Other writeups:

Hyfusing Group Holdings United.

Analysis date: October 23, 2024.

Key Points

15% CAGR 2019-2024 of revenues.

Pioneering company in changing the model of the legal services market.

Value proposition to clients and lawyers.

Very asset-light business and high returns on capital.

Founder of the company with a clear and disruptive vision.

Excellent execution and background of management team.

Competitive advantages.

Strong financial health without financial debt.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

Introduction

Keystone Law Corp. plc (KEYS) is a United Kingdom based company which provides conventional legal services to lawyers and clients through a plug and play platform.

The firm was established in 2002 by James Knight and Charles Stringer, named as Lawyers Direct.

In 2008, the firm re-branded as Keystone Law and by 2011, the Company developed an IT platform through which its lawyers were able to work in remote, allowing to reduce customer costs.

In 2017, Keystone was listed on the London Stock Exchange, with an IPO.

Keystone has been recognized by multiple awards, including , Law Firm of the Year at The Lawyer Awards 2020.

Business Model

“The Group” is made up of three companies, including “The Parent” and two consolidated subsidiaries.

Keystone Law Limited. Provision of legal services. 100% held by The Group.

Keystone Law (Guernsey) Limited. Dormant. 100% held by The Group.

Keystone Law Limited is owned by the Company, whilst Keystone Law (Guernsey) Limited is owned by Keystone Law Limited.

Keystone is basically a Tech Platform that works as a hub for lawyers, reducing costs and driving efficiencies.

Keystone offers lawyers freedom, flexibility and autonomy, recruiting high-quality, experienced lawyers from mid-market law firms.

Keystone is apparently a B2C model however, we can go further. A model where the lawyer is really the client and the clients are the end users, which makes Keystone a purely B2B model.

“We treat our lawyers like clients, and the absence of a hierarchical structure is beneficial in many ways – our lawyers are freed from office politics and unwanted managerial responsibilities and are able to focus exclusively on what they enjoy and do best: being a lawyer”. [Keystone Annual Presentation 2024].

The services delivered are largely bespoke in their nature, being specific to the legal needs of the client and the matter.

The revenue model is simply: lawyers are self-employed, and they decide how, when and where they work, being fully responsive to their clients’ demands. Keystone invoices the clients and pays up to lawyers 75% of the value that they bill. 25% of the bill is retained by The Company as revenue. Lawyers themselves introduce 98% of clients.

PODS are employed by principals, but approved by The Company .

Recruitment process is a cornerstone of Keystone strategy, based on the high quality of the lawyers that creates a virtuous circle, attracting lawyers who are, or who aspire to be, at the top of the profession. The majority of Keystone lawyers continue are recruited from the top 100 law firms, which is a quality and reliability sign.

Regular training and professional development is a pillar in Keytstone risk management policy.

Clients

The client base, comprises predominantly SME businesses as well as high and ultra-high net worth individuals, operates across a broad range of sectors.

Keystone´s client base is a low risk model:

No client/ lawyer dependency none > 5% recurring revenue.

No dependency on one area of law 8 practice areas.

No dependency on one sector (+50 sectors).

Minimal exposure to high-risk legal areas.

Clients say:

“Look no further. This is the firm you want. As I began to manage my sister’s and her husband’s Living Trust, I knew I would need a qualified firm with the proper Trust and Probate credentials. After vetting SoCal firms (I live in NorCal), Keystone was my top finalist. They handled a tough situation, marshaled it through the Courts and beneficiary negotiations and, most important, protected me against liability. At all times, I was kept apprised of what was going on, and I was always afforded an opportunity to comment on draft documents. Look no further. This is the firm you want.”

I was referred to Keystone law group through another attorney. I needed their services as my aunt who has no children, was abused financially and emotionally by a relative of hers. To protect her well being and assets, I had to become her conservator, which is a complicated matter which needs to be petitioned for in front of court. Shawn Kerendian, the main partner, worked with me and explained everything upfront. Cliff Melnick and Dr. Joshua Ross handled my case after that. It was truly a very professional experience. They helped me advocate for her, remained very ethical, we’re on top of things prior to me needing to call them. Most importantly they did not drag the case. I got a temporary and a permanent conservatorship and could have not asked for better attorneys to represent me. Thanks so much.

Value proposition

Keystone provides the following to the lawyers:

Services: infrastructure and support via the central office, and IT platform.

