Other Recent writeups:

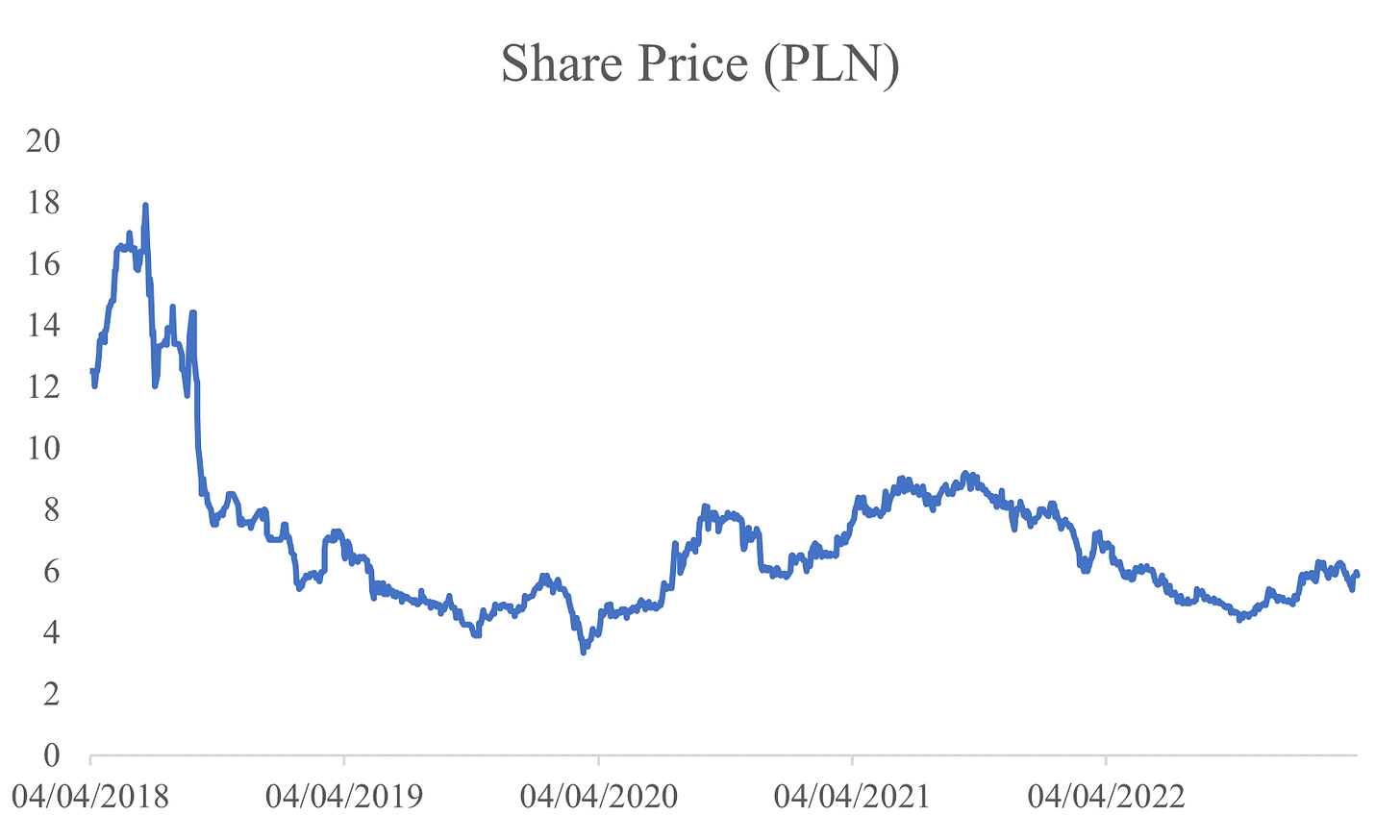

Analysis Date: March 30, 2023.

Key Points

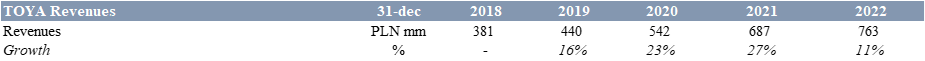

19% CAGR 2017-2021 of revenues.

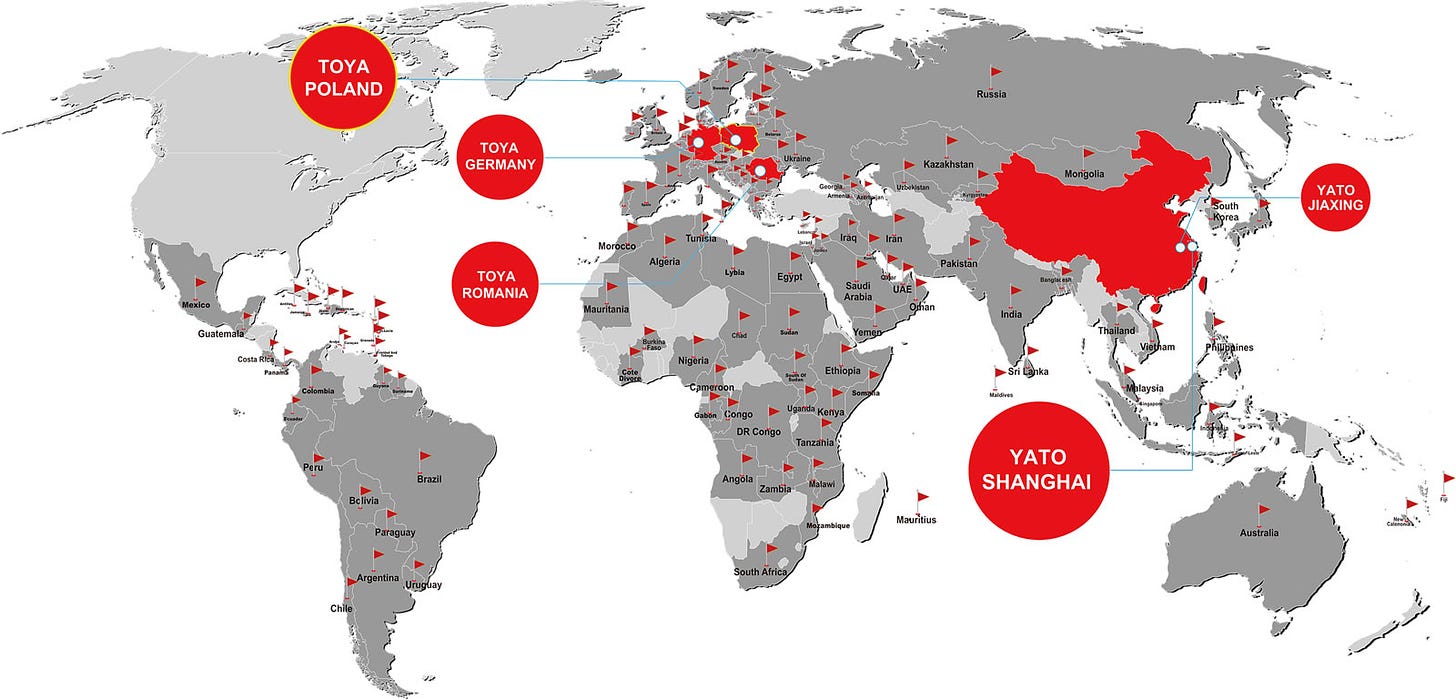

Strong position in global markets.

