Disclaimer:

Eloy Fernández Deep Research publishes equity reports, and analysis posts periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports and posts is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This post is not a BUY or SELL recommendation.

Since their introduction in 1993, ETFs have become increasingly popular until they are the preferred way for many retail investors to invest their savings.

What ETFs are?

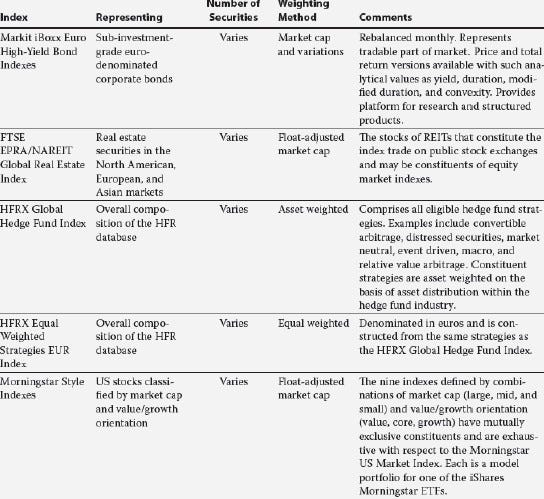

ETFs (Exchange-traded fund) are instruments-equity portfolios tracking an index. A security market index is used to represent the performance of an asset class, security market, or segment of a market.

Exchange-traded funds (ETFs) were developed as an alternative to mutual funds following a passive management strategy.

Popular ETFs are:

SPDR S&P 500 ETF, which tracks the S&P 500

Invesco QQQ ETF, which tracks the Nasdaq 100.

iShares Russell 1000 Growth ETF, which tracks the Russell 1000 index.

Advantages of ETFs

Diversification.

Redemption at trading price.

Lower fees in respect to mutual funds.

Dividends are reinvested automatically.

Tax efficiency.

Disadvantages of ETFs

Costs are higher in respect to stocks.

Lower Dividend Yields.

Limitation to large-cap.

Beta market in ETFs is equal to1 by definition, therefore the investor could limit his ability to bear less risk than the market.

The construction of an ETF prevents the possibility that those stocks of higher quality or more undervalued have a lower weight in the portfolio.

Who Should Invest in ETFs?

Saying that investing in ETFs seems speculative to me is not a direct criticism in any way. On the contrary, I think it is a useful, efficient and low cost tool that can be of great help to many retail investors.

Beginning investors with a long-term horizon benefit from ETFs. Additionally, being a passive investment requires less time, effort, and knowledge.

Enterprising investors and passive strategies.

According to Benjamin Graham's (The Intelligent Investor).

“An enterprising investor is one who is willing to devote more time and effort into researching securities, with the hope of making a better average return than the passive investor over the long term”.

We know that ETFs are a passive investment strategy; therefore if you consider yourself as an enterprising investor, it does not make sense to invest through them.

Jack Bogle, founder of The Vanguard Group, said:

“What happens when you have marketing people instead of investment fiduciaries running money. The ETF is the magic word of the day, the greatest marketing innovation of the 21st century. [Hey, he was on a roll.] They are absolutely speculation, and they have hurt a lot of people.”

For the speculator, the price matters much more than the value. Investing in ETFs is still a speculative action.

The investor's calculation in ETFs is based on the hope that everything going to be alright in the long term based on past events. But we know that in the historical performance of the S&P 500 there is survivorship bias and that historical returns are based on a large sample. So, could you invest in ETFs and lose a lot of money? Refer to the case of the 2008 crisis or even the crash of 1929.

“Nothing is certain except death and taxes”. Benjamin Franklin.

In passive investing, you are constrained to the market. In other words, it would be like going to Costco and buying a predetermined shopping basket with more fish meat just because the first one has a higher price. In an ETF you buy the market: good and bad, cheap and expensive, cyclical and anticyclical.

An experienced stock picker with medium or high knowledge and adequate dedication could beat the market not only from returns, but also by risk adjusted portfolio performance.

If you have not subscribed yet, I can help you discover those little hidden gems that will help you beat the market. Subscribe and enjoy a monthly investment thesis. With your support, you help this project stay alive.

Greetings and have a good week.

Eloy.