Other writeups:

Hyfusing Group Holdings United.

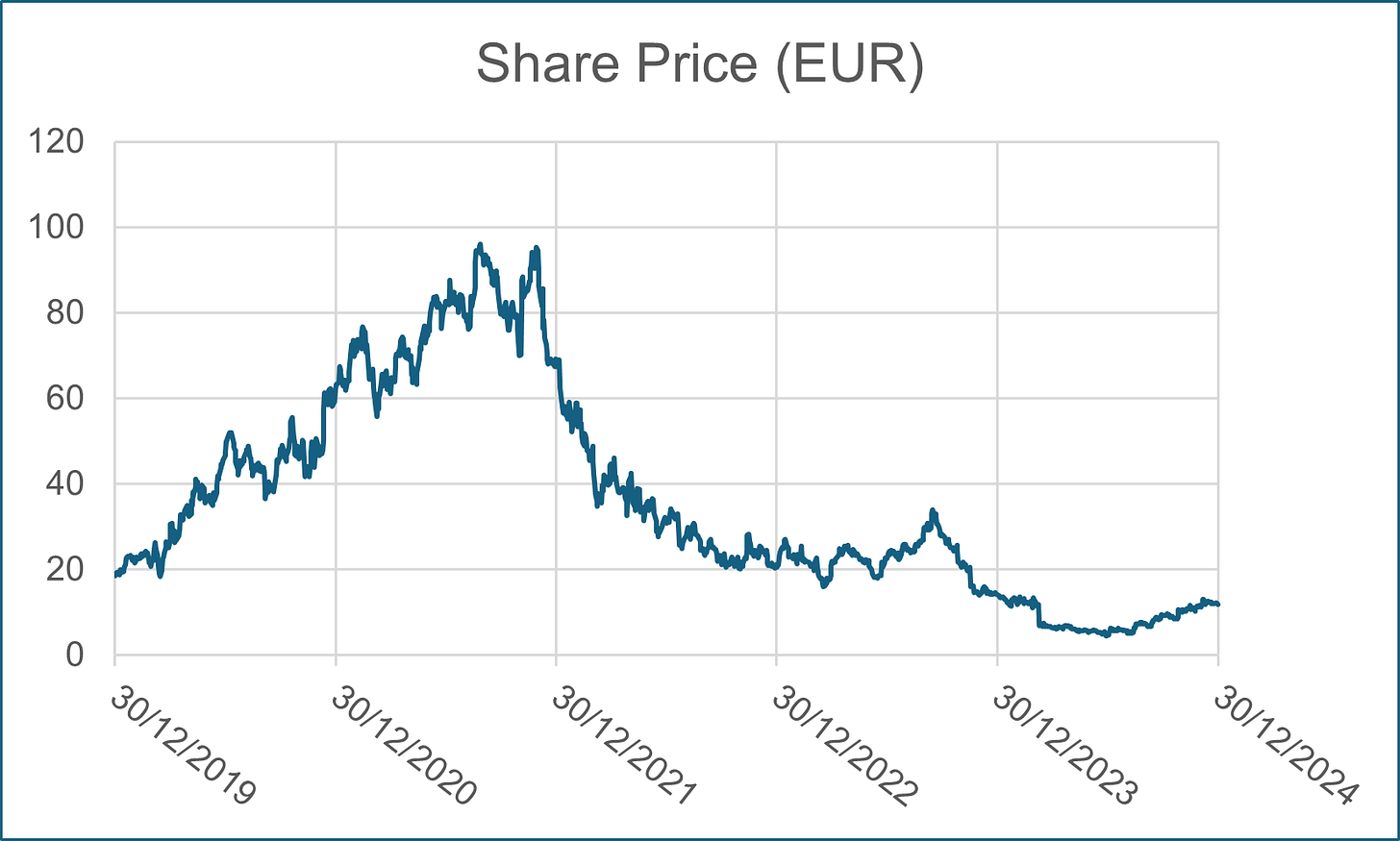

Analysis date: December 30, 2024.

Key Points

Leading meal-kit globally.

High Gross and contribution margins.

Excellent execution.

Key person with skin in the game.

Controversial business.

Questionable but strong competitive advantage.

Business model misunderstanding by the market, but stocks highly undervalued.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

I own Hellofresh shares. Around 7% of total portfolio.

Introduction

Hellofresh is not a small and unknown gem, that you are used to seeing here.

I consider it a company that is well-known and covered by analysts and retail investors. Maybe a lot of you know Hellofresh, actually. However I have considered to write a shorter and more focused on quality side thesis due to a couple of reasons:

It is a very controversial thesis. The Stock has been severely battered due to an erroneous way of understanding the business model of Hellofresh.

I have a high level of conviction in the stock, being an important position in the portfolio. Without meaning to be categorical, I think HelloFresh has a very high upside. So, I think that It is a good way to finish 2024.

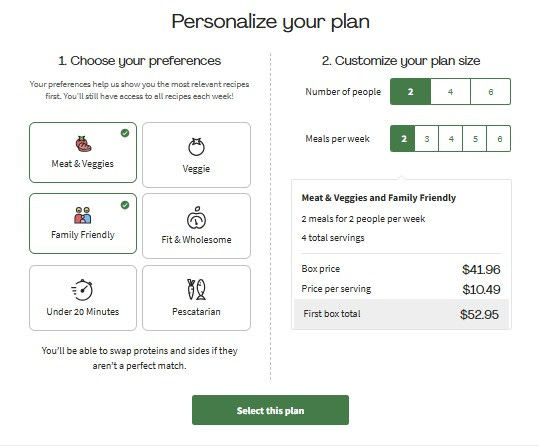

Hellofresh SE (HFG.DE) is a German company founded in 2011 as meal kit provider. The Company is focused on home delivery solutions globally. Currently, Hellofresh operates in countries.

The company, together with its subsidiaries, offers a vast variety of products, such as premium meals, protein swaps, double portions, and extra recipes, as well as add-ons, such as soups, snacks, fruit boxes, desserts, premium online butcher, pet food, etc.

In addition, to Meal-kits, Hellofresh entered the Ready-to-eat meal business (RTE), through the Factor 75 acquisition in 2020.

Business Model

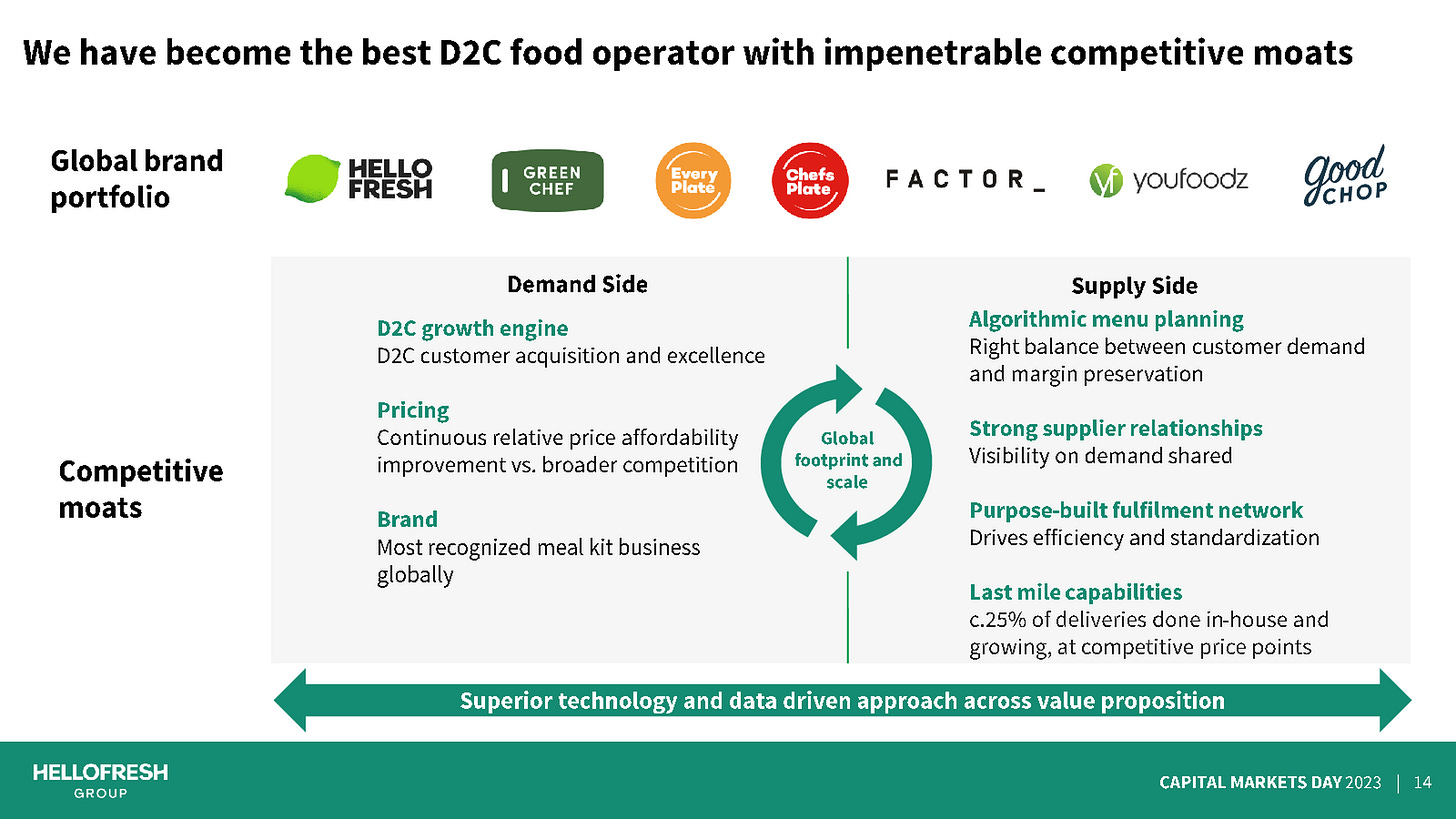

HelloFresh is a D2C business what offers meal-kit solutions. Its operations comprise:

Meal-kits solutions.

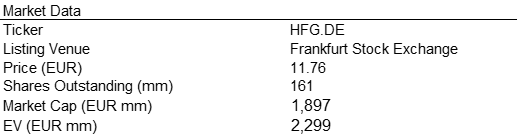

Consumers receive at home a weekly box with at least 2 dinners for two people. The ingredients are proporcionated according with thhe recipes included in the box.

The subscription can be cancelled an reactivated at any time.

The company operates its meal-kit business through the brands HelloFresh, Green Chef, EveryPlate and Chefs Plate.

Meal kits represent around 80% of total revenue.

Ready-to-Eat (RTE).

HelloFresh entered the direct-to-consumer ready-to-eat meals business (“RTE”) through the Factor brand in the US in 2020.

HelloFresh has since expanded its geographic RTE presence to Australia through Youfoodz (acquired in 2021) and in 2023 also launched the Factor brand in Canada, the Netherlands and Belgium.

RTE represents around 19% of total revenue.

Other: butcher, pet food and, add-ons (soups, snacks, fruit boxes, desserts, breakfast and ready-to-eat meals and seasonal boxes).

Other revenue represents around 1% of total revenue.

The model caters to a diverse customer base, including:

Trialists, who tries and drop the service.

Seasonal, who tries the service for a couple of months, stops the servive and comes back.

Occasional, who thinks of Hellofresh as a meal solution for one-time events.

Frequent users, deeply engaged with the service.

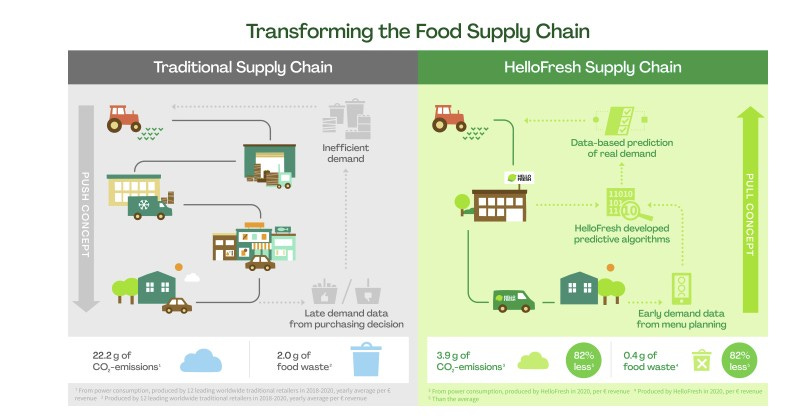

Hellofresh business is vertically integrated and allow to capture more margin in respect to grocery models due to the waste reduction and direct sourcing model that removes intermediaries.

Hellofresh operates with national suppliers what changes the model in respect to traditional grocery chains. It provides a more regular supply for a specific market gaining in efficiency, flexibility and costs. Meal-kits are a very good channel for suppliers to market their products.

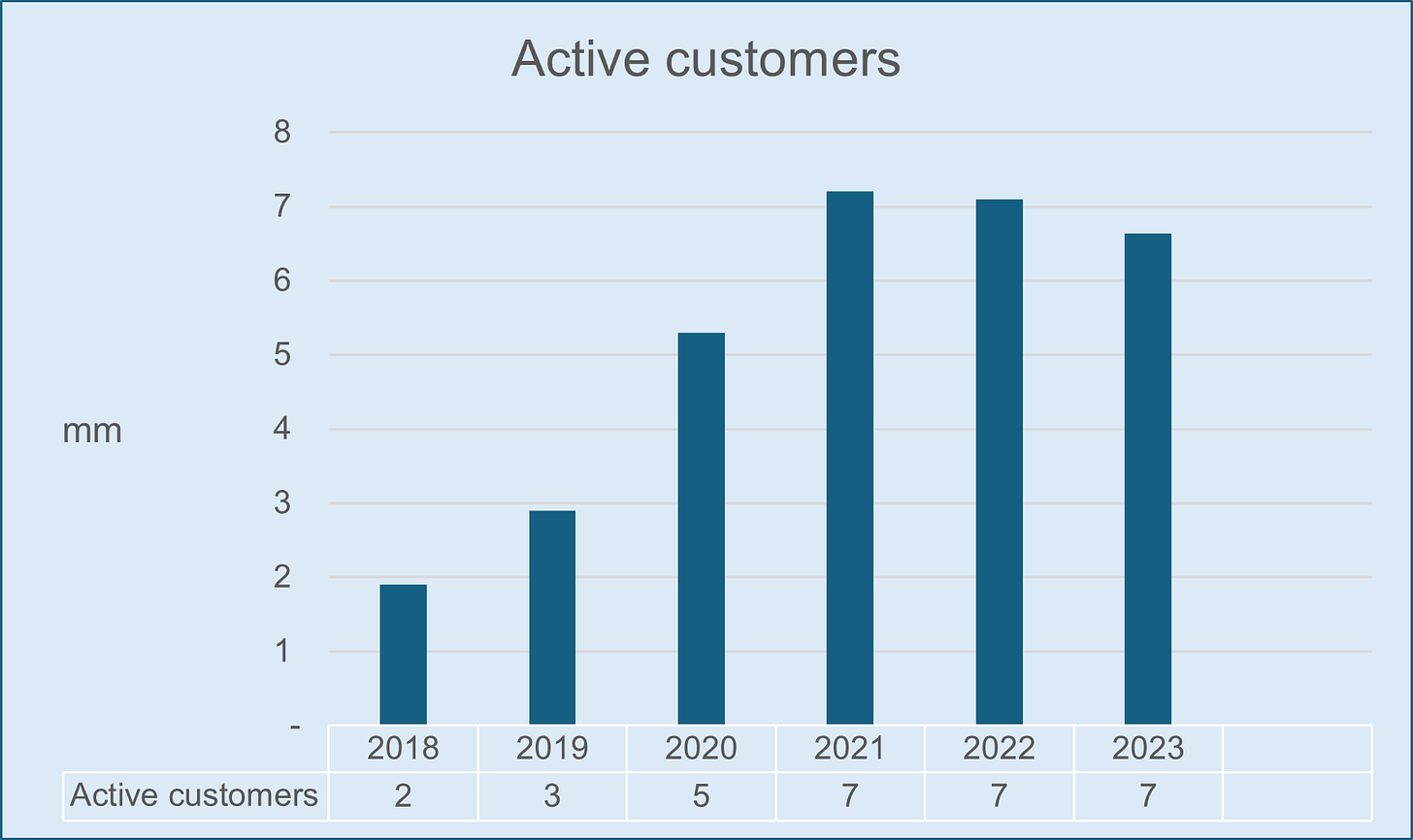

Active customers receive at least one box within the preceding three months (including first-timers and trial customers, customers who received a discounted box and customers who ordered during the relevant period but discontinued their orders and registration with us before period end) counted from the end of the relevant period. In case a household has ordered from two separate HelloFresh brands in the same three-month period, this household would count as two active customers.

The subscription model provides a predictable income stream for the company.

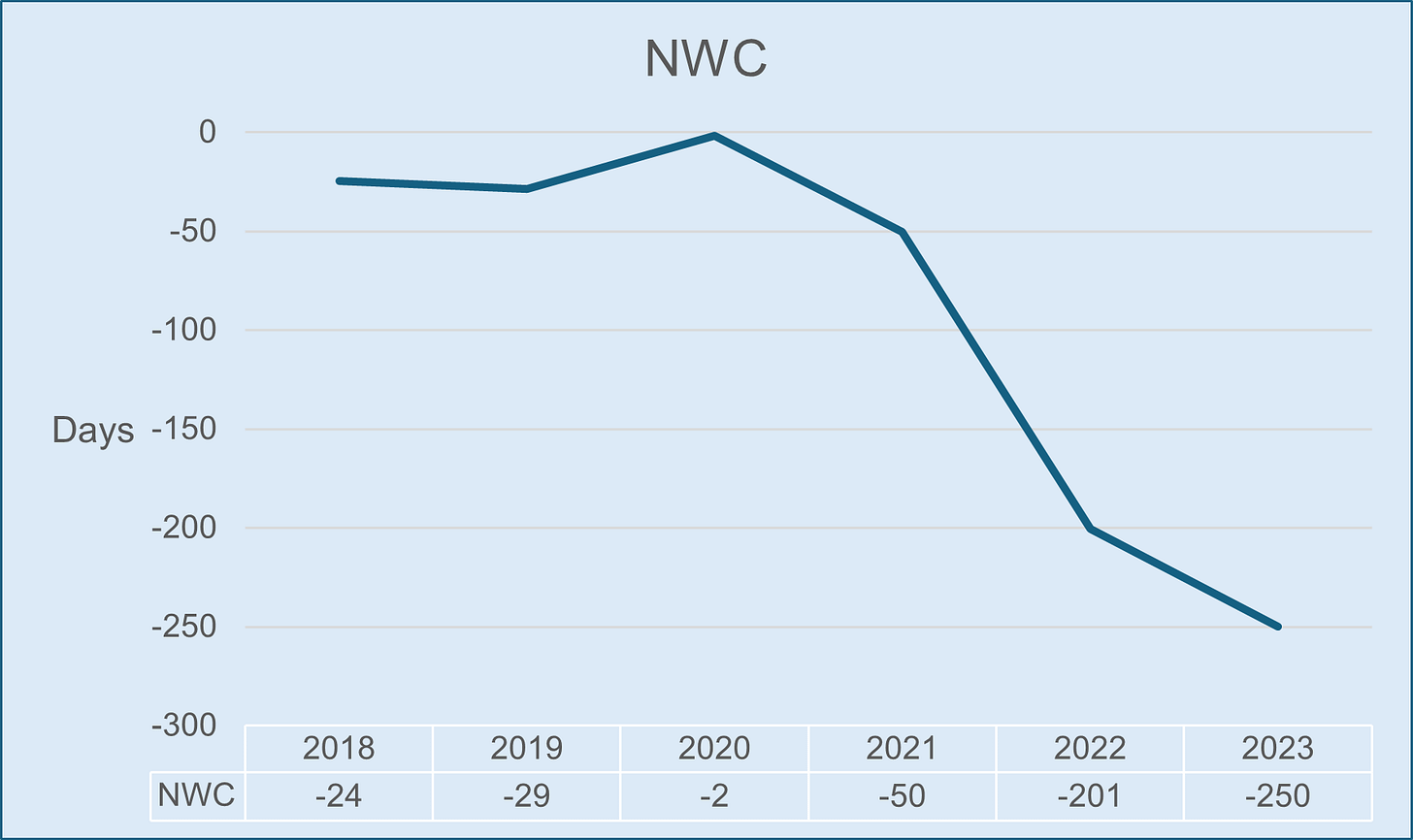

As we will see later, Hellofresh NWC is negative precisely because of this. The Company charges its subscribers at the time but pays its suppliers much later (Around 60 days). This dynamic creates a virtous circle from an attractive cash conversion cycle.

CCC for 2023 is negative around 50 days.

Taking only 50% of cash to operate the business the NWC is negative which in effect indicates a high capacity to finance operations with suppliers and customers.

Value proposition

Meal-kits become a popular way to discover new recipe and cook fresh and healthy at a fair price.

Hellofresh is a preference builder for customers looking for easy and tasty recipes.

A good summary of Hellofresh's key advantage: customization. Here's why it's so important:

Appeal to Diverse Audiences: Different dietary needs and preferences are widespread. By offering a variety of plans, HelloFresh can cater to a much broader customer base, from vegetarians and vegans to those with specific allergies or those simply looking for low-carb options.

Increased Customer Satisfaction: When customers can easily find meals that align with their dietary restrictions and preferences, they are more likely to be satisfied with the service and continue their subscription.

Reduced Customer Churn: The ability to customize prevents customers from feeling limited by the menu, which is a common reason for subscription cancellations.