Network of highly experienced colleagues: more than 30% of work at Keystone is a result of cross-referrals.

Compliance and Risk management, and professional indemnity insurance that covers £50m.

Junior lawyers and paralegals: junior support can be delivered by one of the

junior lawyers employed by the central office to support all senior lawyers.

Brand: working for a prestigious firm offers the possibility of a larger and higher quality client base.

Freedom, flexibility and autonomy for laywers.

“Keystone has a supportive and collaborative culture, which is one of the reasons why lawyers are attracted to the business and remain with us. We treat our lawyers like clients, and the absence of a hierarchical structure is beneficial in many ways – our lawyers are freed from office politics and unwanted managerial responsibilities and are able to focus exclusively on what they enjoy and do best: being a lawyer”. [Keystone 2024 AR].

Transparent remuneration structure: Lawyers are paid once the clients have paid for the services. This structure has two core benefits: typically, lawyers earn more money for the same work than they would in a conventional firm, and Keystone is resilient and highly cash generative.

According to The Company:

“Keystone is one of, if not the, happiest law firm in the country”.

Costs Structure

Cost of sales includes mainly principals and fee earners payments.

Other administrative expenses includes staff costs, agency recruitment fees, insurance premiums and other administrative costs

Lease expenses represent around 0.5% of revenues. Chancery Lane office (Keystone headquarters in London), is under a lease agreement for a five-year term starting in April 2024. The offices play a crucial role in the brand and reputation of the business.

The Company has got no property, plant and equipment.

Interest on client monies held

Keystone Law Group receives funds from its clients in advance. Solicitors Regulation Authority (SRA) requires firms to pay clients ‘fair’ interest on money held on client account. That item represents around £600,000 for FY2024.

Trade receivables impairment and Corresponding reduction in trade payables

Due to the nature of the business, there are high levels of trade receivables, which would result in a change in the corresponding reduction in trade payables and an impact on profit. Until FY2023, both changes were accounted for as a reduction in Revenue and Cost of sales respectively. From FY2023 Trades receivables impairment (1.2% of revenues), and reduction in trade payables (0.9% of revenues), are accounted as separate items.

Industry analysis

Keystone Law Group competes in the U.K. legal services market, which is the second largest in the world (£43.7 billion in revenues).

The UK market operates covering England and Wales, Scotland and Nothern Ireland.

The Legal Services Act 2007 liberalized the market in England and Wales, allowing non-lawyers to own and act in management capacities within law firms. These reforms do not apply in Northern Ireland or have been fully adopted in Scotland.

Legal services segments* :

Magic Circle firms.

The term reffers to the five most distinguished and profitable law firms with their headquarters in London: A&O Shearman, Clifford Chance, Freshfields Bruckhaus Deringer, Linklaters, and Slaughter and May.

Silver Circle firms

It refers to those firms who have a lower turnover than those in the Magic Circle, but still have a significant presence in the City.

Boutique law firms

They tend to specialise in a single practice area and pride themselves on being the experts in their chosen legal field.

High street law firms

High street law firms refers to the smaller legal practices found across the UK. They provide a range of legal services and advice to both individuals and smaller businesses.

Mid-market law firms

They cover the space between the Magic Circle and smaller boutique firms,

*[www.law.ac.uk]

Keystone operates in the mid-market segment and is ranked No. 60 among the largest law firms in the U.K.

The U.K. Mid-market represents around £10 bn. and employs more than 34,000 lawyers.

CEO says:

“Nothing happens in its entirety, and nothing happens overnight. But there is a substantial shift that in the next five years we’re going to see as a big percentage of convention of legal services in the mid-market moving to platform firms. We welcome that very much”.

Competitors

DWF Group Plc.

DWF Group plc, incorporated in 2018 and based in London, offers business services across Europe, the Middle East, Asia, Australia, and North America. It operates through three divisions: Commercial Services, Insurance Services, and Legal Operations, serving sectors such as consumer, financial services, insurance, energy, government, real estate, transport, and technology. As of October 3, 2023, DWF Group plc was taken private.

Gately Holdings.

Gateley (Holdings) Plc, founded in 1808 and based in Birmingham, provides commercial legal and consultancy services internationally, including the UK, Europe, the Middle East, the Americas, and Asia. It operates through four segments: Corporate, Business Services, People, and Property. The company offers a wide range of services, including legal, banking, corporate advisory, taxation, dispute resolution, and real estate services. It serves various clients, including charitable organizations, international businesses, financial institutions, and high-net-worth individuals. The company changed its name from Gateley Plc to Gateley (Holdings) Plc in May 2015.

