Disclaimer:

Eloy Fernández Deep Research publishes equity reports, and analysis posts periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports and posts is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This post is not a BUY or SELL recommendation.

At first glance, and making an unprofessional judgment, we might view a company with negative equity in bankruptcy. However, not only that should be questioned, but in many cases, the stocks of companies with negative equity have outperformed the market by far.

I will explain what negative equity consists of and in what cases it could denote excellent companies.

The Balance Sheet

Balance sheet reports the firm’s financial position at a point in time.

The balance sheet consists of assets, liabilities, and equity. Its fundamental equation is:

A=L+E

Assets (A). Resources controlled as a result of past transactions that are expected to provide future economic benefits.

Current Assets: cash and equivalents, account receivable, securities, inventories and other CA.

Non-Current Assets: Property, plant and equipment (PP&E), investment properties, intangibles (Including Goodwill) and Deferred tax assets.

Liabilities (L). Obligations as a result of past events that are expected to require an outflow of economic resources.

Current Liabilities: Accounts payable, Notes payable and current portion of long term debt, Accrued liabilities and Unearned revenue.

Non-Current Liabilities: Long term financial liabilities and Deferred tax liabilities.

Equity (E). The owners’ residual interest in the assets after deducting the liabilities. Contributed capital, Preferred stock, Noncontrolling interest, Retained earnings (NI-Dividends paid), Treasury stock and Accumulated other comprehensive income.

Firstly you could think that a negative equity means more debt than assets, therefore a weak financial position. However, let's see why this situation can occur.

A typical example of negative shareholder equity is when significant dividend payments are made to investors.

Buybacks can understate book value as well. So, we have two situations what could create a negative equity through Retained Earnings and Common Stock items respectively.

The TransDigm case

If a company is generating a lot of cash used to pay dividends and buyback shares then It could be a sign from a higher quality asset such as a brand, a patent or competitive advantage.

This is the case of TransDigm, a company with negative equity (retained earnings and negative treasury stock).

TransDigm Group Incorporated (TDG) designs, produces, and supplies aircraft components in the United States and internationally. The Power & Control segment offers mechanical/electro-mechanical actuators and controls, ignition systems and engine technology, specialized pumps and valves, power conditioning devices, specialized AC/DC electric motors and generators, batteries and chargers, data bus and power controls, sensor products, switches and relay panels, hoists, winches and lifting devices, delivery systems and electronic components, and cargo loading and handling systems. This segment serves engine and power system and subsystem suppliers, airlines, third party maintenance suppliers, military buying agencies, and repair depots. [TIKR]

This is a company I know well and have had in my portfolio in the past. It is a superior-quality business with clear competitive advantages, a cash generator that delivers value for shareholders. If we look at the chart price, TransDigm has returned a CAGR of 20% over ten years. This means that $1,000 invested in 2015 would be worth around $6,000 today. Not bad at all.

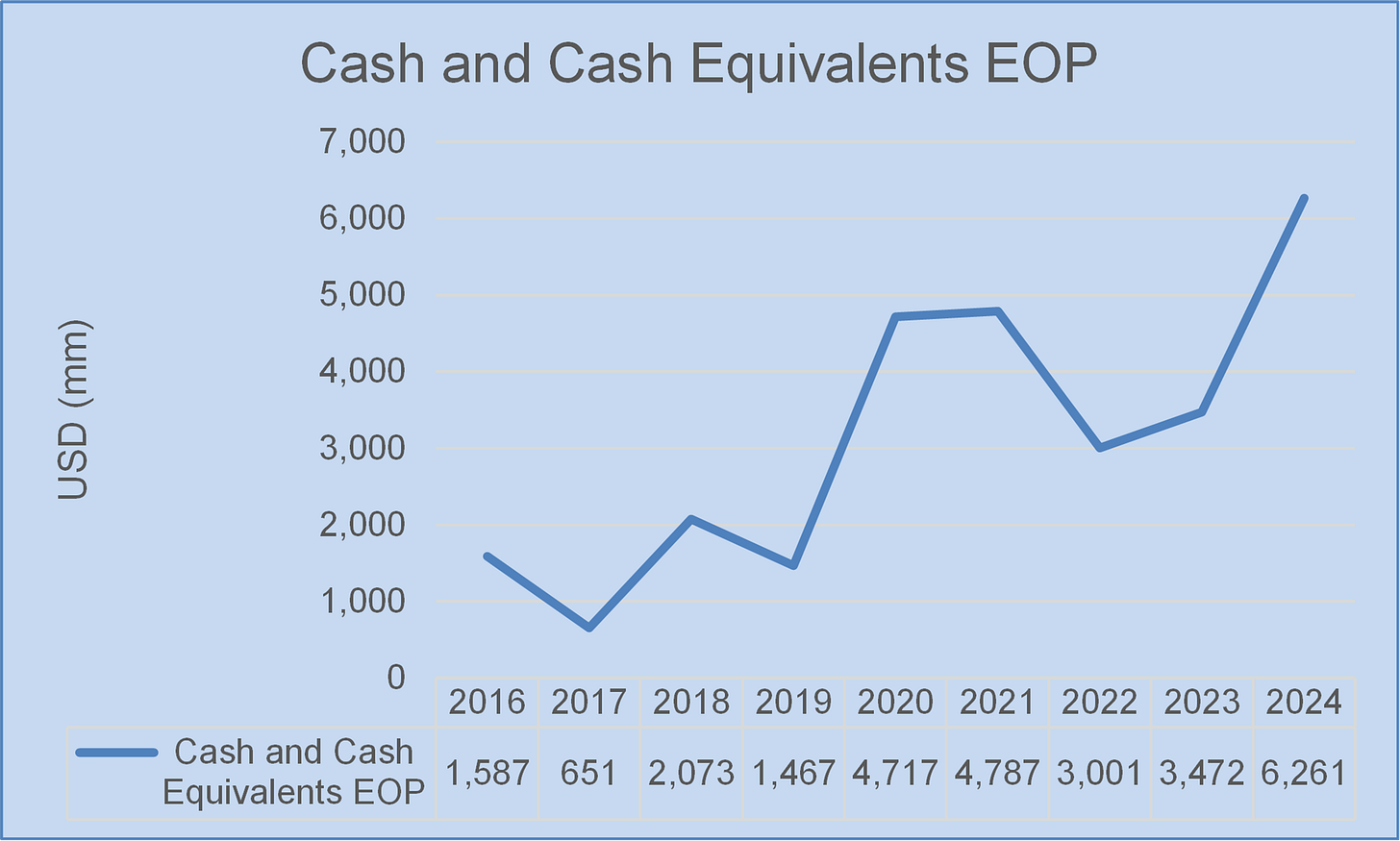

As we can see, TransDigm is a cash generator. So much so that in many fiscal years, it returns more to shareholders than the cash generated. And this is something the company can afford due to the quality of its business, its ability to grow, and its secular revenues.

How buybacks and dividends influence valuation multiples?

Price-to-book ratio

Let's look at the following two cases:

Company X

Market value $100 mm.

Book value $100 mm.

Price-to-book 1x

Company Y

Market value $100 mm.

Book value $50 mm.

Price-to-book 2x

Both companies use $10 mm to buyback 10% of their shares. Then:

Company X

Market value $90 mm.

Book value $90 mm.

Price-to-book 1x

Company Y

Market value $90 mm.

Book value $40 mm.

Price-to-book 2.25x

The effect on company Y is a decrease in book value by a percentage greater than market value, resulting in a higher multiple.

Other quality companies with negative equity

McDonald's Corporation (MCD)

ROCE 23.1%

Payout ratio 59.2%

CAGR 10y 12.2%

Domino's Pizza, Inc. (DPZ)

ROCE 706%

Payout ratio 35.9%

CAGR 10y 15.8%

Lowe's Companies, Inc. (LOW)

ROCE 43%

Payout ratio 36.9%

CAGR 10y 13.6%

Dell Technologies Inc. (DELL)

ROCE 18.8%

Payout ratio 27.8%

CAGR 5y 19.3%

Greetings and have a good week.

Eloy.

The last write-up: