tinyBuild, Inc.

A turnaround thesis.

Other writeups:

Hyfusing Group Holdings United.

Analysis date: November 28, 2024.

Key Points

Video games publisher and IP owner.

Stock has dropped by 98.60% since IPO.

Turnaround case.

Diversified portfolio.

Focused on 1000-hours games, (High longevity and predictable cash flows).

Risky bet with high upside.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This report is not a BUY or SELL recommendation.

I own tinyBuild shares. 1% of total portfolio.

Introduction

This month I publish an atypical investment thesis with respect to the style I usually follow. This is tinyBuild, a case of turnaround that I will analyze in a somewhat different way.

This publication could be less extensive and detailed than some previous ones due to it being an investment of a special nature.

tinyBuild is an idea from Francisco Lodeiro Amado, private investor and Academia de Inversión foundator.

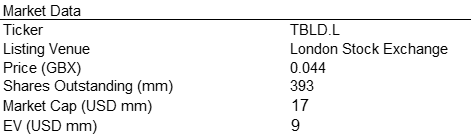

tinyBuild, Inc. (TBLD.L) is american global video games publisher and developer with a catalogue of more than 80 premium titles across different genres, primarily for PC and consoles.

tinyBuild started as an indie game developer in 2011, it incorporated in 2013, it raised capital in October 2017 from Makers Fund and in January 2019 from NetEase. It listed on the London Stock Exchange (AIM:TBLD) in March 2021 and successfully raised more capital in January 2024 adding Atari to its core shareholders.

Business Model

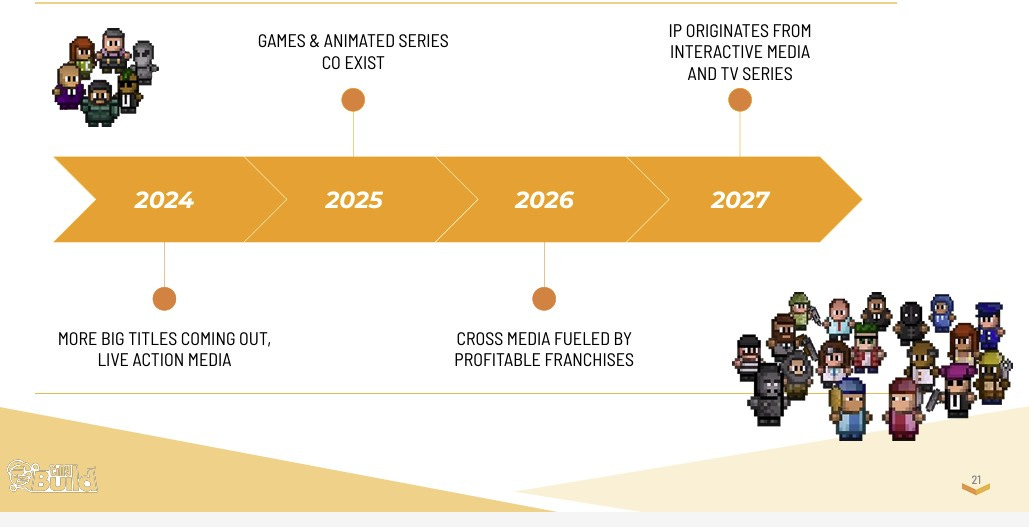

tinyBuild is a publisher focused on IP ownership, creating scalable franchises across multiple media formats.

The business focuses on:

Indie games: limited budgets for development, fewer than ten developers and marketing via social media and word of mouth.

AA games: budget higher than that of indie games, (usually between a few million and tens of millions dollars), teams of around 50–100 people and more marketing power behind them than indie games, but less than that of AAA projects.

However, tinyBuild wants to cover the AAA games niche. AAA games involve vast budgets for development, large teams of developers and marketing budgets that can even exceed the development costs.

On the other hand, tinyBuild invests heavily to create and develop new, high-potential IP with a particular focus on games that can be played for over 1,000 hours.

CEO says:

“So it means that those contracts don't expire like a typical publishing agreement where the publisher does not own the intellectual property. And also what's really important to note here is 89% of sales coming from our back catalog. This is what I mean by 1,000-hour games”.

tinyBuild’s approach to growth is two-fold. On the one hand the Company continues investing in its back catalogue to make its games available on more platforms. This is a low-risk strategy that generates a stable and predictable stream of cash flows. Some of the most successful titles include Deadside, Graveyard Keeper, SpeedRunners, Streets of Rogue, Spiderheck and Potion Craft, alongside Hello Neighbor.