Knights group

Knights Group Holdings plc, founded in 1759 and based in Newcastle-under-Lyme, provides legal and professional services across the UK. Its offerings include business services such as banking, corporate advisory, dispute resolution, and housing regeneration, as well as personal services in areas like family law, estate planning, and tax. The company also engages in property development and engineering projects, and offers services in sectors including aviation, healthcare, and technology.

Anexo Group

Anexo Group Plc, founded in 2006 and based in Liverpool, provides integrated credit hire and legal services in the UK. It operates through two segments: Credit Hire and Legal Services, offering replacement vehicles and legal assistance to consumers involved in non-fault motor accidents. The company manages the entire process, from providing credit hire vehicles to handling personal injury claims and offering administrative services for ATE insurers.

Manolete Partners

Manolete Partners Plc, founded in 2009 and based in London, is an insolvency litigation financing company in the UK. It specializes in acquiring and funding insolvency litigation cases.

(1) From investors lens for FY2024.

(2) Private company.

Competitive advantages

Switching costs

Acquiring high qualified lawyers is shifting to hard. But remuneration structure, services and legal protection retain many of them in The Firm. Churn rate is around 5% vs. 15% in the industry [BTI Consulting Group].

Network effects

Keystone works as a hub for lawyers. Incentives attract the best lawyers. Retaining the best talent implies many more and better clients, which attracts new lawyers. It is a two-way virtuous circle. Win-win for the company, lawyers and clients.

Scale advantages

Scale is a distinct advantage and a clear competitive advantage for Keystone

Keystone gives all lawyers a first class platform, high quality training, insurance services and recognized brand protection. All of that would be unaffordable for many of them individually, and It is possible due to a scale advantage.

Growth

The CAGR 2019-2024 in revenues has been of 15.40%.

Keystone grows organically by recruiting high-calibre, senior lawyers from across the UK legal mid-market who bring with them their client relationships and contacts. Organic growth by recruiting successful lawyers who bring their own client following.

CEO says:

“We have an insatiable appetite for recruiting”.

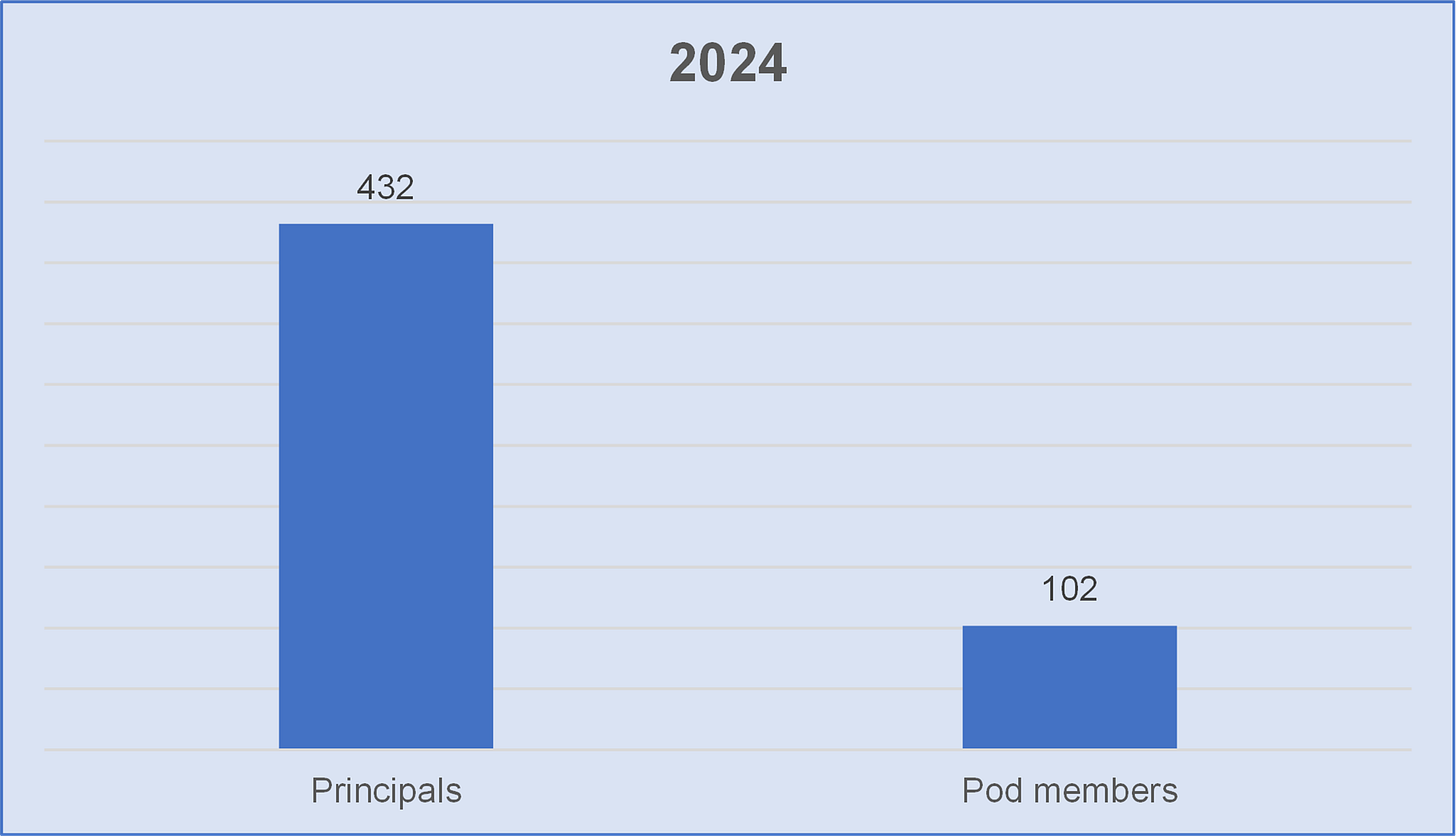

Principals CAGR 2019-2024 is around 9%.

The business supports a 5% annual churn rate across base mainly due to retirement.

In my opinion, Keystone is the leading firm of its type, and the annual number of applicants is increasing regularly. In 2024, offers made and accepted were 103 and 68, respectively.

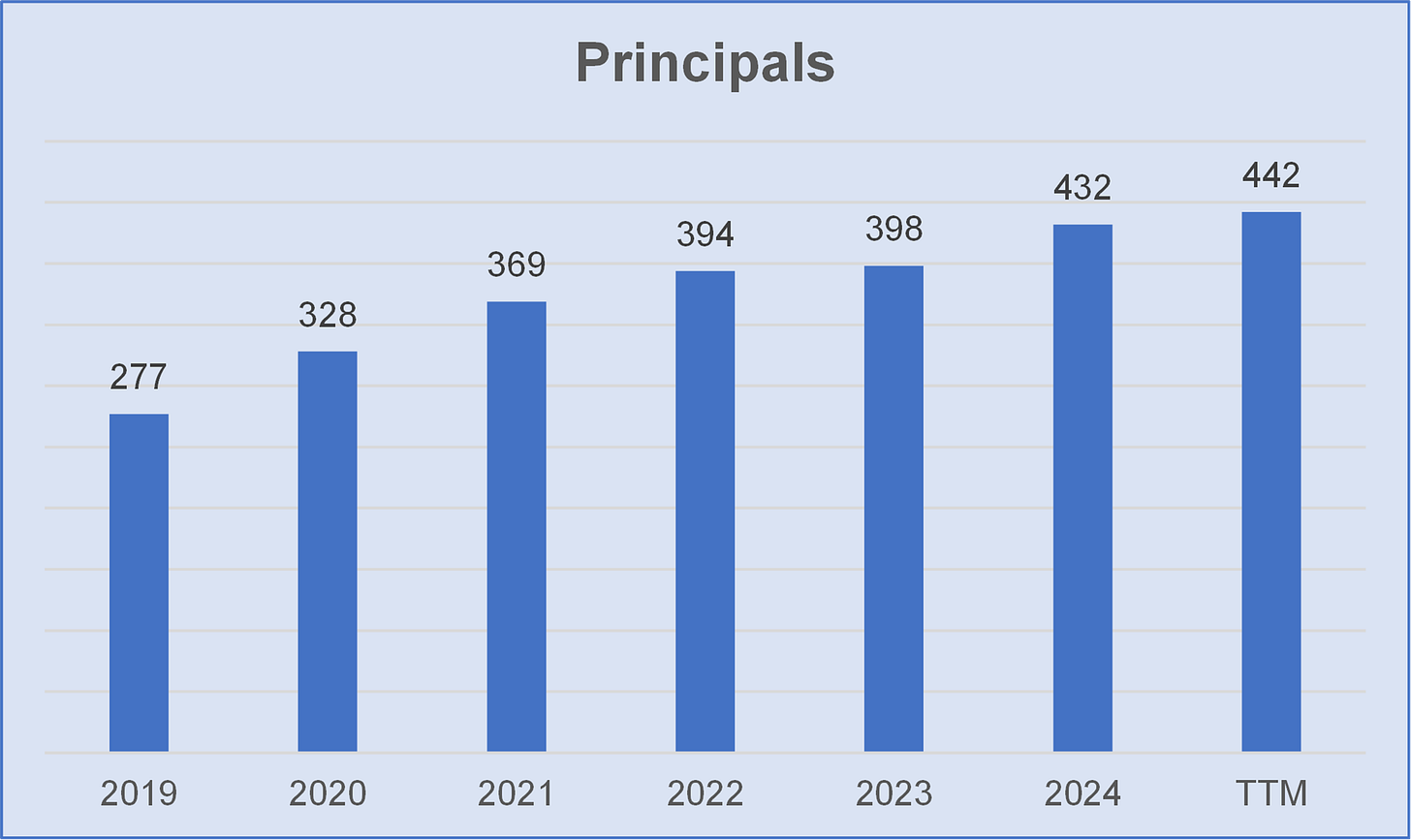

Keystone model is scalable, based on neither physical nor working capital constraints on the rate of growth. Lawyers can be supported by Pods, and grow in terms of revenue by principal. That is a key metric in Keystone growth model that shows the capacity of the company to develop its operational leverage.

Revenue by principals CAGR 2020-2024 is around 6.6%.

To sum up, Keystone can grow through numbers of lawyers, and revenue by principal in an addressable market over £10bn in annual fee income.

Outlook:

CEO says:

“Keystone's position in the market continues to strengthen and I am delighted that our ongoing operational excellence has been reflected in our financial performance. The business has delivered well across all our operational KPIs, reflecting the ongoing growth in demand for the benefits that Keystone provides”.

"Although the U.K. economy continues to have its challenges and the recent change in government has introduced a new element of uncertainty to the future, we remain confident that Keystone will continue to build on this performance to deliver ongoing sustainable growth."

The ability to retain talent and hire new lawyers under Keystone's specifications is a major challenge for the group.

Keystone's growth is strongly limited in the long term as its operations are focused on the British market.

Capital allocation

Dividend Policy

For the period of six months ended 31 July 2024, The Group declared interim ordinary dividend of 6.2p per share (H1 2024: 5.8p).

The total dividends paid since IPO to just under 92p per share, or 100% of the EPS earned over the same period.

The Companys financial position and cash generating model allows a high payout ratio. However, in my opinion, management team make a mistake in capital allocation strategy. Cash generated by the business could be used to a buyback shares programms or growth in new markets.

Many UK-listed firms have the habit to pay high dividends while leaving an insufficient cash for reinvestment or repurchase of shares. That circumstance come from a local culture among British investors, which is very tough to change and shift to a more efficient capital allocation strategy.

Management team

James David Knight (66) is the founder of Keystone Law Ltd. and Keystone Law Group Plc.

He held the titles of Managing Director & Director and Chief Executive Officer & Executive Director, respectively.

Prior to Keystone, he had a ten-year career as a commercial solicitor in London, Hong Kong and Dubai.

Mr. Knight owns 8,927,012 shares ( 28.26% of total ordinary shares).

Ashley Rupert James Patrick Miller (65) has worked as a Finance Director & Director and Executive Director & Finance Director at Keystone Law Ltd. and Keystone Law Group Plc respectively since 2015.

Mr. Miller owns 228,796 shares ( 0.72% of total ordinary shares).

Executive Compensation

The Group operates a long term incentive plan under which any award made is subject to a three year vesting period followed by a one year holding period. Furthermore, no single grant may have a value greater than 100% of the base salary of the individual to whom the grant is made.

The total number of shares which may be granted under this scheme may not exceed 5% of the total share capital of the Company.

Mr. Knight remuneration is £347,000 what represents around 4.5% of Net Income and 0.40% of total sales. Total directors remuneration represents about 10% of total sales.

In my opinion, the remuneration of the key person and the rest of management team is close to being high, but not excessively concerning, in respect to the management team background, nature of business and U.K. standards.

Fixed remuneration payments eliminates the incentives to be aggressive and take risks in order to get certain goals.

Free float represents around 64% of share.

Free float, skin in the game from the key person, and ownership composition indicates a low probability of principal-agent conflict.

The key person has been a cornerstone in the growth and success of Keystone, revolutionizing the legal services and implementing a disruptive business model in the market under an innovative vision.

Financial Metrics

Earnings

EBITDA has been calculated from an investor's lens. The company does not report in terms of EBITDA but rather in terms of PBT (equivalent to EBT). However, from a consideration of the EBITDA to FCF conversion rate, we can get a view of the efficiency of the company on a consistent basis, ignoring interest and D&A expenses, which could be on a more irregular basis.

Capital Structure

We know that Keystone's revenue model involves a 75/25 structure. Clients make payments in advance, thus I assume that the company needs close to 75% of cash and cash equivalents to operate the business in terms of operating working assets.

Keystone model is not based on physical nor working capital investment. Capital intensity rate is around 16% which leads us to think of a very asset-light business.

Profitability

In general, we can say that a ROCE higher than 20% is a good sign.

High ROCE indicates an efficient capital use and a profitable business. Keystone's WACC (Weighted average cost of capital) is around 8%* (under return on capital), which indicates a profitability in the long-term.

*[https://valueinvesting.io/KEYS.L/valuation/wacc].

ROCE is calculated after-tax.

Margins

Due to nature of business, Gross margin is around 25% and regular along the time. Operating costs are mostly fixed in nature, hence we may think in an operating leverage and a future improvement on EBIT margin.

Liquidity

Generally speaking, a good quick ratio is anything above 1 or 1:1. A higher ratio indicates the company could pay off current liabilities several times over.

A good cash ratio would be around 0.5x or more.

Given that, Keystone has not financial debt and account receivables (Bills to clients excepting amount in advance) is closely related to account payables ( 75% of bills), I am not concern about cash ratio levels.

Solvency

The company enjoys a strong financial position, with a net cash position around £8 mm (FY2024) and no Long-term or short-term debt on the Balance Sheet.

Zero debt or near to zero, can grant a company financial stability and autonomy. However, zero debt may be a “Double-Edged Sword”, from a deductible interest payment perspective or in terms of the efficiency of the capital structure.

Risks

Recruitment of new talent to a high standards is limited.

Churn rate could increase in the future, eroding the capacity to retain talent and the business quality.

Downturn in the UK economy

Growth si limited mainly to British market.

The Group remains susceptible to potential liability for negligence.

The Group is subject to a range of regulations.

The self-employed status of the Group’s consultants could change to be workers or employees and, as such, would be entitled to additional benefits.

Strenghts

More than 20 years of background being pioneers and leading a new and disruptive model of legal services.

Skin in the game from the key person, who has been a cornerstone in the growth and success of The Company.

Value proposition to clients and lawyers.

Very asset-light business and high returns on capital.

Competitive advantages.

Valuation

Keystone stocks are trading close to 25x EV/FCF for FY2024.

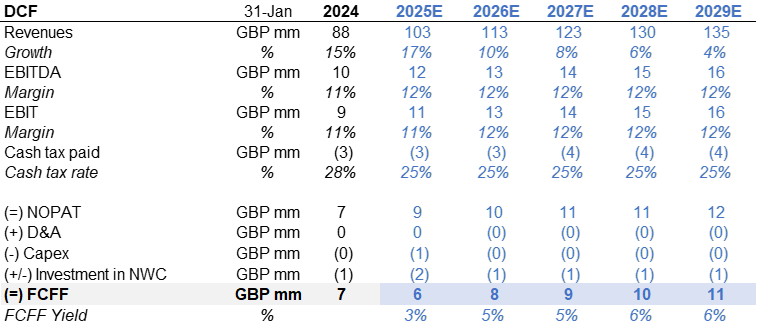

DCF

Assumptions:

Revenue growth 24-29 +9%

Gross margin 26%

EBIT margin ≃12%

Terminal multiple 20x

If you are a professional or qualified investor, and you like my work, don't hesitate to contact me.

Next report: November 28, 2024.