opinion, reducing venues growth is a good decision to decelerate financing obligations growth and return to previous SVS level.

What should we expect now?

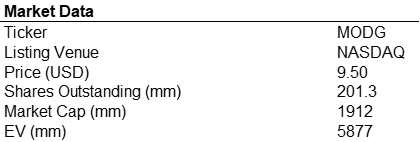

Since the write-up was published, Topgolf stocks have dropped to reach around $9.50 which represents a negative return close to 52%.

Factors that have an influence on the current stock price:

Deceleration in SVS (Same Venues Sales).

Synergies between Callaway and Topgolf have not been materialized.

Slower consumer espend.

Market considers Topgolf debt level as a risky factor.

Uncertainty after intent of separation announcement.

In my opinion, uncertainty and risk level have increased after the announcement. In any way “RISK” means “Fact” or “Event”, but “Probability of”.

Clubs and balls is a strong business with a wide barrier of entry, but the potential growth is limited. The intention of reducing financial leverage could be a catalyst.

“The Golf Equipment Market size is estimated at USD 11,104.36 million in 2023, and is expected to reach USD 13,647.10 million by 2028, growing at a CAGR of 4.21% during the forecast period (2023-2028)”. [https://www.mordorintelligence.com]

Topgolf is in an expansion stage that requires high quantity of capital investment and debt issue. However, potential growth is very high.

I downgrade the stock to “Hold”. Intrinsic value: $20 per share, which represents around 110% upside.

In any way, It does not represent a buy or sell recommendation, but an opinion based in current business and market conditions and trends.

If you are a professional or qualified investor, and you like my work, don't hesitate to contact me.