Analysis date: Jul 14, 2023.

Price return since analysis date: +78.32%

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

At the current date, I own YONEX shares, representing around 6% of my portfolio.

Company Overview

Yonex Co. is a Japan-based company that manufactures, purchases, and sales sports equipment such as sportswear, and also operates related sports facilities.

The Company manufactures badminton rackets, tennis rackets, golf clubs, clothing and shoes, snowboards, shuttlecocks, strings, stringing machines, etc.

Yonex is one of the most famous and well-respected brands in the racquet sports universe.

To know more: YONEX

Q3´25 Results.

Net sales +19.5% YoY.

Gross margin 46% (44%).

Operating Profit ¥11.3 bn. +38.8%.

EBIT margin 11.19% (9.63%).

Net Profit ¥9.2 bn. +47.3%.

EPS ¥107.14 (72.63).

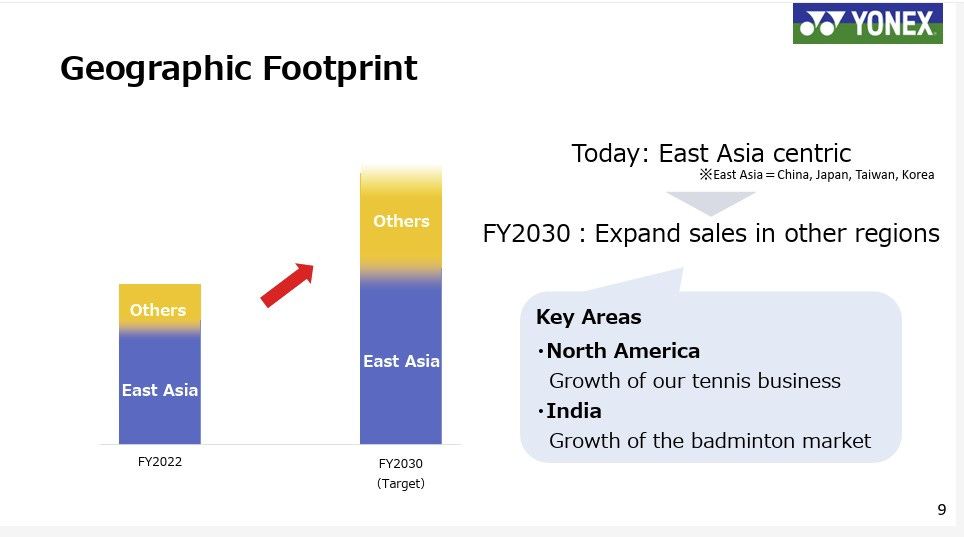

Net Sales by geography

Japan +11.4%.

Asia +28.5%.

North America +7.5%.

Europe +21.6%.

Sporting Goods Division

Badminton +18.8%.

Tennis +4.5%.

Golf -8.8%.

Others +34.1%.

Sports facilities +7.8%.

Forecast for the fiscal year ending March 2025

Assumptions:

The sports market is expected to continue trending solidly.

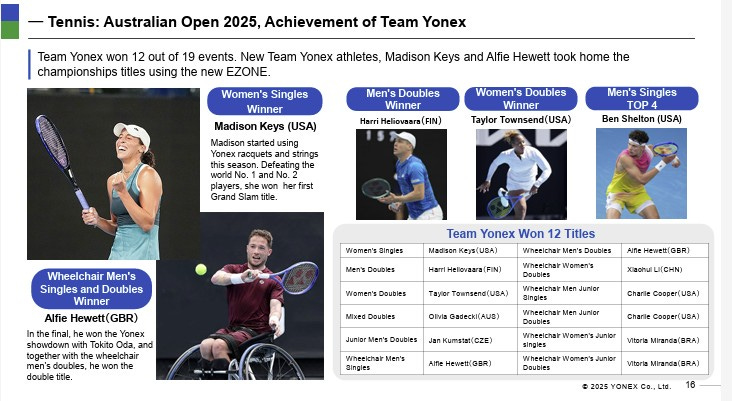

The Company increases marketing investments, leveraging the achievements of athletes in international tournaments to broaden the fanbase.

Net sales ¥134,000 mm +15.1%.

Operating profit ¥13,100 mm +12.8%.

EBIT margin 9.8%.

Earnings per share ¥115.58.

Dividend ¥21 per share.

If you are a professional or qualified investor, and you like my work, don't hesitate to contact me.