XPEL

Market leader with a long runway of growth.

Analyst Coverage

Steve Dyer - Craig-Hallum

Jeff Van Sinderen - B. Riley

Tim Moore - EF Hutton

Analysis date: January 30, 2023.

Key Points

XPEL is the leader on a very under-penetrate market with a long runway of growth.

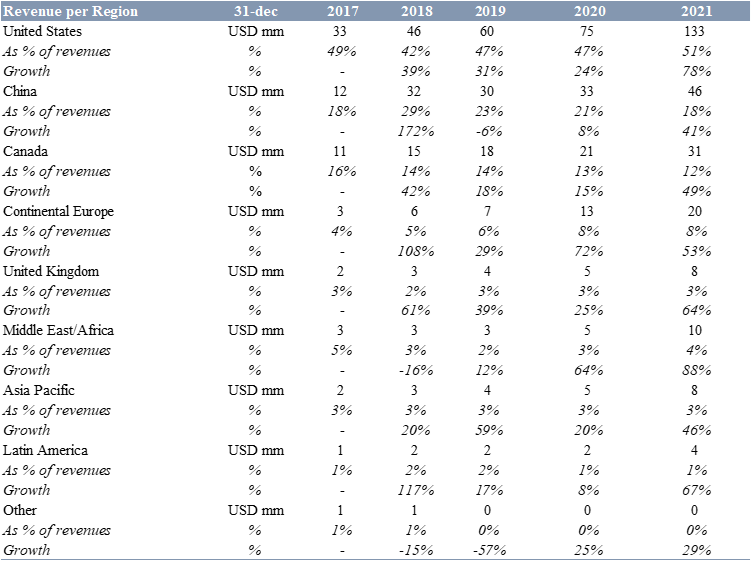

40% CAGR 2017-2021 of revenues.

Asset light model business.

Captive customers through a unique product that cannot be easily replicated.

Brilliant management team execution over the years.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

Introduction

XPEL is a San Antonio, TX. based company leader in the protective film industry. The Company is a leading provider of protective films and coatings, including automotive paint protection film, surface protection film, window films, and ceramic coatings. XPEL products can be used to protect cars, watercraft and for residential and commercial uses too.

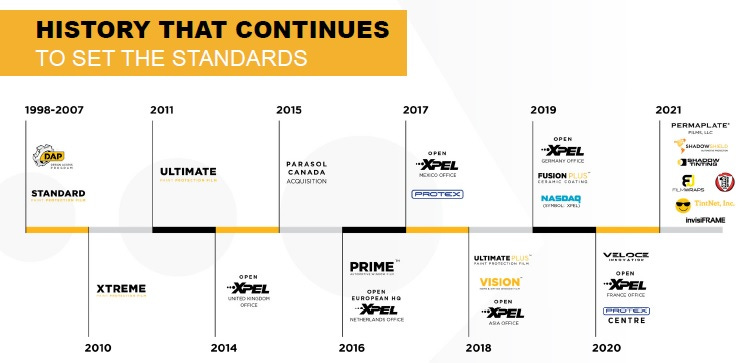

XPEL was founded in 1997 and incorporated in Nevada in 2003. At the beginning, the company was an automotive product design software company to be later a global protective film provider.

2014. XPEL began its international expansion stablishing in the United Kingdom.

2018. XPEL launched the first window and security film protection for commercial and residential uses.

2019. The Company was approved for the listing on Nasdaq trading under the symbol “XPEL”.

Business Model

XPEL is essentially a services company what sells physical products. We could define it as Brand/Distribution business of a commodity.

The Company makes money selling paint protection films to installers, dealers, and distributors. XPEL provides essential services for customers processes such as software and installation labor.

Most of manufacturing process is outsourced to third parties based in the U.S and China.

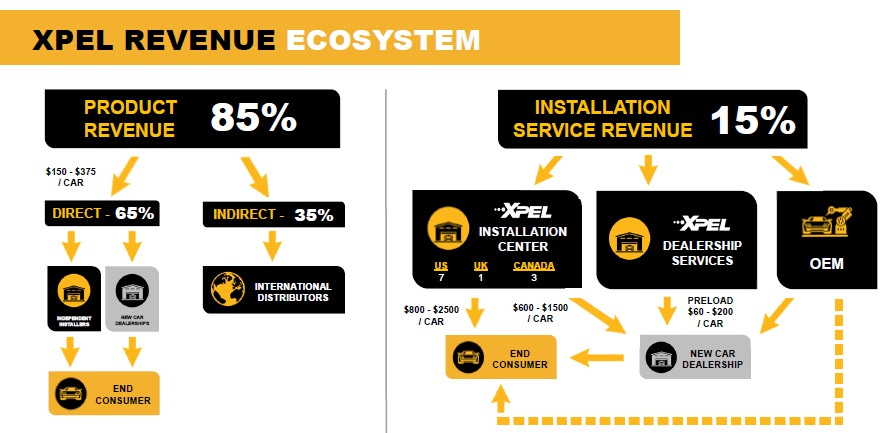

Revenue Model

Product revenue

Paint protection film.

Window film.

Other.

Product revenue represents 85% of total revenue.

65% of product revenue come from direct sales (Installers and new car dealership) and 35% from indirect sales (Distributors).

Service revenue

Software.

Revenues from fees for DAP software access.

Cutbank Credits (Per-Cut fees for pattern access).

Installation labor.

Revenue from installation sales in Company-Owned installation centers.

Training.

Service revenue represents 15% of total revenue.

Product and services

Primary products are paint and surface protection films. XPEL sells a service of software (DAP) to customers to provide them with a pattern database.

What is a Paint Protection Film?

Paint Protection Film is a transparent material that can be applied to any exterior painted surface on vehicle reducing the risk of:

Chips and scratches.

Marks created during washing.

Chemical damage.

Oxidation.

UV exposure damage.

Most of the products are sold for automotive applications, protecting painted surfaces from different types of chemical and mechanical damage like rock chips, acids, and other.

Some of the products are used for non-automotive applications, such industrial as architectural protection.

Product and services range

Automotive Surface and Paint Protection

XPEL ULTIMATE PLUS

It is a Thermoplastic polyurethane-based product and the Company flagship. It has self-healing properties and stain-resistant.

XPEL ULTIMATE FUSION

The same benefits as ULTIMATE PLUS but also contains a hydrophobic top-coat.

XPEL STEALTH

Satin-finished for Magno, frozen and frosted.

TRACWRAP

Used for a short period of time, including road trips, transport or vehicles pending a full installation.

LUX PLUS

Flagship product for Chinese market. It includes self-healing properties and stain-resistant.

XPEL RX

RX protection film against microbes.

XPEL ARMOR

Armor is a PVC-based protection- It resists abrasions and punctures from aggressive terrains. Off-Road and commercial uses.

OTHER FILMS

Solutions for select customers or certain markets.

Surface and paint protection films can be installed in bulk or pre-cut using DAP.

Surface and Paint Protection represents around 69% of total revenue.

