Disclaimer:

Eloy Fernández Deep Research publishes equity reports, and analysis posts periodically. All reports are subject to the following disclaimer.

Eloy Fernández Deep Research gathers information from public (free and paid) databases, company reports and media releases. This information is used as available basis.

Eloy Fernández Deep Research reports should only be taken as guidance. They don’t suppose an investment recommendation. Any investment decision should not be based on the Eloy Fernández Deep Research Report. Eloy Fernández Deep Research is not responsible for any investment decision or later consequences.

The opinion expressed in the reports and posts is my current opinion. This opinion is based on the prevailing market trends and is subject to change.

This post is not a BUY or SELL recommendation.

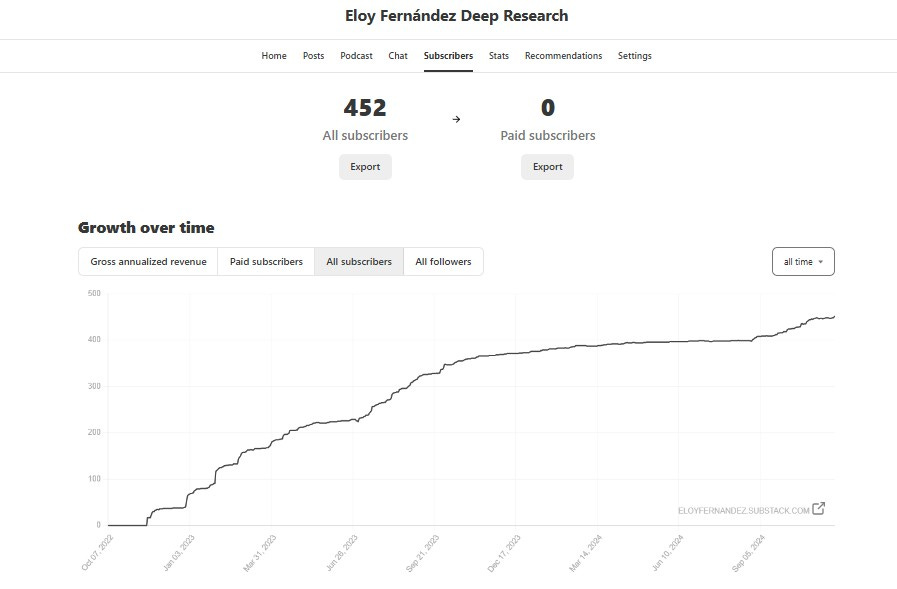

We are celebrating our anniversary. Eloy Fernández Deep Research turns two years old. There are already 452 of us walking this nice path. After two years, it may seem like a very mediocre figure, and although objectively it is, I am very satisfied with the level of activity of the subscribers. Your readings and feedback help me to continue with determination and tenacity. Someone might think that it is a work in vain or with a very poor reward, but in reality this substack always had a different orientation than others. Here we are not going to discover the next ten bagger stock, show magnificent results from my personal portfolio, or publish the letters of that famous investor who everyone admires. I don't criticize it; it is a valid style that have to exist, but it is not my style, I am a different animal.

“Quality is more important than quantity. One home run is much better than two doubles”. Steve Jobs.

I try to publish mainly small gems or unknown companies, categorized into three groups:

High upside with high risk.

Growth and quality businesses.

Stocks that, although with a limited upside, may be interesting to review either for the future when the upside is higher or to learn about business models that can serve to widen our circle of competition.

My goal is not to get a large subscriber base and then monetize the site, getting a volume revenue model. That is not my style. My idea is to obtain quality growth through exhaustive analyses of companies on different styles. (Others could be added to the three points mentioned above in the future, such as special situations, turnarounds or M&A) and at the same time expand the value provided through new sections, products and resources, creating a community. That is the key word: COMMUNITY.

With all this, in addition to trying to provide value for you, I seek to force myself to do a more exhaustive and professional search and analysis job. And I can assure you that it has been of great help for my activity as a private investor. Therefore, I can only be grateful to all of you for supporting me. I will continue on the way of continuous improvement to provide more value in the future and ensure that we become a larger community and, above all, with a higher level that benefits everyone.

Since then, I have published thirteen stock analyses, which I would like to summarize along with their performance.

Analysis date: November 22, 2022.

Return since analysis date: +25%

I do not own shares.

