Disclaimer:

Eloy Fernández Deep Research publishes equity reports, and analysis posts periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports and posts is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This post is not a BUY or SELL recommendation.

I own Spotify shares. 16% of portfolio.

Spotify Technology S.A. (SPOT) is a company based in Luxembourg that provides audio streaming subscription services worldwide. It operates through two segments, Premium and Ad-Supported.

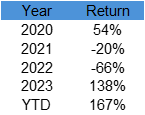

I started buying Spotify shares in 2020 at a price of around $180. Along the way, the stock has suffered significant falls but also joy for shareholders.

Because of that, I took the opportunity to buy shares, which, together with the performance of the stock, has made that Spotify represented more than 18% of my portfolio at its highest price.

Below, I will tell you a few tips that investing in Spotify could teach you.

Investing does not only treat about buy undervalued shares and sell them when outperformed. Investing is all that happens in between.

Last Wednesday, shares reached historic highs, closing stock price at $502. Having my personal case, someone that had bought shares on 05/20/2020 would have an annual return around 25%.

However, this should not lead us to an incomplete analysis of the matter.

It represents a total return around 165%.

In addition, I was buying shares in 2022 at a mid-price of $125.

Conclusions:

If you have a flight plan, it is worth being patient and going against the herd.

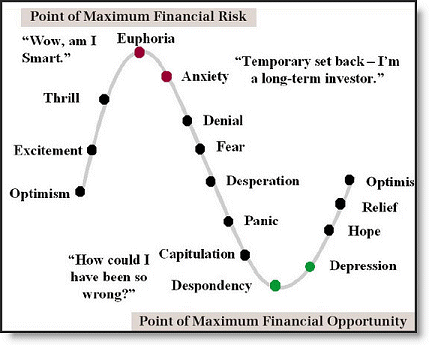

In the midst of successful investing, there is volatility, and you have to be prepared to deal with it.

Going against the market is very painful. If you want to obtain extraordinary returns without suffering, it is better not to invest.

Theory and practice differ when the key moment arrives.

Do you remember “The Five rules” included in Weekly thoughts #3 ?

The five rules:

Don’t buy anything without a previous work.

Don’t buy anything you do not know.

Don’t fall in love with a stock.

Be humble and assume losses.

Keep on a strategy and be consistent.

“Selling is the hardest decision of all”. Seth Klarman.

There are several reasons to sell shares:

Upside is narrower.

An excessive weight.

The thesis has not been fulfilled, and you assume an error.

Taxation strategy, avoiding capital gains by Offset your gains by taking investment losses.

The theory sounds great! However, when you hold shares of a market winner, it is very tough to recognize that it is the moment to leave. At least time to reduce position.

Remember: Don’t fall in love with a stock. Don’t let your ego get in the way of making money.

If you take a good strategy consistently, you might be wrong sometimes, but you will win in the long term.

I have started selling Spotify shares with the aim of maintaining a more reasonable weight. And I think that, although narrower, there is still upside. But the price increases led me to abstract myself and follow my strategy.

Remember that intrinsic value and risk perception are subjective. Thus, each investor may have a different weight for the same stock. Investing is more an art than a science.

People jump on the bandwagon easily when things go right.

Herd mentality bias refers to investors’ tendency to follow and copy what other investors are doing. It is human and understandable behavior. We feel more comfortable with opinions that are widely accepted.

Again, the concept: we often find it emotionally or psychologically painful to go against the crowd.

In 2022, it was very usually to read and hear only bad news about Spotify. The stock was practically in ruins; however, now it is difficult to read or hear a bad sentiment. Obviously, we should not go against the masses systematically. It is important to properly analyze the market sentiment, because many times Mr. Market can be right. Thus, you must do your job and not rely excessively on the majority opinion.