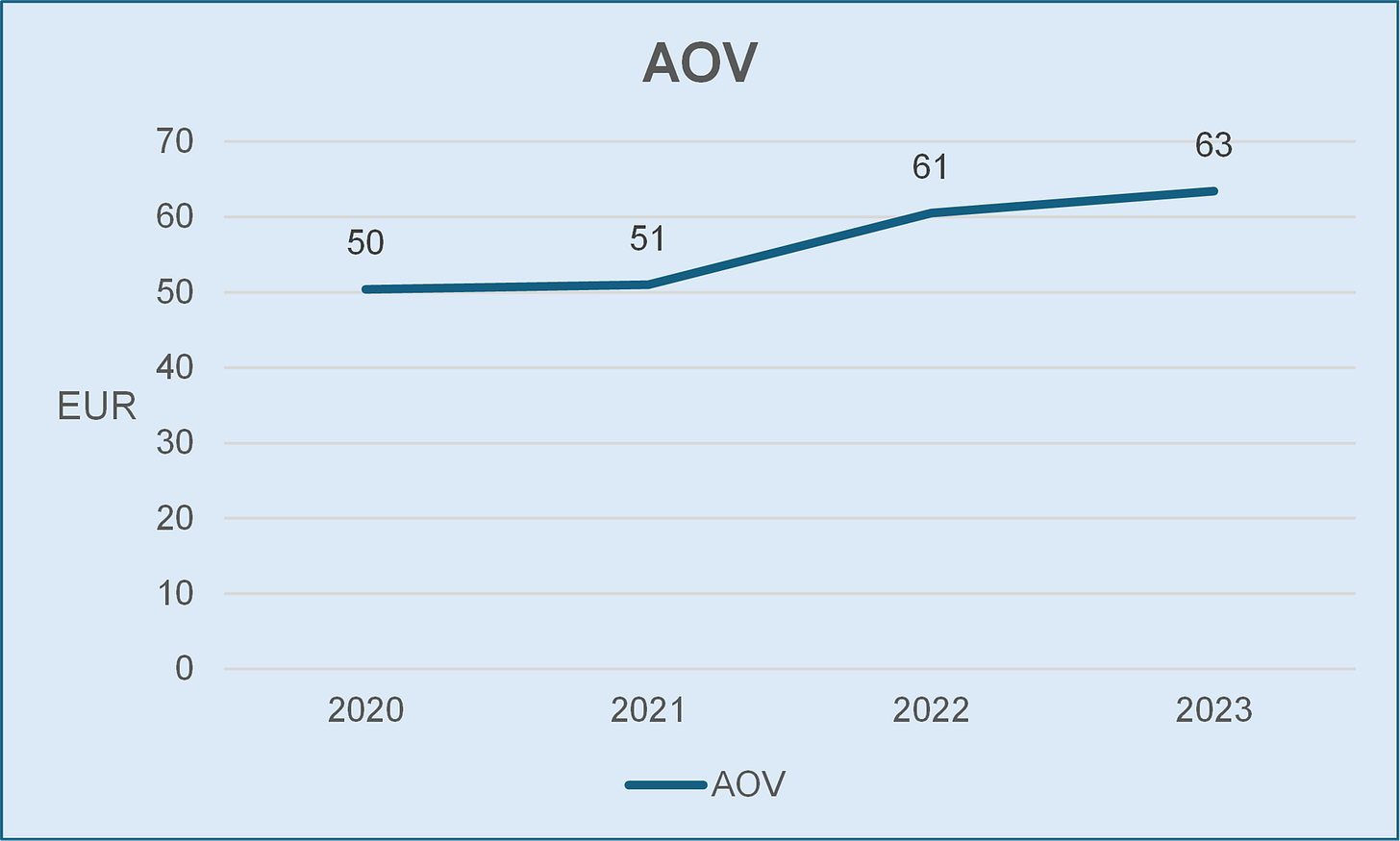

Average Order Value (AOV): is calculated as the total revenue (excluding retail revenue) divided by the number of orders in the corresponding period.

A high average order value is the indicator about a better value proposition for consumers.

In Q3 2024: HelloFresh reported a 4% year-over-year increase in AOV.

Factors:

Expansion of product offerings: HelloFresh has been diversifying beyond meal kits, including ready-to-eat meals, snacks, and other products.

Premiumization: Offering higher-priced options and encouraging customers to add-on extras like desserts or premium ingredients.

Execution

Hellofresh success is based on marketing. Marketing is where The Company has to execute in an excellent way. The key point in this industry is not to be the player that offers the tastiest food, but the one that knows how to do the best marketing work in order to retain customers and generate economies of scale. This is how Hellofresh has beaten all competitors, even some giants of the gourmet industry such as Walmart.

At first glance, we can think that there is a stagnation in the acquisition of new clients, but we have to think beyond the pure subscriber data.

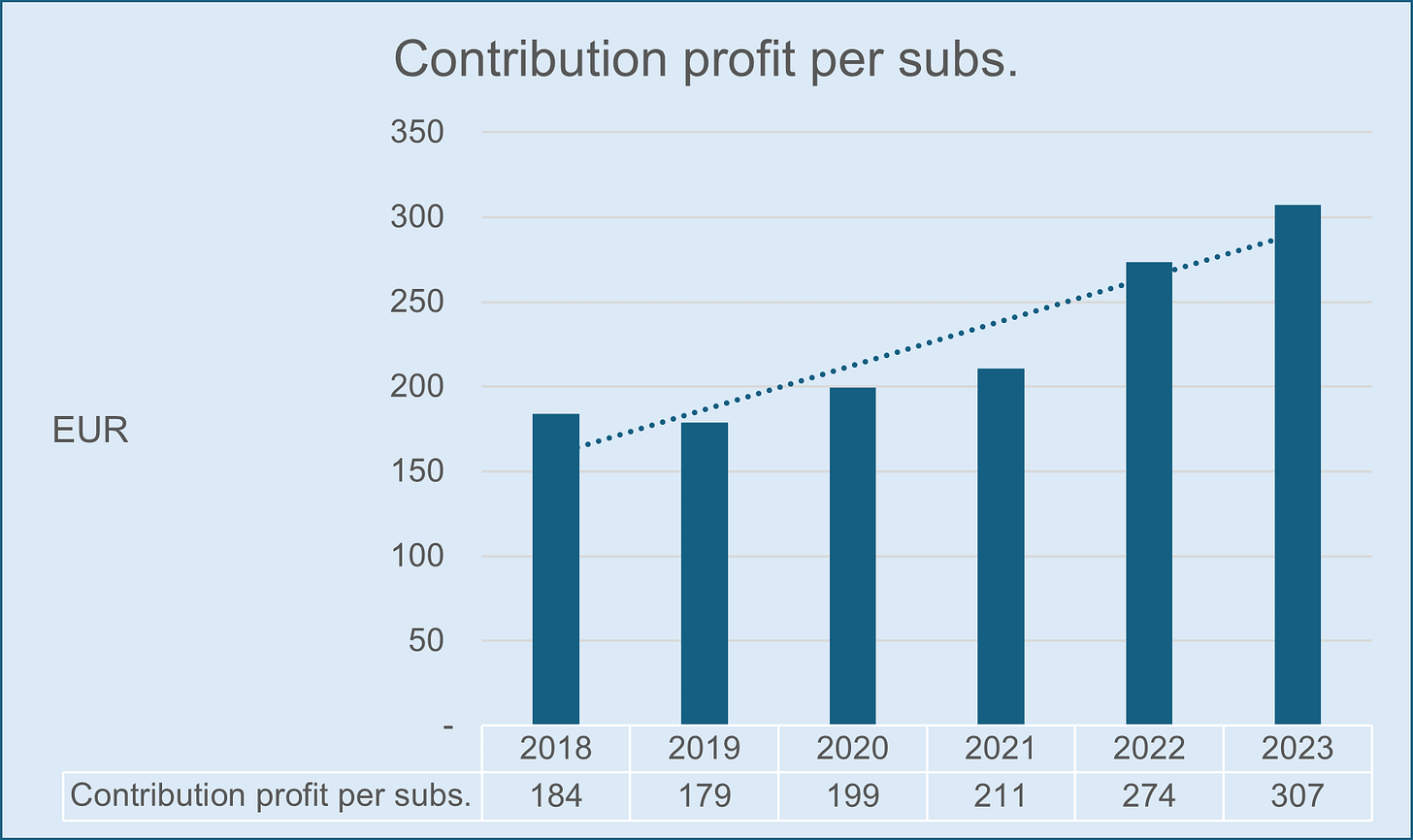

Contribution Margin is calculated as revenue less procurement expenses, and fulfilment costs and helps us to understand how much each product or service contributes to overall profitability.

The contribution per subscriber helps us think beyond the isolated data of the number of new customers, and gives us the profitability of the customers. In my opinion, this is a key metric in the thesis.

Gross margin

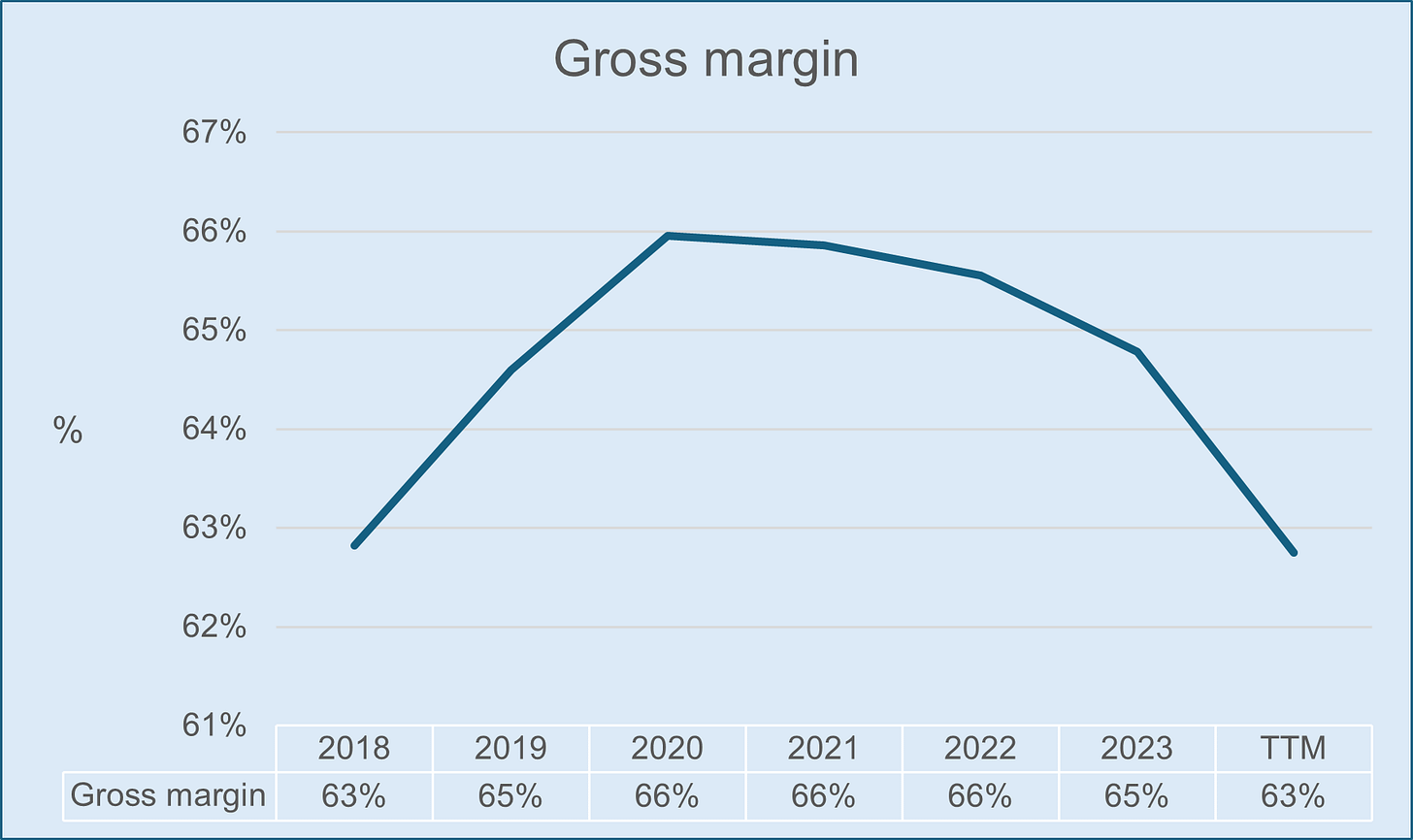

Gross margin is higher than traditional grocery models (63% vs 30%). explained by a waste reduction ans direct sourcing.