Automotive Window Film rolls

XPEL PRIME XR PLUS

98% infrared heat rejection. Multi-layer nano-particle technology.

XPEL PRIME XR

It offers nano-ceramic technology blocking 88% of infrared heat.

XPEL PRIME CS

It blocks 99% of harmful UV rays. Available in black and neutral color.

OTHER FILMS

Lower cost products and sold only in certain markets.

Automotive window film represents around 14% of total revenue.

Architectural Window Film Rolls

Glass solutions under VISION brand name.

SOLAR

It provides solar energy rejection.

SAFETY & SECURITY

PET based-product to secure in case of a breakage.

OTHER

Anti-graffiti and decorative films

Architectural Window Film represents less than 2% of total revenue.

Design Access Program

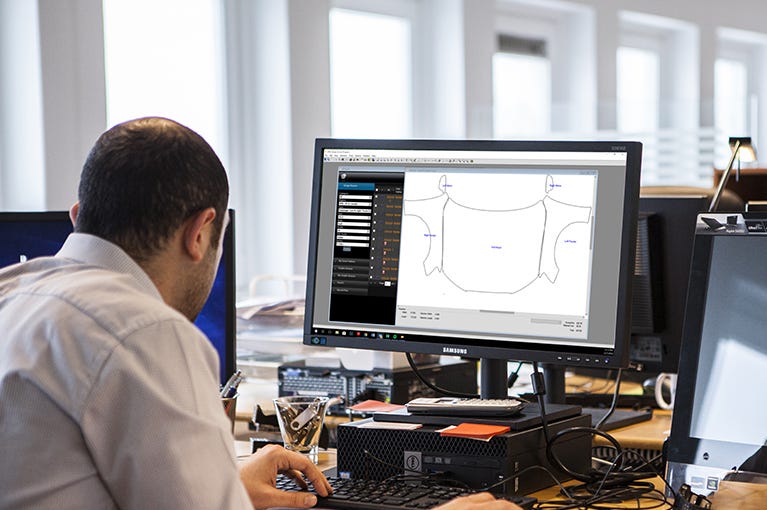

Design Access Program (dap) is a key component in the XPEL model business. DAP customers pay a monthly fee to access to patterns database consisting of 80000 vehicle applications.

Monthly DAP subscriptions represent around 1.7% of total revenue.

Installation Services

Installation services through Company-owned facilities including labor and product revenue.

It constitutes 11.1% of total revenue.

Miscellaneous Products

PRE-CUT FILM PRODUCTS

Pre-cut film for specific shapes.

XPEL FUSION PLUS CERAMIC COATING

It is a hydrophobic , and self-cleaning coating that can be applied in paint, wheels, plastics, etc.

TOOLS AND ACCESSORIES

Microfiber towels, application fluids, plotter cutters and knives.

MERCHANDISE AND APPAREL

Alternatives

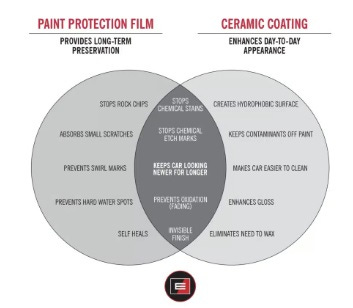

Main alternative to PPF is ceramic coating.

“A Ceramic Coating is a liquid polymer that is applied to the exterior surfaces of a vehicle. After application, it chemically bonds with the vehicle’s factory paint, establishing a layer of protection and a hydrophobic surface. The hydrophobic properties of Ceramic Coating make it harder for contaminants to bond with your car’s paint. This has two main benefits for the car owner”. [1]

“It helps keep the car cleaner for longer”.

“It makes the car easier to clean when the time does come for a wash”.

“A Ceramic Coating will also help reduce the risk of certain kinds of damage”. [2]

Differences between Paint protection film and Ceramic Coating.

Sold units are produced by third parts. However, costs of raw materials, labor costs, shipping and freight may have an influence over amounts per unit that XPEL suppliers invoice to the company.

Film rolls are thermoplastic polyurethane-based products. Prices of raw materials may affect suppliers primarily and XPEL finally.

Thermoplastic polyurethane (TPU) gathers the following properties:

Abrasion/Scratch Resistance.

UV Resistance.

Resilience to oils, greases, and numerous solvents. [3]

Car’s users meet in XPEL PPF protection against damage what may be much more expensive to repair on traditional way. That is more tangible for expensive and luxury cars, where users have a high long-term vision respect to the other car owners.

Customers

XPEL is expanding by acquiring installation facilities and international partners. The strategy depends on the distribution model for each market. That flexibility allows to XPEL more efficiency.

The Company does not enter into commitments to provide goods or services that have terms greater than one year.

XPEL is a B2B and B2C model business. They sell and distribute its products through:

Independent Installers/New Car Dealerships

It includes XPEL protection films, installation training, DAP software and marketing support. XPEL offers 2477 customer service providing installation, software and training support via website and telephone technical support services.

To be considered an authorized dealer, installers must employ certified installers and meet specific requirements as purchase minimums.

Installers can make new purchases depending on DAP software (Cutbanks credits). The company invoices for each cutting pattern, so I can see a virtuous circle.

“It goes without saying that the products are leading the industry - when it comes to paint protection film … window tint, ceramic coating, and some of the other things that XPEL offers. Their products speak for themselves just like Porsche does."

JORDAN TREVINO | PORSCHE BRAND AMBASSADOR

The Company has expanded service offering to new car dealerships with the PermaPlate LLC and TintNet acquisitions.

Dealerships have the following options:

In-house program. Dealerships hire their installers.

Out-sourcing the installation to an aftermarket installer.

Utilizing a labor service model through third parties.

PermaPlate and TintNet add third parties labor option to the company portfolio increasing the exposure to mid-range automobile dealerships.

This channel is around 54% of total revenues.

Distributors

Third-party distributors which sell to other distributors or customers who ultimately install the product to the end customer.

28% of total revenues is trough this channel.

18% of revenues derives from sales to the China distributor Shanghai Xing Ting Trading Co, Ltd.

The China Distributor has a non-exclusive right to use the DAP software and non-exclusive license brand. The China Distributor has a minimum purchase requirement that increase annually,

Company Owned Installation centers.

XPEL operates 11 Company-Owned installation centers. 7 of them in the United States, three in Canada and one in the United Kingdom.

Some of Company-Owned installation centers are located where company independent installers/dealerships operate.

Is it generating a channel conflict?

“We believe these channels have a synergistic relationship with our Company-Owned centers supporting independent installers and dealerships by allowing us to implement local marketing, making inventory available locally for fast delivery, offering overflow installation capacity and assisting with training needs. We believe this channel strategy benefits our goal of generating the most product revenue possible”. [4].

OEM´s /Automobile Original Equipment Manufacturer).

XPEL sells paint protection film and provides installation and pre-delivery inspection to OEMs. It represents around 3% of revenues.

Online and catalog sales.

It includes certain products such as protection kits, car wash products, after-care, and installation tools., representing around 1% of revenues.

Suppliers

The company operates under an asset-light manufacturing model. Third-parties supply XPEL with the majority of its products that comprises three categories:

Product with intellectual property (“IP). Made in a variety of manufacturing locations.

Products that are made for XPEL on an exclusive basis. Made by a third party solely for the Company.

Products that are outsourced on a non-exclusive basis. The Company does not own IP but sourced products on commercial terms from a third party.

Most of products served by suppliers are film rolls that are thermoplastic product-based. Film is a commodity product with certain level of technology on it.

The Company receives its surface and paint protection, automotive window film and architectural window film in a variety of roll forms, including short and master roll format. For some of the Company’s products, the Company engages in a variety of converting activities in its facilities in San Antonio, Texas and in other locations. Depending on the product and the format in which it was received, conversion activities may include: inspection, slitting, rewinding or boxing. Additionally, for some of the Company’s products, including pre-cut film products, the Company performs further conversion which includes cutting film into specific shapes using computer aided cutting equipment. [5]

During FY2021 around 75% of inventory purchases were purchased from Entrotech Inc. Entrotech is an Ohio-based company that supplies automotive paint protection film products to XPEL. They specialize in advanced materials solutions.

“Through our Amended and Restated Supply Agreement that we entered into with Entrotech in March 2017 and renewed in March 2020, we have exclusive rights to commercialize, market, distribute and sell its automotive aftermarket products through March 21, 2022. During such term, we have agreed to use commercially reasonable efforts to purchase a minimum of $5,000,000 of products quarterly from Entrotech”. [6]

Effective October 1, 2022, the Company entered into a new three-year supply agreement with Entrotech under commercially reasonable terms. The previous supply agreement with Entrotech terminated on March 21, 2022. [7]

Regardless of the agreement duration, we may think that XPEL has a high degree of dependency with respect to the suppliers operations. However, as we will see later, the real degree of dependency is not so strong due to:

1.Value proposition.

2.Competitive advantages.

Employees

Number of employees

On December 31, 2021, the Company employed approximately 709 people (full-time equivalents), with approximately 493 employed in the United States and 216 employed internationally.

Loss of key personnel, including members of management as well as key product development, marketing, and sales personnel are key areas in business operations. Loss of key employees could have a negative effect on the Company business. As XPEL continues to grow, more difficult will be to attract talent in key areas in order to maintain a competitive position. personnel we need to maintain our competitive position.

Unit economics

XPEL generates around 84% of total revenues by product revenue (Mainly PPF) and 16% by service revenue.

On the cost side we can consider:

COGS around 64% of revenues.

Cost of sales consists of product costs (84% of revenues) and the costs to provide services (16% of revenues).

Product costs consist of:

Material costs.

Personnel costs related to warehouse personnel.

Shipping costs.

Warranty costs.

Other related costs to provide products to our customers.

Cost of service includes:

The labor costs associated with installation of product in Company-owned facilities.

The labor cost associated with new acquisitions.

Costs of labor associated with pattern design for cutting software (DAP).

The costs incurred to provide training to customers.

Product costs in FY 2021 increased 53.6% over FY 2020. Product revenue increased by around 59%.

Cost of service revenue grew 139.2%

“The increase was due primarily to increased labor costs commensurate with increased installation revenue in our company-owned facilities, increased labor cost associated with our 2021 acquisitions and increased labor costs related to headcount growth required in our production facility to meet increased demand”. [8]

Sales and marketing expenses are around 7% of revenues.

General and administrative expenses represent 13% of revenues.

Depreciation and Amortization expenses represent around 2% of revenues. XPEL reports D&A separately in Cash Flow Statement. Operating expenses reported in the Income Statement include D&A expenses.

Value proposition

Needs are covered by XPEL products from two angles:

End user

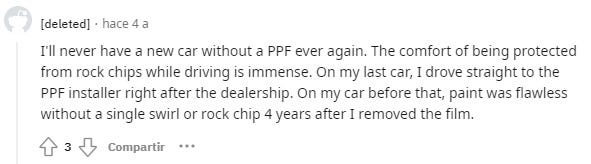

PPF extend the life of the car´s paint and makes that value cars do not depreciate so fast. This is more visible for luxury and premium vehicles.

PPF is self-repairing after being damaged.

PPF is durable respect to ceramic coating.

“When you choose California Tint to add a paint protection film or window tint to your car, you are not only entrusting us with one of your most valuable assets, you are also trusting us to use only high-end products that will protect your car for years to come. This is why we choose to use XPEL products, as they set the industry standard, going above and beyond to provide only the highest quality products”. [9]

Customer

Films installers and EOM´s rely on XPEL based on brand guaranty. End users find an authorized XPEL installer on the Company website. Thus, XPEL provides visibility to installers who do not have a strong web presence.

Essentially XPEL sells clients to their customers.

DAP stores more than 80000 vehicles cutting patterns. This makes a deeper catalogue of services for different types of models.

In other hand, we can see the tremendous influence of labor costs in installation process. DAP software orders the cutting plotter the most efficient pattern reducing wastes and making more efficient the installers work. So, the labor costs, that represent a large amount of installers total cost, are dramatically reduced.

“Of course, when talking about the extent to which XPEL acts as an innovator in the field of vehicle protection, it is important not to forget their revolutionary Design Access Program (DAP) software. DAP is the world’s largest and most comprehensive pattern repository. With over 80,000 patterns on file, DAP gives XPEL Certified Installers the confidence they need to apply XPEL films efficiently and accurately every time, ensuring every XPEL installation goes smoothly”. [10]

“When it comes to protecting your car, you want the job to be done right. We have both the skills and expertise to achieve this for you, along with the help of XPEL’s DAP”.

“This is the design program that allows us to laser cut the film to a precise pattern for every car we cover. That means that the film fits precisely to every panel”.

“There are no dodgy corners and leaving them open to the elements. There are no corrections that need to be made because the film didn’t quite fit. There is no pulling out a Stanley knife to cut a little edge off, even just a little to make it fit. Everything with XPEL is precise - which is unique to XPEL”.

“This technology makes a huge difference to the quality of service we can offer our customers. No matter the model, make, or design of your car, we can use this program to cut a precise pattern unique for your vehicle. Every inch is covered and protected expertly, leaving nothing to chance”.

“In our experience, suppliers of other film don’t provide installers with such a comprehensive database of patterns. Instead, we are required to cut the film by hand a make it fit. This just doesn’t achieve the same level of quality. Corners are harder to get to, corrections are made, and edges need to be trimmed to get the exact fit. On face value, it may look like a great job but it doesn’t compare to the quality and precision offered through the advanced technology of XPEL. Nothing is left to chance”. [11]

Industry

XPEL operates in the consumer discretionary sector and PPF market. Most of sales come from vehicles.

There are about 1.446 billion vehicles on Earth in 2022. 24% of total vehicles are sold in United States, 28% in Europe and 37% in Asia.

Breakdown of vehicles per capita by world region.

1). North America: 0.71 vehicles per capita.

