Disclaimer:

Eloy Fernández Deep Research publishes equity reports, and analysis posts periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports and posts is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This post is not a BUY or SELL recommendation.

“There are two types of bikers: those who have fallen and those who are going to fall”.

When we pick stocks, we can commit two types of errors: errors of commission (falling to the road) and errors of omission (waiting in the boxes while Marc Márquez wins).

The investment process aims to take an adequate level of return with respect to a certain level of risk, minimizing the damage, not eliminating it completely. The risk is inherent to investing and the human being, I would say.

Nobody wants to make mistakes in investing, however no investor has a 100% success rate free of errors. At least I have ever met them.

Errors of omission are mistakes where we failed to act when we should have. So we reject to buy a financial asset, and the error becomes when that asset performs contrary to how we expected.

Below, I list my biggest errors of omission.

Fastenal Co. (FAST)

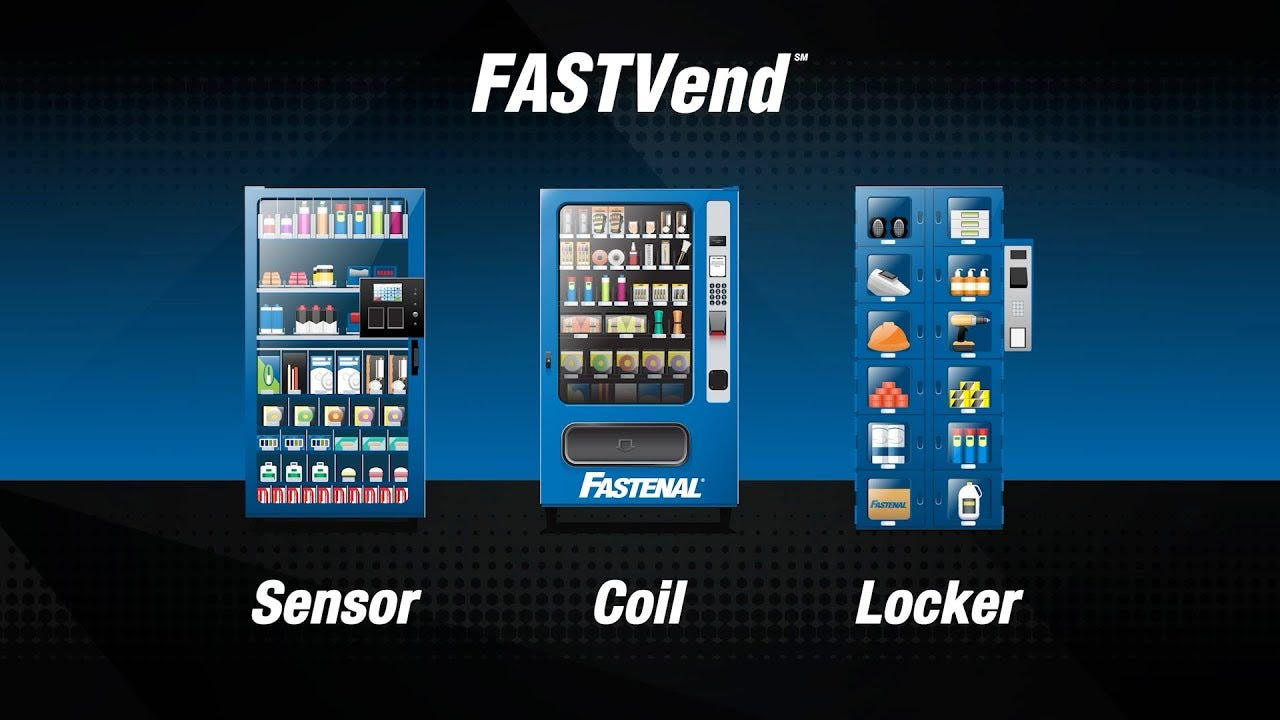

Fastenal engages in the wholesale distribution of industrial and construction supplies internationally. It offers fasteners, and related industrial and construction supplies. The company’s fastener products include threaded fasteners, bolts, nuts, screws, studs, and related washers that are used in manufactured products and construction projects, as well as in the maintenance and repair of machines.

Analysis date: May 12, 2016.

Annual return: 13.96%

Rationale to reject it: low upside.

Lululemon Athletica Inc. (LULU)

Lululemon Athletica Inc., designs, distributes, and retails athletic apparel, footwear, and accessories under the Lululemon brand for women and men.

Analysis date: June 18, 2016.

Annual return: 18.84%

Rationale to reject it: fashionable and ephemeral product. Competitors (Nike, Adidas, Puma, Under Armour, etc.).

SalMar ASA (SALM).

SalMar, is a Norway based company that produces and sells farmed salmon in internationally. It is involved in the harvesting, processing, and smolt production activities.

Analysis date: September 11, 2017.

Annual return: 14%

Rationale to reject it: risks derived from diseases that could reduce production, highly cyclical, limited growth.

Gaztransport & Technigaz SA (GTT)

Gaztransport & Technigaz SA, is a France based company that provides cryogenic membrane containment systems for the maritime transportation and storage of liquefied gas and liquefied natural gas (LNG).

Analysis date: January 12, 2017.

Annual return: 16.96%

Rationale to reject it: ownership (French government trough Engie SA), lack of view, capital intensity, outside my circle of competence.

Investors can commit errors of omission because these mistakes do not engage capital, although they represent a “loss” in cost of opportunity terms.

Remember: It is preferable to bat only those balls what we can bat for a run than bat all of them, despite we lose the opportunity to make a grand slam.

Sometimes the market makes time to recognize the stock’s intrinsic value. Sometimes, It never does it. Valuation is a subjective process.

The last Thursday, Evolution Gaming AB (EVO), presented quarterly results. Net revenues increased by 14.7%, EBITDA margin raised to 71.7% (70.4%). The Group continues with expansion plan, opening new studios in Colombia and Czech Republic.

I’ve been covering the stock since March 2022. Currently, Evolution represents around 11% of my stocks' portfolio.

In my opinion, fundamentals are the strongest ever. Moat and business strengths are unbroken. Margins, cash generation, buyback shares program, growth at double-digit, and acquisitions support my thesis. Furthermore, multiple is compressing despite stock price is dropping.

Stock price is more or less flat since I started to buy shares.

Last events, such as the Philippines ban on offshore gaming and Japanese regulations, could have affected the Asian market uncertainty, and Georgia employees strikes as well. In my opinion, all of it have a short-term influence, but not a long-term one.

Meanwhile, from my lens, the upside of Evolution is higher than ever.