MIPS AB (MIPS) is a Sweden-based company that sells solutions against rotational forces, integrating them into helmets brands models. MIPS AB is a world-leader in this area. The company was founded in 1995 by Hans Von Holt, a Swedish brain surgeon.

Analysis date: December 29, 2022.

Return since analysis date: -57.22%

I own shares. 2.30% of portfolio.

Leatt (LEAT) is a South African based company that designs, develops, markets and distributes protective equipment and apparel for motor sports and leisure activities, including riders of motorcycles and cycles mainly.

Analysis date: January 30, 2023.

Return since analysis date: -39.26%

I do not own shares.

XPEL (XPEL) is a San Antonio, TX. based company leader in the protective film industry. The Company is a leading provider of protective films and coatings, including automotive paint protection film, surface protection film, window films, and ceramic coatings. XPEL products can be used to protect cars, watercraft and for residential and commercial uses too.

Analysis date: February 28, 2023.

Return since analysis date: -8.85%

I do not own shares.

OTC Markets Group Inc. (OTCQX: OTCM) is a U.S based-company that engages in the financial market business. It offers OTC Link trading systems, corporate services and market data.

OTC-traded securities are organized into three public markets: OTCQX Best Market, OTCQB Venture Market and Pink Open Market.

Analysis date: March 30, 2023.

Return since analysis date: +29.18%

I own shares. 2.40% of portfolio.

TOYA, S.A. (TOA) is a Polish-Based company whose core business activities include production of hand tools, power tools, professional gastronomy equipment and equipment useful in every home.

Analysis date: April 27, 2023.

Return since analysis date: +41.14%

I own shares. 4.35% of portfolio.

Altia Consultores S.A. (ALC) is a Spain-based company primarily engaged in the provision of information technology (IT) services. The Company's activities are divided into seven business areas:

The Company cooperates with a number of entities, such as IBM, McAfee, Hewlett-Packard (HP), Hitachi Data Systems, Oracle and Microsoft. It is a subsidiary of Boxleo Tic SL.

Analysis date: June 29, 2023.

Return since analysis date: -56.81%

I own shares. 3.70% of portfolio.

Topgolf Callaway Brands (MODG) is a leading golf company that provides golf entertainment experiences, designs and manufactures golf equipment, and sells golf and active lifestyle apparel and other accessories through its family of brand names.

Analysis date: July 14, 2023.

Return since analysis date: +42.38%

I own shares. 5.40% of portfolio.

Yonex Co. (7906.T) is a Japan-based company that manufactures, purchases, and sales sports equipment such as sportswear, and also operates related sports facilities.

The Company manufactures badminton rackets, tennis rackets, golf clubs, clothing and shoes, snowboards, shuttlecocks, strings, stringing machines, etc.

Yonex is one of the most famous and well-respected brands in the racquet sports universe.

Analysis date: July 31, 2023.

Return since analysis date: +8.05%

I own shares. 2.20% of portfolio.

Straco Corporation Limited (S85) is a Singapore-based company of tourist attractions in Singapore and China. The Company operates through two segments: Aquariums and Observation Wheel.

Its current portfolio includes Shanghai Ocean Aquarium, Underwater World Xiamen, Lintong Lixing Cable Car and Singapore Flyer.

Analysis date: September 14, 2023.

Return since analysis date: +32.74%

I own shares. 4.50% of portfolio.

Build-A-Bear Workshop, Inc. (NYSE:BBW), a Delaware corporation, was founded by Maxine Clark in 1997. BBW sells teddy bears and other stuffed animals and characters.

Customers can assemble and tailor the product through the choice of sounds and oufits varying scents, sounds, and outfits.

Analysis date: August 23, 2024.

Return since analysis date: -15.25%

I own shares. 0.90% of portfolio.

Hyfusin Group Holdings Ltd. (8512.HK) is a Hong Kong-based investment holding incorporated in the Cayman Islands, principally engaged in the manufacturing and sale of candle products.

Analysis date: September 25, 2024.

Return since analysis date: +9.73%

I own shares. 2.90% of portfolio.

TAKEUCHI MFG. CO., LTD (6432.T) is a Japan-based company principally engaged in the manufacturing and sale of construction machinery, such as compact hydraulic excavators and track loaders.

Analysis date: October 23, 2024.

Return since analysis date: +13.43%

I do not own shares.

Keystone Law Corp. plc (KEYS) is a United Kingdom based company which provides conventional legal services to lawyers and clients through a plug and play platform.