We are back with a new section: Weekly Thoughts. My goal is, in addition to selecting hidden gems from the stocks market, to provide value for you. Little by little, I will add new content that may be of interest to you and that will make EF deep Research a more dynamic and enjoyable space. In this case, I will publish a weekly summary of thoughts, reflections, and ideas about the stocks market, companies, and finance in general. Don't miss it!

The national pastime already has finalists. Dodgers and Yankees will face off in the World Series. And what does this have to do with investing? If we look at Juan Soto (NY Yankees) or Shohei Ohtani (LA Dodgers), we could recognize many skills that a smart investor who intends to beat the market must have.

A good player knows how to choose the balls. He doesn't hit for the sake of hitting, but rather counts based on the situation of the game and the players on base.

A good player forgets about a bad turn at bat and concentrates on the next one.

A good player doesn't hit randomly, looking to hit very hard. He has a strategy with a plan A, a plan B and a plan C.

A good player uses a variety of different playing styles and strategies, and the same applies to investing in the financial world. Chasing a grand slam can be very unproductive, and yet a single can give you the victory.

To sum up, success in investing comes down to having patience, having a strategy in place and being ready to adapt your strategies as needed.

Many creators publish their portfolios periodically. Honestly, respecting everyone's work, I don't see the point in it. I don't intend to have an investment club, there are already many.

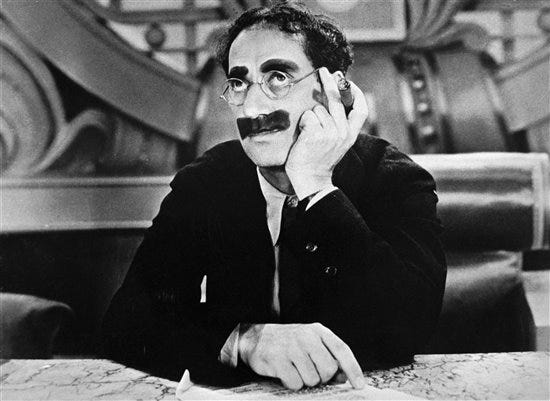

“I don’t want to belong to any club that will accept me as a member” Groucho Marx.

“Portfolio management is the art of selecting and overseeing a group of investments that meet the long-term financial objectives and risk tolerance of a client, a company, or an institution”. [https://www.investopedia.com/terms/p/portfoliomanagement.asp ]

A portfolio is like a hand-made suit tailored on Savile Row. A good portfolio is bespoke depending on multiple factors such as, age, time preference, liquidity needs, willingness/ability to bear risk, etc. It makes no sense to try to present my personal portfolio as a guide for 400 people (hopefully one day 10,000 or 20,000. Subscribe now!). That's why I prefer to publish ideas that can serve in themselves as an investment or as a basis for learning about a sector, an industry, or a market. In this way, we make use of different businesses of very different nature, but almost always with one thing in common: small gems that have hardly been discovered. I like to think that my audience is intelligent and of a high level. So I give you a developed idea and you do the work beforehand. Here, the concept of subjectivity in the valuation process plays a key role. From my lens, a stock may be undervalued but, another investor thinks the other way. Financial analysis is an art in nature, nor a science purely.

A couple of weeks ago, I played golf with some strangers. After the usual introductions, the conversation on hole 1 went like this:

— Mr. X, nice to meet you— one of them said.

— Nice to meet you, too.

— What do you do? —

Finance— I answered, visibly concentrating on putting the glove on my left hand—. I manage my personal portfolio—.

— I can't believe it, and what's going up now?—.

I thought “The ball when I hit it 200m with my hybrid” but I replied: — That I can't know, it wouldn't be professionally—.

— But if you're in finance, you should know, right?—.

In my opinion, business is the least important of the important things, and golf is the most important of the unimportant things. Serious things to mix up.

Man is the only animal that trips over the same stone twice. The average investor (including professionals), spends too much time trying to predict the future in the markets, too focused on timing.

Peter Lynch said:

“Far more money has been lost by investors trying to anticipate corrections than in the corrections themselves.”

Maybe it is a cultural aspect. I don't know if in Spain the effect is even greater (give your opinion in the comments), but the public has a very bizarre concept of financial analysis and asset management. Imagine playing golf with a doctor and introducing yourself like this: “Hi, my name is Joe. I have pain here, near my shoulder. Could you tell me what injury I have?”

Finally, I ask you to do me a big favor. Answer the survey below. It would be a great help to me in getting to know my audience. That way, I can continue to provide higher quality content that is more focused on you.