Disclaimer:

Eloy Fernández Deep Research publishes equity reports, and analysis posts periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports and posts is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This post is not a BUY or SELL recommendation.

Risk

Risk is defined in financial terms as the chance that an outcome or investment's actual gains will differ from an expected outcome or return.

In finance, volatility is commonly associated with risk.

Risk means uncertainty, however it is not something to be avoided, but managed it.

Risk management process seeks to:

Identify the risk tolerance.

Identify and measure the risks.

Modify and monitor these risks.

The risk that is eliminated by diversification is called unsystematic risk. We could say that unsystematic risk can be eliminated for free.

One study showed that it only took about 12 to 18 stocks in a portfolio to achieve 90 of the maximum diversification possible.

My portfolio is currently made up of 18 stocks, which would be within the theoretical range of sufficient diversification. 50% of the total portfolio comprises six stocks; that is, 50% of the portfolio is concentrated in 32% of securities including cash position.

The risk that remains cannot be diversified away and is called the systematic risk (market risk).

Total risk= unsystematic risk+systematic risk

Systematic risk is largely unpredictable and generally difficult to avoid. But we can manage it, for example providing an adequate distribution of weights.

Theoretically, risk rises with an increase in return. However, we know that risk (uncertainty) is subjective and depends on different factors.

The risk return relationship.

When I buy stocks, I try to allocate weights rationally, taking into account the following factors:

Upside.

Risk.

Level of conviction.

A valid matrix for my level of risk aversion and my particularities could be the following:

Reducing or increasing coefficients can be applied depending on the level of conviction and knowledge of the company. Many times I get great ideas from other people with very well-crafted theses. In these cases, it is not necessary to tear down the house and build anew; I simply rely on the work of another investor to make a reduced thesis adapted to me. But in these cases, knowledge is not, and cannot be, complete. It is not about copying a thesis, but rather about taking it as a basis. Remember that investment is not a contest of originality.

On the other hand, there are companies that I know perfectly, that I have followed for many years, and that I have analyzed from the beginning. These are what I call “blank thesis” because you start from 0. Depending on what is stated above, you can play with the assigned weights.

It is clear that you cannot always reach all of these weights at once. As we gain conviction or upside changes, we can move them. Sometimes the thesis fails, and we must recognize the error and, sell the position completely. Do not blame yourself for it or enter into a process of permanent loss.

The weighted mean of a set of numbers is computed with the following equation:

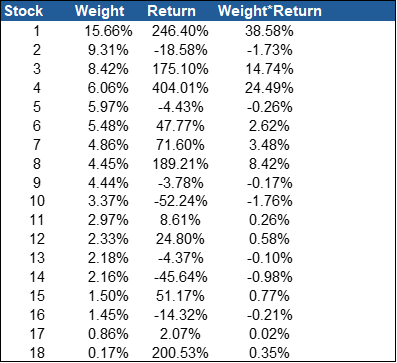

Let's look at the distribution of weights and returns in my portfolio, taking into account a cash position of around 18% and considering a neutral effect in total return.

It means a total return around of 89%.

We can see that in many cases, a high loss in a stock represents a small loss for the total portfolio, due to its weight. So, we can manage a high risk (e.g. : tinyBuild, Hyfusin or Straco) and a smaller risk, with a right weight assignment.

Therefore, sometimes high risk and high upside do not mean that a company is not uninvestable, but that the risk must be managed (not eliminated). That is why many of my ideas, which to a certain extent are small hidden gems with high potential but also high risk, are totally risky investments and should be taken as such. A portfolio composed in a reasonable proportion of this type of stocks (Risky but highly undervalued), can provide a very interesting alpha in the long term. All you need is patience, insight, and gut. A lot of gut.

And do not forget that size matters.