Disclaimer:

Eloy Fernández Deep Research publishes equity reports, and analysis posts periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports and posts is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This post is not a BUY or SELL recommendation.

Most people are familiar with the three main financial statements: Income Statement, Balance Sheet and Cash Flows Statement. However, few are familiar with the SCI (Statement of Comprehensive Income).

Next we will see what the SCI and OCI are and how they impact equity.

We have to understand that SCI=Net Income+OCI (Other comprehensive Income).

What OCI is?

We know that A=L+E where Equity (E) that is the residual interest in the net assets of an entity that remains after deducting its liabilities

So, What can cause the change in Equity?

Capital Changes: changes related to investment and return of capital to

shareholders such as Issuance of new shares, paying out of dividends to shareholders and buy-back of own shares from the market.

Performance Changes: Primary Activities (Reported in P&L) and Non

primary Activities (Not reported in P&L).

Primary Activities: Revenues, COGS, SG&A, Marketing expenses, gains, etc. All of that is reported thought Income Statement.

Non-primary Activities that are reported through Other Comprehensive Income.

Thus, OCI comprise Unrealized gains and losses from cash flow hedging derivatives, unrealized gains and losses from available for sale securities, foreign currency translation gains and losses and adjustments pension liability.

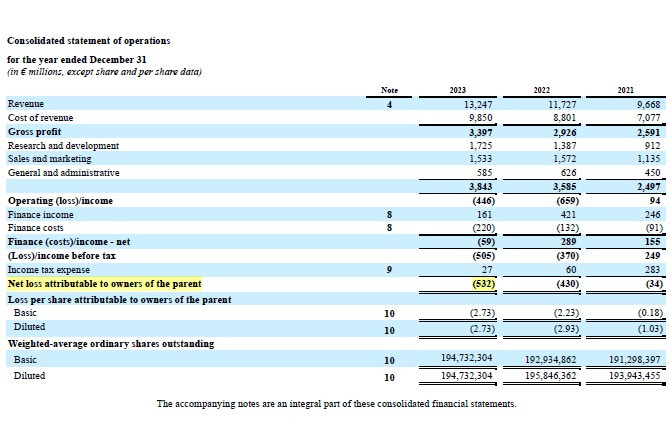

Changes in equity (including changes in net income) can be seen in the Statement of Changes in Equity. Let's focus on Spotify to shed more color on this.

Total Comprehensive Income=Net Income+OCI

-518=-532+14

In this simple way, we can map changes in equity and keep in mind that not all items are reported via P&L.

If you did not know this, I would like you to let me know in the comments. As you know, my project to create investment analysis learning materials, and it is very important to me knowing if I am creating value for you.

Due to personal issues, the March investment thesis is coming late. So, April will have two posts. I apologize for this, but I will give you a sneak peek at some key points about the company I am analyzing:

European beverage business with a century background.

Unique assets in the form of market-dominant brands.

Secular revenues.

Cash generator and high return on capital.

High dividend.

Greetings and have a good week.

Eloy.

The last write-up: