Other Recent writeups:

Analyst Coverage

Steve Silver-ARGUS Research.

Brendan McCarthy, CFA-Sidoti & Company, LLC.

Daniel Baldini-Oberon Asset Management.

Analysis date: February 28, 2023.

Key Points

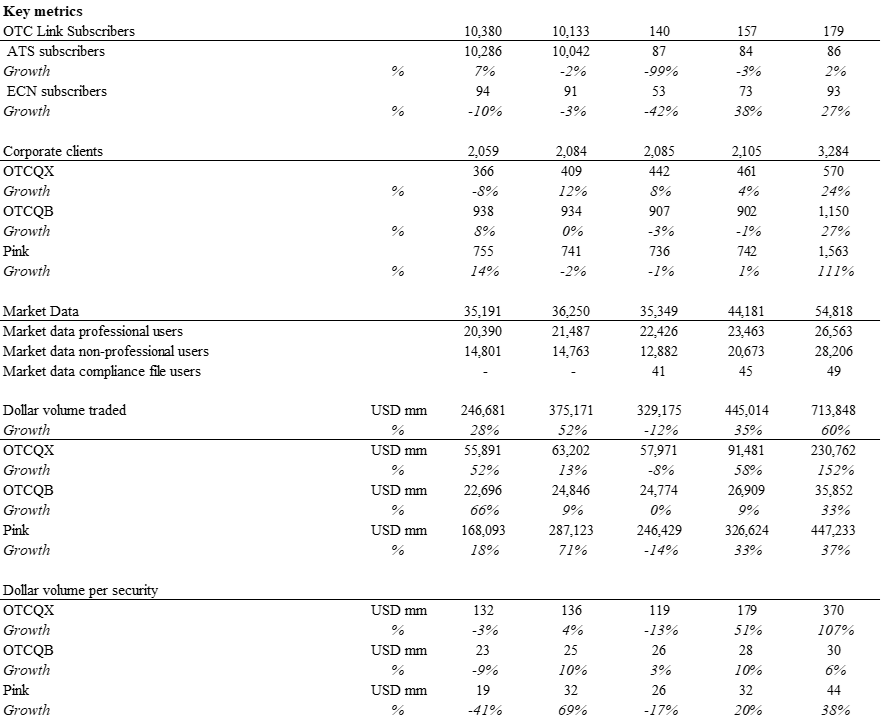

OTC Link trading systems, corporate services and market data business.

Subscription-based model that allows to the company to employ negative NWC.

13% CAGR 2017-2021 of gross revenues.

Asset light model business.

Brilliant execution over the years but fairly valued.

Disclaimer:

Eloy Fernández Deep Research publishes equity reports periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

Introduction

OTC Markets Group Inc. (OTCQX: OTCM) is a U.S based-company that engages in the financial market business. It offers OTC Link trading systems, corporate services and market data.

OTC-traded securities are organized into three public markets: OTCQX Best Market, OTCQB Venture Market and Pink Open Market.

Short Historical review

1913. The company was as the National Quotation Bureau (NQB). NQB reported quotations for both stocks and bonds, (Pink Sheets and Yellow Sheet).

1963. The company was owned by Commerce Clearing House CCH.

1999, the NQB introduced the real-time Electronic Quotation Service.

2000 NQB changes its name to Pink Sheets LLC.

2008 Pink Sheets LLC changes to OTC Markets.

2010 The company changed to its current name, OTC Markets Group.

2022. OTC Markets Group announces acquisition of EDGAR® Online, a disclosure documents and company financials provider.

Currently the company operates regulated markets for trading 12,000 U.S. and international securities.

Business model

The Company operates three business lines:

OTC Link LLC what is a FONRA member broker-dealer.

Market Data Licensing distributes market data and financial information.

Corporates services operating OTCQX and OTCQB© markets.

Essentially OTCM takes a fee for services from subscribers, corporate clients and professional and non-professional users.

Product and services

OTC Link

OTC Link LLC, a FINRA broker-dealer what operates:

OTC Link ATS

It is a SEC regulated Alternative Trading System through OTC Link ATS provides regulated quotation, messaging, trade execution and reporting services. It offers a network-based model facilitating transactions over-the -counter.

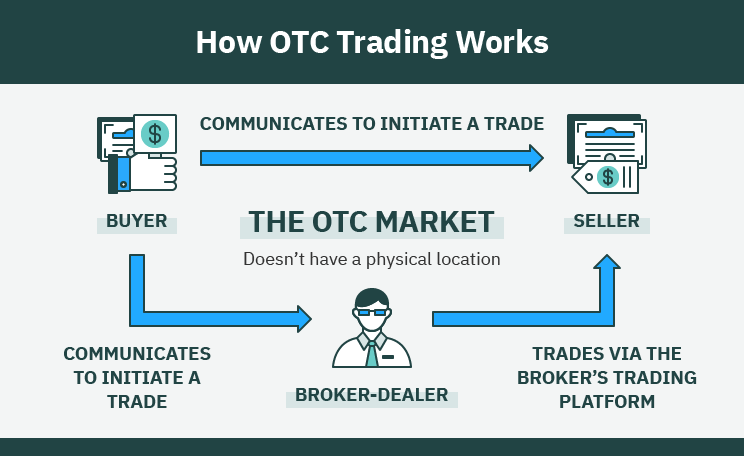

How OTC transactions works?

Basically over-the-counter is the process of trading securities via broker-dealer against to trade on a centralized exchange.

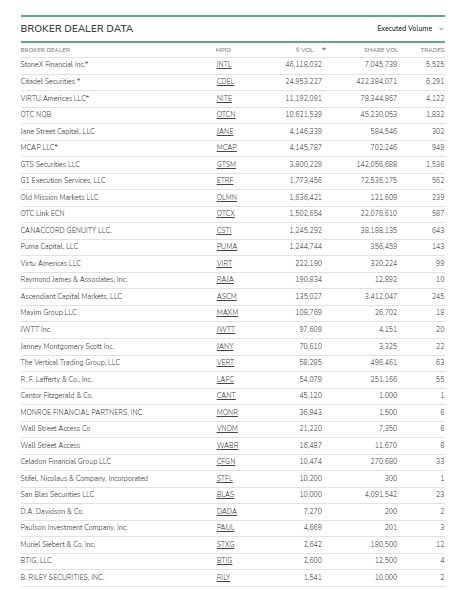

Broker-dealers subscribers to OTC Link ATS pay fees to publish quotes and deliver trade messages electronically to the counterparties.

OTCM pays rebates to resellers of ATS services which are recorded as a reduction of gross revenues.

OTC Link ECN (Electronic Communication Network).

It provides subscribers with anonymous order matching functionality.

ECN generates revenues based on share volume executed on the platform.

In addition broker-dealers counterparties pay a fixed fee per share executed.

OTC Link NQB (National Quotation Bureau).

It operates as a Interdealer Quotation System and matching engine.

NQB generates revenues similarly to ECN.

Brokers-dealers pay monthly subscription fees to access to the trading system. Fees are based on authorized users per subscriber.

OTC Link represents around 29%of gross revenues for FY2021.