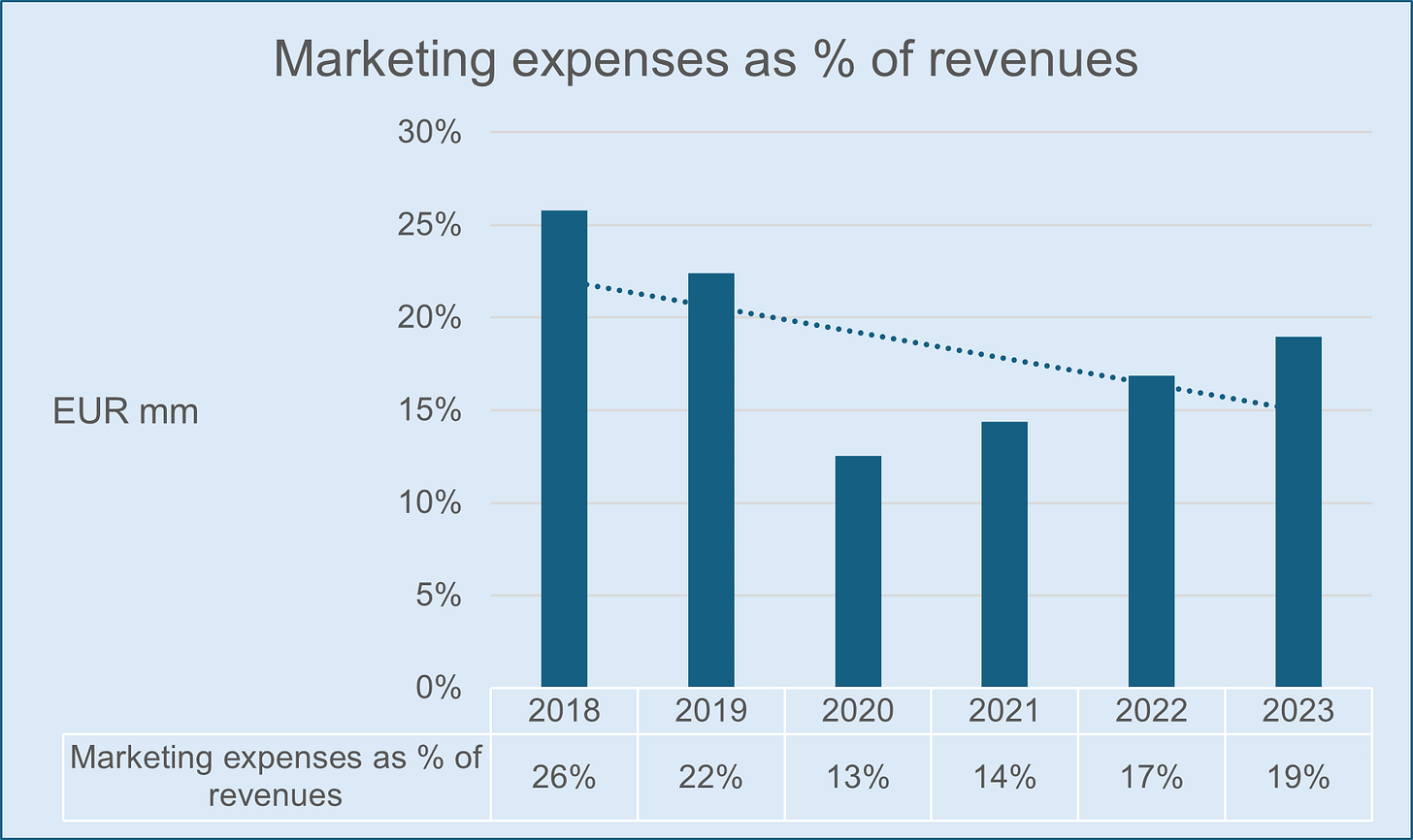

Marketing expenses. To fully understand the business of Hello Fresh, we need to understand the essential role of efficiency in acquiring a new customer and in keeping them. The acquisition cost is a one-off and has a leverage power. In fact, we know that the company is reducing the marketing cost as a percentage of sales, due to a lower marketing expenses for meal-kits . This effect is partially offset by continued ramp-up of RTE new customer acquisitions.

Customer retention is paramount for HelloFresh's long-term success.

HelloFresh periodically introduces promotional campaigns and discounts to attract new customers and retain existing ones. That pricing strategy coupled with the extensive customer database helps HelloFresh stay ahead of the competition and maintain customer loyalty by effectively reducing the churn rate and increasing order frequency at the same time.

Factor 75

In 2020 Hellofresh entered into an agreement to acquire all of the outstanding equity interests of Factor75, Inc.paying $277 mm. in cash.

Factor is a fully-prepared meal delivery service that is taking a whole new approach to fresh-prepared food.

Rationale: Increase convenience.

In 2020 Factor reported revenues by $100 mm. Hellofresh tripled revenues in just one year and without cross selling, which gives us an idea about ability to execute of Hellofresh.

Competitive advantages

Scale advantage

HelloFresh is the clear market leader, benefiting from economies of scale in purchasing, production and distribution.

By leveraging economies of scale, they are able to offer high-quality ingredients and recipe cards at an affordable price.

CEO says:

“We want to have a strong focus on our tenured customer base to increase their retention and order frequency, and as a result, improve overall marketing ROI. This entails improving the service levels we provide through real-time information of where the order currently sits in our supply chain, proactively informing customers of any potential issues with an order, and providing better customer service through self-serve tooling and Gen AI”.

Apparently, meal kits does appear to be a simple business without entry barriers. However, if we go into large scale, it is extremely difficult to execute successfully. We have to remember the Walmart case, and that Hellofresh is the only profitable player in the meal kit industry.

Growth

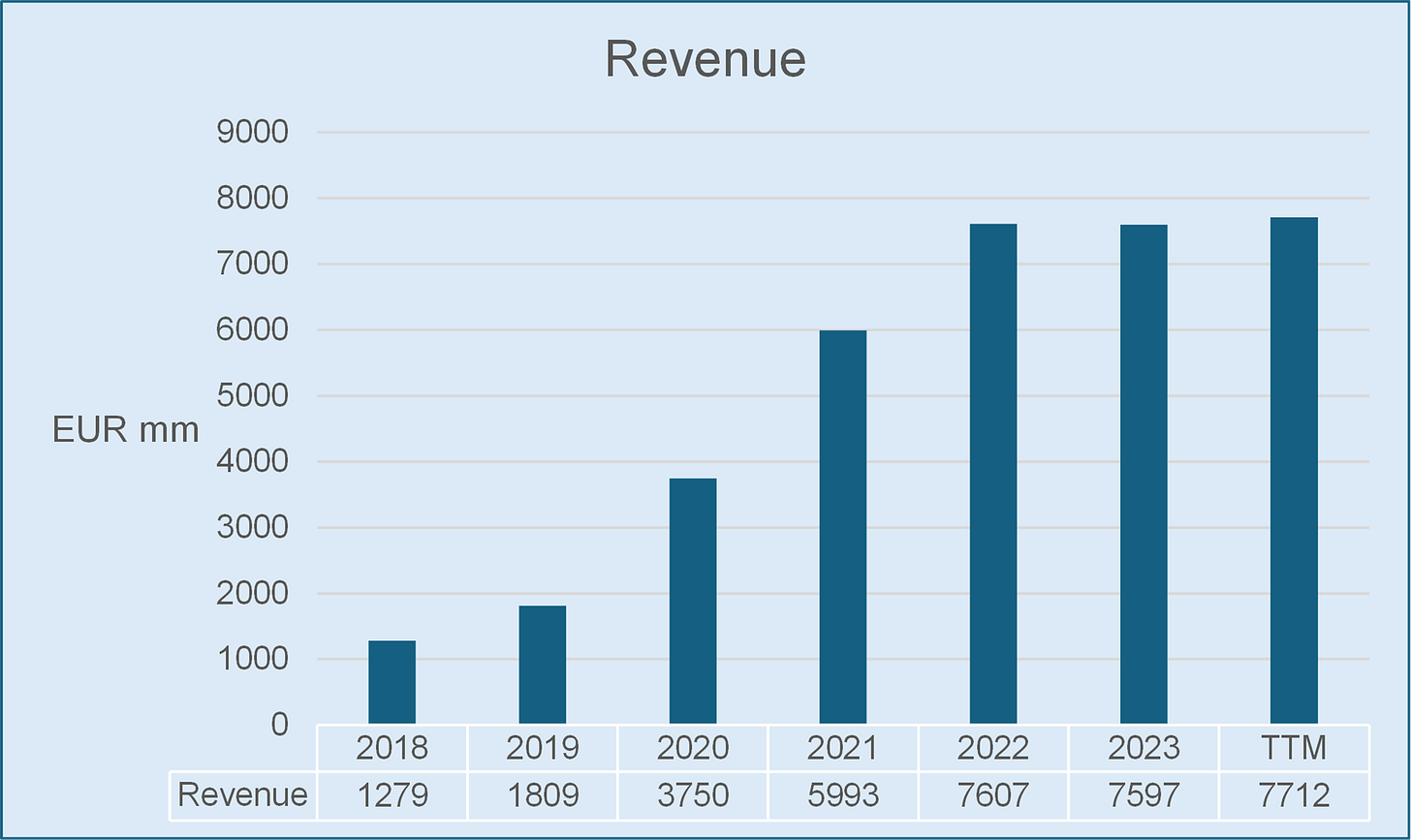

The CAGR 2018-2023 in revenue has been of 42.81%. This growth path is supported by Hellofresh large customer base that it has built over time with a technology- and data-driven approach. This has enabled it to refine its offerings and be highly efficient in both acquiring new customers and retaining existing ones.