2). Europe: 0.52 vehicles per capita.

3). South America: 0.22 vehicles per capita.

4). Middle East: 0.18 vehicles per capita.

5). Asia/Pacific: 0.14 vehicles per capita.

6). Africa: 0.05 vehicles per capita.

7). Antarctica: 0.05 vehicles per capita.

[12]

The global automobile sector is a huge contributor to the growth of the global paint protection film market. The expanding automobile sector, coupled with supportive government policies for safety and carbon emissions, will further increase the footprint of the market. Increasing population and rapid urbanization will play a pivotal factor in increasing vehicular sales across the globe.

“It was the height of the Vietnam War, and the U.S. Department of Defense (D.O.D.) was receiving one report after another of helicopters being significantly damaged by shrapnel and debris. This was especially apparent on areas like rotor blades, and across surfaces carrying sensitive military equipment.

According to automotive experts, the D.O.D. set out to find a solution, which is precisely when good old 3M comes into the picture. The textile and chemical giant was gung-ho about finding a solution to this problem, and tasked some of its greatest minds with developing a protective layer that could be just as resilient as it was transparent and lightweight.

Before long, the U.S. military was presented with what appeared to be a solid solution to its chopper problem. By modifying the chemical structure of a super strong urethane film, 3M’s engineers had developed a product that could withstand both significant amounts of elemental abuse, and moderate surface damage from things like artillery shrapnel. Inexpensive, relatively easy to apply and replace, and resistant to UV degradation and common aviation fluids, this film was an instant success”. [13]

The global pandemic negatively affected the paint protection film market. Lockdowns and disruptions in the supply chains affect to the market. A majority of resources were reallocated towards the healthcare.

PPF for vehicles is a low penetration product in Europe or Asia. But market more mature like Canada or United States have potential still.

Being a discretionary product, PPF market may be sensitive to disruptions such as economic recession. However I think that it could be compensated with a high level of acceptance.

“The global paint protection film market is projected to grow from $456.8 million in 2021 to $697.1 million in 2028 at a CAGR of 6.2% in the forecast period”. [14]

Read More at:

https://www.fortunebusinessinsights.com/paint-protection-film-market-102936

Competitors

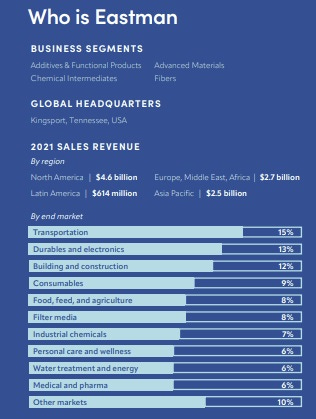

Eastman

Eastman Chemical is a company specializing in chemical processes and polymer science. They compete with XPEL mainly through under the Llumar and Suntek brands.

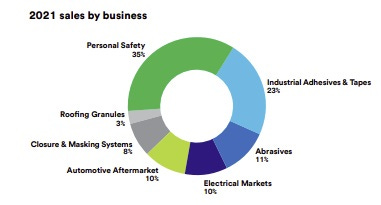

3M

Minnesota Mining and Manufacturing Company; is a United States-based company that investigates, develops, manufactures and sells diversified technologies. They competes with XPEL through Scotchgard™ line products, a PPF that offers Self-healing technology.

Expert comments: “XPEL Clear Brand outperforms 3M when regarding self-healing properties. Even though 3M was the first company to enter the clear paint film industry, XPEL manufactured the first-ever self-healing film, which means that a scratched surface looks new shortly, even after a scratch”.

The 3M Lawsuit

After nearly two years of court filings, 3M and XPEL reached a agreement in a patent infringement lawsuit brought forth by 3M on December 30, 2015 in federal district court in Minnesota.

The original suit alleged that XPEL’s XPF PPF product infringed 3M’s U.S. Patent No. 8,765,263 (`263), which is “a multilayer protective film comprising a first layer, a second layer and a pressure-sensitive adhesive layer.” XPEL denied the allegations.

The companies have now agreed to a settlement, under which XPEL will acquire a license to the ‘263 patent. [15]

Competitive advantages

Intangible assets

"Patent Lawyers Drive Nice Cars". [16]

CEO Says: “Software company as a standalone business model was not a very good business. It took, it took different management wasn't me, before me in around 2008 to say, hey, this concept of paint protection film has a lot of legs. It's a really good product, but it needs more than software and patterns. It needs a brand, it needs training, it needs consumer awareness, it needs all of these other things”.

XPEL is a tech company that sells physical products. Intellectual property rights play a key role in The Company strategy since they give to XPEL capacity to maintain its competitive advantage.

“We own intellectual property rights, including numerous patents, copyrights and trademarks, that support key aspects of our brand and products. We believe these intellectual property rights, combined with our brand name and reputation, provide us with a competitive advantage”. [17]

XPEL brands are recognizable and prestigious from two angles:

End users take the XPEL value proposition as the best solution to protect car paint surfaces.

Customers that rely on XPEL product as the best way to generate new clients and improve efficiency and profitability through DAP Software.

Switching costs

“Sticky customers aren’t messy, they’re golden”. [18]

54% of XPEL revenues are from Independent Installers/New Car Dealerships channel. To understand The Company switching cost advantage we should put ourselves in customer shoes.

XPEL provides customers with protection films, installation training, DAP software and marketing support. DAP is a key point in a value delivered to installers who will refuse to switch to competence products due to the high costs incurred with respect to the theorical cut in price. Thus, XPEL creates captive customers.

High cost may be:

A less efficient cutting pattern.

Weaker base of cars pattern.

Loss of clients.

Adaptation to new process and new cutting software.

Installer says: “We love the DAP that is offered by XPEL. The accurate pre-cut kits result in better fitment and it reduces our installation time by 25%. All of this makes both our installers and clients happy. There is no need for disassembly and the pre-cut kits allow for better coverage from rock chips".

Ultimately XPEL ensures to sell film creating captive customers through to the large software benefits.

Growth

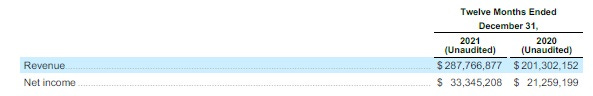

The acquired companies were consolidated into financial statements on their respective acquisition dates. The aggregate revenue of 2021 acquisitions consolidated into 2021 consolidated financial statements were $16,569,435. Thus, we can say that 2021 organic growth was around 52%.

Unaudited consolidated pro forma combined financial information.

United States and Canada are the most mature market. Europe is a low penetration market and it represent a strong growth opportunity.

CEO says: “Europe is under-penetrated and it is 6 years behind U.S. in terms of market development. So we see a huge opportunity in the market itself and then for the opportunity for that to impact the business globally, so that's sort of driven the steps that we in a sense replicate what we're doing in the U.S. and Europe but obviously be mindful of the differences and differences that we need to operate but that's what driven that investment”.

Market size target for United States is around 0.75-1 dollars per capita.

The key is understand that XPEL product is very innovative and markets are under-penetrated.