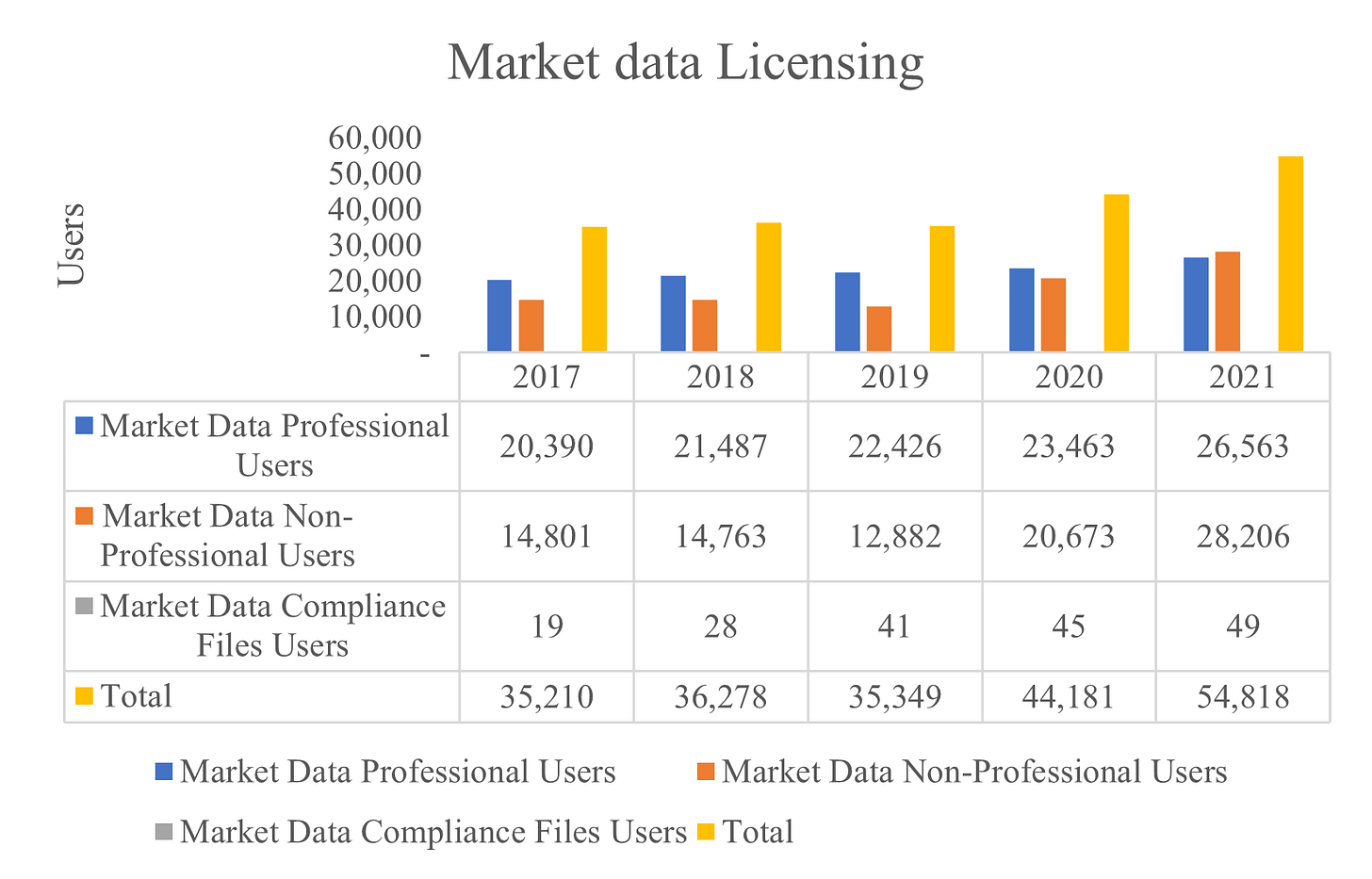

Market Data Licensing

OTCM generates a large amount of market data and information. Market Data Licensing business provides access to market data and financial information including:

Real-Time.

Delayed and end-of-day quotation and trading data.

Security master data.

Company data.

Compliance data.

Licenses are priced per enterprise or per user.

Subscribers pay monthly fees and revenues result mainly from sales through redistributors who earns fees on a contractual fixed rate. These fees are recognized as reduction of gross revenues.

Market Data Licensing represents around 33% of gross revenues for FY2021.

Corporate services

OTCQX Best Market.

It provides public trading without requirements and cost of exchange listing. To join OTCQX companies must meet a minimum financial disclosure and qualitative standards.

OTCQX is divided into OTCQX U.S. and OTCQX International. Both are comprised of 170 and 400 companies respectively.

OTCQB Venture Market

It provides public trading for development-stage companies.

Pink Open Market

Companies securities that do not meet the standards or choose not to apply OTCQX or OTCQB trade in the Pink Open Market.

Pink Open Market companies are categorized as “Pink Limited Information”.

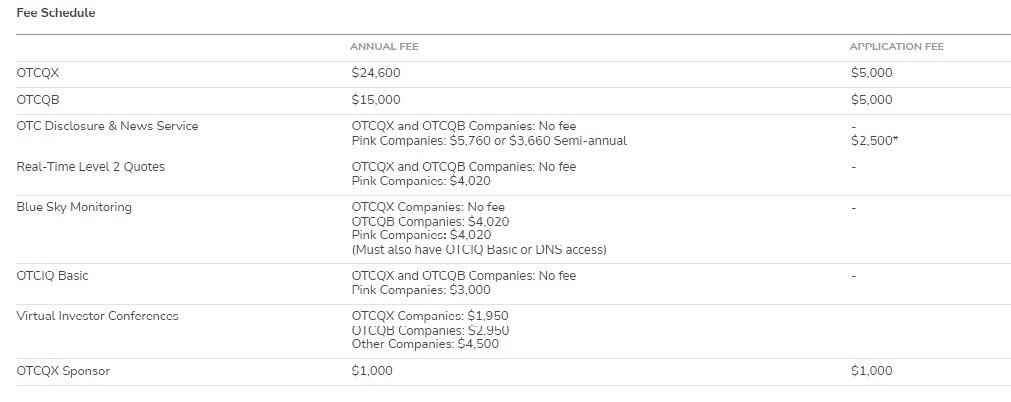

Companies pay a one-time and annual or semi-annual fees upon renewal.