As we saw previously, Hellofresh's growth is healthy in terms of the active customer in respect to CAC.

Summing up, we could say that Hellofresh has gained market share through efficient operations, innovative marketing strategies, and customer satisfaction.

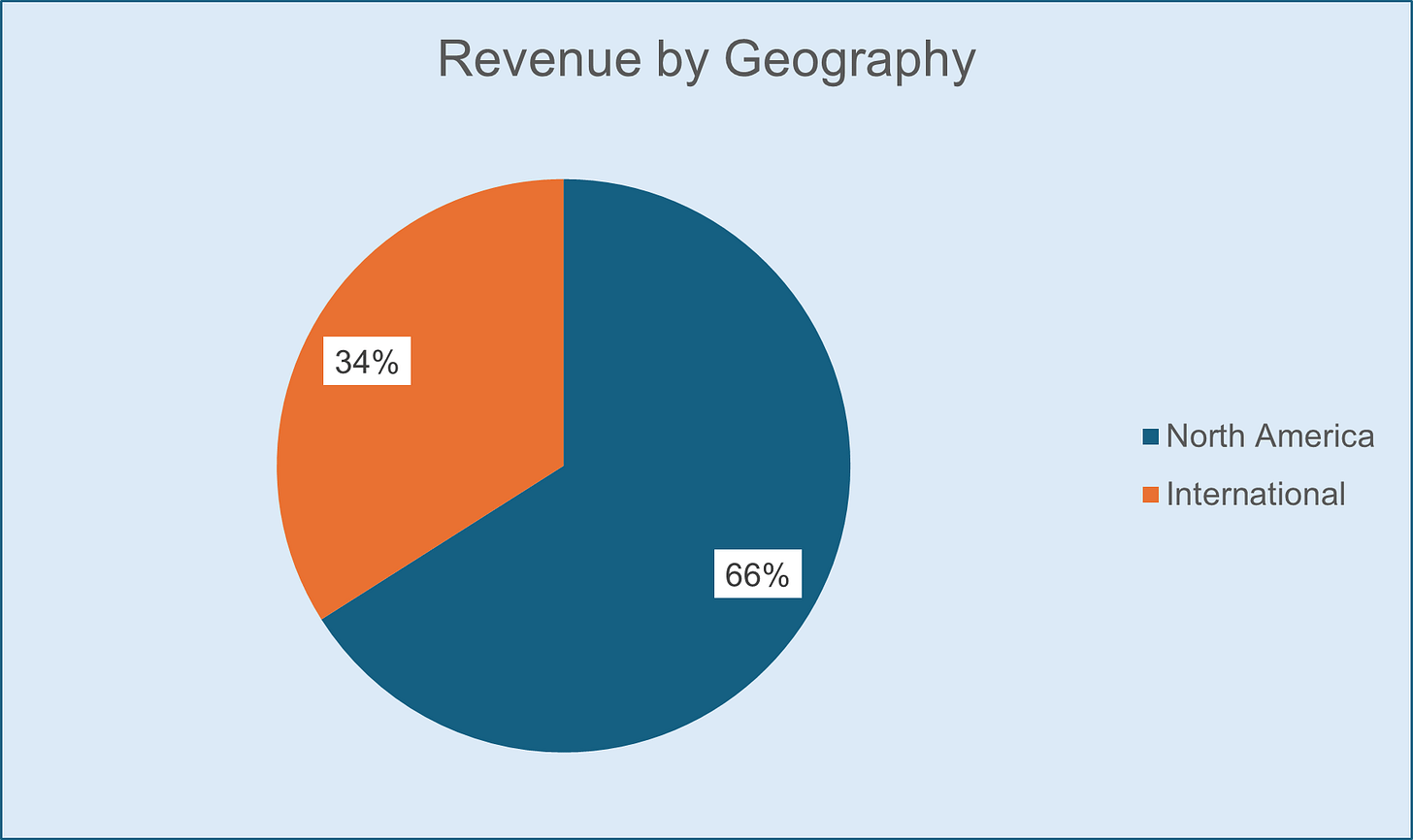

Currently Hellofresh operates in 18 countries (2023). The Company is ramping up many countries where online grocery penetration has more than doubled.

CEO says:

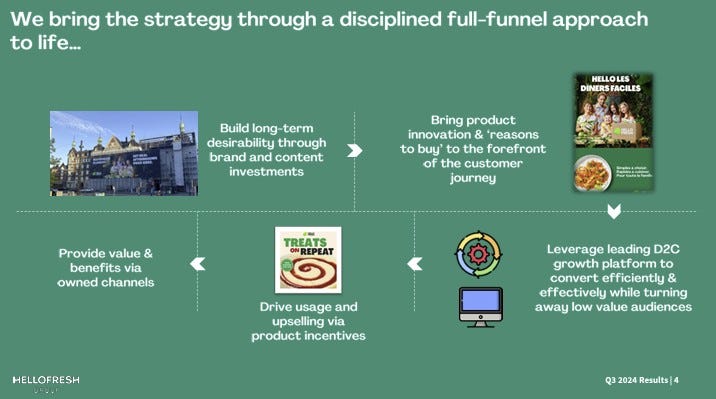

“We aim to bring this strategy to life in a data-driven and disciplined approach across the whole funnel from awareness to consideration, trial, usage and reconnecting formers with the product. We have started to shift some of our overall budget into brand and content investments in the recent back-to-school period and saw a positive impact on brand recall and brand desirability. As we continue to drive an ambitious product innovation road map, we plan to talk more about new and recently launched product features”.

Hellofresh can base its growth through:

Higher penetration. Demographic tailwinds such as younger generations ,pre health-conscious and more willing to pay for convenience could help to a new tendency.

New markets.

New products.

“Filling de pipe”. TAM of RTE is higher than Meal-kits. The Company is gradually envolving from a pure meal kit business to a fully integrated meal solution company.

Management team

The key person is Dominik Ritcher who founded in 2011 The Company together with Thomas Griesel, and Jessica Nilsson.

