Analysis date: September 25, 2024.

Price return since analysis date: +7.67% (+7.42% after results).

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

At the current date, I own Takeuchi shares, representing around 3% of my portfolio.

Company Overview

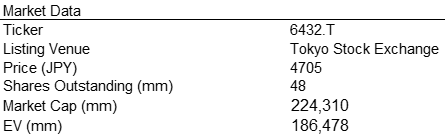

TAKEUCHI MFG. CO., LTD (6432.T) is a Japan-based company principally engaged in the manufacturing and sale of construction machinery, such as compact hydraulic excavators and track loaders.

Established by Mr. Akio Takeuchi in 1963, Takeuchi developed the world’s first compact excavator in 1971 and developed the first compact rubber track loader in 1986. In this regard, Takeuchi transformed the global construction equipment markets.

To know more: TAKEUCHI MFG. CO., LTD.

Q2´24 Results.

Net sales +4.4% YoY.

Gross margin 34.1% (24.1%).

Transportation costs 3.6% of net sales (3%).

Salaries and allowances 1.5% of net sales (1.4%).

EBIT margin 25.3% (16.2%).

Net cash position ¥37,832 mm (-31.43%). Mainly due to an increase in inventories and decrease in Payables.

Dividends: Fiscal year ending February 2025 (est.) ¥200 (¥158).

Revised forecast for the fiscal year ending February 2025

Net sales ¥215,500 mm Previous: ¥224,000 mm

Operating profit ¥44,500 Previous ¥38,500

Earnings per share ¥629.36. Previous ¥576.91

Management team says:

“In the previous forecast, we expected sales to increase significantly due to persistent demand for housing, aging living infrastructure, and increased construction investment supported by government measures. In Europe, on the other hand, we had expected a decrease in sales volume of compact excavators, which are mainly used in housing-related construction, due to factors such as the slump in consumer spending and housing demand caused by the prolonged high prices and the rise in geopolitical tensions”.

“As a result of the above, consolidated sales volume for the fiscal year ending February 2025 is expected to decrease by 8.6% compared with the previous fiscal year (1.6% increase in North America, 14.9% decrease in Europe). (Previous forecast: 17.2% increase in North America, 10.2% decrease in Europe, and 1.0% increase on a consolidated basis)”.

“Based on this situation, we have revised our full-year consolidated earnings forecast. Although we expect net sales to fall short of the previous forecast, we expect profits to exceed the previous forecast due to factors such as a decrease in ocean freight costs and the impact of the yen's depreciation”.

Substitution of CEO

Toshiya Takeuchi, President and Representative Director of Takeuchi, has been hospitalized for medical treatment and is temporarily substituted by Osamu Kobayashi will act as President.

If you are a professional or qualified investor, and you like my work, don't hesitate to contact me.

Next report: October 24, 2024.

Acknowledgments: to @rhinoinsight for the header banner.