The cornerstone of growth is that Europe is a very under-penetrated market. We can assume 15-20% of U.S market penetration .

If XPEL reaches similar penetration in Europe the market size may be extremely large.

From that point of view the strategy is straightly related to maintain a dominant position in Canada, showing a great execution in U.S market keeping in mind the great opportunity of European market where around 28% of cars are sold.

MACRO GROWTH OPPORTUNITIES

Rock Chips Are Top Consumer Complaint

Paint Protection Film Low Penetration to New Cars Sold

Fragmented Market Provides Opportunity Ripe for Consolidation

Dealerships Need Tangible, Profitable Products

Equivalent Opportunities Domestically & Internationally

Down Market Penetration Opportunity With Dealership Services Business

Capital Allocation

M&A

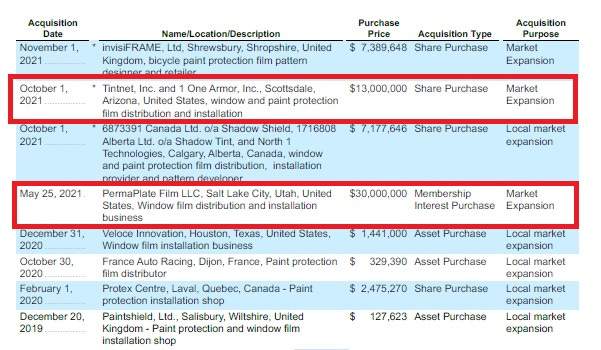

Tintnet

October 1, 2021.

Tintnet is a window film installation business. The company is located in Arizona, United States.

The rationale is market expansion in window film segment.

PermaPlate Film LLC

May 25, 2021.

PermaPlate is a Utah-based company that is specialized in window film installation.

The rationale is market expansion in window film segment.

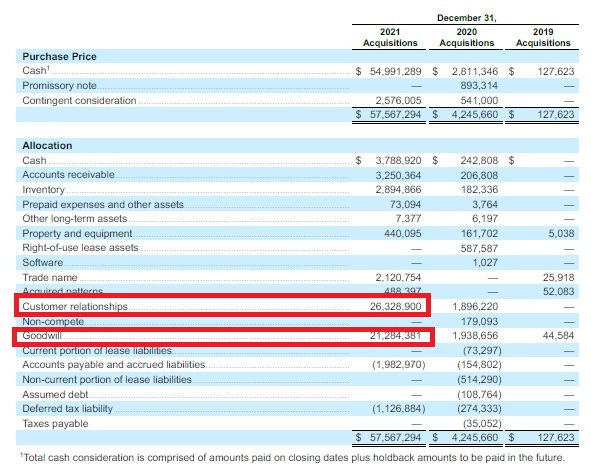

The purchase price for each acquisition was allocated to the identifiable assets acquired and liabilities and contingent liabilities assumed based on their respective fair values, including customer relationships totaling $26.3 million.

Both businesses have improved installation labor segment.

CEO says : “As mentioned before, XPEL has been busy acquiring key businesses, and the acquisition of PermaPlate and Tint Net acquisitions in 2021 allowed XPEL to add a third-party labor option to their service portfolio. Thanks to this addition, XPEL's service revenue (particularly the installation labor segment) more than doubled in 2021 compared to 2020 ($24 M in 2021 and $10 M in 2020), and this trend continued into 2022. The service business is a higher margin segment, so this significant growth in services resulted in an overall margin improvement”.

CEO says: “We closed the acquisition of the paint protection film business of our Australian distributor in october”. “We are already seeing great progress in momentum in Australia in a short time since we acquired the business”.

Strategy

“XPEL is currently pursuing several key strategic initiatives to drive continued growth. Our global expansion strategy includes establishing a local presence where possible, allowing us to better control the delivery of our products and services. We will continue to add locally based regional sales personnel, leveraging local knowledge and relationships to expand the markets in which we operate”.

“XPEL also continues to expand its delivery channels by acquiring select installation facilities in key markets and acquiring international partners to enhance our global reach. As we expand globally, we strive to tailor our distribution model to adapt to target markets. We believe this flexibility allows us to penetrate and grow market share more efficiently. Our acquisition strategy centers on our belief that the closer the Company is to its end customers, the greater its ability to drive increased product sales. In our last fiscal year, we acquired several businesses serving multiple markets in the United States, Canada, and the United Kingdom, in furtherance of this objective, and we have continued this trend with an October 2022 acquisition in Australia”. [19]

Shareholder retribution

“We have not paid any cash dividends on our Common Stock to date and do not anticipate any cash dividends being paid to holders of our Common Stock in the foreseeable future”. [20]

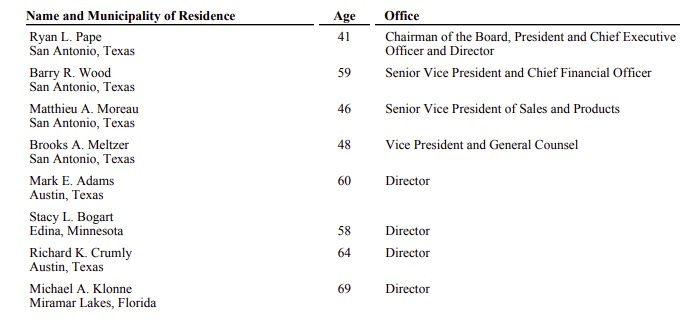

Management team

Board of Directors and Executive Officers

Executive Officers

Ryan L. Pape has served as our President and CEO since 2009, as a director since 2010 and Chairman of the Board of Directors since 2019. From 2008 to 2009, Mr. Pape served as our Vice President of Operations, and has previously also served in other positions in operations and technology within the Company.

Mr. Pape who graduated from the University of Texas in Austin with a Bachelor of Science Degree in Computer Science, started his career in technology consulting. [expel.com]

Barry R. Wood joined the Company in June 2016 as Senior Vice President and CFO. He covers the Company’s finance functions. Mr. Wood have spent his e professional career in the public accounting and finance fields.

From 2011 to 2016, Mr. Wood was Vice President of Dispensing Operations with OptumRx, Inc.

From 2008 to 2011, Mr. Wood served as the Chief Financial Officer of PTRX, Inc., a pharmacy benefits and prescription home delivery company.

Prior to this, Mr. Wood served in various executive finance roles with AT&T and audit manager for Ernst & Young.

Mr. Wood graduated from Southern Illinois University - Edwardsville with a Bachelor of Science Degree in Accountancy, and obtained his Master of Business Administration with a Finance Concentration (MBA) at the University of Texas - Dallas. He earned his Certified Public Accountant designation in 1986 . [21]

Directors

Mark E. Adams is a entrepreneur who spent the first 17 years of his career working for large companies such as Xerox, Johnson & Johnson and Bostik, Inc., and has spent the last 16 years creating, building, running and selling several successful companies in a variety of different industries.