Good execution and alignment of interest from Management Team and Board.

Average business but shares extremely undervalued.

Positive economic trends in Poland (50% of sales).

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

Introduction

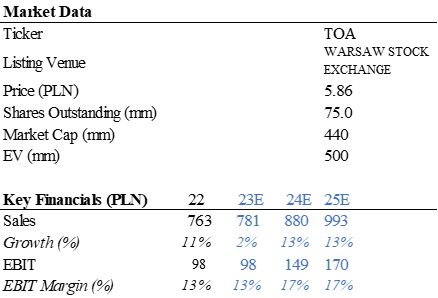

TOYA, S.A. is a Polish-Based company whose core business activities include production of hand tools, power tools, professional gastronomy equipment and equipment useful in every home.

Short Historical review

1990 TOYA IMPORT-EXPORT S.C is founded in Wroclaw, Poland.

2001 Establishment of TOYA S.A.

2003 Brand diversification and beginning of the dynamic development of YATO, STHOR, VOREL, POWER UP, FALA, FLO brands.

2003 Establishment of TOYA Romania in Bucharest.

2008 Establishing YATO China in Shanghai.

2011 Debut of TOYA S.A. on the Warsaw Stock Exchange.

2014 Acquisition of 100% of shares in the Chinese company YATO Tools (Shanghai) Co., Ltd.

2016 Debut in the professional gastronomy equipment industry and opening a second online store in Poland – yatogastro.com

2019 Establishing YATO Tools (Jiaxing) Co., Ltd. - a subsidiary in China.

Business model

The core business activities of TOYA S.A. include import and distribution of industrial goods, mainly hand and power tools:

Professionals.

DIY use.

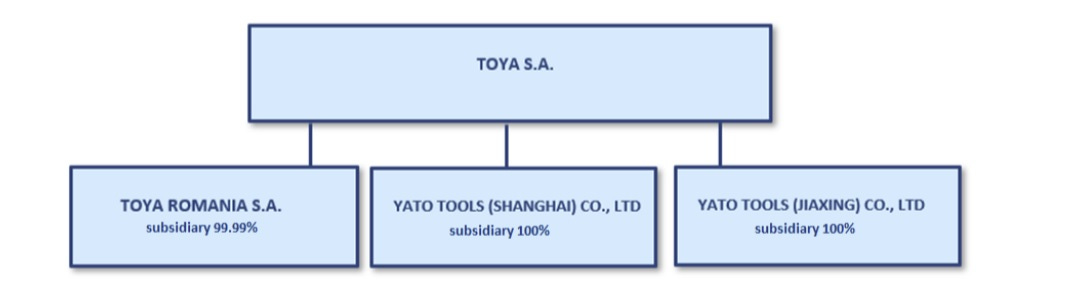

The Company operates through following entities:

Product and services

YATO

YATO is the professional tools European brand with a better average Price Quality. The warehouse based in Shanghai, cover more than 4000 items.

It includes a range of professional hand and pneumatic tools. YATO´s products comprise general purpose and specialist tools:

Construction and gardening tools.

Spanners

Screwdrivers

Pliers and pipe wrenches

Electrician tools

Hammers

Hydraulic tools

Pneumatic tools

Special automotive tools and equipment.

YATO offers products for gastronomy since 2017.

YATO enjoys good reputation in the market, in terms of quality and offered prices.

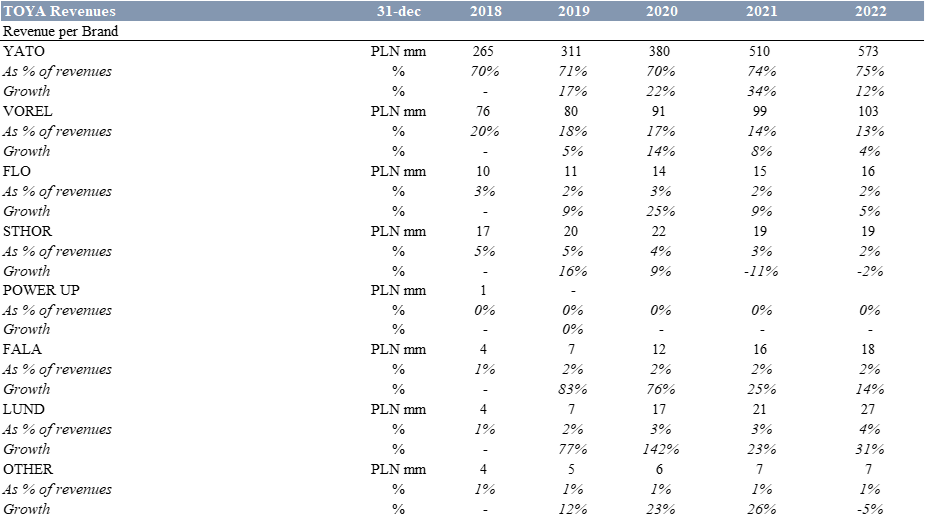

YATO branded represents around 75% of revenue in 2022.

VOREL

VOREL is focused on hand workshop and construction tools for DIY use.

VOREL sales represents around 13% of revenue in 2022.

FLO

FLO is a brand which includes a wide range of tools required for gardening works, such as garden hand tools, electric garden tools, gasoline garden tools, gasoline and electric garden accessories as well as other garden accessories.

FLO sales represents around 2% of revenue in 2022.

FALA

Under FALA brand, the Group also sells bathroom fittings. The product range covers:

Faucets.

Bathroom and shower sets.

Shower hoses.

Pop-up wasters.

Shower heads.

Shower rails.

Bathroom scales.

FALA sales represents around 2% of revenue in 2022.

STHOR

Under the brand STHOR, the Group sells modern common use power tools. The brand’s product range is addressed to

DIY enthusiasts and households which do not use tools professionally. The tools offered include: impact drills, cordless

tools, rotary hammers, grinders, jigsaws, circular saws, planers, soldering guns and decoration tools.

STHOR sales represents around 3% of revenue in 2022.

LUND

LUND is dedicated to DIY uses.

LUND sales represents around 4% of revenue in 2022.

Main cost factors that have an influence may be:

Raw materials prices.

Manufacturing costs.

Shipping and freight.

Labor.

Mistakes or scraps.

Customers

The Group specifies four operating and reporting segments for its activities:

Sales on local markets (Poland, Romania and China ) to retail networks.

Sales on local markets (Poland, Romania and China) in wholesale market (Authorized distributors, wholesalers and stores).

Retail sales (Mainly online sales).

Export sales.

Toya S.A. is a B2B business but they provides products what will be sold later to professionals and DIY users. The company is able to serve a high range of products for different users at best price.

Suppliers

TOYA outsources manufacturing processes to third-parties.

Network of suppliers is highly diversified. For many years TOYA S.A. has cooperated with around 100 foreign and 70 domestic suppliers. That range ensures high independence and strength negotiating position.

YATO Tools (Shanghai) and YATO Tools (Jiaxing) enforces the position through Asian manufacturers.

The Parent signs short-term agreements , which ensures flexibility in negotiations.

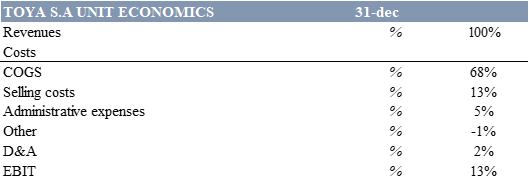

Unit economics

OPEX includes:

Material and energy consumption.

Costs of transportation.

Third-party services.

Taxes and fees.

Cost of employee benefits.

Other costs.

D&A expense is reported by the company as OPEX (Selling costs and Administrative expenses).

Competitive advantages

Advantageous location

TOYA S.A. is located in Wroclaw, the third largest city in Poland, with a total of 1.3 million residing in the metropolitan area. The company distributes product to customers in Baltic regions, mid Europe, Russia, Ukraine, Balkans and France. Location in the center of Poland provides to TOYA a privilege situation , domaining those markets through an efficient logistic.

Yato Tools seated in Shanghai, due to its strategic location creates many opportunities for the further dynamic development of the entire Group. Yato Tools is the main center of export and logistics across the Group. According to the Management Board such a solution will significantly facilitate access to international markets and help to increase export.

Growth

Industry analysis

TOYA operates in Mechanical Hand Tools industry. Market size is around USD 21B.

Main market driving forces:

Construction Industry.

Furniture Market.

Real Estate market.

The leading players in the industry are:

Robert Bosch Tool Corporation (US)

Stanley Black & Decker Inc (US)

Snap-on (US)

Metabowerke GmbH (Germany)

Hilti Corporation (Liechtenstein)

Techtronic Industries Co. Ltd. (TTI - Hong Kong)

Makita Corporation (US)

Wurth Group (Germany)

Klein Tools (US)

Rawlplug S.A. (Pol)

TOYA leads the polish market with around 4000 customers B2B.

“Mechanical Hand Tools Market Size was valued at USD 15,489.5 million in 2021. The mechanical hand tool industry is projected to grow from USD 16,127.67 million in 2022 to USD 21,394.92 million by 2030, exhibiting a compound annual growth rate (CAGR) of 4.12% during the forecast period (2022 - 2030). The growth in the construction industry and increased use of capital goods in households are the key market drivers enhancing the market growth of mechanical hand tool market”. [1]

Management team

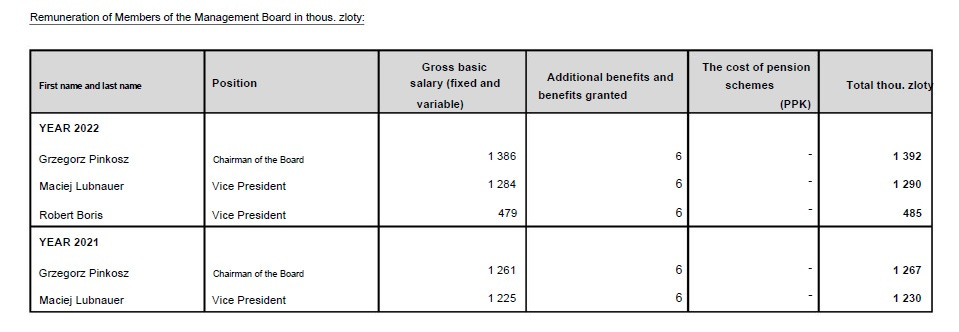

Grzegorz Pinkosz - President of the Management

In the company since 1999. In 2004 he was appointed Vice President of the Board of Directors. He is Chairman of the Board of Directors of TOYA S.A. since 2009.

Currently, he is also Chairman of the Board of Directors of TOYA Romania S.A. and Vice Chairman of the Board of Directors of YATO Tools (Shanghai) Co., Ltd. (China).

Grzegorz Pinkosz owns 146,812 of ordinary shares (0.20%).

Maciej Lubnauer - Vice-President of the Management. 61,831 ordinary shares.

Robert Borys - Vice-President of the Management Board. 8,528 ordinary shares.

Jan Schmidt is the Vice-Chairman of the Supervisory Board and the controlling shareholder with around 37.69% of shares.

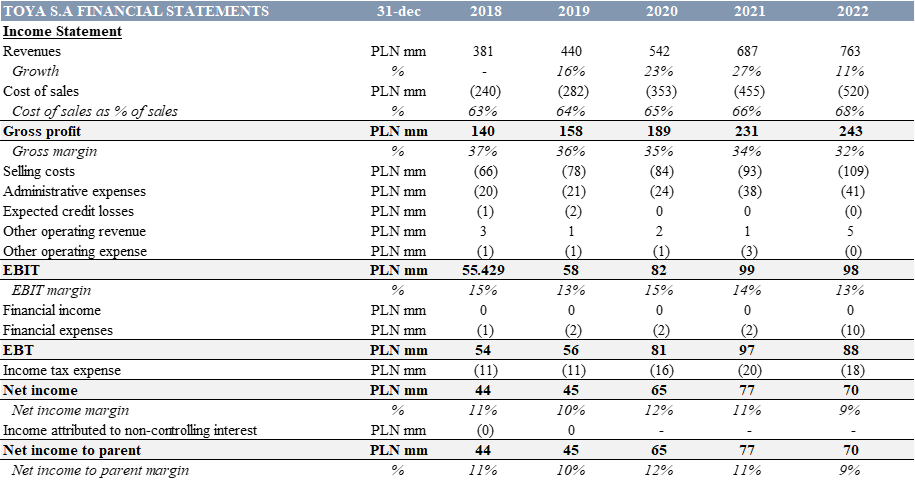

Financial metrics

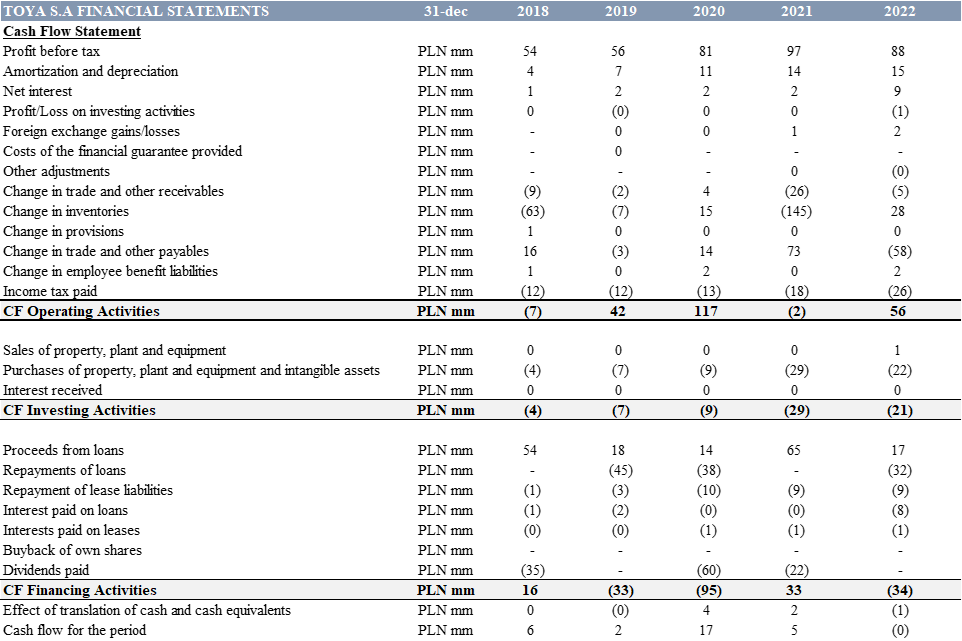

Financial Statements as reported

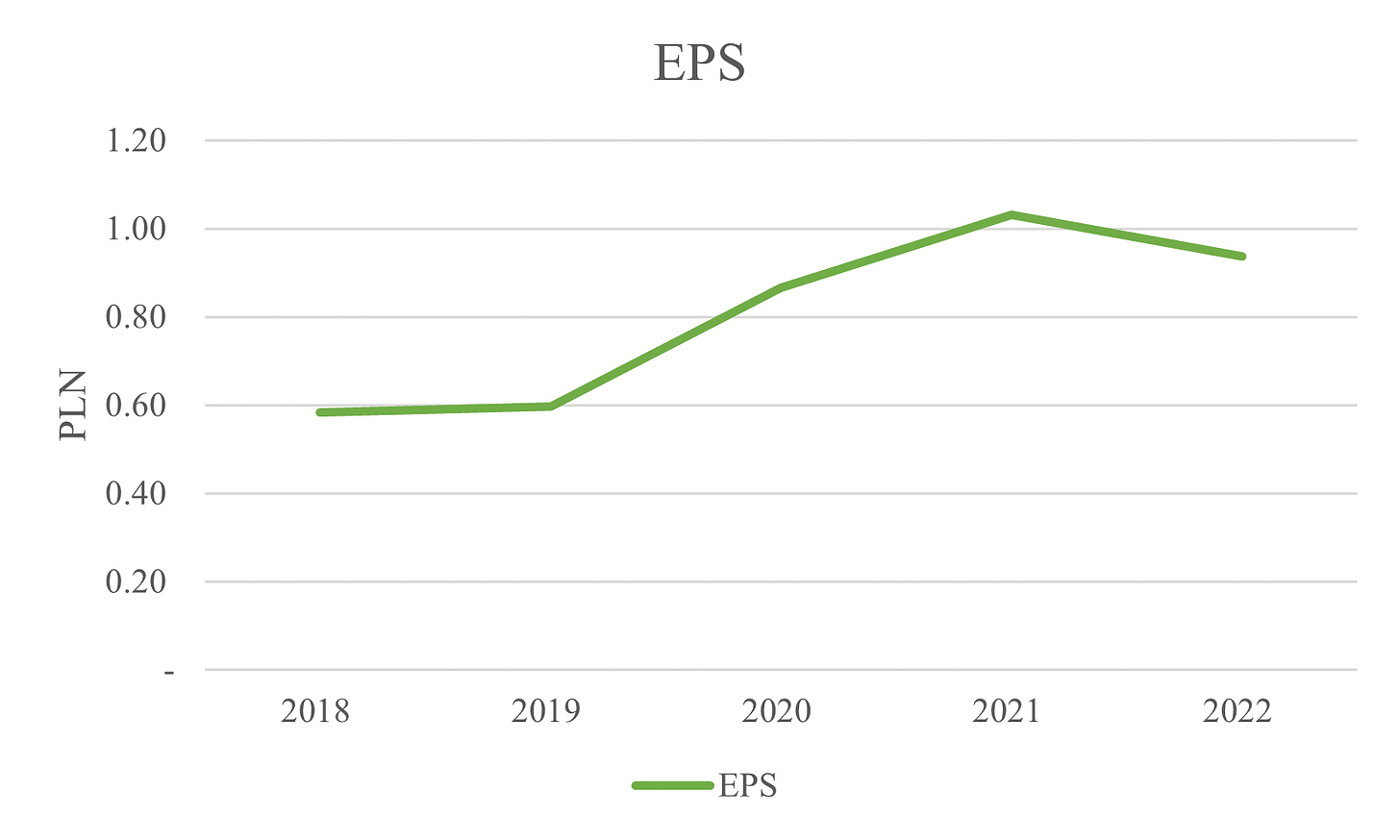

Earnings

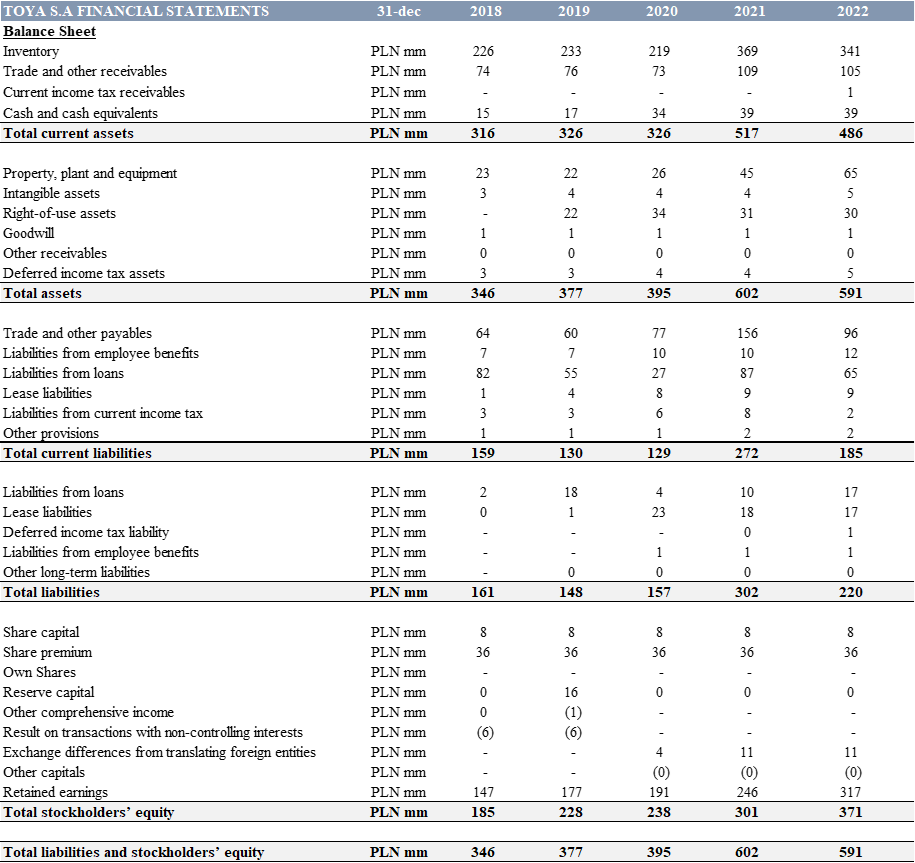