CEO says:

“By 1,000-hour games, I mean literally that. If you look at the reviews of our tiles like Streets of Rogue or SpeedRunners or Secret Neighbor. You go to their steam pages, you scroll all the way down and then you check the time play on some of those reviews. It will be thousands of hours. This means that we are really excited about investing into titles that are highly replayable, that are systems driven, where we create content that can be consumed multiple, multiple times instead of focusing on things like cut scenes that the player sees once, cost us a lot of money and then never sees again”.

tinyBuild publishes around 6-10 games/year, with 1-5 years of development for each of them. The price is between $5 and $40.

Currently, The Company maintains 70 games on Steam.

Hello Neighbor

Hello Heighbor is a horror game developed by Dynamic Pixels and published by tinyBuild. You must get into your neighbor's house and find out the secrets he hides in the basement. Play against advanced AI that learns from your movements.

“After publishing indie games since 2013, an interesting evolution happened to the business after the launch of Hello Neighbor. The game became a viral success and helped tinyBuild expand into merchandising, books, and spawned a prequel and multiplayer Spin-off”. [tinyBuild].

Kingmakers

Kingmakers is about travelling back in time to medieval [ boroughs ] in England with modern weapons and you're able to mow down thousands upon thousands of enemies on screen. We could call it the medieval Call of Duty.

“The reception has been absolutely phenomenal. There's a lot of expectations for this game, and we are going to be sharing the release plans for that relatively soon. [tinyBuild].

Expected date: end of 2024. although delays are expected.

Streets of Rogue

It is not a mass market game. What this title offers us in terms of its style of play can fit perfectly within roguelikes. A mayor who promised to lower taxes and provide alcoholic beverages to the people fails to keep his promise and, in the end, the citizens rebel against such a situation.

Revenue Model

Fees paid to Sony, Nintendo, Microsoft and Steam are around 30%. Epic Game Stores is 12%.

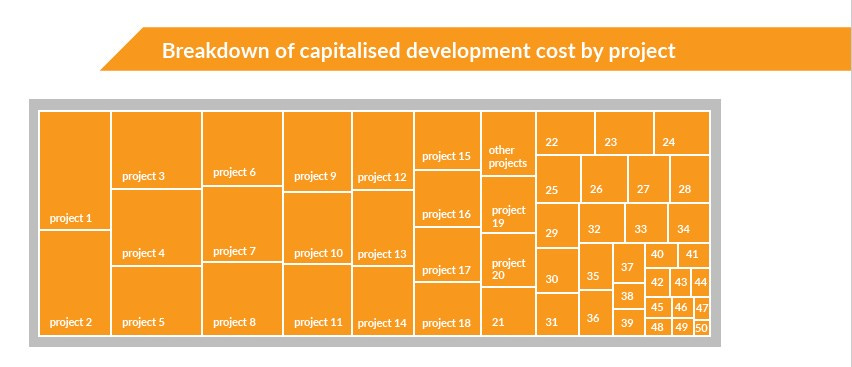

tinyBuild supports its development partners to ensure that all games reach their full potential and that the developers participate in the games’ long-term success through a variety of incentive programmes customized to the specific circumstances. Capital allocation is well diversified across the wide portfolio: no project attracted more than 15% of the total development budget in 2023 and there were over 20 projects with an annual spend of over $0.5m. Each game budget is reviewed periodically and adjusted up or down to reflect audience validation and commercial potential.

tinyBuild’s geographical footprint has consolidated in 2023, following the relocation of staff and studios from areas affected by the invasion of Ukraine into relatively safer locations. It continues to source talent in Eastern Europe, and support staff and potential new joiners.

SG&A expenses for FY23 represent around 58% as % of total revenues (37%). This due to a reduction in revenues around 30% and increase in costs such as salaries and relocations costs.

Cost of sales include primarily the amortization of debt costs and royalty payments.

Cost of sales increased by much more than 200% due to impairments of software development cost from acquisitions whose value was written down as zero on the B.S. Thus, It is a non-cash item, but an accounting item.

Future Strategy

Focus on IP franchises.

1000-hour games. +Longetivity in back catalogue games.

Systems vs. pure content (Minecraft case), increasing gameplay.

Moving from Indie /AA to AAA games.

“In 2023 we have refocused on products that connect with audiecnces, using hard data to back it up, evidenced by early 2024 traction abd annoucements. We are also leaner and more efficient with a lower and more flexible cost base”. [tinyBuild].

