Disclaimer:

Eloy Fernández Deep Research publishes equity reports, and analysis posts periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports and posts is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This post is not a BUY or SELL recommendation.

“The idea of financial freedom is no conspiracy to deceive the masses; but it sure has sold unimaginable amounts of financial products and services! “. Barry Ritholtzchief, investment officer of Ritholtz Wealth Management LLC.

Dreaming is free. Many people think that their ideal life could be compatible with spending the day on the beach drinking mojitos, sailing and playing golf. But the reality is that the beach and too many mojitos are boring, (There is never too much golf). The modern concept of financial freedom is bizarre and unrealistic. Perhaps because behind all these ideas there is an industry that profits in the form of the sale of books and courses. Living off your assets is a seemingly attractive and simple concept: get out of bed and only worry about the money that falls into your pocket. But the reality is very different.

Then, what do we need to make a living off stocks? Is that possible? Yes and no, at the same time.

In order to build a portfolio that produces enough returns to cover our cost of living, several aspects would have to be kept in mind:

Strategy. Someone who is looking to an adequate relation of Risk-return, should hold a consistent strategy, be patient and obstinate.

Income needs and cost of living. According to OECD, average of disposable income in the world is $33,604 per year. That amount could change depending on the location, personal situation, age, children, etc.

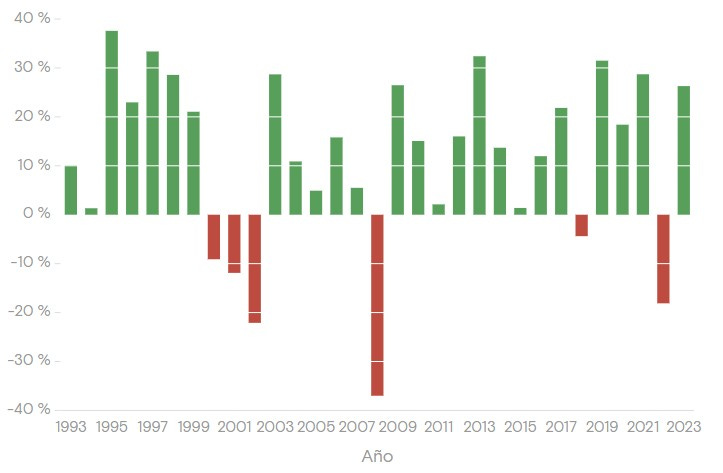

Returns. Over the past 32 years, the S&P 500 Index (in USD) had a compound annual growth rate of 10.57%. We have to keeping in mind that It does not mean a constant return of 10% annually, but a Long-term scenario much more sinuous where the volatility demand a safety fund of cash, and a very frugal style of life.

To put it in context, in 2008 a portfolio of $200,000 would have become in $126,000. We would have had to wait almost four years to recover the equity at inception in nominal terms, without taking into account the inflation rate.

It is true that an intelligent and highly qualified investor can beat the market. But that requires hard work and exclusive dedication. The mojitos and the beach are over. Only time for golf.

Safety fund. Set aside enough money to support yourself. We can suppose (taking the example above), that is necessary a safety fund in cash at least around 4x your income needs after-tax. For the OCDE case, It would represent $134,000.

Taxes. In U.S. Long-term capital gains are taxed at 0%, 15%, or 20%. For Spain case, gains around €35000 are taxed at 21% of effective tax rate.

Education, what derives from, needs to make returns with an adequate level of risk.

Personal Equity. For $33,604 income needs and Spain taxation rates, we would need an optimal portfolio of $400,000 (Under personal assumptions and calculation method). The total personal equity amounts around $535,000. All of that without inflation rate effects, and considering the average of income needs around the world. For the U.S. case, this amount exceeds $1,000,000.

The 4% rule

The 4% rule holds that an initial withdrawal rate of 4% of the value of the typical portfolio at retirement should be sustainable over 30 years (adjusted annually for inflation). These assumptions give us an even more unfavorable situation.

How can we get that amount of money?

Ignoring lottery prizes (unlikely), rich grandmothers or inheritances, the only way is to make a high amount of net worth is by accumulating wealth from a very young age. A high salary combined with a frugal lifestyle could mean that at 40 we could talk about such wealth. In which case, what reason would there be to leave a high-skilled, high-income job to take on the risks of the financial markets? In addition, we would have to acquire adequate education and investing enough quantity of time. All for much less than we can earn working in our circle of competence.

Conclusions:

Living off stocks requires a high and continuous education level.

Living off stocks requires a high equity.

Living off stocks requires temperament and having guts. In many cases you have to get the path less trodden, and walk in the opposite way in respect to the herd, while you are losing money.

Living off stocks is possible, but is very tough.

“During the gold rush, it’s a good time to be in the pick and shovel business.” Mark Twain, writer.

Having said that, it would be advisable not to pay much attention to the investment gurus; they sell courses and books. Because the only way to get rich quickly and from nothing through the stock market is this: pick and shovel, friends.