OTCM also charges for the right to host webcast presentations and online events.

Corporate services represents around 38% of gross revenues for FY2021.

On November 9, 2022, OTC Markets Group completed the acquisition of EDGAR® Online, an established supplier of real-time SEC regulatory data and financial analytics.

EDGAR covers the United States public company disclosure dataset, including SEC Reporting, Bank Reporting and and News Service.

As March 1, 2022 , OTCQX and OTCQB markets are exempt from state Blue Sky laws regarding 37 states. In my opinion that recognition make to both, OTCQX and OTCQB more attractive. However, long-term investors confidence is very difficult to determine.

Customers

We have to think on OTCM customers as:

Companies who choose to apply to trade in OTCQX, OTCQB or Pink Open Market.

Companies who are trading in OTCQX, OTCQB or Pink Open Market.

Broker-dealers.

Professional and non-professional users of market data.

A majority of OTC Link and Market Data Licensing customers are financial institutions.

Market Data Licensing uses third parties to sell data to end users. Three largest or redistributors represent 11% and 15% of gross revenues for 2021 and 2020.

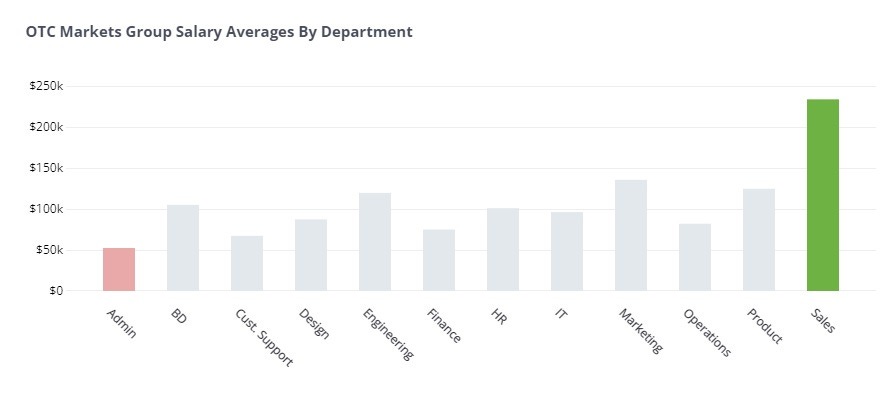

Employees

On December 31, 2021, OTC Markets Group employed a total of 107 employees, all of whom are full-time employees.

Employees support three business lines:

Information Technology.

Marketing.

Finance/Corporate Administration support.

Stock-based Compensation

Staff is a pillar on OTCM operations. Retention of employees is the key to ensure a long-term performance.

“We believe great people make a great company, and we pride ourselves on attracting and retaining top talent and developing a collection of creative minds who find inspiration in their work. We have designed our compensation and benefits programs to promote the retention and

growth of our employees along with their health, well-being and financial security. [1]

The Company grants stock options to new, full-time employees as of the last date of their first month of employment, with the strike price set at the closing price on the day prior to the grant date. Stock options granted vest in equal installments, annually, over 5 years.

Unit Economics

OTCM pays redistribution fees and rebates related to arrangements with

market data redistributors. In addition The Company pays rebates to certain resellers of OTC Link ATS services. These payments represent around 3% of Gross Revenues.

Payments made to subscribers providing liquidity are recognized as transaction-based expenses representing around 9% of Gross Revenues.

Compensation and benefits costs consist of:

Cash bonus

Base salaries

Commissions related to sales

This item represent around 33% of Gross Revenues.

IT Infrastructure and information services costs is related to support the OTC Link ECN, system security and workstation equipment. It represents around 7% of Gross Revenues.

Professional and consulting fees comprise basically OTC Link’s regulatory and clearing costs. It represents around 4% of Gross Revenues.

Marketing and advertising represent around 1% of Gross Revenues.

Occupancy costs amount around 2% of Gross Revenues.

General, administrative and other costs represent around 1% of Gross revenues.

In my opinion Compensation and benefits, and IT Infrastructure have certain level of scalability.

Value proposition

OTC Markets operates to Facilitate Trading and Transparency Among Stakeholders.

Broker-dealers

The company serves technology and data to broker-dealers who depend on OTC Markets to trade securities.

Market makers attract business by competing on price, execution quality, and their ability to fill large or specialized orders.

Companies

Fees for apply and operates on Stock Exchanges are much higher than OTC Markets, mainly for Early Stage companies.

Tiered markets, OTCQX, OTCQB and Pink, support the needs of public companies through:

Technology and access to digital information.

Disclosure standards (Blue Sky Laws and Rule 211).

Public and efficient platform that ensures market transparency.

Compliance evaluating company compliance with OTCQX and OTCQB qualifications.

Every day, regulated broker-dealers, public companies, and their investors, depend on OTC Markets to trade and value billions of dollars of securities. Our mission is to create better-informed and more efficient financial markets, and we provide our users with the tools, transparency, and technology to succeed in the public markets. [2]

Investor

Over-the-counter securities are traded without being listed on an exchange. OTC trading helps promote equity and financial instruments that would otherwise be unavailable to investors.

OTCM provides compliance data to the SEC and other regulators so they can oversee market activity and monitor compliance with securities laws and regulations.

In summary a greater transparency degree makes it easier for investors to make informed decisions and allows broker-dealers to meet their regulatory obligations.

Competitive advantages

We can see competitive advantages from different angles:

Services to broker-dealer community

Switching costs.

Cost to switch to an alternative is too high for broker dealers, mainly from regulated quotation, messaging, trade execution and reporting services which are essential for trading.

Network effect

Brokers-dealers need to operate where other operate.

Companies

Switching costs

OTCQX markets achieved 96% retention rate for FY2021, up versus the 94% retention rate for FY2020.

90% of OTCQB companies renew subscriptions.

Despite that, in my opinion is a second class advantage because listed companies engagement could be temporal. Exchange trading is much more expensive than OTC trading , but stock exchanges provides other advantages such as more liquidity and visibility.

Intangible assets.

OTCQX and OTCQB. Over-the-Counter markets is synonym of OTC.

Professional users of Market Data

Switching costs.

High cost to migrate to an worse service of market data.

Growth

Trading volumes are highly unpredictable and could decline in the future.

In my opinion the Corporate Services growth resulted from sales and increased demand to comply with Rule 15c2- 11.

Rule 15c2- 11

Rule 15c2- 11 took effect in September. This rule set minimum current disclosure

standards for companies to continue to be quoted on broker-dealer networks, such as OTC Link ATS.

Many companies expanded their subscription to OTC’s Disclosure and News Service.

In my opinion past growth could be difficult to replicate due to:

Tailwinds as Rule 15c2- 11 and trading market securities.

TAM growth is limited.

CEO says:

“Over the long-term, we expect OTC Link to contribute revenues closer to the 20% range. We note that OTC Link’s total addressable market growth is somewhat limited”.

Growth around 5-10% could be a realistic figure for next five years.

According to the management narrative OTC Markets Group strategy is focused on:

Drive sustainable revenue growth across each of our business lines that increases long-term per share earnings power.

Commercialize regulatory status under Rule 2-11 to create new opportunities for public companies and broker-dealers.

Advocate for additional regulatory recognition of our markets to increase the value of being public.

Pursue corporate development efforts to grow and diversify our product suite and client base. [4]

Capital Allocation

M&A

EDGAR®

In November 2022, OTC Markets Group completed the acquisition of EDGAR® Online, a premium supplier of real-time SEC regulatory data and financial analytics, from Donnelley Financial, LLC, for $3.5 million in cash.

Rationale

This acquisition is within SEC Rule 15c2-11. The Company is looking for expanding data and disclosure services.

CEO says:

“EDGAR Online has a long history of providing company disclosure and financial information, structured data sets and insights. This acquisition expands our reach to cover the full complement of U.S. public companies, adding SEC reporting data to the issuer data we currently provide to our disclosure and news service. As a long-time EDGAR Online customer ourselves, we value its data and analytics products”.

“The enterprise customer base includes regulators, exchanges, brokerage firms, data distributors and financial portals that rely on EDGAR Online's mission-critical SEC data and compliance tools. EDGAR Online services are embedded into our issuer compliance and disclosure digitalization process”.

“This high-quality data allows our team to build automated tools that track a company's compliance with disclosure, financial standards and regulatory reporting requirements. By bringing these vital services in-house, we protect our existing operations and have an opportunity to expand our data offering and distribution channels”.

“Along with our purchase of the EDGAR Online business, we are bringing in a team with deep technological and operational expertise. These skills are useful for building our platform, supporting public companies’ disclosure distribution, streamlining data-driven market standards and allowing broker/dealers to automate business processes”.

Blue Sky Data Corp.

In May, 2022 OTCM acquired Blue Sky Data Corp. for around USD 12 M in cash.

Rationale

New subscription to OTCM´s Blue Sky data products expanding the subscriber base.

CFO says:

“Our market data licensing business saw an increase in gross revenues of 6% with the full quarter benefit of the acquisition of Blue Sky Data Corp., which closed during the second quarter of 2022”.

Shareholder retribution

During 2021, the Company paid USD $25.5 in dividends, and $1.5 million in respect of repurchases of Class A Common Stock. Pay-out ratio is around 26%.

CEO says:

“In closing, I am pleased to announce that on November 10th, our Board of Directors declared a special dividend of $1.50 per share and a quarterly dividend of $0.18 per share, each payable in December. These dividends reflect our ongoing commitment to providing superior shareholder returns”.

In November 2021 and 2020, the Board of Directors authorized the increase in the number of shares available for issuance under the Plan by 190,000 and 200,000 shares, respectively.

Industry

OTC Markets Group operates in Financial service industry, under FINRA regulations. This is the largest independent US regulator that oversees brokerage firms and exchange markets.

The global financial services market grew from $25848.74 billion in 2022 to $28115.02 billion in 2023 at a compound annual growth rate (CAGR) of 8.8% [https://www.thebusinessresearchcompany.com/report/financial-services-global-market-report]

The global financial services market is segmented -

1) By Type: Lending And Payments, Insurance, Reinsurance And Insurance Brokerage, Investments, Foreign Exchange Services

2) By Size Of Business: Small And Medium Business, Large Business

3) By End User: Individuals, Corporates, Government, Investment Institution [5]

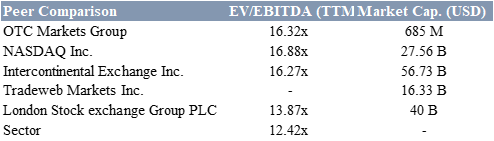

Competitors

Nasdaq Inc.

It operates as a technology company that serves capital markets and other industries. It operates in three segments: Market Platforms, Capital Access Platforms, and Anti-Financial Crime. The Market Platforms segment trading services, including equity derivative trading and clearing, cash equity trading, fixed income and commodities trading and clearing, and trade management service businesses. [6]

London Stock exchange Group PLC

London Stock Exchange Group plc engages in the market infrastructure business primarily in the United Kingdom, the United States, other European countries, Asia, and internationally. The company operates through three segments: Data & Analytics, Capital Markets, and Post Trade. It operates a range of international equity, fixed income, exchange-traded funds/exchange-trading, and foreign exchange markets, including London Stock Exchange, AIM, Turquoise, CurveGlobal, FXall, and Tradeweb. The company also provides information and data products, such as indexes, benchmarks, real time pricing data and trade reporting, and reconciliation services, as well as network connectivity and server hosting services; market trading services; and clearing, risk management, capital optimization, and regulatory reporting solutions. In addition, it offers media training, events space, and studio hire services. Further, the company licenses capital markets; installs software; and provides maintenance services. London Stock Exchange Group plc was founded in 1698 and is headquartered in London, the United Kingdom. [7]

Intercontinental Exchange

Intercontinental Exchange, Inc., together with its subsidiaries, engages in the provision of market infrastructure, data services, and technology solutions for financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, Singapore, India, Abu Dhabi, Israel, and Canada. It operates through three segments: Exchanges, Fixed Income and Data Services, and Mortgage Technology. The company operates regulated marketplaces for listing, trading, and clearing an array of derivatives contracts and financial securities, such as commodities, interest rates, foreign exchange, and equities, as well as corporate and exchange-traded funds; and trading venues, including regulated exchanges and clearing houses. It also offers energy, agricultural and metals, and financial futures and options; and cash equities and equity options, and over-the-counter and other markets, as well as listings and data and connectivity services. In addition, the company provides fixed income data and analytic, fixed income execution, CDS clearing, and other multi-asset class data and network services. Further, it offers proprietary and comprehensive mortgage origination platform, which serves residential mortgage loans; closing solutions that provides customers connectivity to the mortgage supply chain and facilitates the secure exchange of information; data and analytics services; and Data as a Service for lenders to access data and origination information. Intercontinental Exchange, Inc. was founded in 2000 and is headquartered in Atlanta, Georgia. [8]

Tradeweb Markets Inc.

Tradeweb Markets Inc. builds and operates electronic marketplaces in the Americas, Europe, the Middle East, Africa, Asia Pacific, and internationally. The company’s marketplaces facilitate trading in a range of asset classes, including rates, credit, money markets, and equities. It offers pre-trade data and analytics, trade execution, and trade processing, as well as post-trade data, analytics, and reporting services. The company provides flexible order and trading systems to institutional investors. It also offers a range of electronic, voice, and hybrid platforms to dealers and financial institutions on electronic or hybrid markets with Dealerweb platform; and trading solutions for financial advisory firms and traders with Tradeweb Direct platform. The company serves in the institutional, wholesale, and retail client sectors. Its customers include asset managers, hedge funds, insurance companies, central banks, banks and dealers, proprietary trading firms, retail brokerage and financial advisory firms, and regional dealers. Tradeweb Markets Inc. was founded in 1996 and is headquartered in New York, New York. Tradeweb Markets Inc. is a subsidiary of Refinitiv Parent Limited.[9]

Management team

Officers and Directors

R. Cromwell Coulson, President and Chief Executive Officer (55). Mr. Coulson has been President, CEO and a Director of OTC Markets Group since 1997. He is responsible for the Company’s overall growth and strategic direction.

Prior to OTC Markets Group, he was a trader and portfolio manager at Carr Securities Corporation, an institutional broker-dealer and market maker.

Business School.

Antonia Georgieva (47), joined OTC Markets Group in January 2021 as CFO. Ms. Georgieva has more than 17 years of M&A and capital markets experience in fintech and financial services. Prior to joining OTC Markets Group, Ms. Georgieva was a Partner at Drake Star Partners, a global investment banking firm. Previously, Ms. Georgieva was a Managing Director at BMO Capital Markets Corp.

Matthew Fuchs, Executive Vice President, Market Data Licensing.

Lisabeth Heese Executive Vice President, Issuer Services.

Michael Modeski President, OTC Link LLC.

Bruce Ostrover, Chief Technology Officer.

Jason Paltrowitz, Director, OTC Markets Group International Ltd; Executive Vice President.

Daniel Zinn, General Counsel & Chief of Staff.

Gary Baddeley, Director.

Louisa Serene Schneider, Director.

Andrew Wimpfheimer, Director.

Neal Wolkoff, Chairman of the Board of Directors.

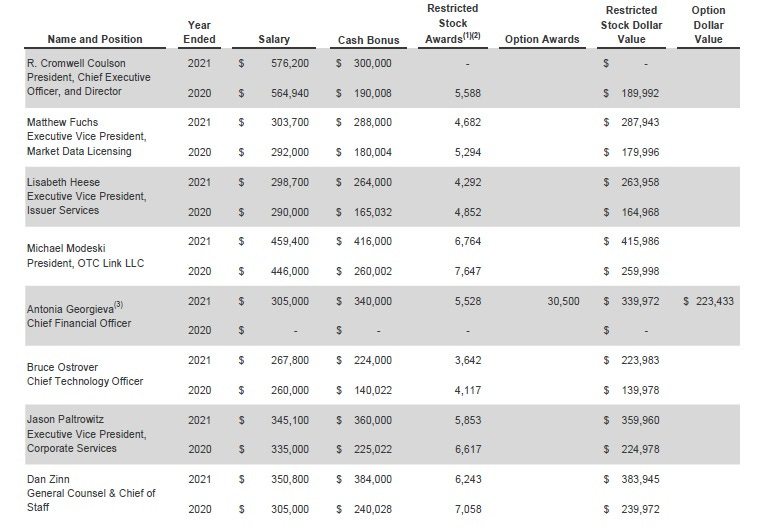

Compensation

All officers and directors may be contacted at OTC Markets Group’s address.

** Beneficial share ownership includes vested options, options scheduled to vest within 60 days of March 1, 2022, and stock owned subject to an RS Agreement.

(1) Includes 370,000 Class A shares held by Mr. Coulson’s wife and 24,800 total Class A shares held equally by two trusts for the benefit of Mr. Coulson’s children. Mr. Coulson disclaims beneficial ownership of these securities and this Annual Report shall not be deemed an admission that Mr. Coulson is the beneficial owner of these securities for any purpose. Mr. Coulson’s wife and children are beneficiaries of the Cromwell Coulson Family 2012 DE Trust, which owns 884,000 Class A shares of the Company. These shares are not included in the number of shares Mr. Coulson beneficially owns, and Mr. Coulson disclaims beneficial ownership of

these securities. This Annual Report shall not be deemed an admission that Mr. Coulson is the beneficial owner of these securities for any purpose. The change in Mr. Coulson’s beneficial ownership as of March 1, 2022, reflects the repurchase by the Company on January 29, 2022, of 13,944 Class A shares at a price of $61.50 per share.