Background

The stock price has dropped by 98.60% since the IPO date in 2021.

I will now explain the causes that, in my opinion, have caused such a loss of value for the company in the stock market.

IPO stock overvaluation.

12x sales. COVID-19 tail winds.

Revenue cut by bundles around 30% (Mainly from xBox and Play Station)

Calamitous capital allocation strategy.

HakJak Studios was opened in 2020 and closed in 2023.

Versus Evil was acquired in 2021 and closed in 2023. Impact of $31 mm.

DeMagic Games was incorporated in 2022 and closed in 2024.

Those are some examples that have derived in accounting losses in the P&L, but they do not have effect in cash flows activities.Failed launches.

Video games industry situation. -55% since 2023.

Equity raise in december 2023 highly dilutive. The Company issued 192 mm of shares at 5 GBX. £12 mm raised for (10mm from the CEO and 2mm from Atari) in order to conclude pending developments.

Competitive advantages

Intangibles: IP property. Hello Neighbor and Kingmakers.

Network effect: Depending on the game, users could increase exponentially based on what other people are building. Here, the 1000-hour game strategy plays a cornerstone, increasing the longevity, users base and getting a free marketing spend.

Tinybuild is competing in the the gaming industry. It focuses on all platforms, including PC´s and consoles. It is a very high competitive industry with low barriers of entry. In the last year the number of games published have increase strongly due to the digital distribution model.

Growth

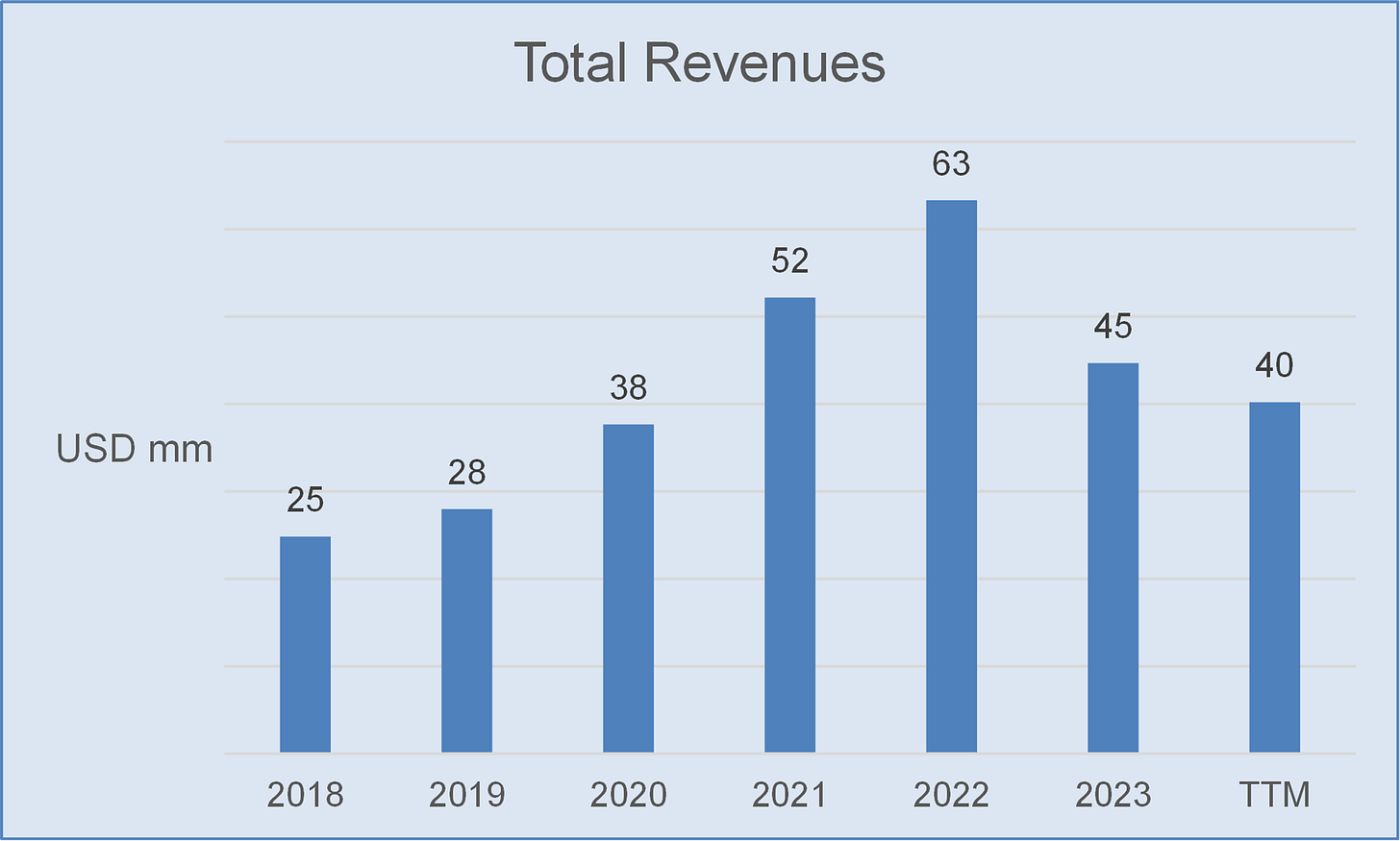

The CAGR 2019-2024 in revenues has been of 12.47%.

Revenues dropped in FY2023 by 31% much exclusively due to the drop in platform deals.

CEO says:

“The things that have impacted us the most was further revenue compression in the second half of last year, which is mostly due to the delays that have happened at Versus Evil, our secondary publishing label and large contracts falling through”.

Management team

The key person is Alex Nichiporchik who founded The Company in 2011. Mr. Nichiporchik gave up the high school to become professional gamer. He owns around 20% of shares.

Mr. Nichiporchik executed a wrong capital allocation strategy in the past, but he regrets of new dilution programs and is convinced about a cost reduction program that can change the business direction.

Atari owns around 8% of shares.

Free float represents around 74% of share.