In 2000, Mr. Adams left Bostik to pursue an entrepreneurial path and bought a minority interest in a small Industrial distribution business. There he grew sales and net income by almost 300% in three years. Upon selling his interest in that company in 2003, Mr. Adams then founded Advocate, MD Financial Group, Inc., which created and operated what became one of the largest medical liability insurance underwriting companies in Texas and Mississippi.

Mr. Adams sold that company in 2009 and continued running the company as President and CEO until 2011.

Mr. Adams is co-founder of following companies:

Murphy Adams Restaurant Group, Inc.Kind Health, Inc.

Ayro Automotive, Inc. (NASDAQ),

Future Medical Products, LL.

Evergreen Farms, LLC.

Sun House Ventures, LLC.

Mr. Adams served on the Board of Directors of Astrotech, Inc. (Nasdaq: ASTC) and Ayro, Inc. (Nasdaq: AYRO).

Mr. Adams is a large individual XPEL stockholder and has served on the XPEL Board of Directors since 2010. [22]

Strategy

CONTINUE GLOBAL EXPANSION

Operations in 9 Countries

Build Out Sales Team In Under-penetrated Geographies.

DRIVE GLOBAL BRAND AWARENESS

High Visibility At Premium Events.

Advertising Placement In Media Consumed By Car Enthusiasts.

EXPAND NON-AUTOMOTIVE PRODUCT PORTFOLIO

Find Opportunities That Leverage The Channel and Brand.

Find Opportunities That Leverage Existing Products & Technology.

CHANNEL EXPANSION VIA ACQUISITION

Acquire Select Installation Facilities in Key Markets.

Acquire International Partners for Global Reach.

[23]

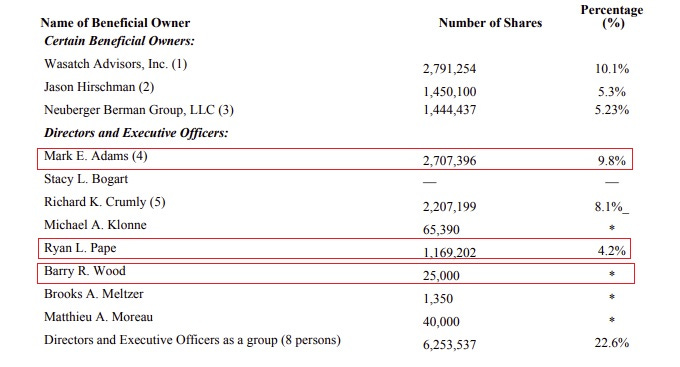

Security Ownership

*Less than 1%

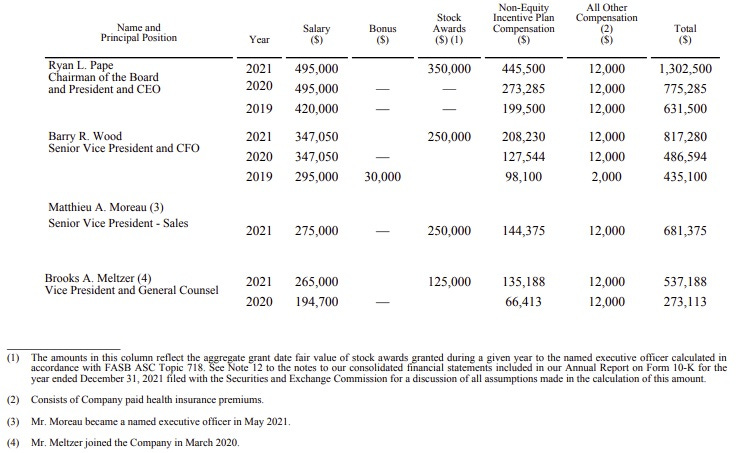

Compensation

“The Company’s compensation philosophy is to provide compensation that will attract and retain high-performing talent, motivate the Company’s executive officers to create long-term value and enhance stockholder value, provide a fair reward for their accomplishments, and foster our executive officers’ professional and personal growth. The Company believes that the compensation of its executive officers should align the executive officers’ interests with those of the stockholders and focus executive officer behavior not only on the achievement of near-term corporate goals, but also on the achievement of long-term business objectives and strategies”. [24]

The Company maintain excellent executive compensation and governance practices.

Grant compensation is at-risk and variable.

Short-term incentive compensation is measurable and rigorous.

Compensation is compared against industry peer group.

They do not reprice stock options.

They do not allow hedging of Company Stock.

They do not provide supplemental executive retirement plans.

Peer Group and Benchmarking

The Compensation Committee use a peer group of 13 companies to evaluate salaries, bonus and long-term incentive plan.

Clarus Corporation

Marine Products Corporation

WD-40 Company

Dorman Products, Inc.

Marrone Bio Innovations, Inc.

Winmark Corporation

e.l.f. Beauty, Inc.

Mister Car Wash, Inc.

YETI Holdings, Inc.

Fox Factory Holding Corp.

Purple Innovation, Inc.

GrowGeneration Corp.

Vivant Smart Home, Inc

The pay ratio calculation as of December 31, 2021 was 33:1. Pay ratio is calculated by dividing the total 2021 compensation of the CEO by the total 2021 compensation of the median employee. The total compensation of XPEL median employee is $39,613.

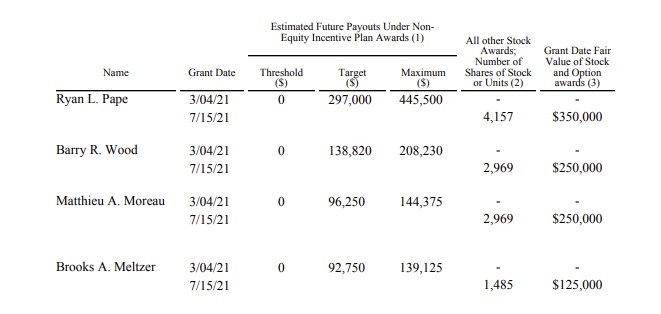

Grants Of Plan-Based Awards

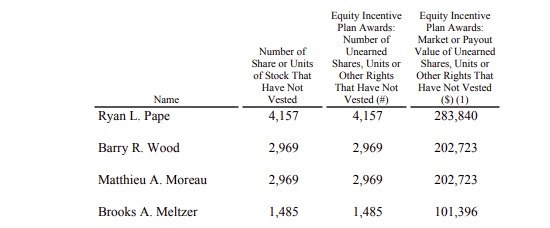

Outstanding Equity Awards At Fiscal Year End

The market value was calculated based on the closing price of XPEL’s common stock on December 31, 2021 of $68.28 per share multiplied by the number of shares of stock that had not vested as of December 31, 2021.

There were no exercises of stock options and other stock awards by any named executive officers during the fiscal year ended December 31, 2021 and none of the Restricted Stock Units awarded in 2021 had vested as of December 31, 2021.

XPEL does not sponsor any pension benefit plans and none of the named executive officers contribute to such a plan.

XPEL does not sponsor any non-qualified defined compensation plans or other non-qualified deferred compensation plans and none of the named executive officers contribute to any such plans. [25]

Risks

Given that XPEL sells discretionary products, global economic crisis could negatively affect to sales, results of operations, and financial condition.

