Disclaimer:

Eloy Fernández Deep Research publishes equity reports, and analysis posts periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports and posts is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This post is not a BUY or SELL recommendation.

As always, your comments and feedback are of great help to me. With your support, you encourage me to continue publishing. But today I am not only going to ask you to subscribe or give me a like. Today I am going to ask you for something much more important.

These days, Spain, my country, is broken with pain and sorrow. The catastrophe in Valencia has already left more than two hundred dead, and the rescue forces and civil authorities expect even more. Thousands of people have lost their homes, cars, belongings, pets, and businesses.

The situation is very difficult in the area. There is a lack of the most basic things, such as drinking water, electricity, medicines, clothes, etc. Today I ask you, wherever you are, to click on the link below and do your bit with your donation. However small it may be, it will be of great help.

Thank you very much, and a hug to all those affected and to all of Valencia. We will pray for you.

“Selling is the hardest decision of all”. Seth Klarman.

Making a selling decision is much harder than knowing when to buy a stock. It requires a clear strategy and a thorough knowledge of the underlying asset. That is why many investors with little knowledge or who do not do the work, have many difficulties in the selling process, sticking to a stock for too long or selling too soon when events occur that are unrelated to the company's fundamentals.

That circumstance is aggravated when we own an extremely quality stock or when it has outperformed. Then we fall in love.

The five rules:

Don’t buy anything without a previous work.

Don’t buy anything you do not know.

Don’t fall in love with a stock.

Be humble and assume losses.

Keep on a strategy and be consistent.

“What’s needed is, first, a definite rule for purchasing which indicates a priori that you’re acquiring stocks for less than they’re worth. Second, you have to operate with a large enough number of stocks to make the approach effective. And finally, you need a very definite guideline for selling”. Benjamin Graham.

Your reason to sell should be based in valuation, but it requires being hardworking and knowing that valuation process is highly subjective. Thus, you need to keep in mind that your sell price could be very different from others investors.

“If selling still seems difficult for investors who follow a value-investment philosophy, I offer the following rhetorical questions: If you haven’t bought based upon underlying value, how do you decide when to sell? If you are speculating in securities trading above underlying value, when do you take a profit or cut your losses? Do you have any guide other than “how they are acting,” which is really no guide at all?”. Seth Klarman.

Investing requires humility and operating on time. When intrinsic value falls or the margin of safety is reduced, it does not make sense to maintain a stock in a portfolio, despite having suffered a huge loss. Recognize the error, sell it, and learn for the future.

“Ego trip: a journey to nowhere”. Robert Half.

A colleague of mine teach me something like that:

“Write down on a piece of paper all stocks that you maintain in your portfolio but would not like to have in it. After that, sell them, regardless of their performance”.

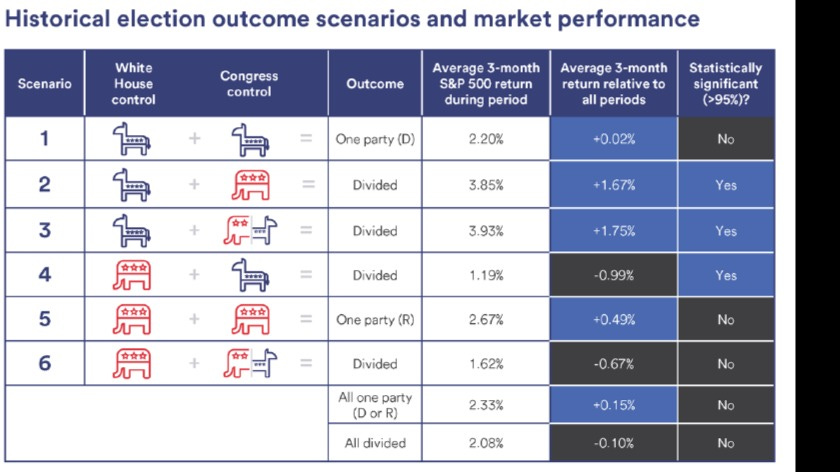

The 2024 election season enters its final days, and the race for President remains too close to call.

U.S. Bank investment strategists studied market data from the past 75 years and identified patterns that repeated themselves during election cycles.

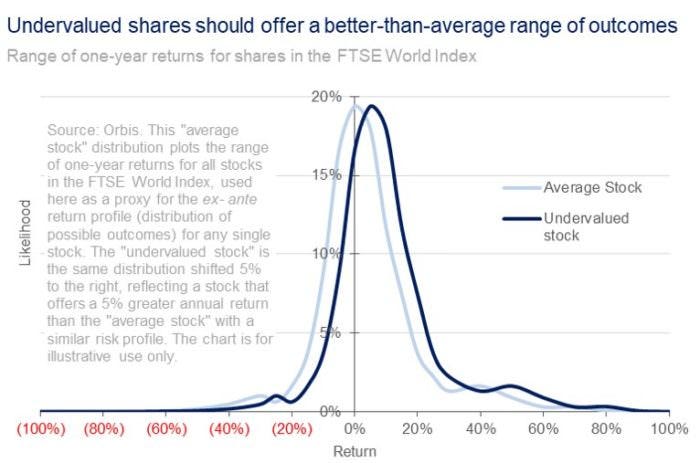

Many investors try to predict macro trends; however, rather than forecasting macro trends, a better approach is to estimate what a business is worth. By making a selection of undervalued stocks, we can outperform the average market and get away from the noise of markets.

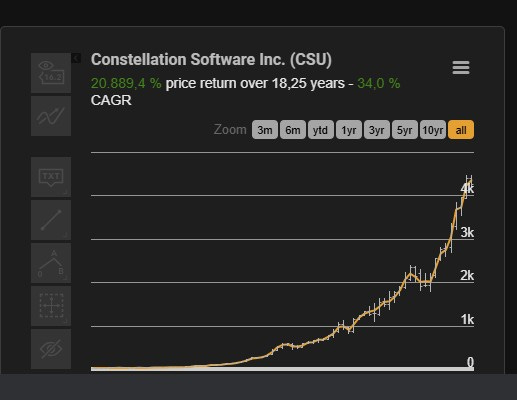

The long term and knowledge of good businesses should be the horizon and investing guide for stock pickers.

Fed announcements, elections, and extraordinary events can strongly affect the markets, but in the end, in the long term, all of that becomes noise in which the masses fall under the herd behavior.

“Your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.” Peter Lynch.