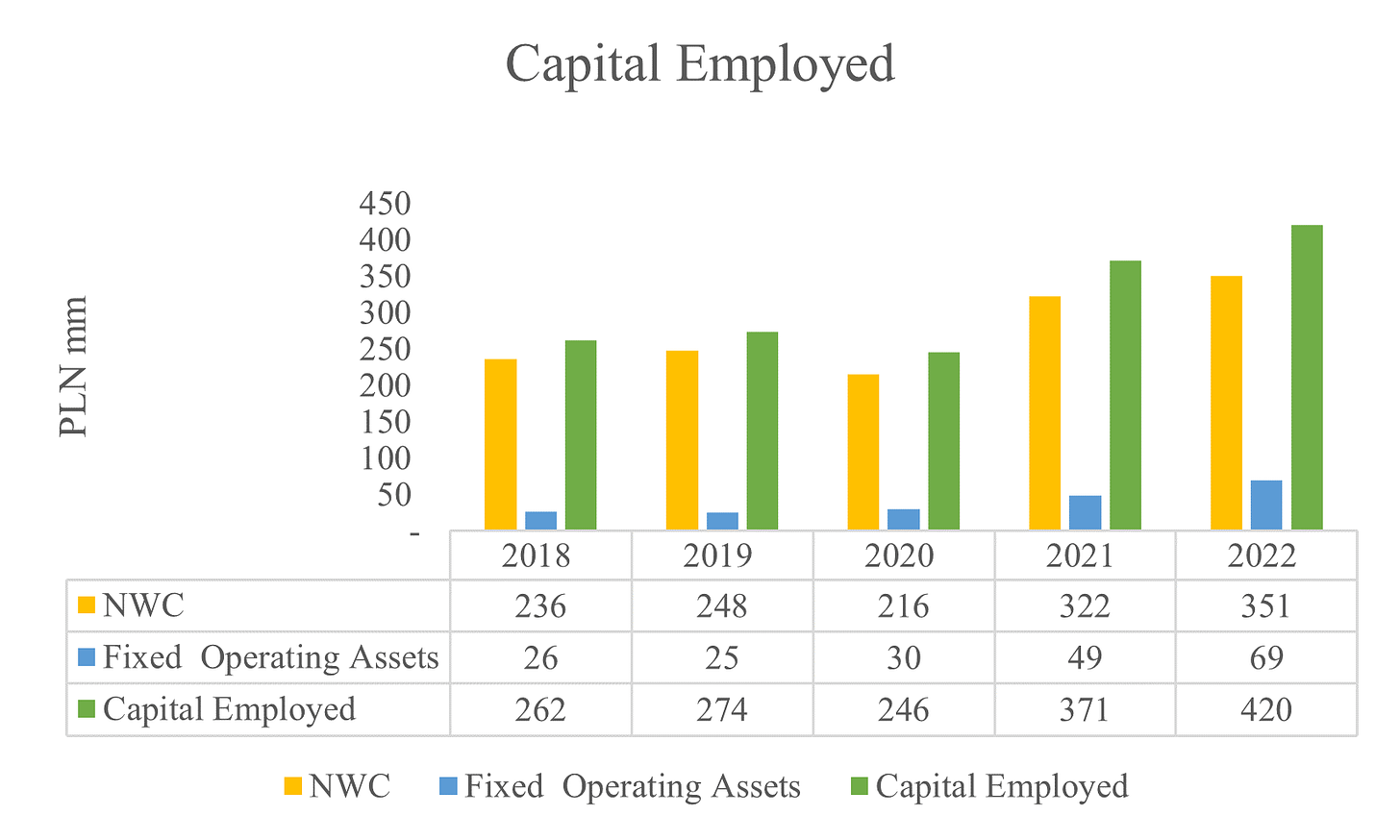

Capital structure analysis

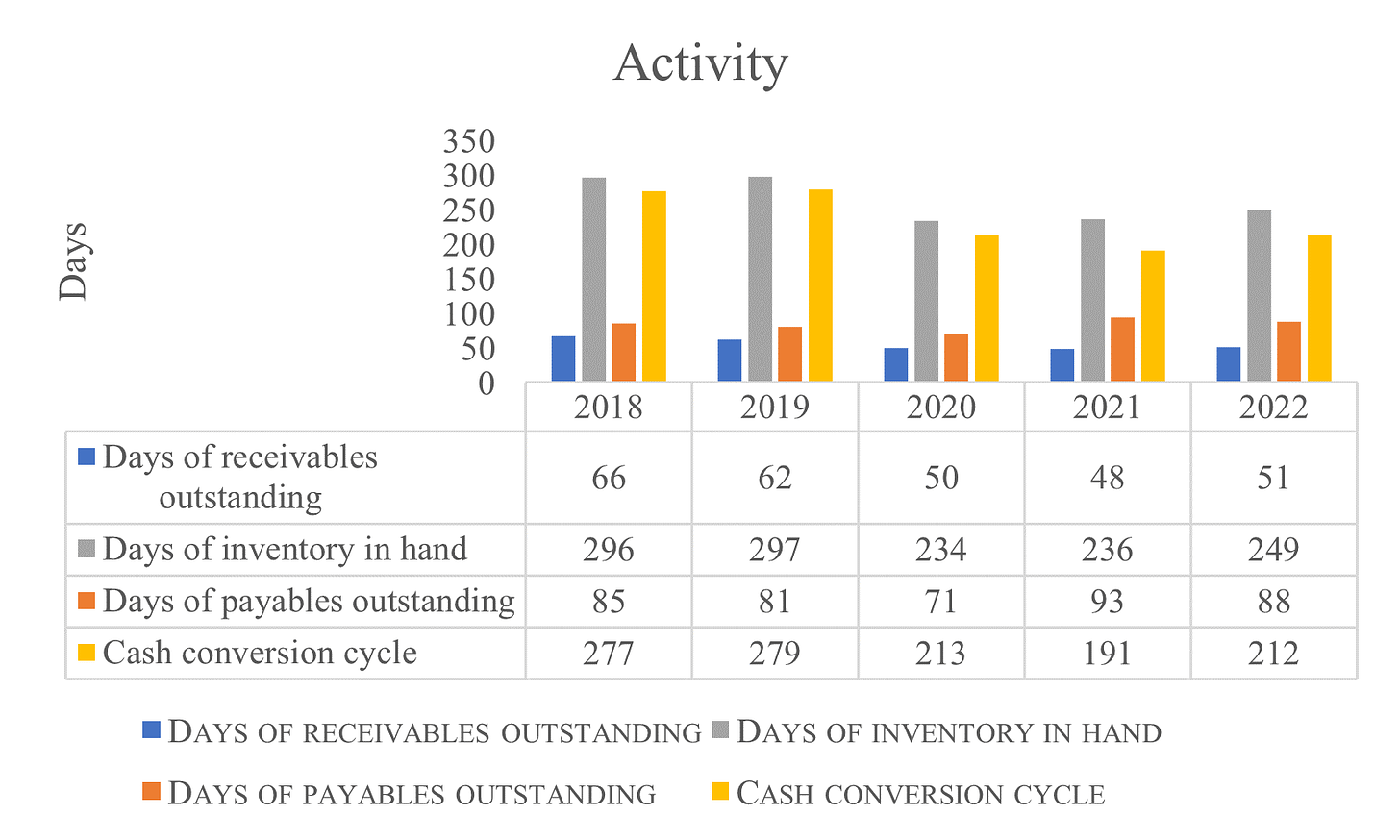

TOYA is not a Asset-Light model business, It is Fixed Asset-Light model business. Business requires a high quantity of WC (Inventory mainly) to operate. In my opinion, management of inventory is a key point in TOYA operations.

Capital employed is around 50% of revenues for FY 2022.

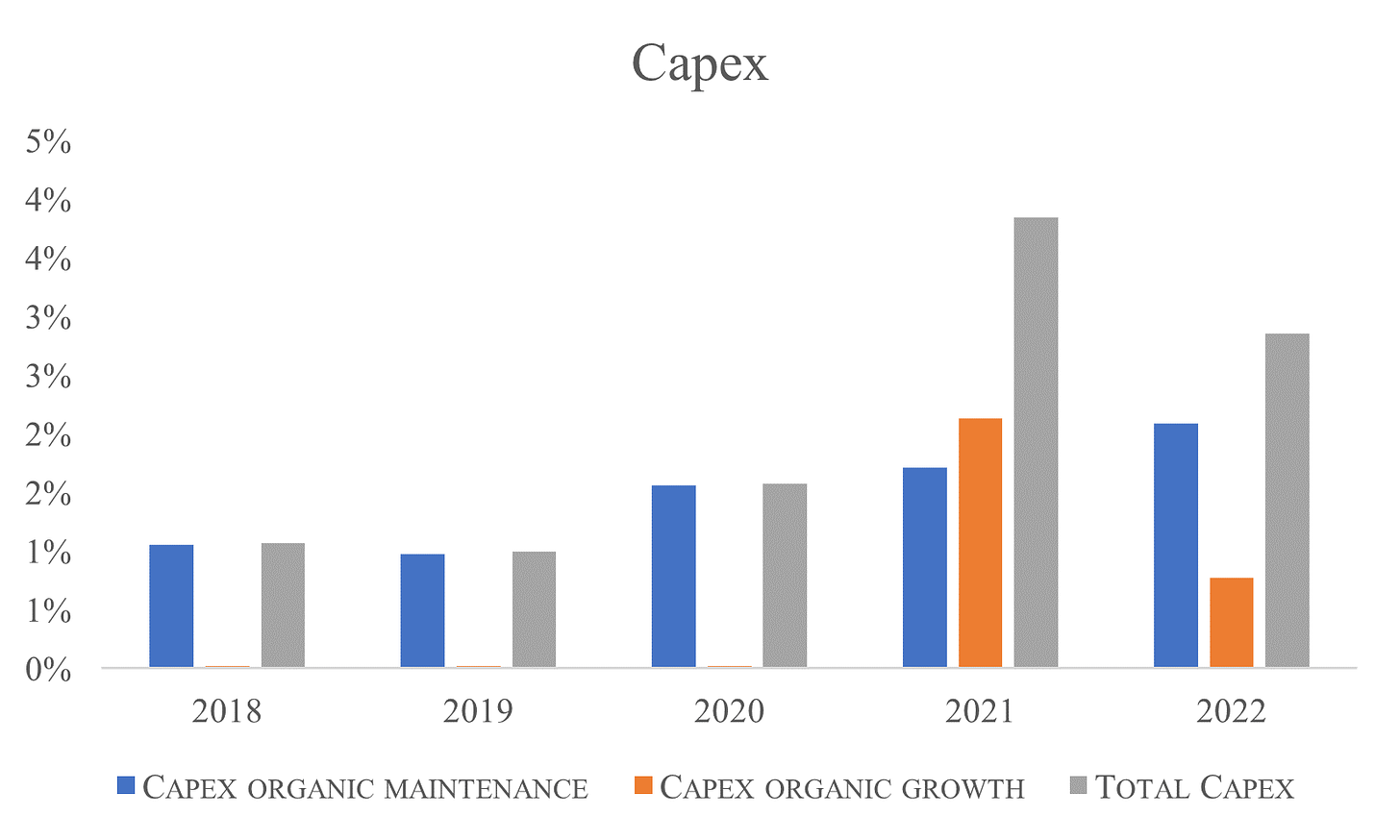

Total Capex represent around 3% of revenues.