(2) Ms. Georgieva’s outstanding options consist of 30,500 awarded in January 2021, at an exercise price of $33.99, 6,100 of which are vested.

(3) Mr. Ostrover’s outstanding options consist of 4,800 awarded in November 2017, at an exercise price of $25.00, none of which are vested.

(4) Includes 221,498 Class A shares held by the Melinda Wimpfheimer 2012 Irrevocable Trust, of which Mr.held by the Melinda Wimpfheimer 2012 Irrevocable Trust, of which Mr. Wimpfheimer is a beneficiary.[10]

(1) All restricted stock awards are Class A Common Stock. The 2021 and 2020 restricted stock awards consisted of shares of unvested stock, which vest equally over five years.

(2) The fair market value of the Class A Common Stock was $61.50 at grant date for shares awarded related to the year 2021, and $34.00 at grant date for shares awarded related to the year 2020.

(3) Ms. Georgieva joined OTC Markets Group in January 2021.[Annual Report 2021]

As of December 31, 2021 R. Cromwell Coulson HOLDS 3,274,744 shares.

In addition, Mr. Coulson’s wife and children are beneficiaries of the Cromwell Coulson

Family 2012 DE Trust, which owns 884,000 Class A shares of the Company. [11]

“Officers and directors hold approximately 4.1 million shares of Class A Common Stock, which may be “control shares” subject to the volume and manner of sale restrictions under Rule 144. These shares are excluded from the number of shares freely tradable”. [12]

Risks

Much of OTC Markets revenue is fixed under subscription, however interest rates and macroeconomic conditions can contribute to decline trading volumes and OTCM revenue.

There are very few alternatives for companies who do not meet requirements to be listed on stock exchanges. However companies who meet that requirement could switch to stock exchanges.

OTC Markets is under reputational risk. Operating results could be harmed if The Company is not able to maintain reputation.

In order to hold employees, OTC Markets maintain buyback programs. It is difficult to evaluate the value delivered to shareholders under those policies.

OTC Markets Group does not file financial statements with the SEC.

Financial Metrics

Financial Statements as reported

Earnings

Capital structure analysis

I consider that cash is not necessary to operate the business excepting short-term restricted cash. NWC is negative due to subscription model business, what allows to The Company to finance its operations through customers payments.

We can make an conservative assumptions considering all cash amount to calculate capital employed on operate the business. In this case NWC is USD 17 M for FY2021 versus around USD 7 M of Fixed operating assets.

Capital employed (including cash), represents around 23% of Gross Revenues. OTCM is a very asset-light model business.

Capex requirement is very low. Maintenance and growth Capex represent around 1.5% of Gross Revenues.

High rate of conversion EBITDA to FCF suggests a asset-light model too.

Profitability

Operating cash flow higher than NI is desirable and a sign of profitability.

In my opinion ROE is overstated due to financial leverage. Despite that pre-tax ROCE (Including cash), for FY2021 is around 150%.

Liquidity

Solvency

OTC Markets have no outstanding debt. $1.5 million are available for business operations under a line of credit.

“OTC Markets Group maintains a commercial banking relationship with JPMorgan Chase. On July 7, 2012, the Company entered into a line of credit agreement with JPMorgan Chase (the “Line of Credit”). Pursuant to various extensions, the Line of Credit provides up to $1,500 of available borrowing capacity to fund business operations through June 24, 2022. Since inception, we have not drawn funds on the Line of Credit. Under the terms of the Line of Credit, we agreed to fulfill certain affirmative and negative covenants and other specified terms”. [13]

Valuation

[1] [4] [10] [11] [12] [13] Annual Report FY2021

[2] OTC Markets Group.

[5] https://www.thebusinessresearchcompany.com/report/financial-services-global-market-report

[6] [7] [8] [9] Seeking Alpha

do you think that # of pubic firm traded at OTC market will decline over the period of time as happened at big stock exchanges? that an existential threat .. beside it, OTC has been able to increase revenue but there will come a tipping point when # of firms would decrease and OTC will fall off the cliff. any thoughts about it?