Financial Metrics

Profitability

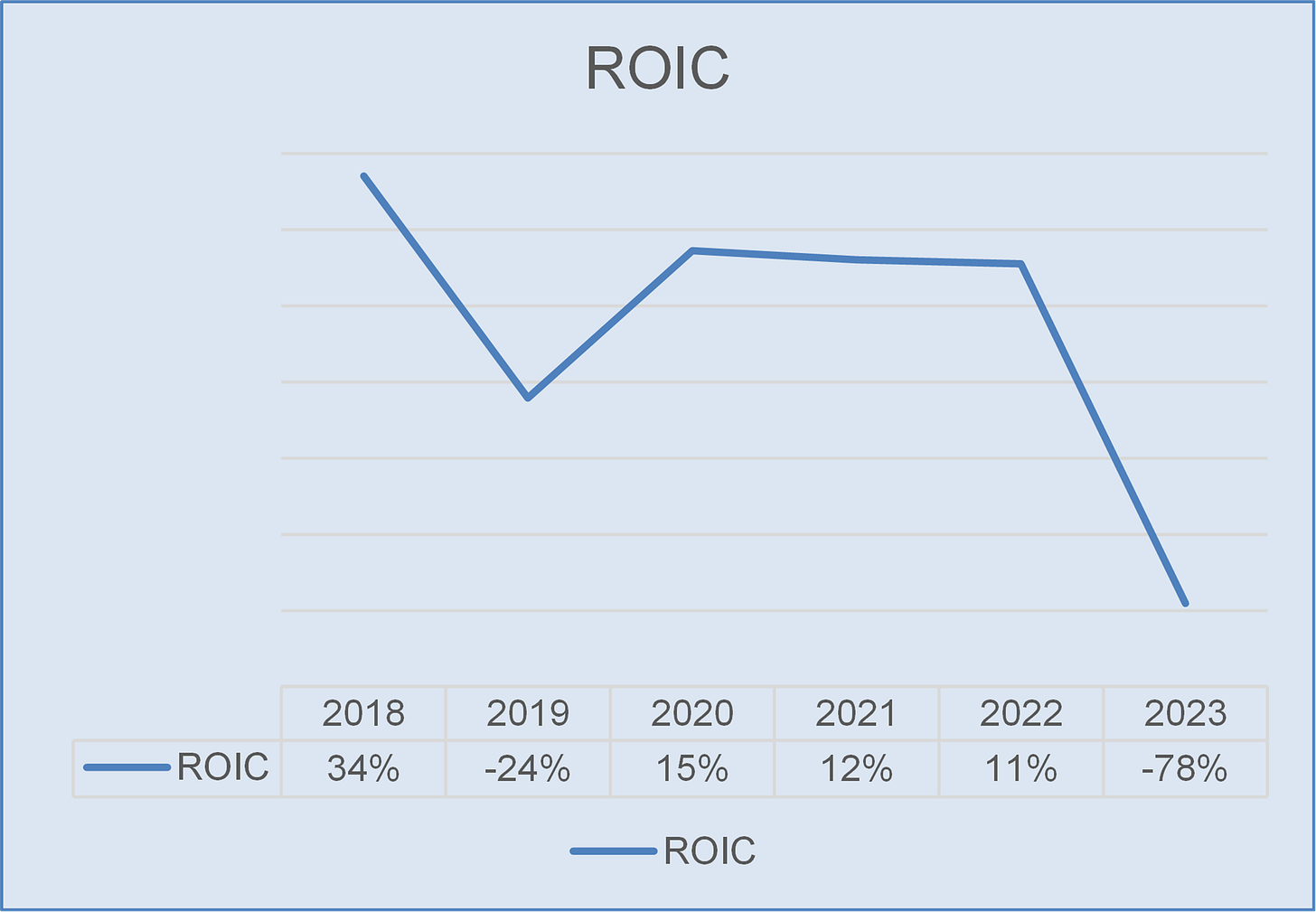

As we can see, although the company is going through a bad time, the ROIC in the past has been around that of the industry and above the WACC, which is around 8%.

Margins

We can see that the margins have eroded mainly for two reasons:

Post COVID-19 adjustments.

Impairments of intangibles and software development derived from disvestures.

Impairments do not supposse a cash outflows but a P&L item (Non-cash).

Why FCF is negative?

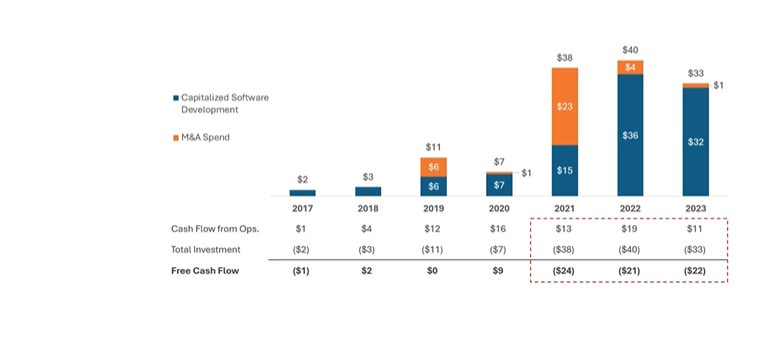

CFO is positive, and is above of Net Income. Then we will see how tinyBuild is investing and the cause of a negative FCF despite a positive CFO.

Software development investments represent near to $83mm in the last three years. what means that The Company is investing in future projects improving the FCF and reversing the current situation.

For lack of a better word and being conservative, I think it is a good sign for the future.

Liquidity

Generally speaking, a good current ratio is anything above 1.2 . A higher ratio indicates the company could pay off current liabilities several times over.

Solvency

The company enjoys a strong financial position, with a net cash position around $9 mm. and no Long-term or short-term debt on the Balance Sheet.

Risks

Market growth, new developments and technological trends.

The Company depends on a relatively small number of games for a significant portion of its revenues and profits.

The increasing importance of mobile gaming.

Dependence on a concentrated customer and third-party platform base.

Delays in new launches.

Ability to compete in AAA games.

Strenghts

Strong financial position.

Longetivity of back catalogue that provides predictable and stable cash flows.

High quality IP.

Know how.

Network effect.

High potential of new launches (Kingmakers).

Valuation

tinyBuild stocks are trading close to 0.22x EV/Revenues (TTM).

Assumptions:

Base case

Revenue growth 24-26 +5%

FCF margin 5%

Terminal multiple 10x

Upside: 25%

Bull case

Revenue growth 24-26 +15%

FCF margin 15%

Terminal multiple 15x

Upside: 641%

Taking a bear case where tinyBuild stock value is zero, the upside is near to 100%.

Last consideration: in my opinion, this investment is highly risky. Risk is a subjective term, and is for that stocks in this category should be adequately weighted in order to maintain a good relationship between Risk, Downside and potential Upside.

In other words, whoever invests in tiny must know what they are doing, and the impact of possible losses on their portfolios from a global point of view.

If you are a professional or qualified investor, and you like my work, don't hesitate to contact me.

Next report: December 27, 2024.

Se pueden comprar acciones en DEGIRO. Un saludo.

Like how you name dropped Atari in this as if it's something of note lol