Future events, like legal conflicts or demands, could have an influence on the company reputation. (See The 3M Lawsuit).

Products may suffer obsolete by launching of alternatives and substitutes in the market.

Customers such as OEM´s could launch their own technology to compete with XPEL.

DAP could loss value delivered to installers who may find out alternatives, eroding films sales and results of operations.

Strategy related to acquisitions and investments could be unsuccessful or consume significant resources.

The company may incur substantial indebtedness in the future to meet the expansion strategy.

Under-penetrated markets where potential is higher, requires investment capital. The company may adopt a erratic strategy of capital allocation to meet the targets.

Catalysts

PPF is a innovative product. Market size may growth strongly, specially in under-penetrated markets as Europe.

Electric vehicles trend.

Global market cars.

Financial Metrics

Financial Statements as reported

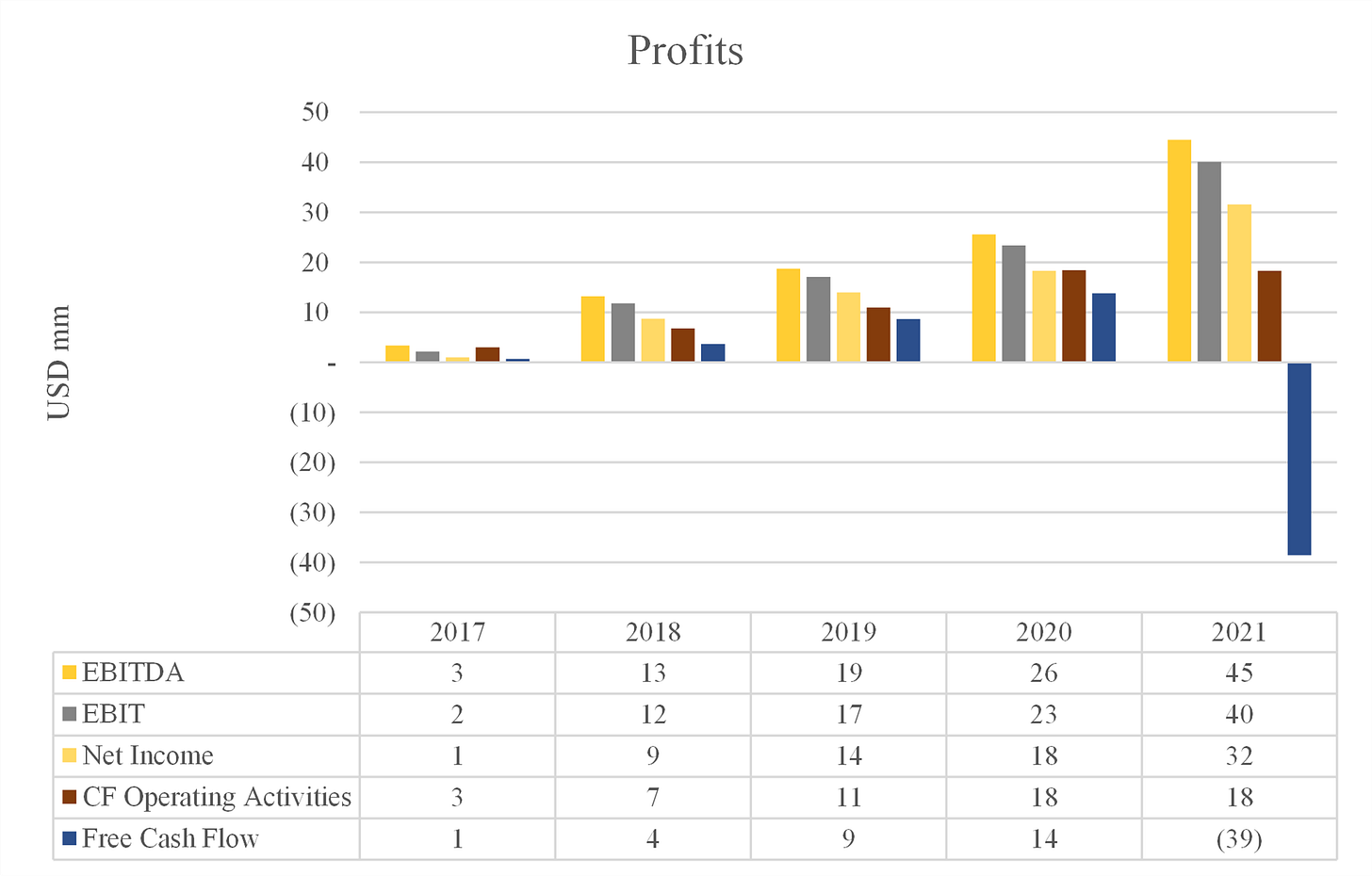

Earnings

Positive trend of EPS due to an increase in NI.

Capital structure analysis

Capital employed increased for 182% due to intangibles assets acquisition what have a weighted average useful life of 9 years, and an increase in WC investment.

Capex is calculated ex acquisitions. Including acquisition for FY 2021 Capex is around USD 57 M.

Profitability

FCF margin for FY 2021 is negative due to acquisition. Gross margin trend is very positive.

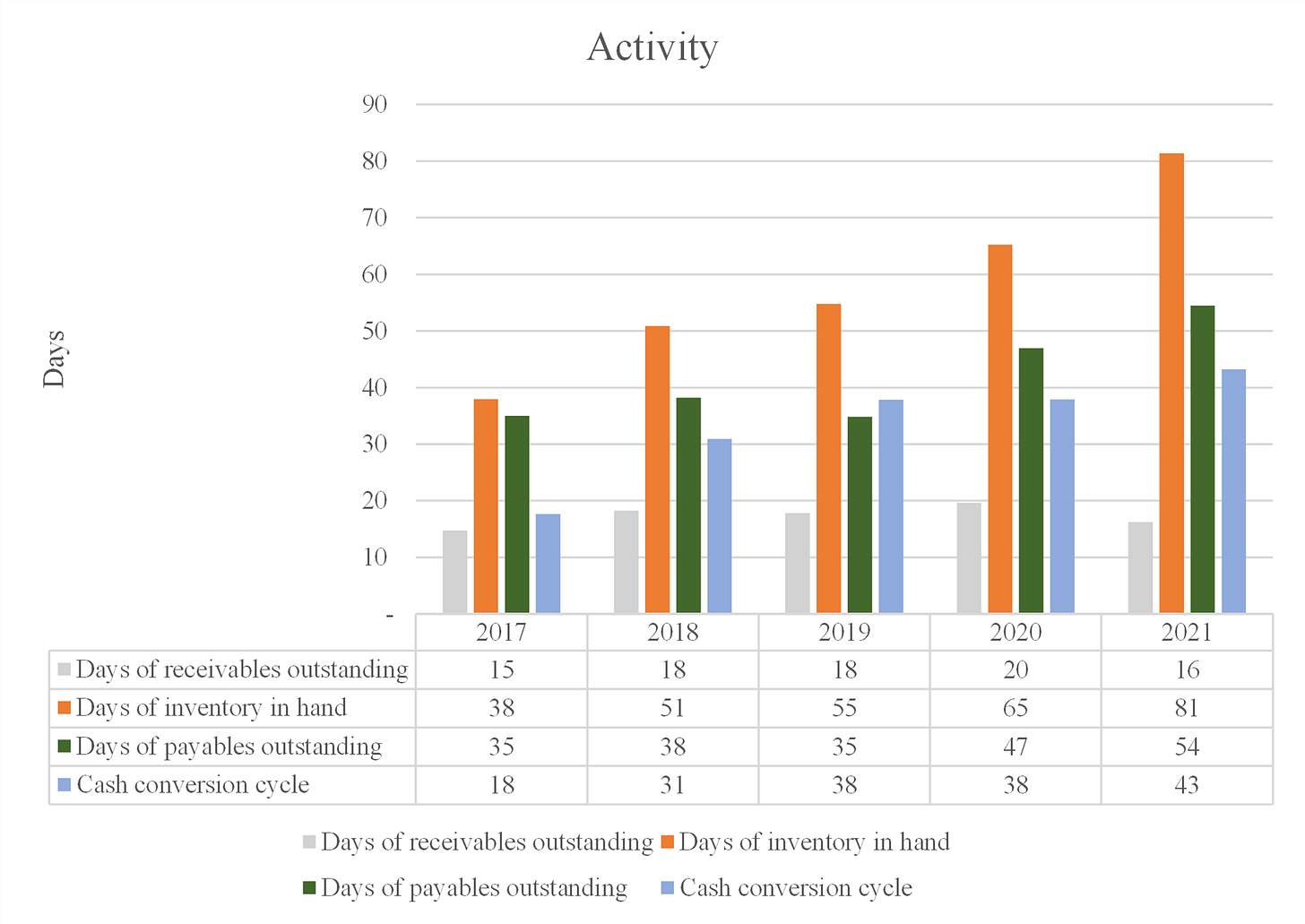

Operating cash flow lower or same than NI is a sign of low profitability. In this case due to high expense in WC in last four financial years (mainly changes in inventory).

High ROCE suggests a very asset light model and a good quality of business.

Activity

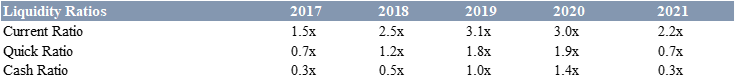

Liquidity

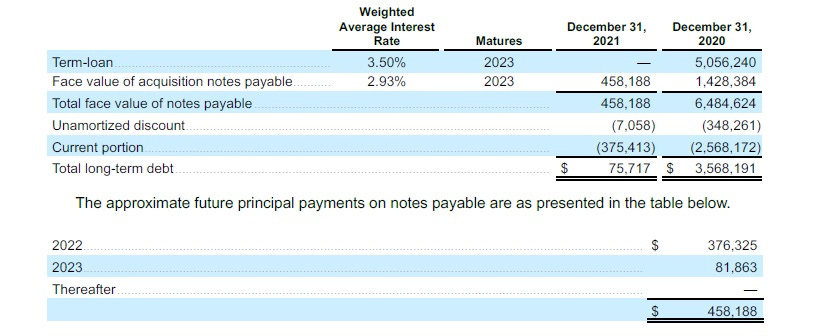

Solvency

XPEL has a $75,000,000 revolving line of credit with Texas Partners Bank (which does business as the Bank of San Antonio) established on May 21, 2021.

This facility is utilized to fund the Company's working capital needs and other strategic initiatives. Borrowings under the credit agreement bear interest on borrowed amounts at the Wall Street Journal U.S. Prime Rate less 0.75% per annum if the Company's EBITDA ratio is equal to or less than 2.00 to 1.00 or the Wall Street Journal U.S. Prime rate less 0.25% if the Company's EBITDA ratio (as defined in the facility) is greater than 2.00 to 1.00. The facility also contains a fee of 0.25% of the unused capacity on the facility. The interest rate for this credit facility as of December 31, 2021 was 2.50%. The Company paid interest charges on borrowings under this facility of $154,549 during the year ended December 31, 2021, and had a balance of $25.0 million as of December 31, 2021. This facility matures on July 5, 2024.

Covenants:

Senior Funded Debt (as defined in the Loan Agreement) divided by EBITDA (as defined in the Loan Agreement) at or below 3.50 : 1.00 when tested at the end of each fiscal quarter on a rolling fourquarter basis.

A minimum Debt Service Coverage Ratio (as defined in the Loan Agreement) of 1.25 : 1.00 at the end of each fiscal quarter when measured on a rolling four-quarter basis.

The Company has a CAD $4,500,000 revolving credit facility through HSBC Bank Canada, and is maintained by XPEL Canada Corp. This Canadian facility is utilized to fund the Company's working capital needs in Canada. This facility bears interest at HSBC Canada Bank’s prime rate plus 0.25% per annum and is guaranteed by the parent company. As of December 31, 2021 and 2020, no balance was outstanding on this line of credit.

As of December 31, 2021 and December 31, 2020, the Company was in compliance with all debt covenants. [26]

“Our business strategy may include incurring more indebtedness in the future. We recently increased the amount of our revolving credit facility to $75.0 million, of which $25.0 million was outstanding as of December 31, 2021. Our degree of leverage could have important consequences for the holders of our Common Stock, including increasing our vulnerability to general economic and industry conditions; requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing our ability to use our cash flow to fund our operations, capital expenditures and future business opportunities; restricting us from making strategic acquisitions or causing us to make non-strategic divestitures, limiting our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions and general corporate or other purposes; and limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged. Any of the above consequences could result in a material adverse effect on our business, financial condition and results of operations”. [27]

Valuation

[1][2] https://www.exclusivepaintprotection.com/paint-protection-film-ceramic-coating/

[3] https://omnexus.specialchem.com/selection-guide/thermoplastic-polyurethanes-tpu

[4][6][8][17][19][20][26][27] Annual Report FY2021

[5] Annual Report FY2019

[7]https://www.sec.gov/ixdoc=/Archives/edgar/data/0001767258/000176725822000060/xpel-20221001.htm]

[9][10] https://mycaliforniatint.com/why-we-use-xpel/

[11] https://www.ausdetail.com.au/blog/why-we-use-xpel-paint-protection-film]

[12] https://hedgescompany.com

[13] Avalonking.com

[14] https://www.fortunebusinessinsights.com/paint-protection-film-market-102936

[15] https://www.windowfilmmag.com/2017/03/3m-and-xpel-settle-lawsuit/

[16] Pat Dorsey The Little book that builds wealth. Page. 34

[18] Pat Dorsey The Little book that builds wealth. Page. 43

[21][22] xpel.com

[23] XPEL Presentation

[24] [25] XPEL DEF-14 A Proxy Statement 04/08/2022