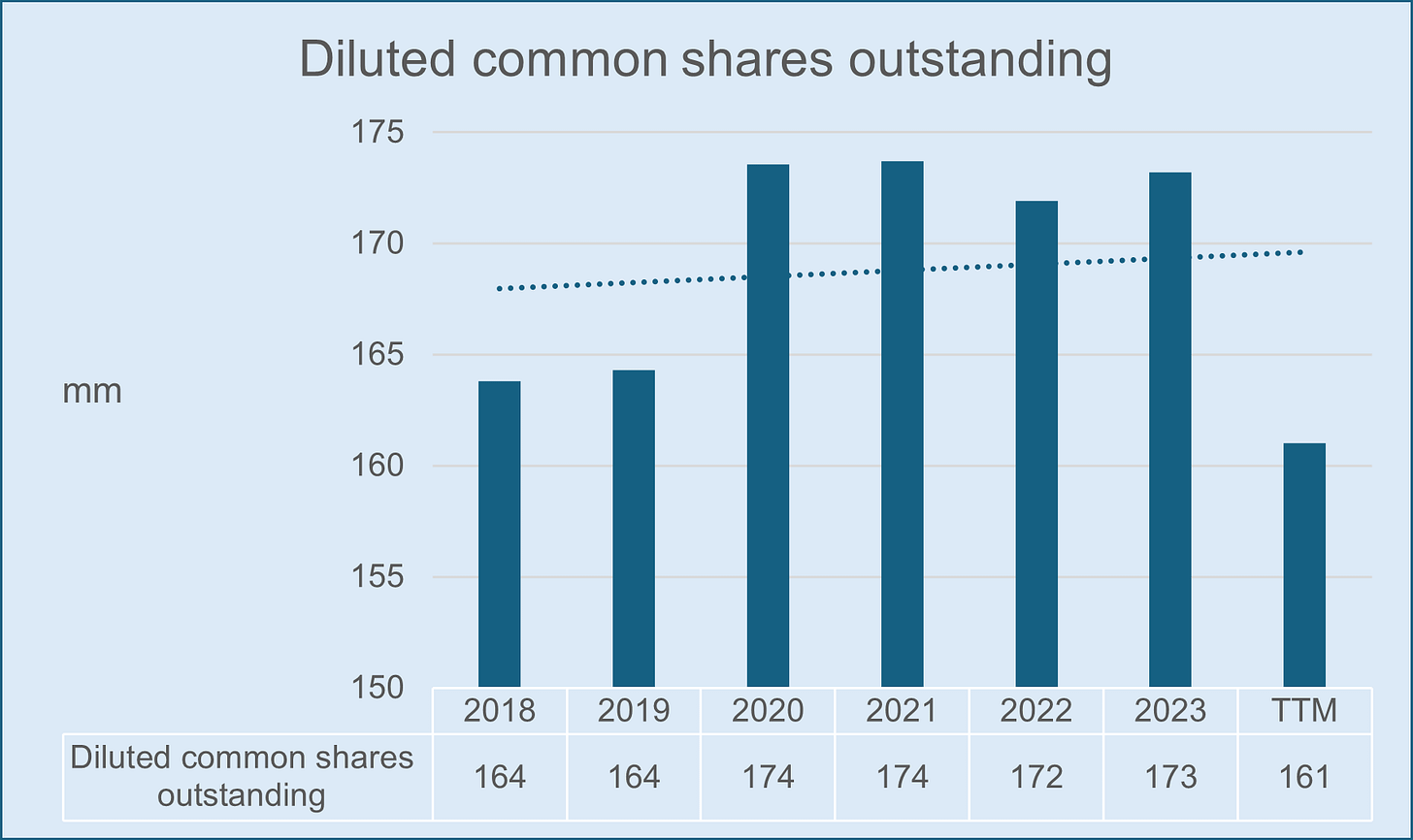

The management team is highly aligned with the goal of long-term value creation. Mr. Ritcher owns around 5% of shares.

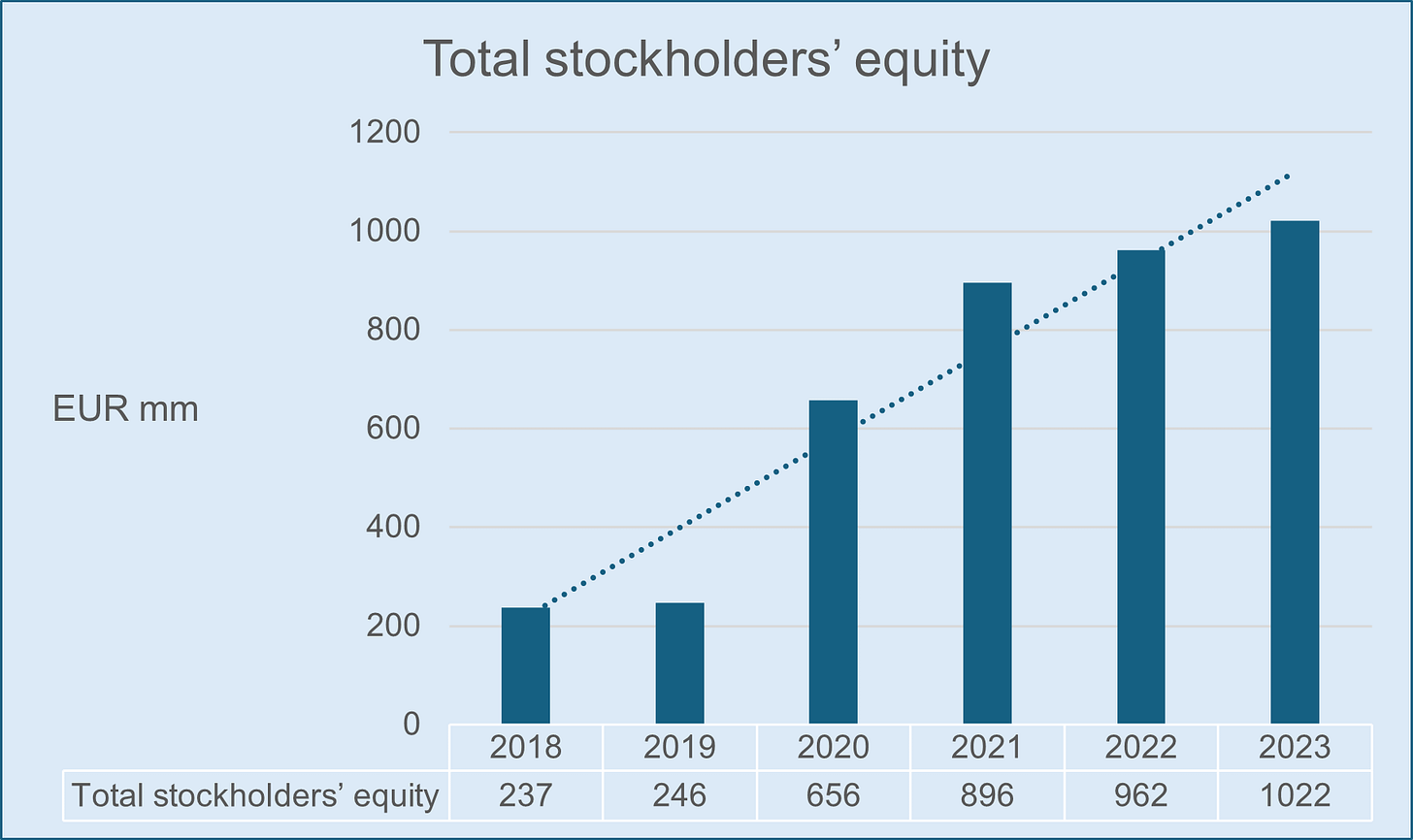

Long-term value creation

The Company successfully concluded its 2023/2024 EUR 150 million buy-back program on 17 December 2024 , split into EUR 113.25 million buy-back of Company shares and EUR 36.75 million buy-back of the Company's extant convertible bond.

Solvency

The company maintain a total net debt amount of €400 mm. what represents around 1.30x EBITDA (Of a investor lens).

Risks

TAM ceiling.

Competition from other meal-kit providers. In my opinion most meal-kit are going bankrupt and they cannot compete with Hellofresh. I only see one player capable of performing at Hellofresh's level: Amazon.

Inflation impact, waht is a double edge sword, becasuse could be a opportunity to close gap with high-end grocery retailers.

Key Strenghts

Best-in-class execution.

Market dominance.

Expansion.

Operational efficiency.

Strong competitive advantage.

Valuation

Assumptions:

Base case

Revenue growth 23-28 +5%

FCF margin 3%

Terminal multiple 18x

Upside: 155%

Next report: January 30, 2025.

I wish you a happy new year full of good investments. Regards,

Eloy.