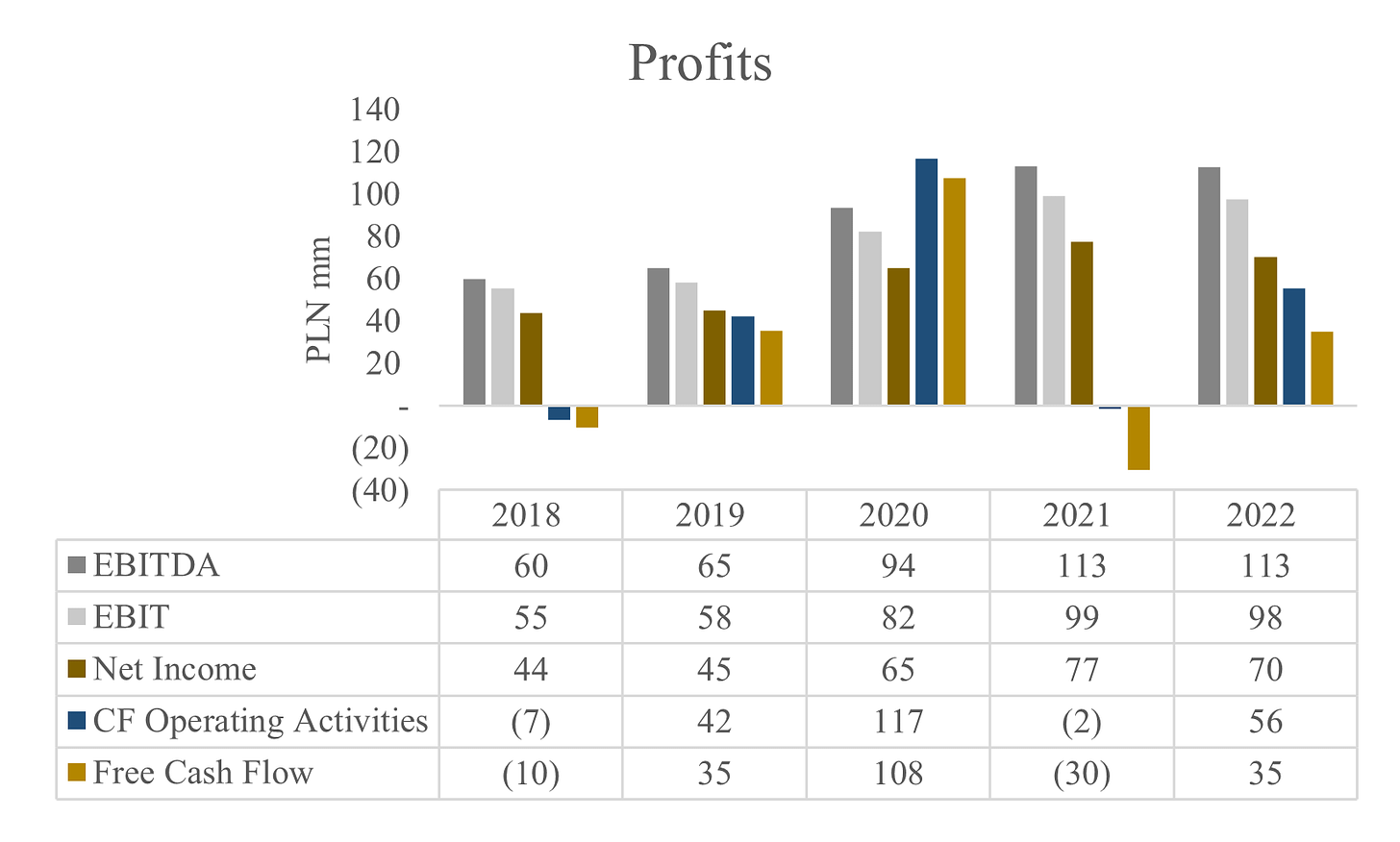

Profitability

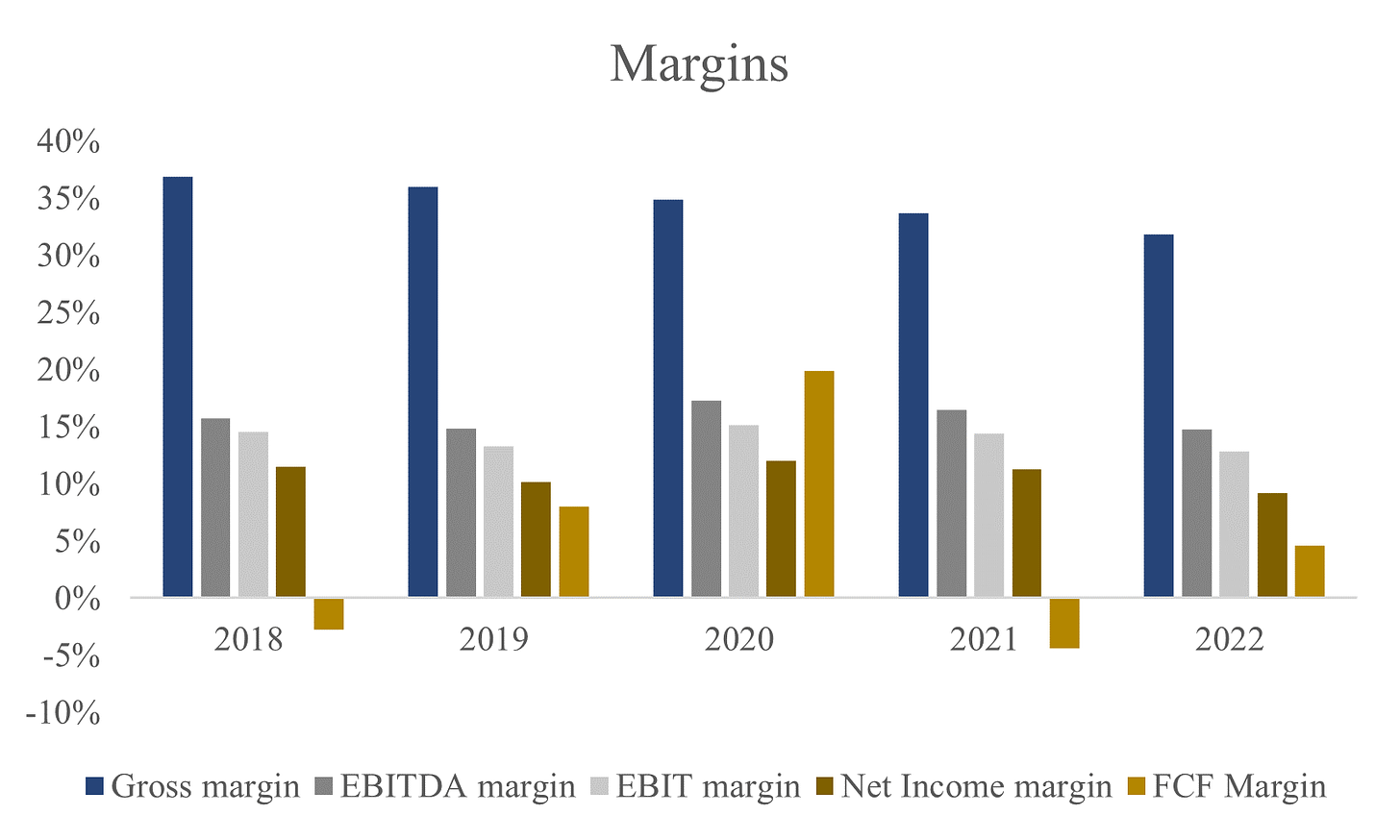

EBITDA margin is around 15% vs 5% FCF margin. EBITDA-to-FCF conversion is around 30%. In my opinion It is due to changes in Inventory what makes CFO lower than past years.

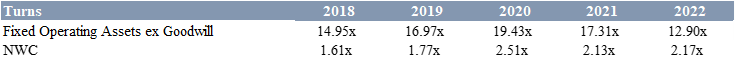

Activity

Inventory Write-down for FY 2022 and FY 2021 are 5M and 3M respectively. We should think in write-down as a negative accounting item, given that It suggest a lack of capacity to sell old inventory or obsolesce.

In other hand, Gross margin was 32% in FY 2022 (34%). Write-down and write-off increase COGS reducing Gross Margin.

Revenues for 2022 grow and inventory account was lower respect to 2021. In 2022 Inventory represents around 46% of revenues (54%). In my opinion this is a good sign.

It is important to understand not only margins but also how a company rotates capital.

High turns over Fixed Operating Assets suggest:

Efficiency.

Low PP&E due third-parties model.

Turn over NWC is lower than over Fixed Operating Assets but we can think in certain degree of efficiency.

Liquidity

Solvency

TOYA has a healthy financial position. Net Debt represents around 54% of EBITDA. Financial Leverage is moderate and Interest Coverage is around 10x.

Risks and catalysts

Risks

TOYA is not a intensive fixed capital business, but needs a substantial quantity of WC to operate. Lack of capacity o manage inventory or other items from WC may affect to results of operations.

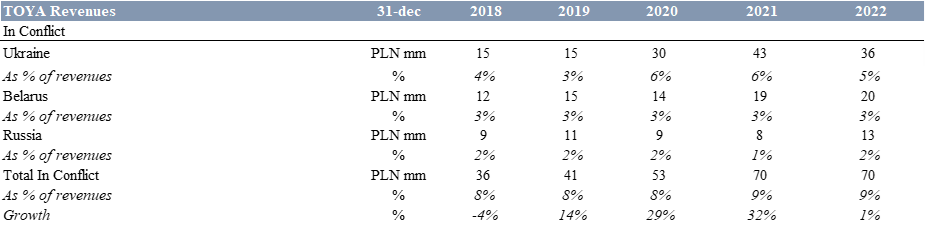

10% of revenue come from conflict areas (Russia, Belarus and Ukraine). A worsening in conflict may affect to results of operations.

TOYA operates in a very competitive industry. TOYA products are easily replicable. Investing in TOYA may be a value trap (Low quality to low price).

Reporting and base currency (PLN) is different to local currencies where The Parent operates through its subsidiaries. FX currency is a risk what may affect to financial results.

TOYA is a low liquidity stock. In 2018 GetBack and Altus TFI was involve in accusations of fraud: The consequences were massive redemptions at Altus who was around 10% holder in Toya at the time.

Catalysts

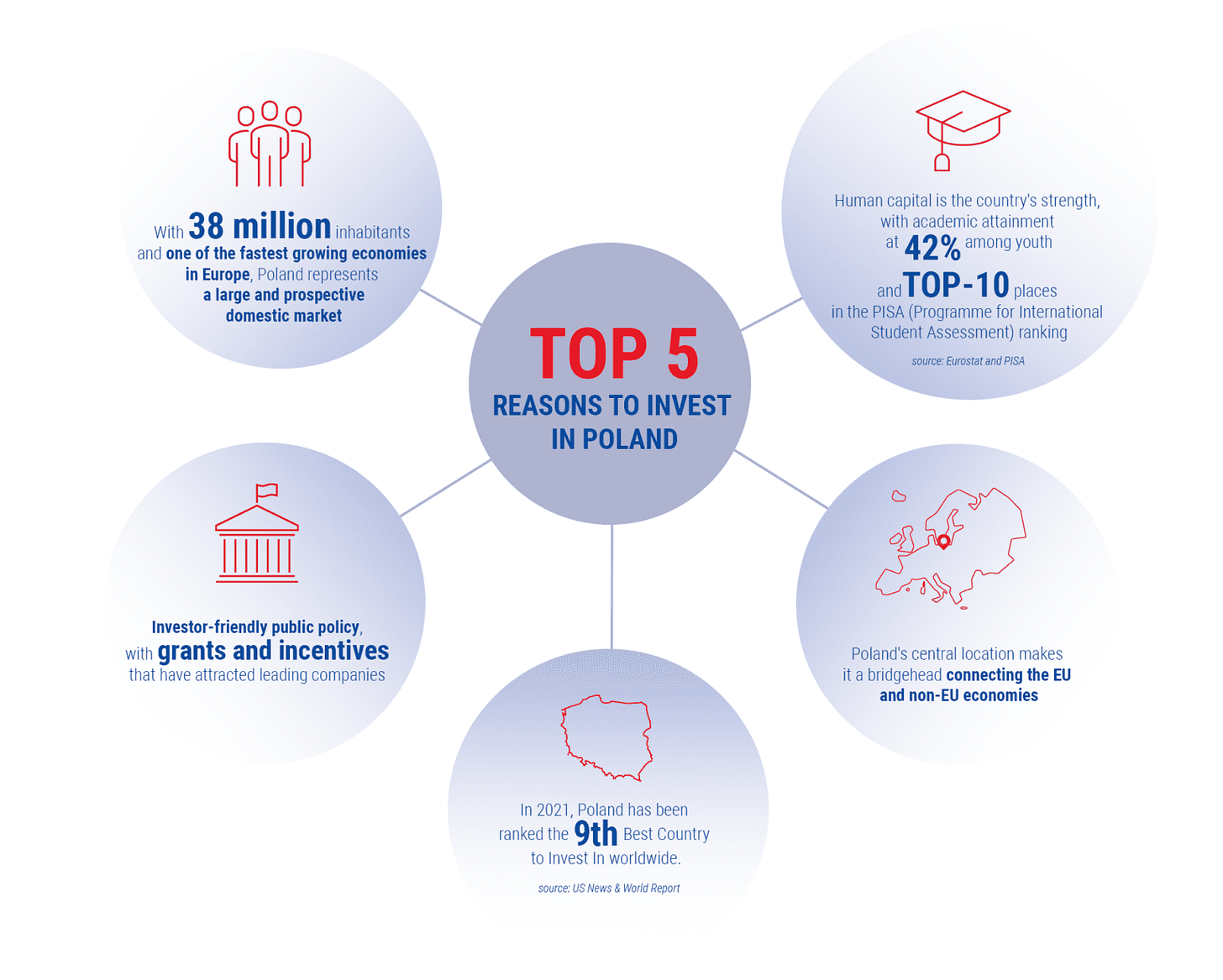

Invest in Poland! Why?

Poland is one of the economically most stable and fastest growing countries in Europe. It is a member of the European Union, OECD and also of G20 countries.[2]

Poland at the end of 2020 was ranked as the third preferred location in Europe for foreign investments. In 2020, it had nearly 200 foreign investments for a total value of EUR 10 billion. [3]

Poland has a strong position on the list of business-friendly places. Revenues earned by foreign investors in Poland have been continuously rising. They exceeded EUR 19 billion in 2020, more than twice the figure recorded a decade ago. In 2020, the United Nations Conference on Trade and Development ranked Poland the second in Europe and fifth globally in terms of the value of greenfield investment: USD 24.3 billion. [4]

Forecast of high growth of GDP.

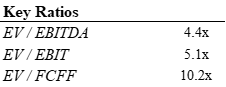

Valuation

We could assume a base growth scenario:

Poland: 12% growth..

Romania: 12% growth.

China: 10% growth.

Export ex-conflict areas: 15% growth.

Conflict areas: Revenues 0

CAGR Revenues 22-27 11%.

Revenues 2027 PLN 1264 M.

EBITDA Margin 14%

EBITDA 2027 PLN 177 M.

Sector EV/EBITDA around 12x. We will take 10x for TOYA.

TOYA EV/EBITDA (FWD) 2027 2.80x

Value per share 2027 PLN 21

[1] www.globenewswire.com

[2] https://www.trade.gov.pl/en/support/why-should-you-invest-in-poland/

[3] Polish Investment and Trade Agency (PAIH)

[4] KPMG report

might have missed something - but why has the stock been dead for 10 years?

I have not yet come across this stock being mentioned yet in EM fund documentation... Will include a link to your piece for my Monday "Emerging Market Links + The Week Ahead" post...